Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

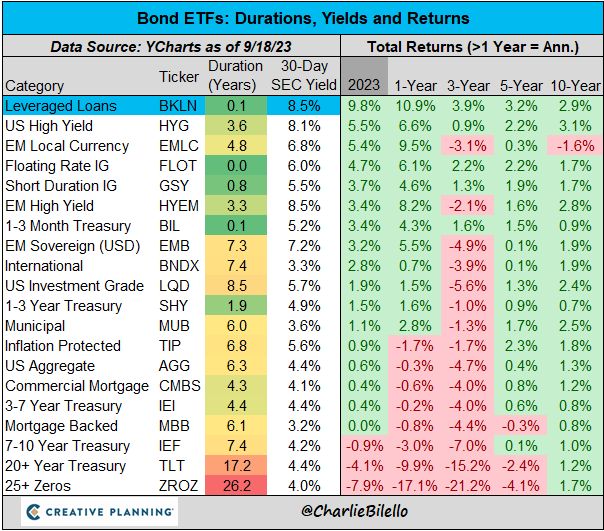

The best performing segment of the bond market this year? Leveraged Loans, up close to 10%. $BKLN

Source: Charlie Bilello

An ugly canadian CPI, surging crude oil prices and cautious positioning ahead of tomorrow's FOMC decision have pushed #us treasuries yields to their highest since 2007...

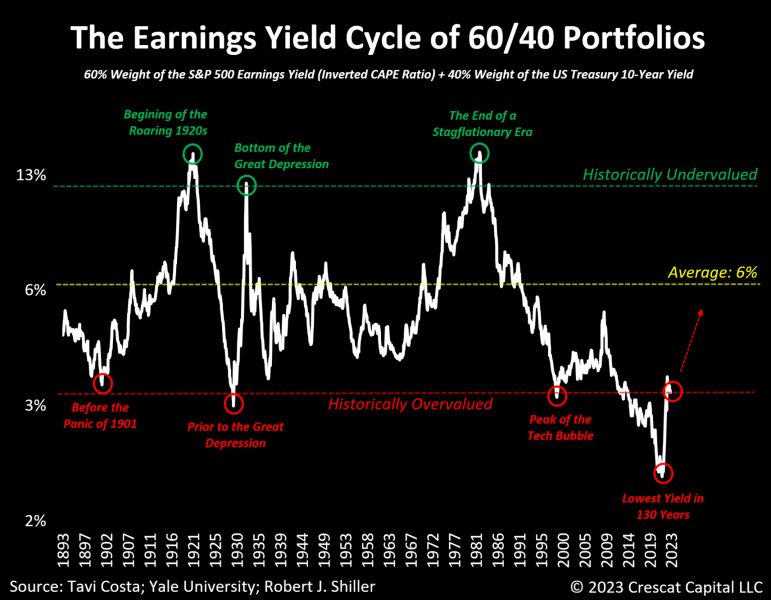

Bonds are now at their cheapest to stocks since Oct 2007... Source: Bloomberg, www.zerohedge.com

Is the 60/40 portfolio overvalued?

In August 2021, the combined valuation of overall equities and US Treasuries had reached its most expensive level in 130 years. To put the current valuation imbalance into perspective, its recent peak was a staggering 61% higher than its previous peak in the early 2000s. Although prices have corrected somewhat, particularly in the Treasury market, multiples are still elevated today. Source: Tavi Costa, Bloomberg

