Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Europe’s debt market sees first live deal halted this year

The EU market saw its first postponement of a live deal this year as borrowers struggled to tighten pricing in an active session for the market.

German building society Bausparkasse Schwaebisch Hall AG halted a €500 mio offering of 10y covered bonds after setting final terms. Source: Bloomberg

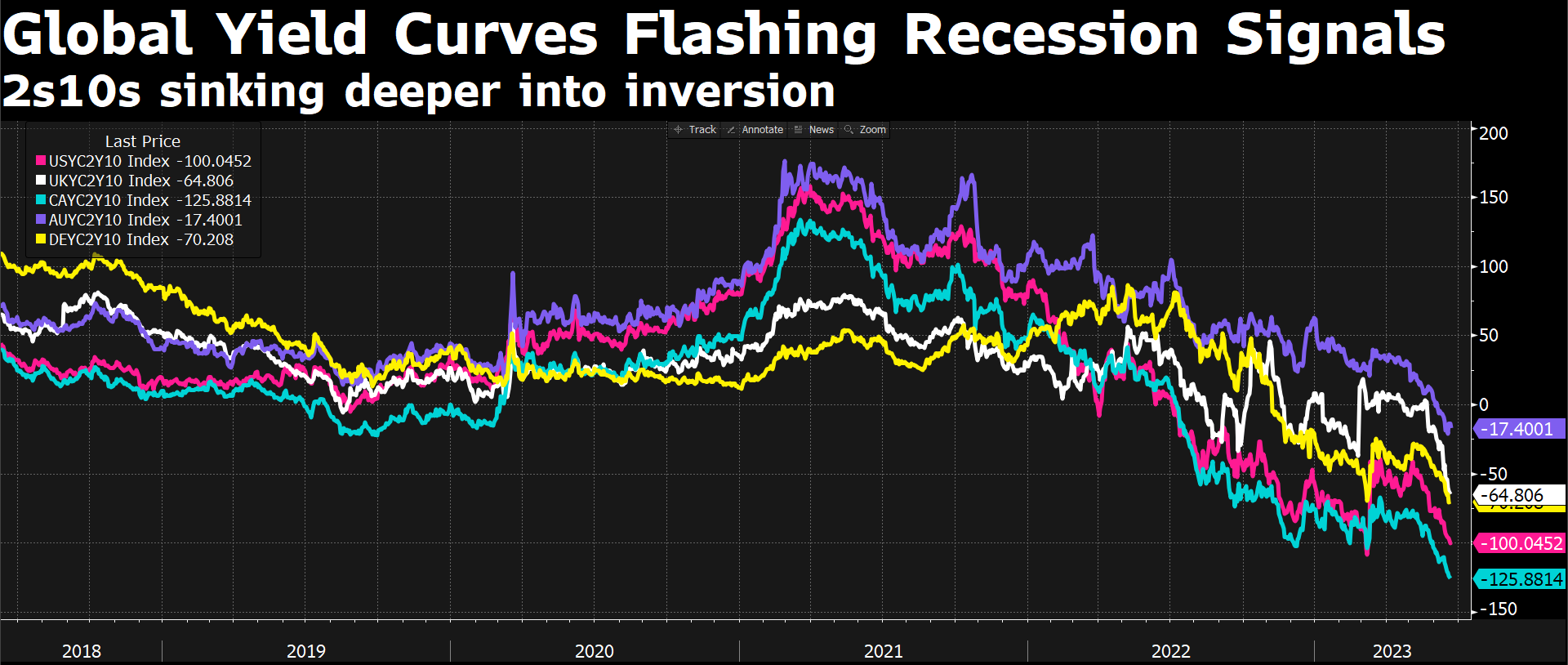

Global Yield Curves' (2s10s) inversion deepens, flashing recession signals

Source: Bloomberg TV Chart

Treasury longs extend

The latest JP Morgan client survey shows the most outright long positions since 2019. Source: Bloomberg

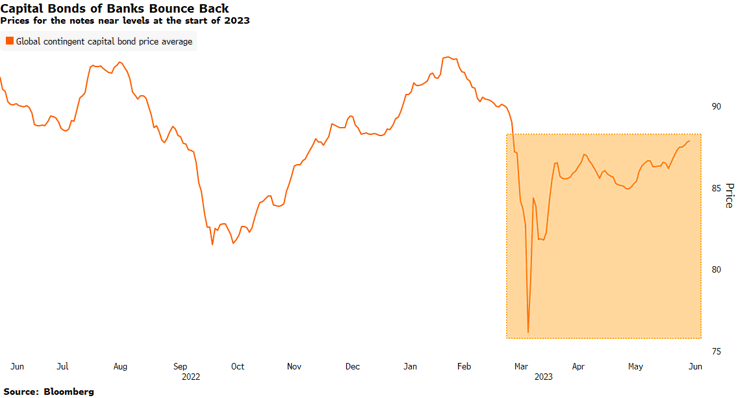

Riskier bank bonds back as returns rise, AT1 Market reopens

Two European banks on Tuesday sold the first

publicly-syndicated AT1 bonds on the continent since the Credit Suisse’s crisis.

