Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

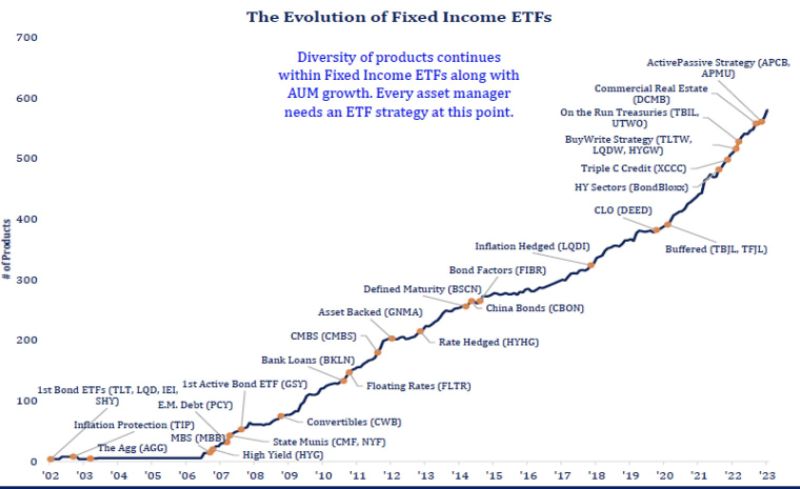

The evolution of fixed income ETFs in one picture...

This chart really shows off how far things have come in 20 years and how far the ETF industry goes with an asset class. Source: Todd Sohn thru Eric Balchunas

Moody's has cut credit ratings of several small to mid-sized US banks on Monday

Moody's said it may downgrade some of the nation's biggest lenders, warning that the sector's credit strength will likely be tested by funding risks and weaker profitability. This does not come as a surprise to us as US banks are facing several headwinds at the time being: 1) Inverted yield curve and lower trading / M&A activity weighing on profitability; 2) Deteriorating loan book quality due to Commercial real estate exposure but also US consumers starting to being hit by rising debt costs (credit card, mortgages, etc.); 3) Deposits withdrawals. Source: reuters

Market-implied inflation expectations over the next 5-10 years have risen to the highest levels in more than a year

Traders are starting to game out a future with sustainably higher inflation and higher long-term bond yields. Source: Bloomberg, Lisa Abramowiz

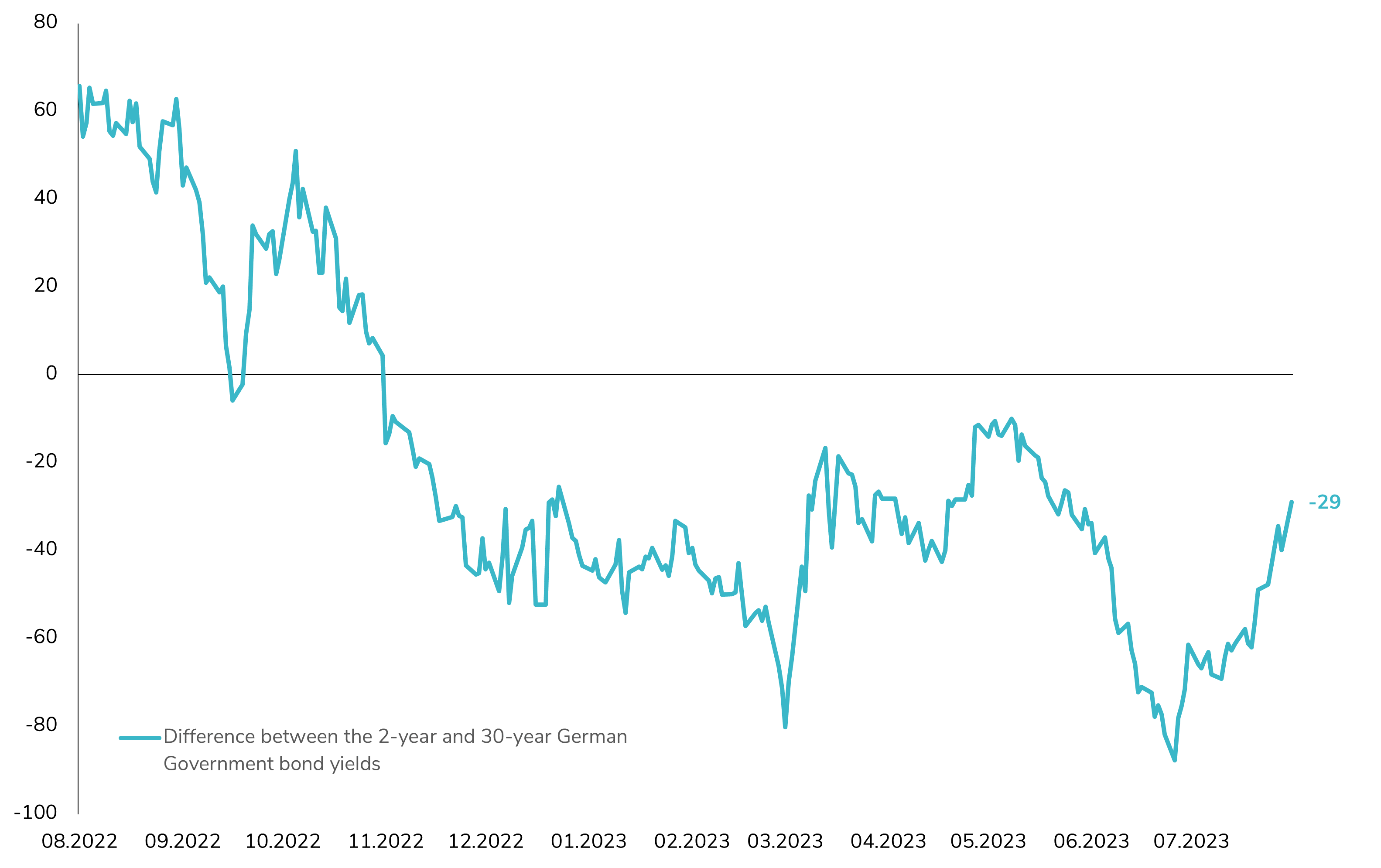

Why is the German Yield Curve Sharply Steepening?