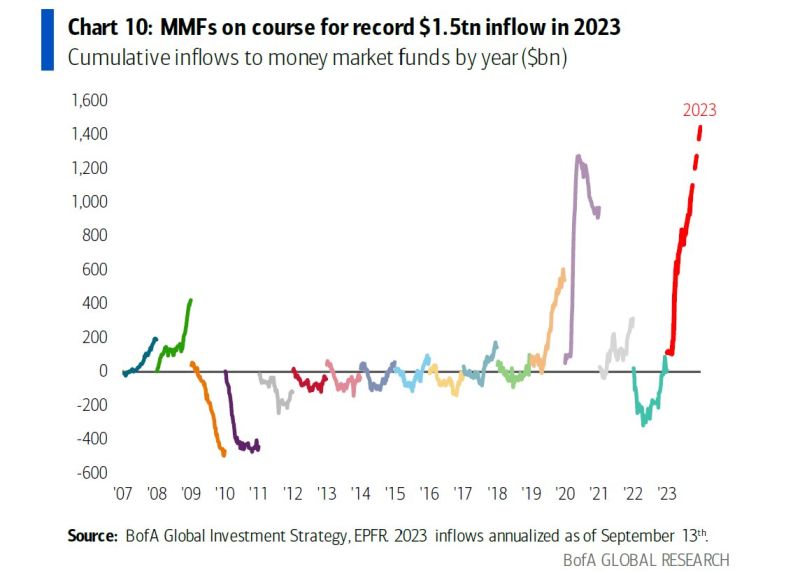

Money markets are on track for a record $1.5 trillion inflow in 2023

Source: BofA

Credit Suisse bond investors plot lawsuit against Switzerland

A group of international bond investors is drawing up plans to sue Switzerland in the US courts for expropriation over the losses they suffered after the state-orchestrated rescue of Credit Suisse. The case is being brought together by law firm Quinn Emanuel, according to people familiar with the matter. Quinn Emanuel is already suing Switzerland’s financial regulator, Finma, over its decision to wipe out $17bn of Credit Suisse bonds when the bank was taken over by UBS six months ago. Lawyers at Quinn Emanuel are laying the groundwork to sue Switzerland in the US, where they believe there is a greater chance of convincing a judge to waive the country’s sovereign immunity rights. The suit could be filed by the end of the year, though it is not certain to proceed, according to people involved in the discussions.

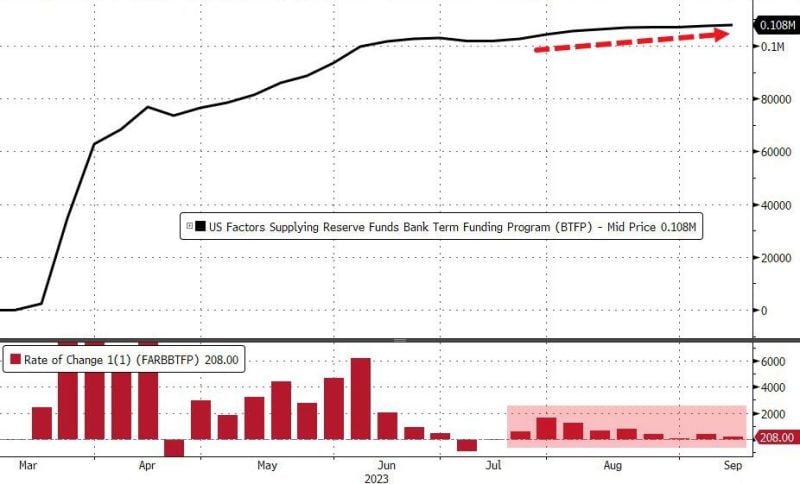

OOPS! A bank liquidity indicator sounds the alarm!

Usage of The Fed's emergency bank funding facility rose once again (+$208M) to a new record high over $108BN as long-term government bond yields keep rising... Source: Bloomberg

Rising Italian Yields and the Looming Debt Question: What Lies Ahead for Eurozone?

The 10-year Italian yield has reached its highest level since March, while the difference between the 10-year Italian and German yields is trading above 180bps for the first time since June. Beyond speculating on whether the ECB will raise interest rates to 4% or not, the significance of Italy's debt burden should be a fundamental concern, especially if they announce a new tightening of their monetary policy by ending reinvestments in their PEPP program or, worse still, making further disinvestments under the APP program.

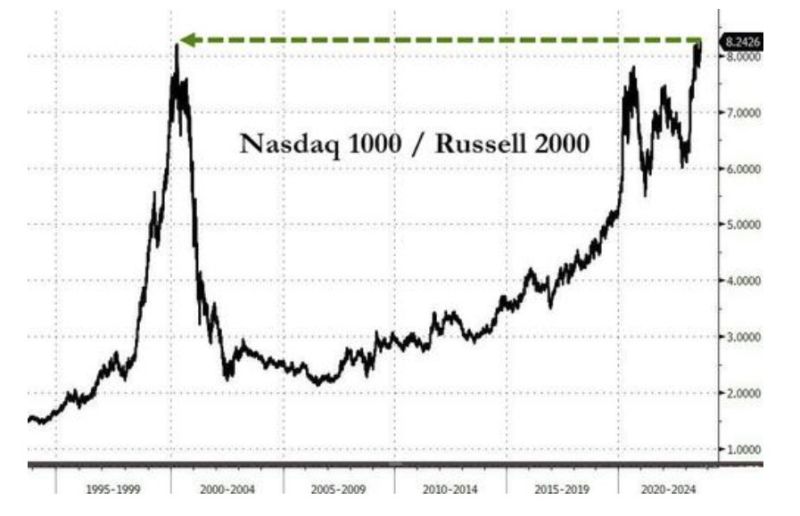

Despite the rise in bond yields, the Nasdaq 100 held up better than the Dow and other US indices on Tuesday

Tuesday was the way the Nasdaq's second best performance relative to the Russell 2000 since November 2021, breaking out to a new cycle high. The last time Nasdaq/Russell 2000 traded here was March 2000 - the very peak of the dotcom bubble... Source: Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks