Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Oups... Is Porsche a dead man walking?

Source: Alex @alex_avoigt on X

Nobody stays in a job for the perks.

People stick around when they have: 👉 Autonomy 👉 Trust 👉 Growth 👉 Fair pay 👉 Work-life balance Source: Corporate Rebels

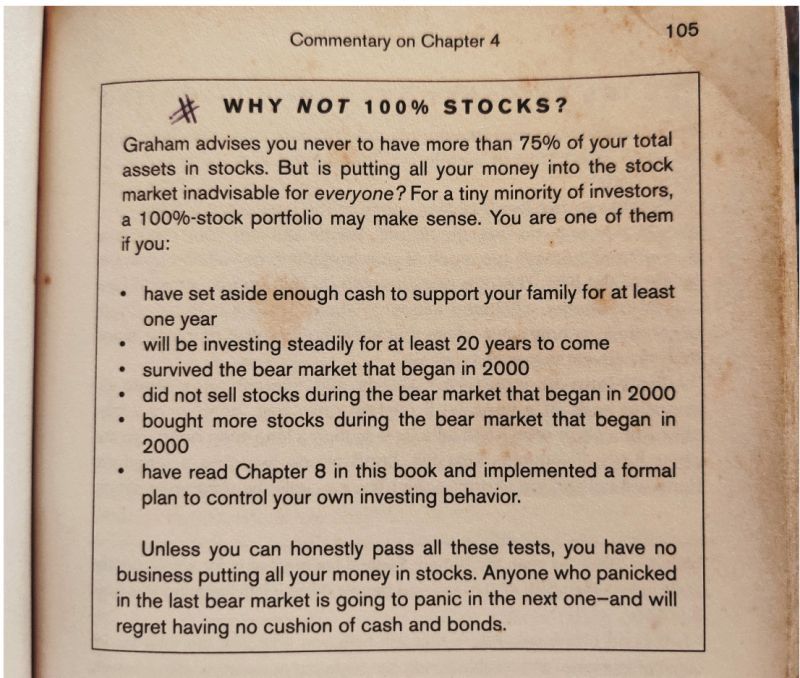

Jason Zweig on reasons to not allocate 100% to stocks:

Source: Brian Feroldi

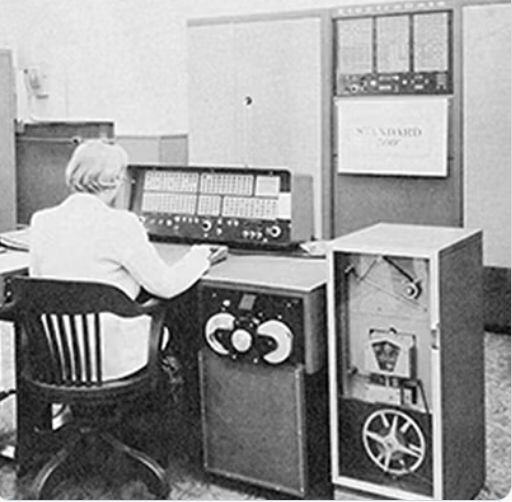

Happy 68th Birthday to the S&P 500! 🎉📈

Yesterday marked a significant milestone in financial history On March 4, 1957, Standard & Poor’s officially launched the S&P 500 Index, replacing its previous 90-stock index. For nearly seven decades, the S&P 500 has been a benchmark for the U.S. equity market, evolving alongside the economy and shaping investment strategies worldwide. From its inception to becoming a cornerstone of global finance, the index has stood the test of time, reflecting innovation, resilience, and market dynamics. Here’s to 68 years of market history—and many more to come! 🥂📊

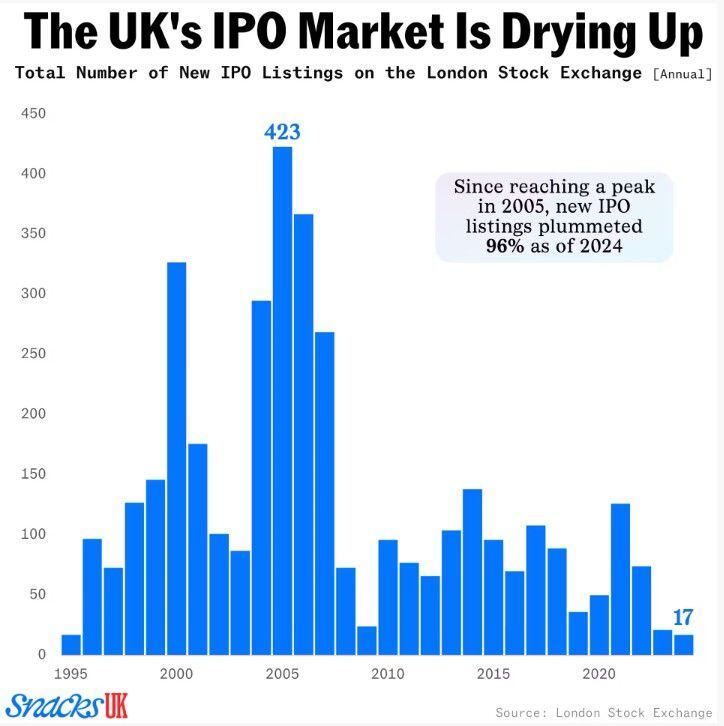

Where did all the UK IPOs go?

