Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The point of making money is not so you can buy everything.

Source: Seek Wiser

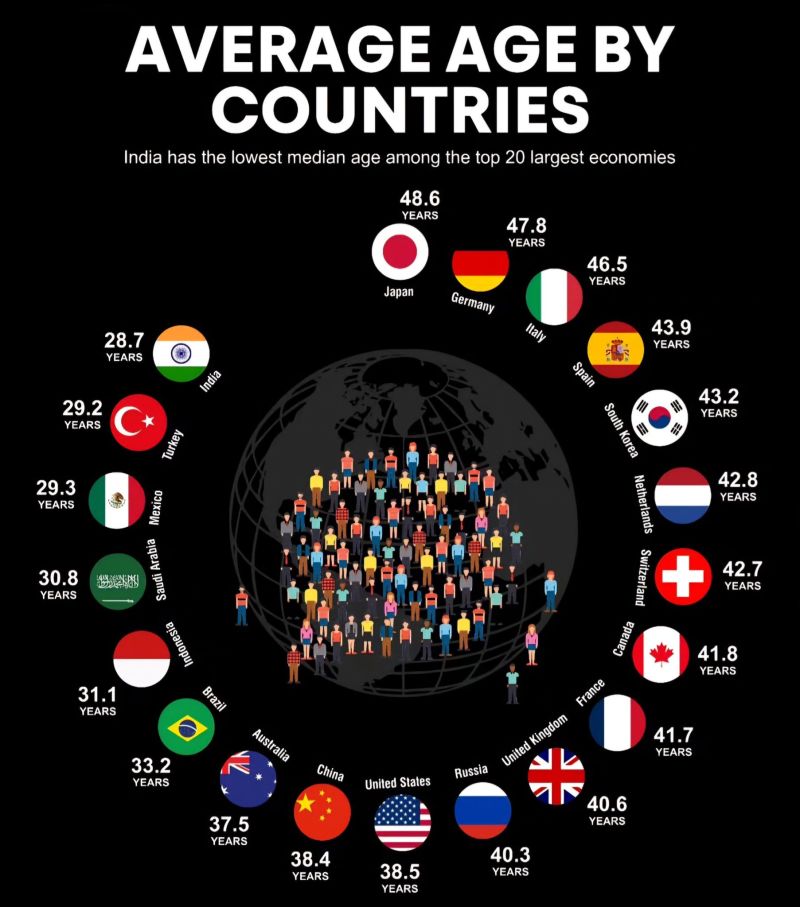

Everyone knows that Japan is getting old, but look what is happening in major European countries.

Who is supposed to pay for pensions and healthcare entitlements in Germany, Italy and Spain in few years? Source: Michael A. Arouet

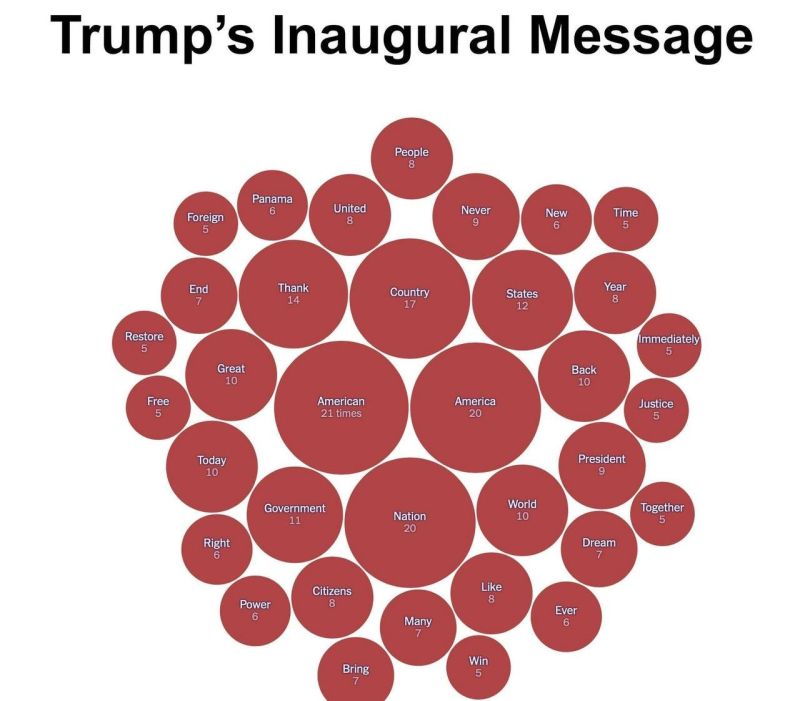

Words used most often in Trump's speech.

Source: Wall Street Mav

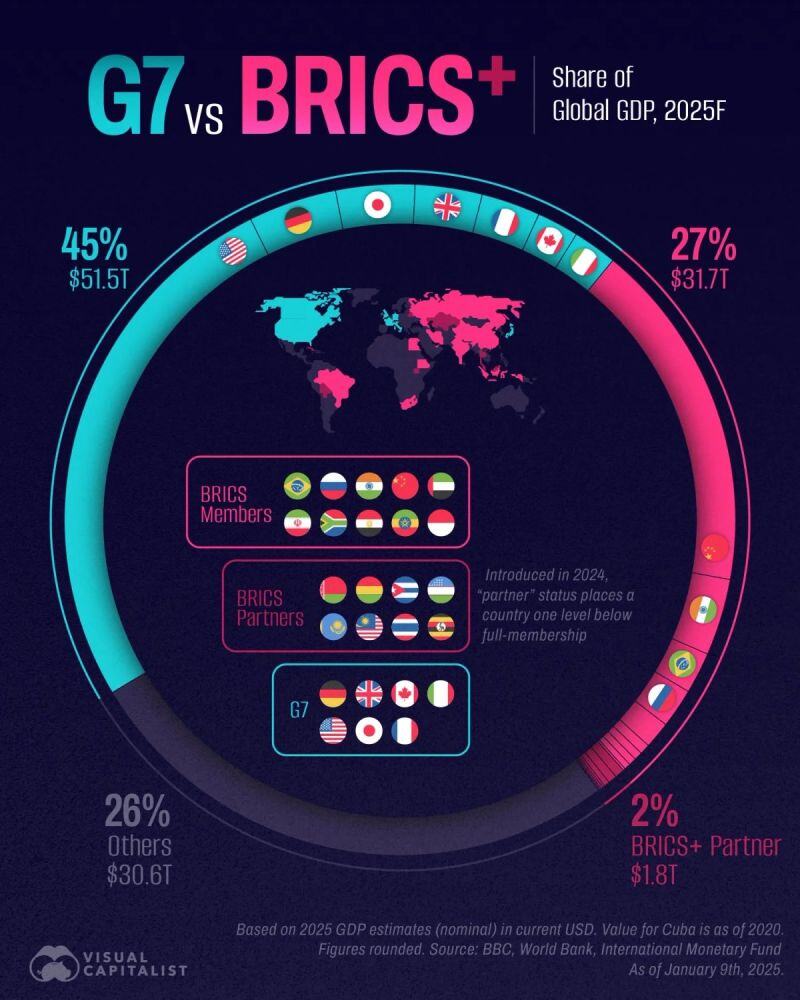

G7 vs. BRICS - Global GDP

Source: Barchart, Visual Capitalist

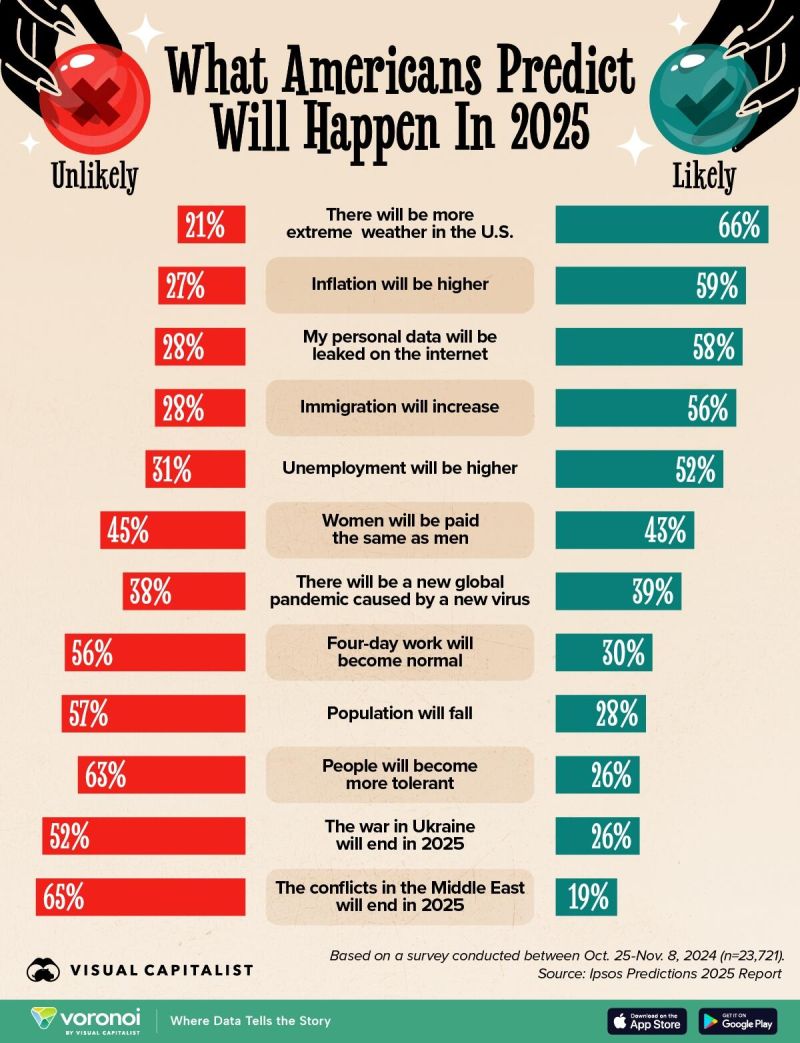

The year 2025 begins with a new president taking office, a ceasefire in Gaza, and wildfires causing extensive destruction in Los Angeles - all within the first month.

So, what can we expect from the rest of the year? This graphic, via Visual Capitalist's Bruno Venditti, presents predictions for 2025 on various topics, based on a survey conducted by Ipsos between October 25 and November 8, 2024, in the United States. Source: Visual Capitalist

Signs of the time... German Chancellor Olaf spoke in front of a half-empty congress hall at wef25 in davos.

Source : @schuldensuehner on X

This may be the most perfect photo ever taken during trump inauguration.

The longer you stare at it, the more fascinating and remarkable it becomes. Source: Benny Johnson on X

Investing with intelligence

Our latest research, commentary and market outlooks