Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

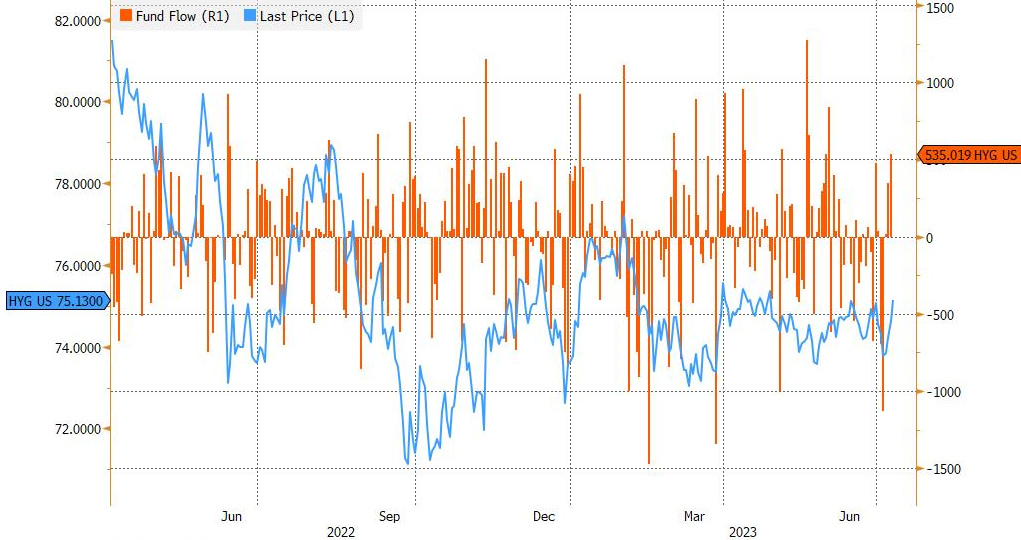

Investors added a net $535 million to IShares iBoxx High Yield corporate bond

This was the biggest one-day increase since June 2 and the third straight day of inflows, totaling $897.9 million. The fund's assets increased by 6.9% during that span. The fund has suffered net outflows of $543.4 million in the past year. Source: Bloomberg

Currently, the 10-year yield is at 3.98%

A move above 4% on the 10-year Treasury yield caused the last 2 blowups in financial markets: - UK pension fund - US regional banks Source: Game of Trades

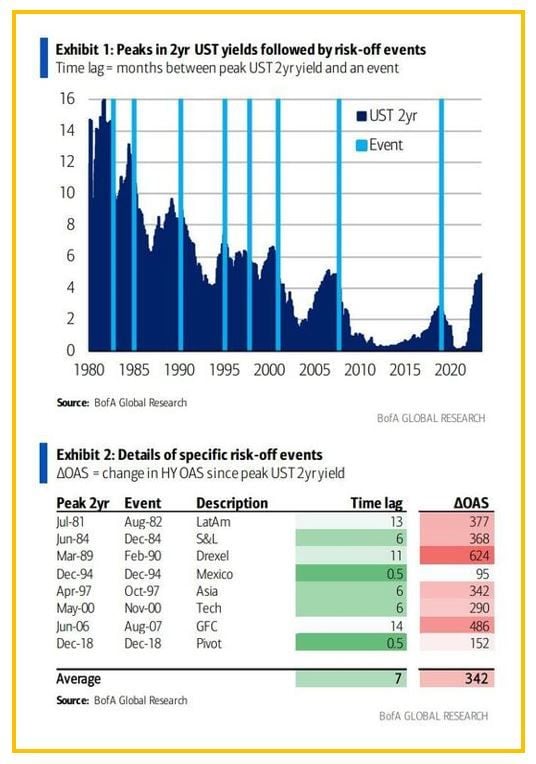

These charts by Bank of America show that every single episode of a local peak in UST 2yr yield was followed by some risk-negative event over the past 40 years.

These #charts by Bank of America show that every single episode of a local peak in UST 2yr yield was followed by some risk-negative event over the past 40 years. Such episodes ranged from mild (Mexican peso crisis in Dec 1995; HY +95bp) to moderate (Asia FX crisis in Oct 1997; HY +350bp ) to severe (GFC; HY all-time wides). The lag between the peak in 2yr yield and subsequent event varies from just a couple of weeks to just over a year, with an average being 7 months. Source: BofA, www.zerohedge.com

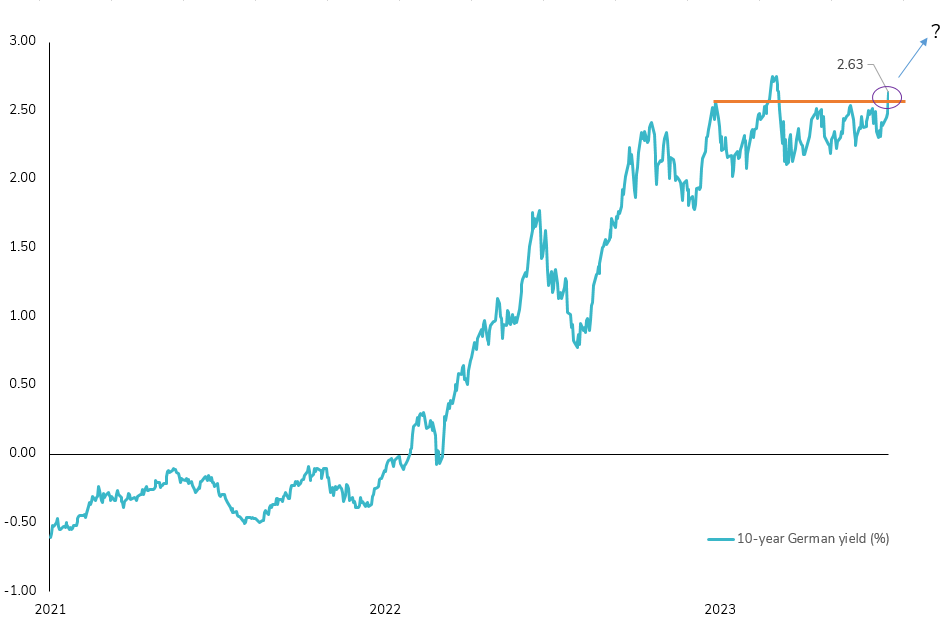

10-year German yield : a key technical breakout triggered?

The German 10-year yield has experienced a significant surge of almost 30 basis points since the start of July, marking a notable technical breakout. This breach of the 2.5% resistance level has the potential to alter short-term market sentiment and pave the way for higher rates. The upward momentum has been fueled by several factors, including the synchronized hawkishness observed in developed countries such as the US, Eurozone, and the UK last week. Additionally, hawkish FOMC minutes (release yesterday) and resilient hard data, including strong employment figures in the US and robust industrial production in Europe, have contributed to the yield's upward trajectory. It is worth noting the emergence of a catching-up effect in soft data, as indicated by the latest report on the U.S. ISM composite index. Tomorrow's release of the June NFP report could further ignite the discussion. Will we test the year's highs (2.75%) in this early summer period?