The London Stock Exchange had fewer new IPO listings last year than during the global financial crisis. The UK saw the lowest number of IPOs in decades, with a mere 17 listings added — down 96% from its 2005 peak. source : snacksuk, bloomberg

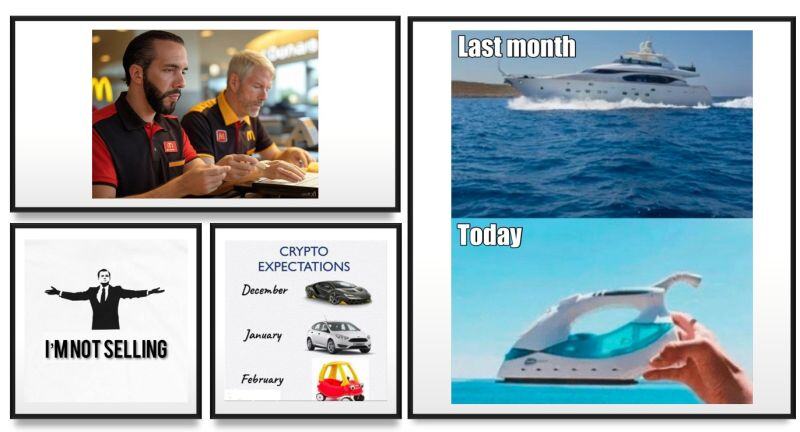

Bitcoin under $90k...

here's a compilation of the best crypto liquidation memes on X

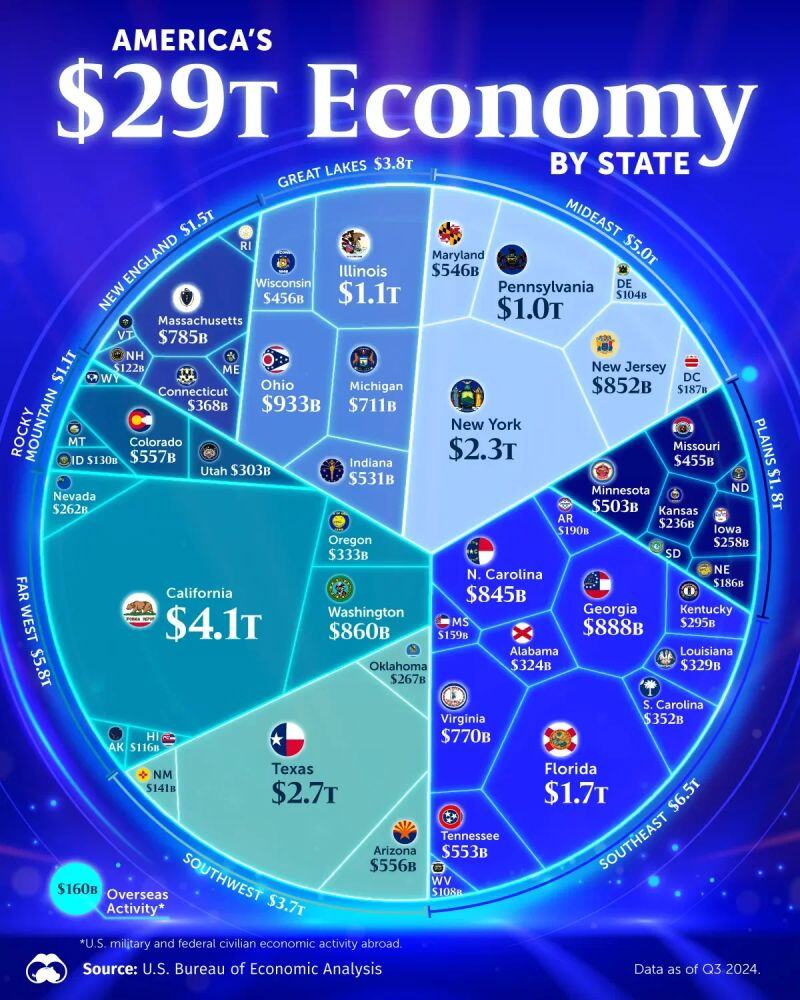

Visualizing America's $29 Trillion Economy by State

Which states contribute the most to the U.S. economy? his graphic breaks down the country's GDP by state, including overseas activity. source : visualcapitalist, voronoiapps

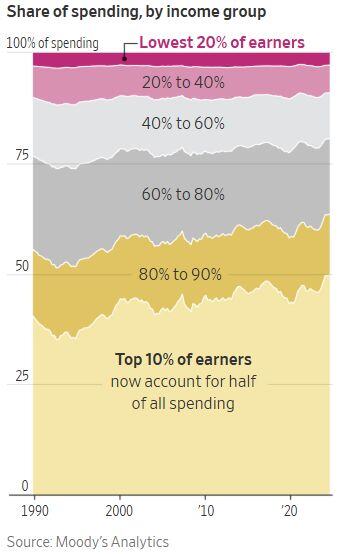

The top 10% of income earners in the US now account for half of all consumer spending, a record high.

(Note: top 10% = households making >$250k). Source: Charlie Bilello, Moody's analtics

Investing with intelligence

Our latest research, commentary and market outlooks