Easing concerns about the health of the banking sector and hopes that major central banks are nearing the end of their tightening cycles contribute to the move. Source: Bloomberg

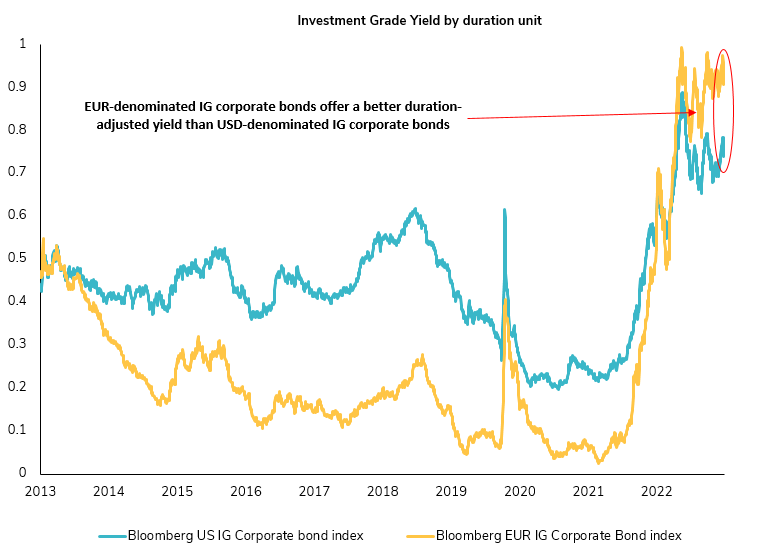

Attractiveness of EUR IG vs. US IG at decade high! 📈💼

🌍 Absolute yields in the global credit market present compelling long-term entry points, especially for high-quality European corporate bonds. Compared to the US market, the attractiveness of EUR Investment Grade (IG) credit is soaring. While concerns about a deeper recession in Europe have caused some turbulence, they have also opened up intriguing investment opportunities. Moreover, the recent Credit Suisse incident has further contributed to the dynamic landscape. 📊🔍 Is it time to seize the potential yield offered by EUR IG bonds? 💡💰 Source : Bloomberg

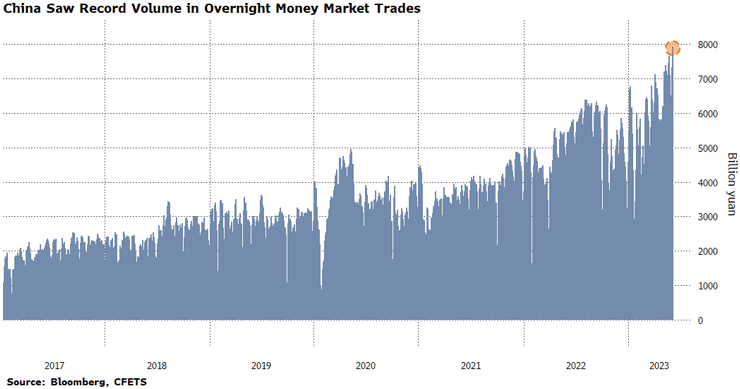

China traders are leveraging up the most on record fluch cash

A gauge of leveraged activity in China’s

money market has notched another record as onshore financial

institutions take advantage of ample liquidity to boost

borrowing.

Turnover of so-called overnight pledged repo trades surged

to an all-time high 7.9 trillion yuan ($1.1 billion) on Tuesday.

An increase in volume may be indicative of banks using cheap

funding costs to buy bonds, even if the transactions also

include the day-to-day financing needs of firms in the market.