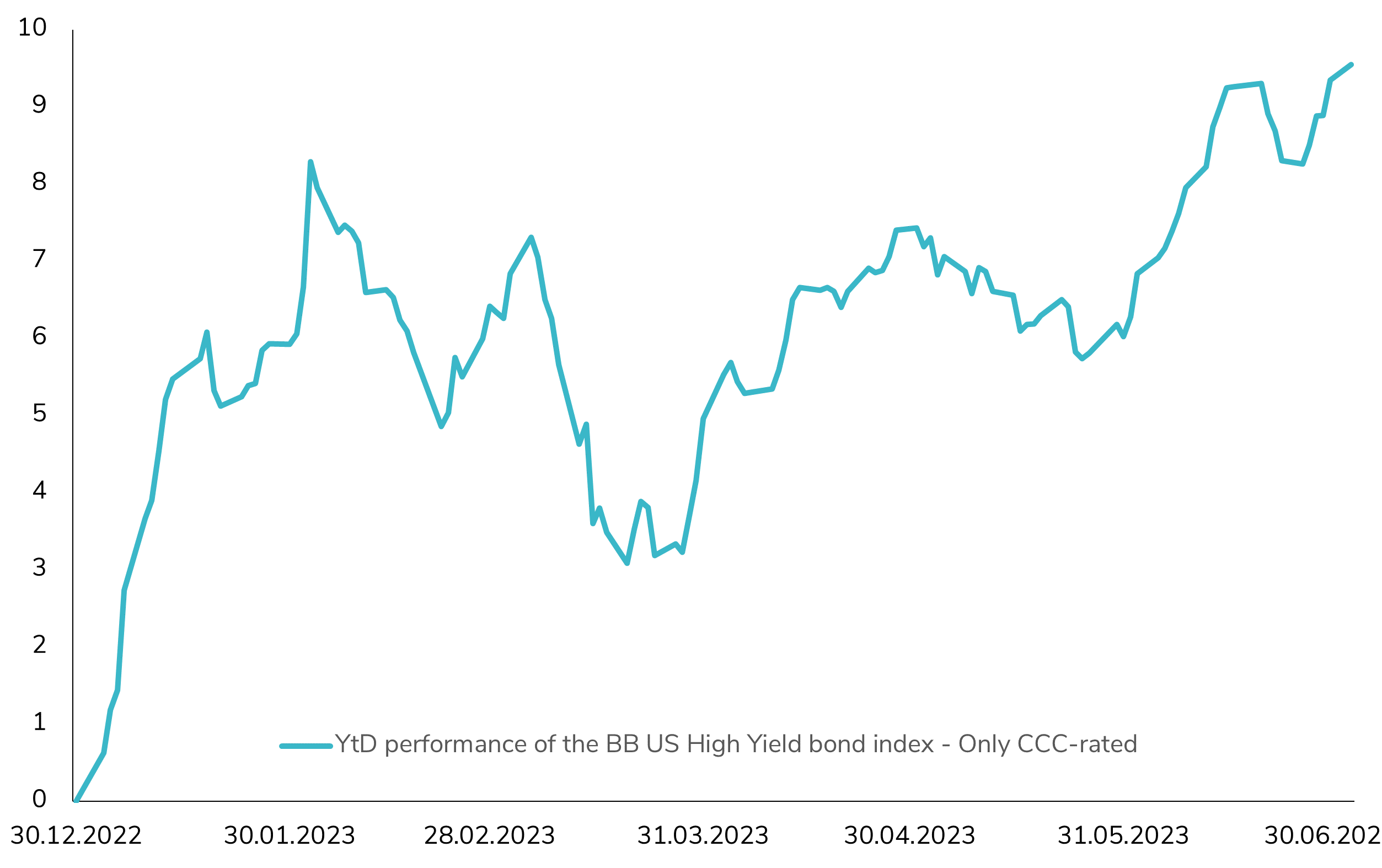

Surprising Performance: U.S. High Yield CCC-rated Bonds up 10% YTD!

The Bloomberg US High Yield CCC-rated bond index has recorded an impressive 9.6% gain in 2023. Despite concerns of an impending U.S. recession, the lowest quality segment of the high yield market has emerged as one of the top performers in the U.S. fixed income space. The resilience of the U.S. economy and robust release of hard data have contributed to a significant tightening of the average credit spread for CCC-rated bonds, reaching a 1-year low of 835bps. This represents a 165bps tightening since the beginning of the year. Notably, CCC-rated credit spreads are currently below the historical average of 925bps, while the average yield remains in line with historical levels at 12.8% compared to 12.7%. Furthermore, it is worth mentioning that less than 2% of the index is set to mature in 2024. The question now arises: will CCC-rated bonds continue to outperform driven by strong technical factors, or have we reached the top? Source: Bloomberg.

Shifting Dynamics in 3-Month US Futures: A Hawkish Turn

The recent shift in the 3-month US futures market has grabbed investors' attention. FED Governor Powell's increasingly hawkish tone has sparked a repricing frenzy, altering market expectations for rate cuts. The latest data shows a significant turnaround, with futures no longer projecting any cuts in 2023 and only one in the first half of 2024. This remarkable repricing indicates a growing sentiment of an extended period of higher interest rates. The resurgence of the 3-month SOFR Future June 24 contract to pre-SVB crisis levels further underscores the market's confidence in this new direction. Source: Bloomberg

