Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The World’s Largest Sovereign Wealth Funds

Source: Voronoi, Visual Capitalist

The more we learn the more we realize how little we know

Source: Yasin Arafeh

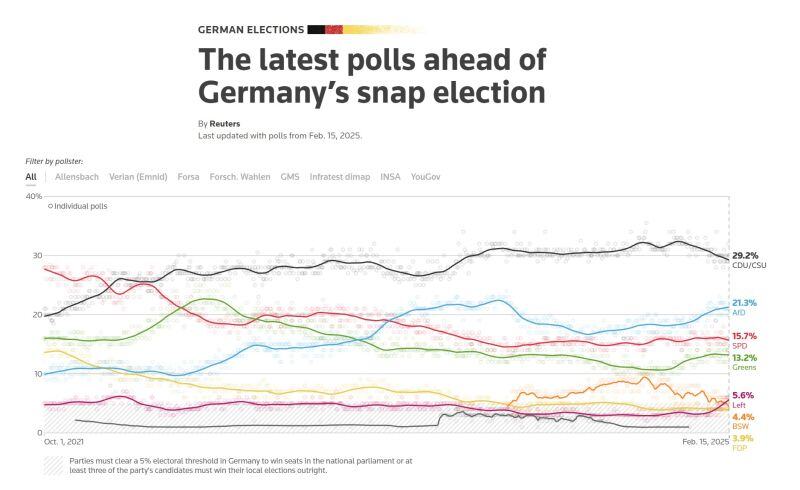

Germany will hold a snap national election on February 23 following the collapse of Chancellor Olaf Scholz's three-way coalition.

Currently, the CDU/CSU leads in Reuters polling aggregate by 8 points over the AfD. The far-right AfD has gained 4.6 points since June 2024. The SPD, the current leaders in the national parliament, have lost 12.1 points since the last federal election, and are currently in third place. Germany has two centrist, “big-tent” parties: Scholz's centre-left Social Democrats (SPD) and the opposition conservatives, an alliance of the Christian Democrats (CDU) and their Bavarian sister party, the Christian Social Union (CSU). Both have lost support in recent years, with smaller parties such as the Greens and far-right Alternative for Germany (AfD) gaining ground. The SPD, conservatives, Greens and AfD are all fielding candidates for chancellor. Also running are the pro-market Free Democrats (FDP), the far-left Linke and the leftist Sahra Wagenknecht Alliance (BSW), who are all at risk of missing the 5% threshold to make it into parliament, according to opinion polls. Source: Reuters

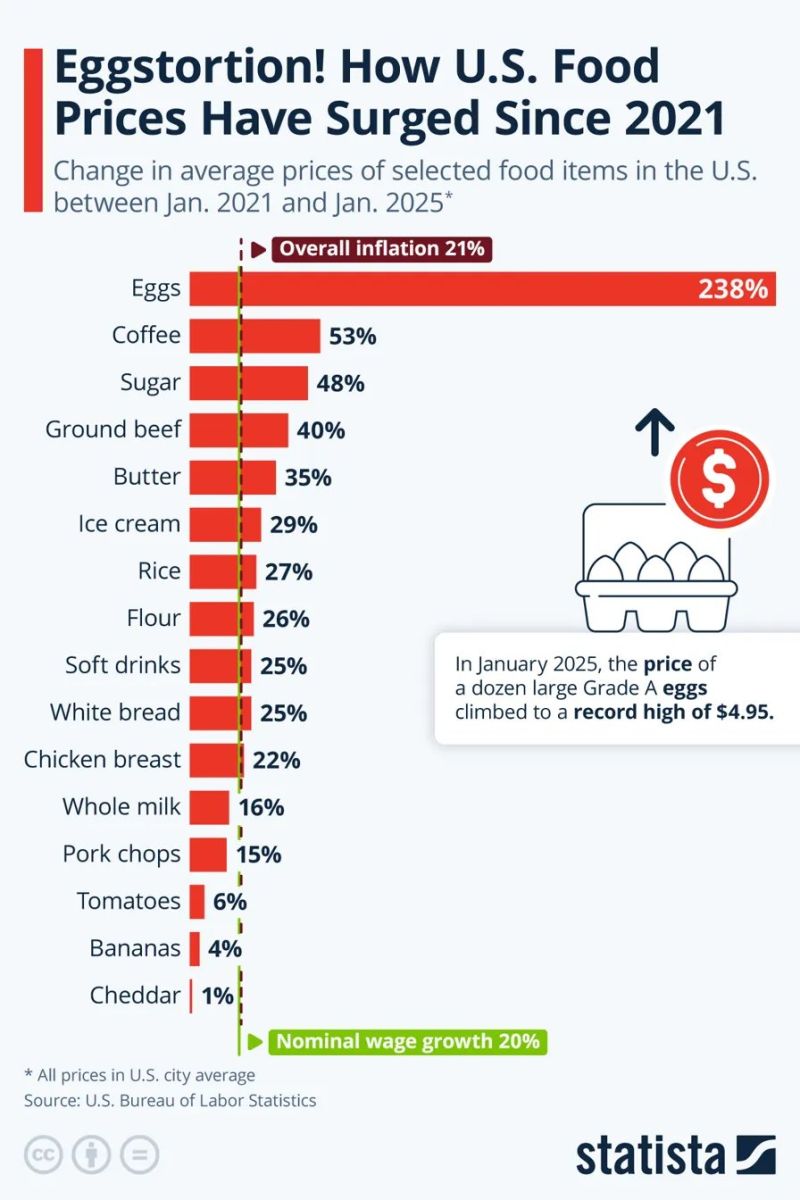

EGGS-ORBITANT! PRICES CRACK NEW RECORDS AS BIRD FLU STRIKES

A dozen eggs now costs $4.95 - up a shell-shocking 238% since 2021. U.S. farms forced to eliminate 34M hens in recent months as bird flu decimates supply chains. USDA Report: "The timing and scope of HPAI outbreaks has created an imbalance in the nation's supply of table shell eggs" While Americans aren't exactly walking on eggshells about cheese (1%) and bananas (4%), other staples like coffee (53%) and beef (40%) continue to burn holes in wallets. Source: Statista

"The more you learn, the more you'll earn." — Warren Buffett

Source: Value Theory @ValueInvestorAc

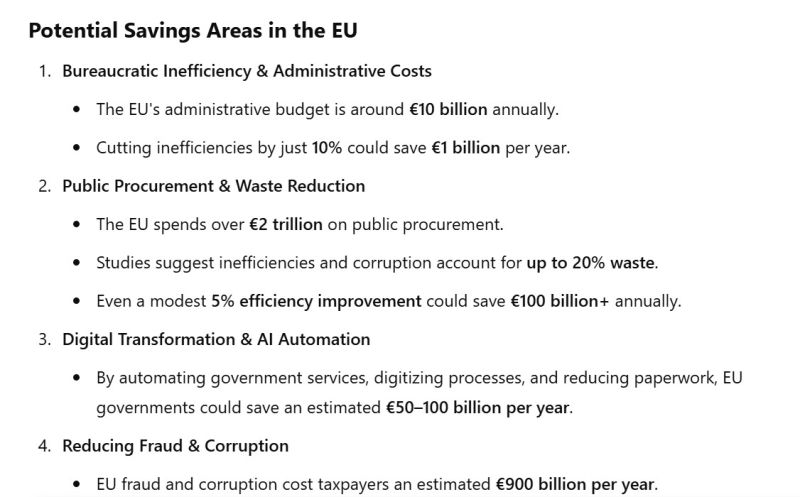

I asked ChatGPT the potential savings if the Department of Government Efficiency (D.O.G.E.) was implemented across the European Union.

Here's the answer: MORE THAN A TRILLION EURO PER YEAR (Fyi, the EU budget deficit is around 500 billion euros).

Investing with intelligence

Our latest research, commentary and market outlooks