Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Donald Trump was once asked on 'The Apprentice': "What's the most important lesson in business?"

Here's what he answered: SPEED. When Trump saw big opportunities, he acted fast: • Trump Tower: Seized prime Fifth Avenue location • Plaza Hotel: Record-breaking purchase • Mar-a-Lago: Turned $10M investment into $22.7M annual revenue. But there's a crucial lesson here: Success isn't just about the size of your moves. It's about the speed at which you make them. Trump's philosophy works because it combines two critical elements: 1. Spotting massive opportunities 2. Acting before others can Source: Hosun @hosun_chung on X

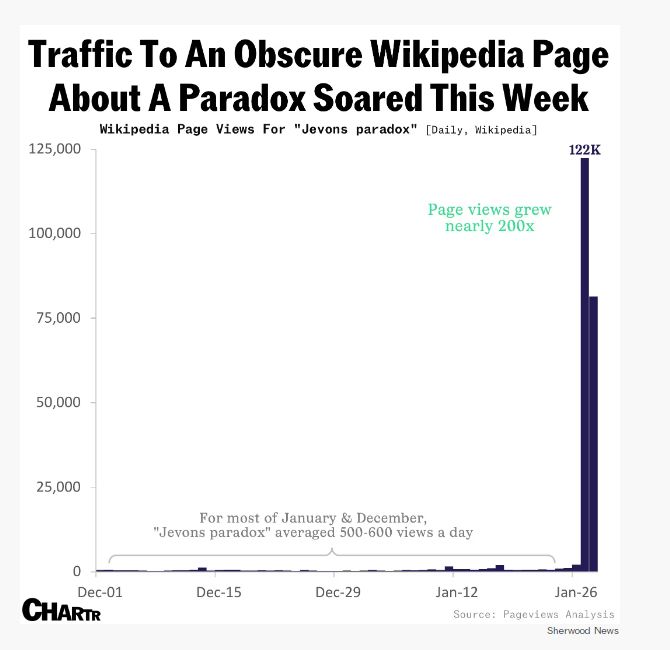

⚡ The Jevons paradox

🚨 In the wake of DeepSeek turning the entire industry on its head — and wiping nearly $600 billion off of the market cap of Nvidia in a single day — one new phrase has become table stakes for anyone wading into the DeepSeek discourse: Jevons Paradox, with traffic to its associated Wikipedia page soaring this week. 👉 Per that very Wikipedia page: “...the Jevons paradox occurs when technological advancements make a resource more efficient to use (thereby reducing the amount needed for a single application), however, as the cost of using the resource drops, overall demand increases causing total resource consumption to rise.” 👉 The original example posited by Mr. William Stanley Jevons, summarized nicely by Axios, was coal. Progress in steam engines, which enabled them to use less coal, didn’t lead to a drop in coal demand — it led to a huge rise. Though a bit of an oversimplification, that is essentially the crux of the current debate in AI: DeepSeek reportedly achieved something for a lot less money and resources than US competitors like OpenAI and Meta used. That could be interpreted in two ways: • We will therefore need fewer high-tech chips like the ones Nvidia makes, and fewer energy plants to power them (which is why power and datacenter stocks got hammered this week); • Or, and this is where the Jevons Paradox comes in, WE WILL WANT EVEN MORE 💪 The market seemed to follow the first school of thought on Monday 🐻 , but came around to the second by Tuesday 🐮 , with chip analysts and tech heavyweights, most notably Microsoft’s CEO Satya Nadella, citing the paradox as proof that AI use will “skyrocket.” 🚀 🚀 🚀 Source: Chartr

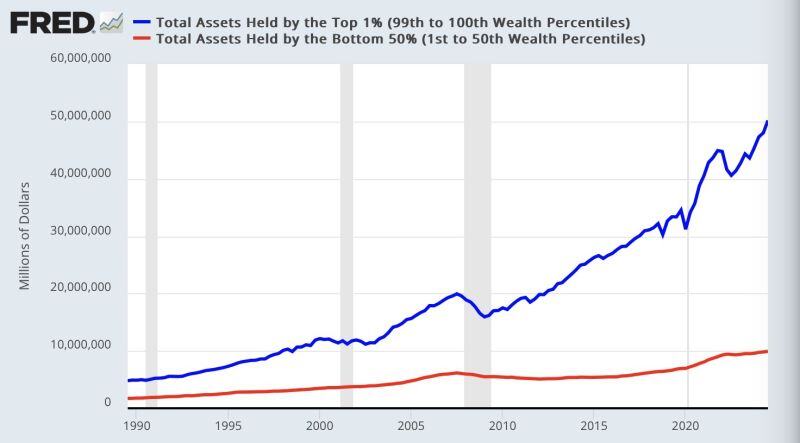

In the 1990 the wealth gap between the top 1% and the bottom 50% was $3 trillion.

Now the gap is $40 trillion. Source: Sven Henrich @NorthmanTrader

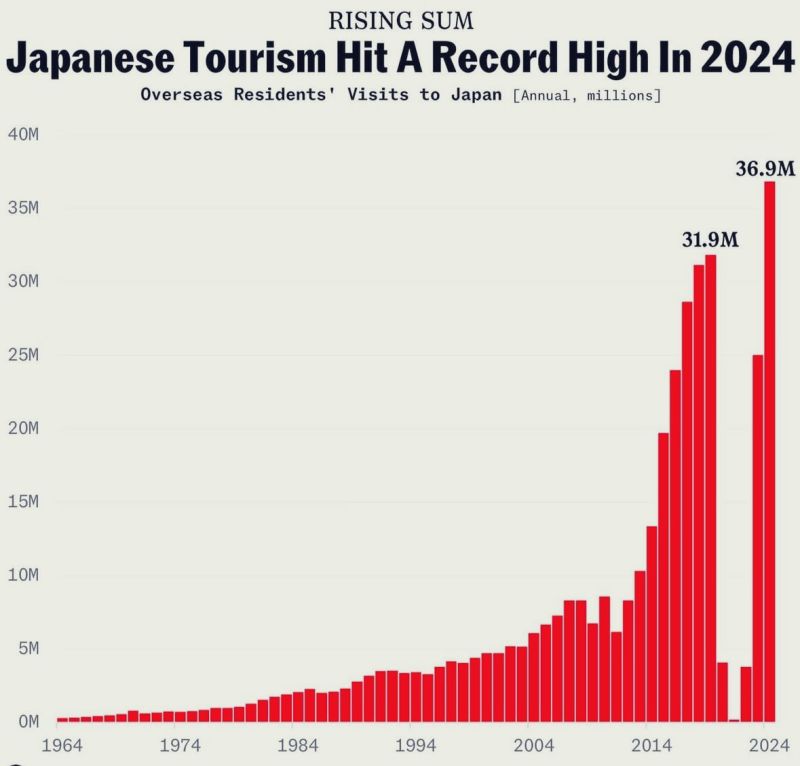

So many tourists flying to Japan

(The weak yen helps). It is an extraordinary country to visit by the way. Source: The long view on X

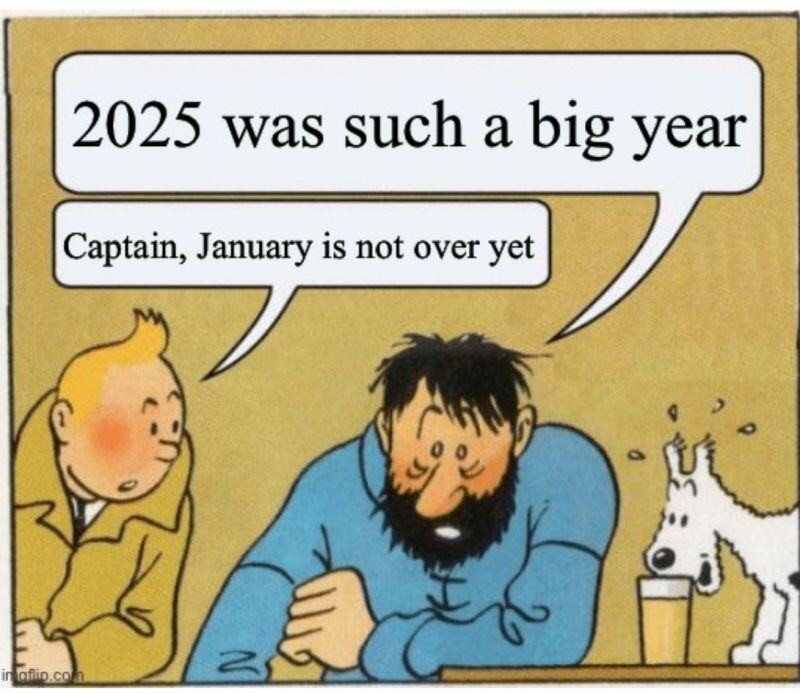

These past few weeks have been interesting:

- Trump talks about taking over Greenland/Canada/Panama - The first crypto-friendly White House aims to create a strategic bitcoin reserve - DeepSeek undermined the belief in US tech supremacy and triggered the biggest 1-day drop in a stock in history

Investing with intelligence

Our latest research, commentary and market outlooks