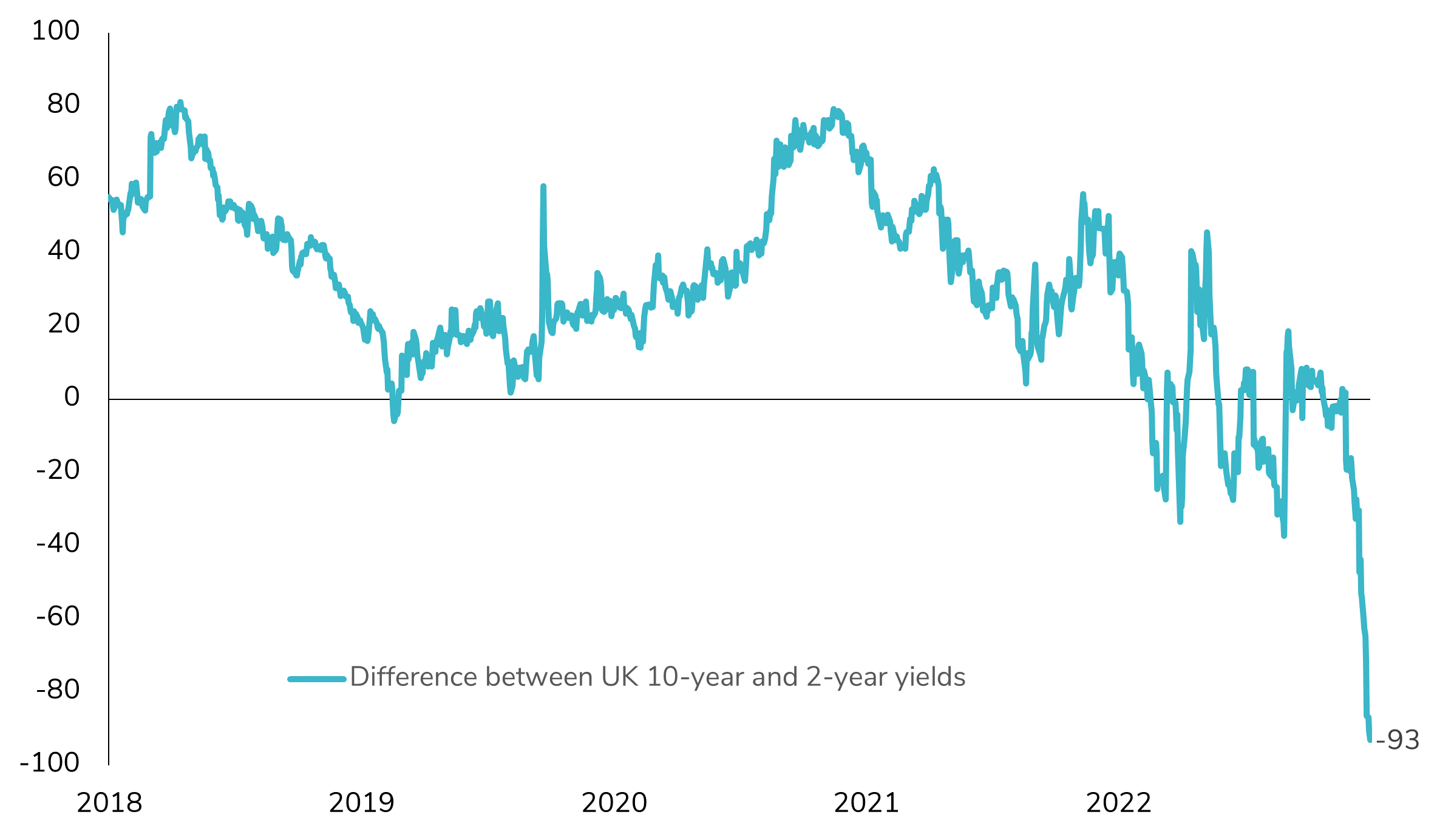

UK bond market is sending a signal!

The recent developments in the UK bond market have caught the attention of investors. In June, the UK yield curve (2s10s) experienced an unprecedented decline, marking one of the steepest drops in decades, and it is now approaching -100bps. This significant shift reflects the market's conviction that the Bank of England (BoE) will take decisive measures to combat inflation. However, it also raises concerns about the potential impact on the UK economy and its medium-term growth prospects. Should the BoE keep pushing the limits (rate hikes) until something breaks?

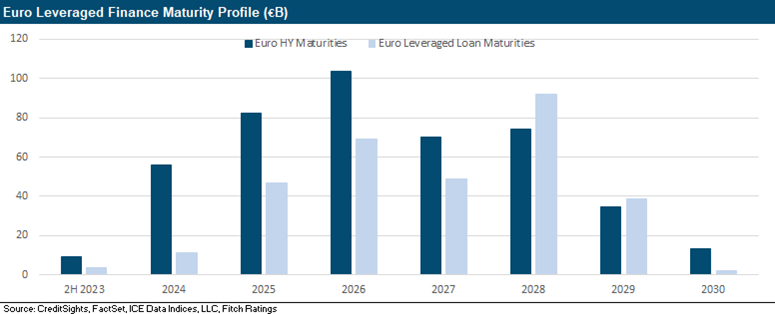

Limited Pressure from Issuance Activity for European High Yield Bonds in H2 2023!

The European high-yield (HY) market is expected to maintain a positive technical landscape in the second half of 2023, as corporate high-yield refinancing needs remain moderate. This favorable dynamic should counterbalance any potential outflows, as observed on the US market where HY funds are recording significant outflows, but offset by sluggish activity on the primary market. Source: CreditSights

Investing with intelligence

Our latest research, commentary and market outlooks