Source: Bloomberg

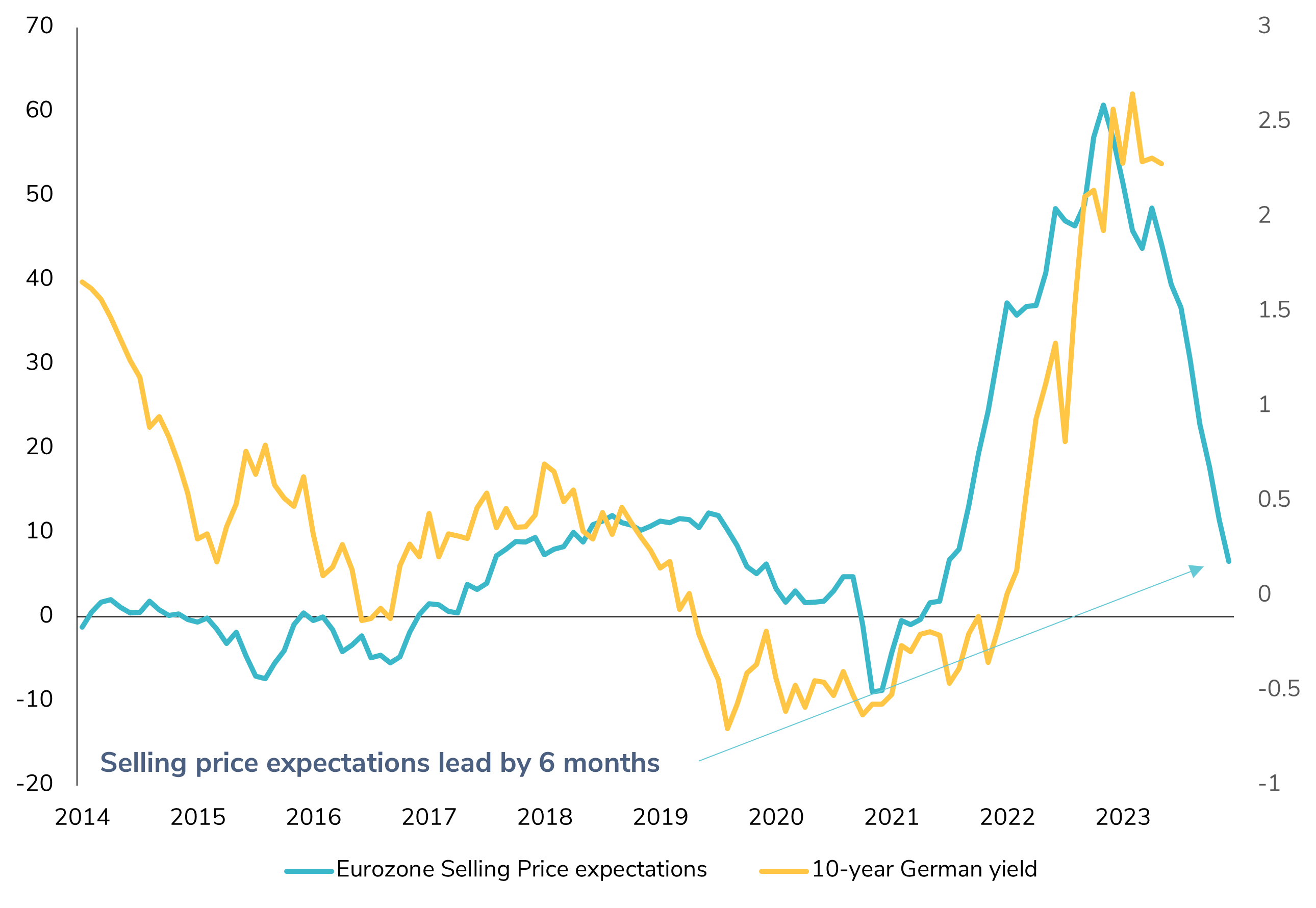

Is it time to increase duration in EUR bonds?

The latest European Commission survey on Eurozone selling price expectations shows a significant decline, suggesting that inflation should continue to decrease in the coming months, alleviating pressure on the ECB to tighten its monetary policy. After a possible one or two final tightening moves by the ECB in June and/or July, is it worth considering a higher allocation to European rates, particularly core bonds? Source : Bloomberg.

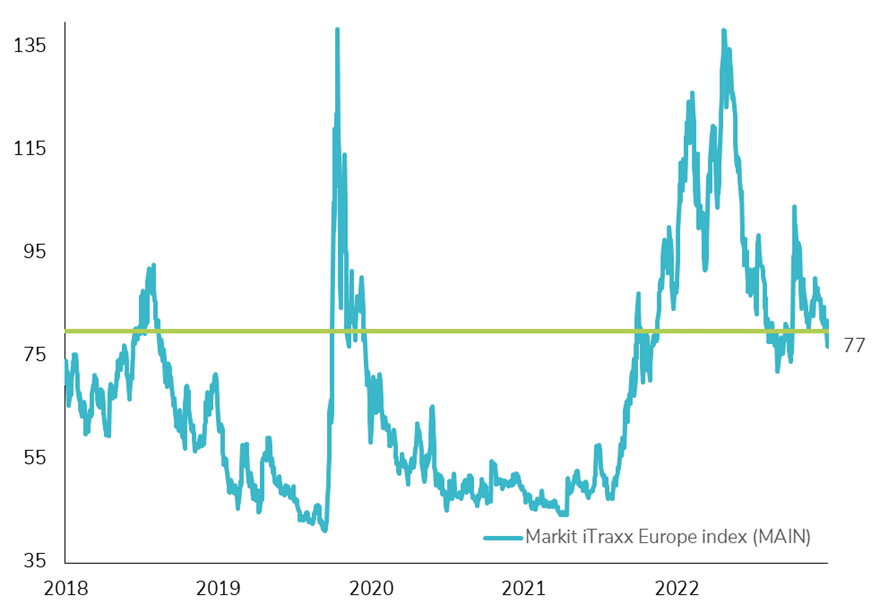

📈 European Investment Grade bonds ride the wave of positive momentum!

The iTraxx Main index, which monitors the 5-year credit default swaps (CDS) of IG corporate bonds, achieved a significant breakthrough by crossing the 80 bps threshold for the first time since the banking stress experienced in March. This development indicates a positive shift in market sentiment and improved confidence in the IG corporate sector. This achievement in the credit market raises an important question: Is the market too complacent with the current situation, or does it suggest that a soft landing has become the baseline scenario? Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks