Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Germany drops its decade-old anti-nuclear stance.

In a statement to the Financial Times, German and French officials confirm Germany will no longer oppose nuclear in EU energy policy. A historic shift!

*IRAN READY TO SIGN DEAL WITH CONDITIONS: NBC CITING OFFICIAL

Source image below: Skynews

🔵 Here are the key takeaways from President Donald Trump's "lavender carpet" visit to Saudi Arabia yesterday:

✔️ Economic Deals and Investments: Trump secured a $600 billion investment commitment from Saudi Arabia into the U.S. economy, focusing on sectors like AI, energy, infrastructure, and defense. This included a $142 billion arms deal, described as the largest defense cooperation agreement in U.S. history, covering air and missile defense, maritime security, and more. Additional deals involved U.S. companies like Google, Oracle, and Boeing, with Saudi investments in AI data centers and energy infrastructure. ✔️Lifting Sanctions on Syria: Trump announced the lifting of U.S. sanctions on Syria, in place since 1979, to support the country’s reconstruction under its new leadership following the fall of Bashar al-Assad. This decision was made at the request of Saudi Crown Prince MBS and was celebrated in Syria as a step toward economic recovery. Trump also planned a brief meeting with Syria’s new president, Ahmed al-Sharaa, in Riyadh.

Donald Trump plans to announce a new trade pact with the UK on Thursday, in what could make Britain the first country to ease tariff tensions with the US

➡️ https://lnkd.in/eG8ABj8f Trump said in a post on his Truth Social platform on Wednesday that a “Big News Conference” was coming “concerning a MAJOR TRADE DEAL WITH REPRESENTATIVES OF A BIG, AND HIGHLY RESPECTED, COUNTRY”. The expected UK-US deal is one of 17 agreements that the Trump administration has been aiming to sign with its major trading partners as it rows back on the sweeping tariffs on countries around the world announced on April 2. The US president has been under pressure to deliver some early deals to show investors that he is serious about de-escalating the trade tensions that have caused huge volatility in markets in recent weeks. But US officials have also insisted that a wide range of countries have made offers to Washington in the hope of clinching deals to put a lid on their trade disputes with Trump. The scope and details of the pact expected on Thursday with the UK was not clear, including whether further negotiations will be needed to finalise it, and how much relief from US tariffs Britain will get. The Financial Times reported on Tuesday that Washington and London were close to agreeing a trade pact that would offer lower-tariff quotas for British cars and steel exports, which were hit by 25 per cent levies by Trump earlier this year. Such tariff relief would help offset the impact of Trump’s “liberation day” levies on UK exports to the US — which were set at the baseline rate of 10 per cent last month. Source FT

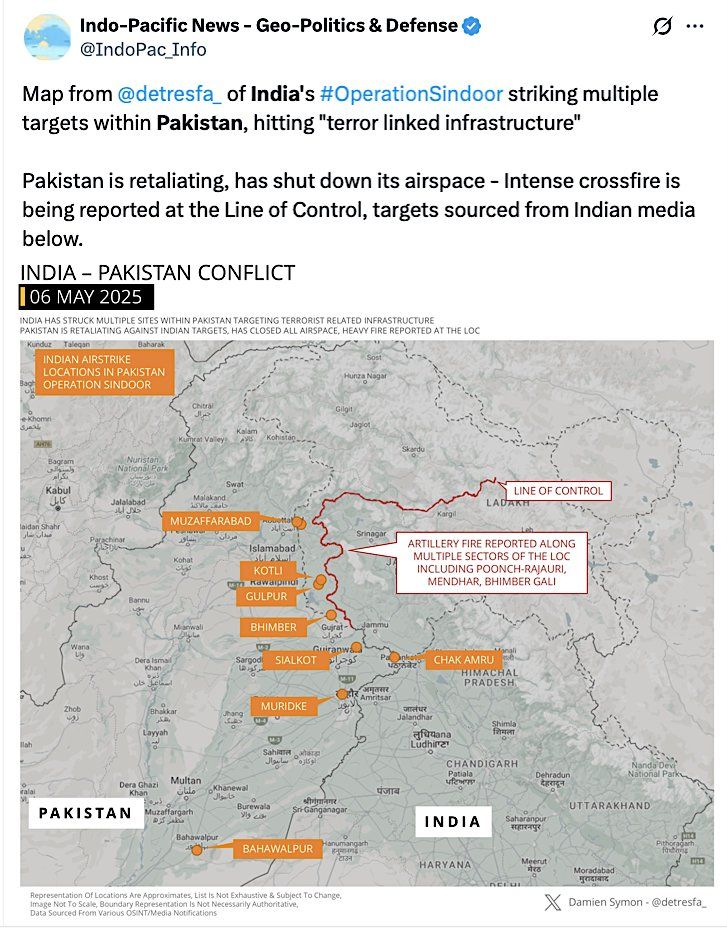

🚨Two nuclear powers are now at WAR, as Pakistan launches retaliatory strikes against India after India’s initial attack

➡️ India says it has targeted 9 Pakistani terror camps in Pak occupied Kashmir using standoff missile strikes as part of Operation Sindoor

U.S. rejects Japan's exemption from "reciprocal" tariffs - Kyodo

▶️ The United States has refused Japan's full exemption from not only a 10 percent "reciprocal" tariff but a country-specific tariff in recent negotiations, sources close to the matter said Monday. ▶️ U.S. officials including Treasury Secretary Scott Bessent told Japan's top negotiator Ryosei Akazawa in their meeting in Washington last week that the administration of President Donald Trump intends to put only a cut in the 14 percent country-specific tariff, suspended through early July, on the negotiating table, the sources said. ▶️ The U.S. side stressed in the second round of the negotiations that it will only consider extending the 90-day suspension or lowering the 14 percent tariff depending on the progress of their talks, according to the sources.

India has proposed zero-for-zero tariffs on U.S. auto parts and steel, according to Bloomberg

Amid continued trade talks with Washington, India has reportedly proposed to charge zero tariffs on steel, auto components and pharmaceuticals from the US on a reciprocal basis. According to a report by Bloomberg quoting people familiar with the development, the reciprocal tariffs have been offered up to a certain quantity of imports from the US. Beyond the set limit, imported industrial goods would attract the regular level of duties, the sources said. The offer was reportedly made by trade officials from the Indian side who visited Washington in late April to expedite negotiations on a bilateral trade deal. A deal is expected to be closed by autumn this year, the report quoted the sources as saying.

🔴 U.S. AND UKRAINE LAUNCH RECONSTRUCTION & MINERALS DEAL

▶️ The United States and Ukraine have officially established the United States-Ukraine Reconstruction Investment Fund, giving American companies priority access to develop Ukraine's valuable natural resources. The agreement grants the US privileged access to investment projects for Ukraine's aluminum, graphite, oil, and natural gas reserves as part of broader reconstruction efforts. ▶️Treasury Secretary Scott Bessent: "Thanks to President Trump's tireless efforts to secure a lasting peace, I am glad to announce this historic economic partnership agreement between the United States and Ukraine." Source: U.S. Treasury Department, @sentdefender thru Mario Nawfal

Investing with intelligence

Our latest research, commentary and market outlooks