Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

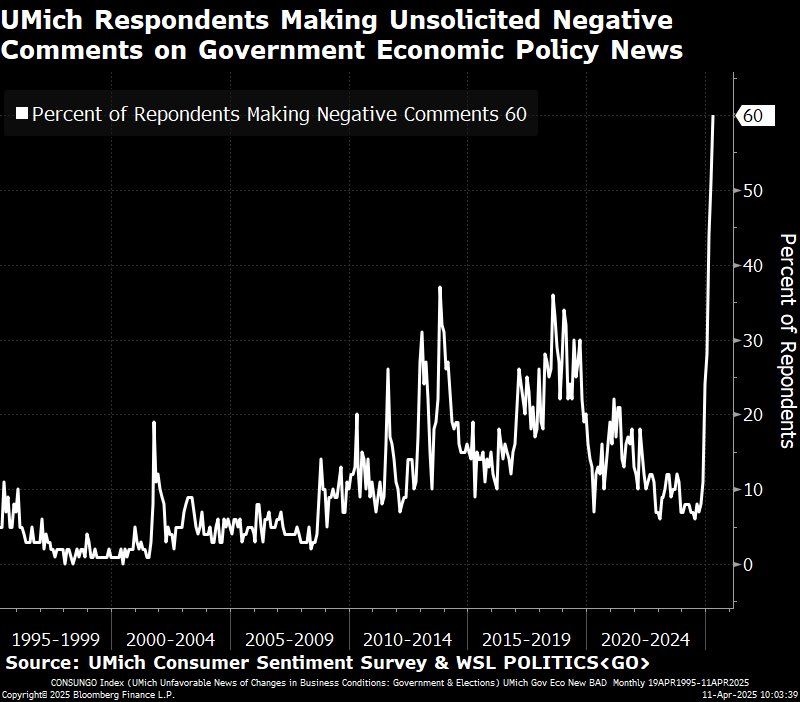

Chart for future history books...

Source: Michel A.Arouet, Bloomberg

Breaking news: China’s finance ministry said the increase from current additional levels of 84% would take effect from April 12.

Xi Jinping breaks silence, says Trump is bullying Europe and the entire world “There are no winners in tariff wars. Going against peace means isolating yourself,” Xi said during a meeting in Beijing with Spanish PM Pedro Sánchez — one of the hardest-hit in this trade war. The Chinese leader urged the EU to unite with Beijing against the U.S. president’s “unilateral intimidation.” Source: FT