The German yield curve has experienced an impressive steepening of almost 60bps in just one month! This significant movement can be attributed to several key factors that are driving the shift: Fundamentals and Economic Outlook: One of the primary drivers behind this steepening is the market's reassessment of the potential avoidance of a recession. There's a positive repricing of economic fundamentals, suggesting improved prospects for growth and stability. Additionally, there's growing concern about structural inflation running higher than initially expected. Notably, the German 5-year breakeven rate has surged to 2.63%, reaching its highest level since 2009, which has translated into higher long-term yields. Front-End Yield Curve Repricing: The recent decisions made by the European Central Bank (ECB) have also played a role in the steepening. Firstly, the ECB chose to no longer remunerate the bank's minimum reserve held at the central bank. Additionally, today's surprise decision by the Bundesbank's Executive Board further impacted the market. The decision was to remunerate domestic government deposits held with the Bundesbank at 0%, starting from 1 October 2023. Both of these developments could potentially increase demand for German short-term papers. Source: Bloomberg.

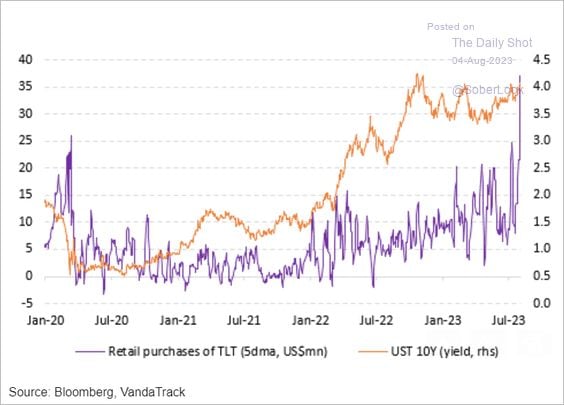

The fact that Retail investors are rapidly buying the iShares 20+Year Treasury Bond ETF (TLT) - despite the bond bloodbath - could mean that the sentiment is far from being oversold

From a contrarian perspective, this is NOT a positive for long-dated bonds. Source: The Daily Shot, Bloomberg, VandaTrack

Shorting US 10y bonds seems to be one of the most crowded trades at the moment

Among the shorts, Billionaire investor Bill Ackman. To his opinion, if long-term inflation is 3% not 2%, the 30y Treasury yield could rise to 5.5%. In contrast, Warren Buffett has announced buying positions in 10y US Treasuries. Source: Bloomberg, HolgerZ

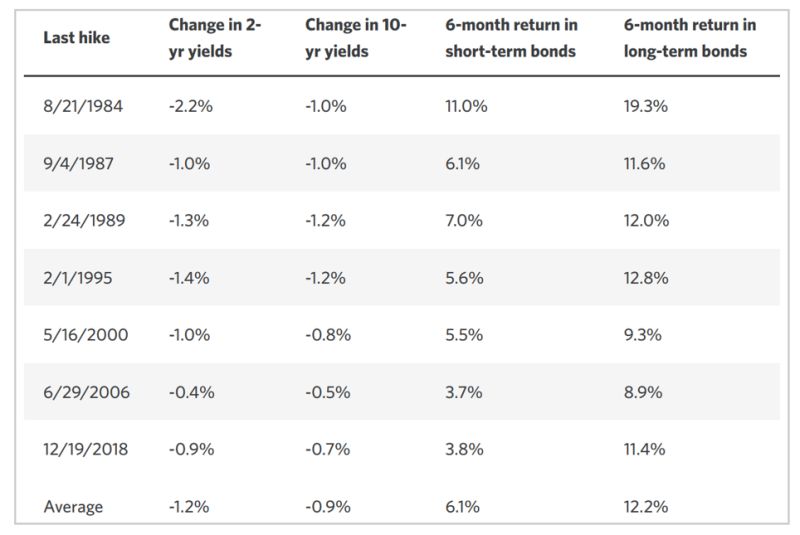

Before dumping your government bonds think twice

Over the past 40 years, US treasury yields have always declined six months after the last Fed hike. Source. Edward Jones

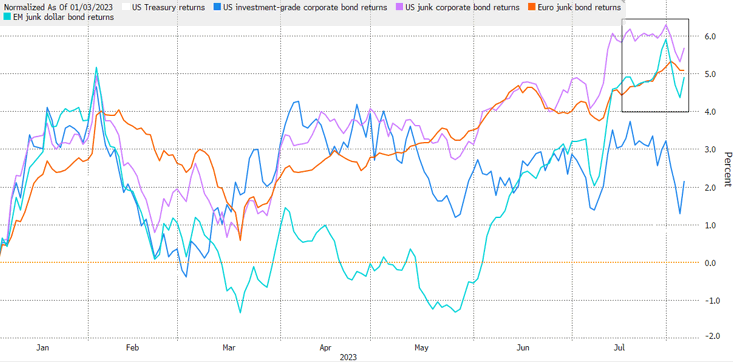

Junk bonds are outperforming as soft landing narrative builds

High-yield has returned 6.50% this year vs 3.70% for high-grade.

Junk bonds are emerging as a sweet spot in global fixed-income markets wracked by some of the worst volatility this year, as investors increasingly bet that major economies will avoid recession for now.

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks