Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

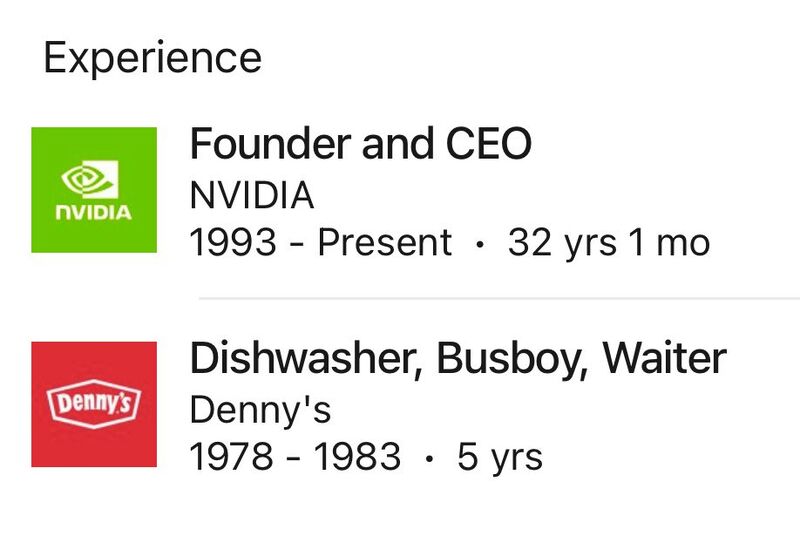

The CEO of Nvidia has a legendary LinkedIn profile:

Source: Brew Markets @brewmarkets

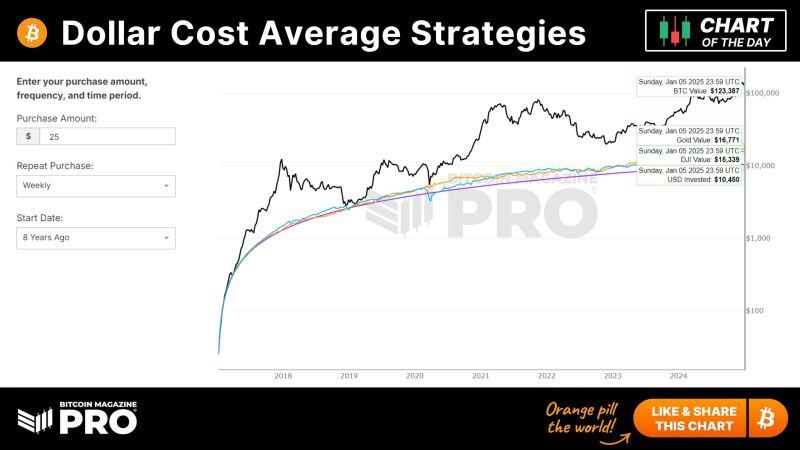

If you started dollar cost averaging in 2017 with just $25 a week, your $10,450 invested would have returned:

⛏️ Gold: $16,770.50 🏦 Stocks: $15,339.39 🔥 Bitcoin: $123,386.57 Disclaimer: Past results do not guarantee future returns Source: Bitcoin Magazine

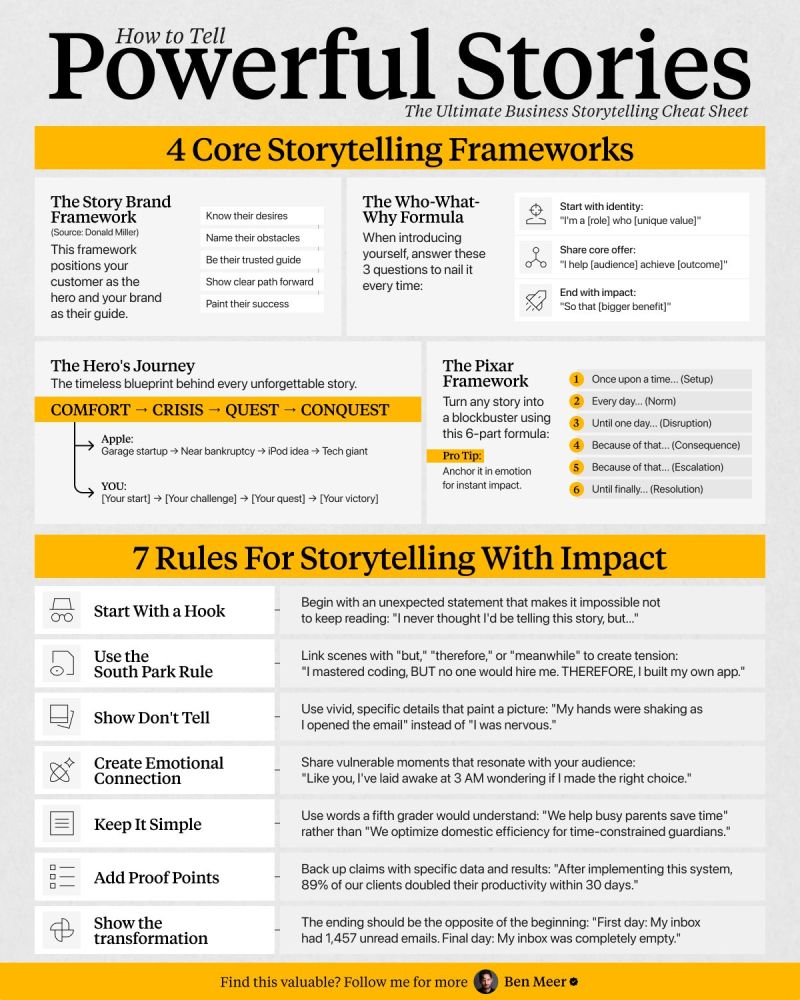

Storytelling is a high ROI skill.

But it's massively overlooked (in life and business). 11 storytelling tips to accelerate your career by Ben Meer @SystemSunday on X:

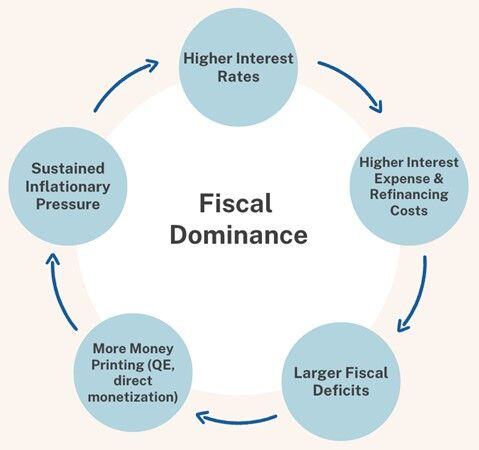

There have been many definitions of fiscal dominance over the years, but one that explains it well comes from Daniel J. Ford:

"Fiscal dominance is an economic condition that occurs when a country’s debt and deficit levels are sufficiently high that monetary policy ceases to be an effective tool for controlling inflation. In fact, persistently high interest rates in an environment of perpetually large deficits actually risk exacerbating inflation". Another definition: "Fiscal dominance occurs when fiscal deficits become as significant as, or more important than, private sector lending and monetary policy in driving economic activity". Source: Lyn Alden

Canadian Prime Minister Justin Trudeau announces resignation

Justin Trudeau’s popularity has been at a historic low after voters and members of his own party turned against him following a turbulent period of speculation about his ability to govern the G7 country. Source: FT

Bitcoin vs. fiat

Source: ₿itcoinTeddy @Bitcoin_Teddy Disclaimer: These are not investment recommendations. Cryptoasset investments can be complex and high risk.

Investing with intelligence

Our latest research, commentary and market outlooks