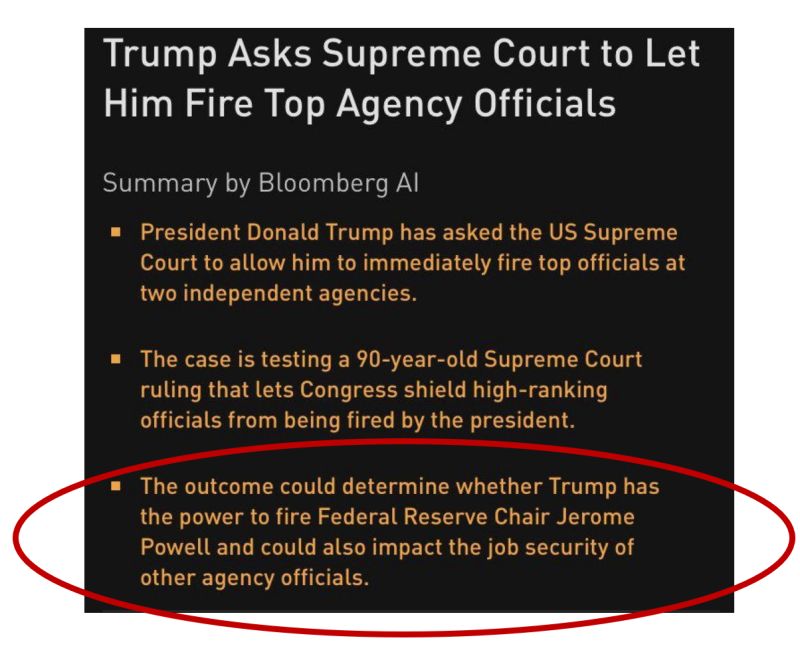

🔴 BREAKING: PRESIDENT TRUMP JUST ASKED THE SUPREME COURT FOR THE AUTHORITY TO FIRE FEDERAL RESERVE CHAIR JEROME POWELL

Source: Bloomberg

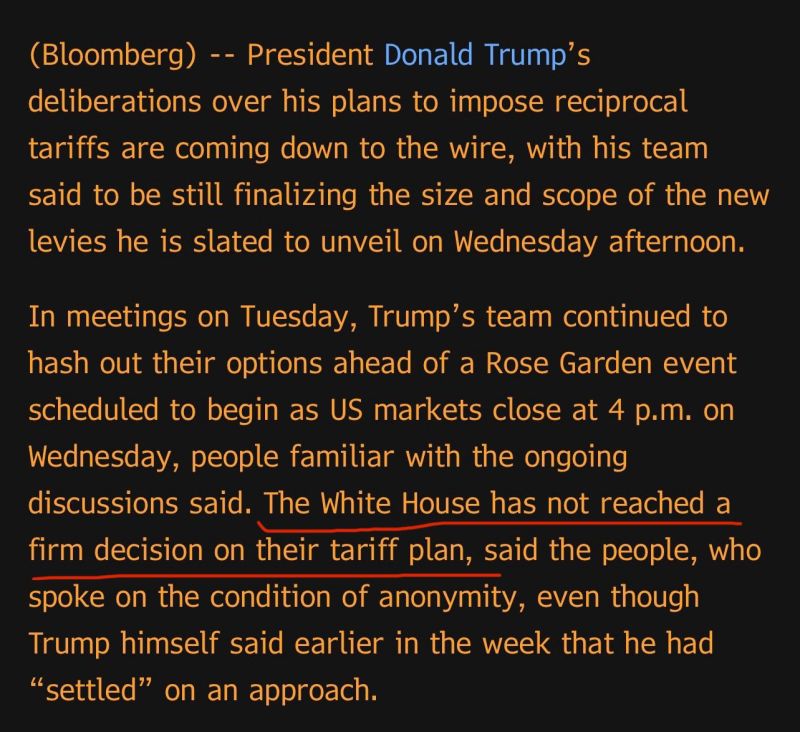

Just a reminder that this story was leaked on Monday, and then denied by the White House.

Source: James Chanos @RealJimChanos

🔴 EU TO TRUMP: TWO CAN PLAY THE TARIFF GAME — BIG TECH MAY GET BURNED

👉 With Trump slapping 25% tariffs on EU cars and threatening more, Brussels is plotting a counter strike — and this time, it’s not just bourbon and blue jeans on the line. 👉 EU officials are eyeing U.S. services exports, including Big Tech and intellectual property, as leverage — think blocked patents, frozen software updates, and Starlink losing out on juicy contracts. 👉EU diplomat: “The Americans think that they are the ones with escalation dominance, but we also have the ability to do that,” Source: FT thru Mario Nawfal on X

President Trump Unleashes 25% Tariffs On Foreign-Made Auto Imports

"...we are going to charge countries for doing business in our country..." President Trump has announced a 25% tariff on all cars not made in the US. “This will continue to spur growth,” Trump told reporters. Trump confirmed that these new tariffs are in addition to existing tariffs and are expected to result in $100 billion in revenues. To underscore his seriousness, Trump said, “This is permanent.” In addition to the tariffs, Trump discussed his plan to allow Americans to deduct interest payments on cars that are made in America. source : zerohedge

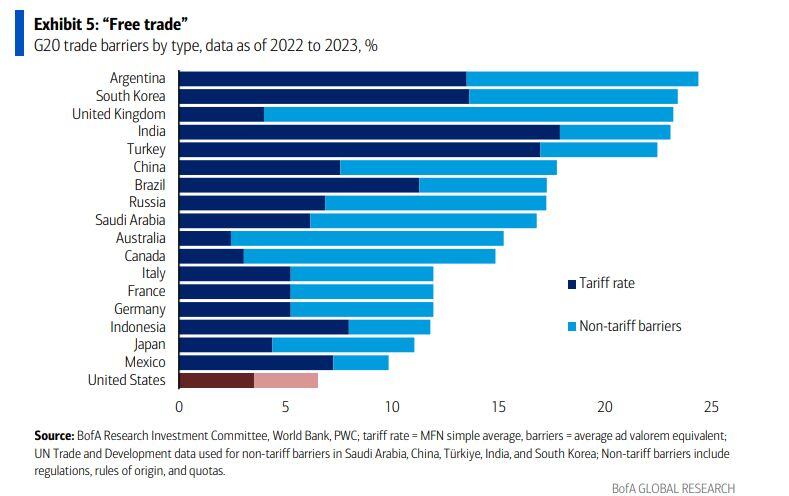

Every G20 country has higher average tariff rates than the United States save two

and most countries hide the true costs in expensive barriers like quotas, price controls, labeling requirements, and testing rules. Source: BofA, zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks