Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

TRUMP: THE BIGGEST BILL IN AMERICAN HISTORY IS COMING

No tax on tips, no tax on Social security, no tax on overtime. "In the coming weeks and months, we will pass the largest tax cuts in American history and that will include no tax on tips, no tax on Social Security, no tax on overtime. It's called the One Big Beautiful Bill, and it will be the biggest bill ever passed in our country's history. It will include the biggest tax cuts, regulation cuts, military supremacy, and just about everything else." Source: @RapidResponse47 thru Mario Nawfal, FoxNews

🔴 BREAKING >>>

According to Reuters, the Trump administration is working on changes to a Biden-era rule that would limit global access to AI chips, including possibly doing away with its splitting the world into tiers that help determine how many advanced semiconductors a country can obtain, three sources familiar with the matter said. The sources said the plans were still under discussion and warned they could change. But if enacted, removing the tiers could open the door to using U.S. chips as an even more powerful negotiating tool in trade talks.

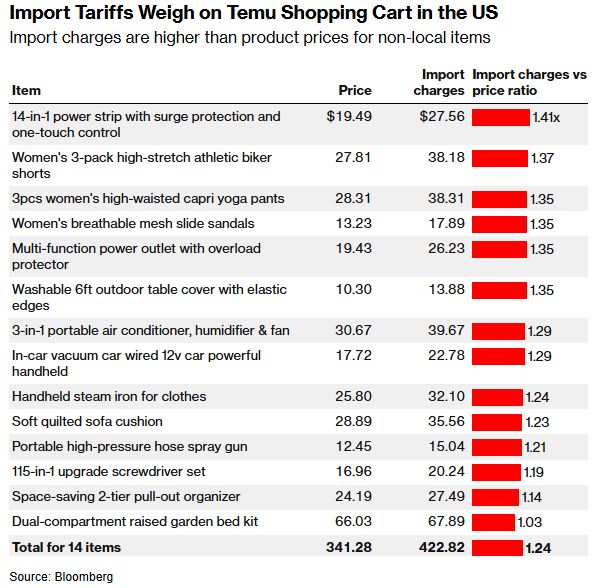

The import charges for many items on Temu (Chinese discount retailer) are higher than the cost of the products themselves.

Source: Charlie Bilello

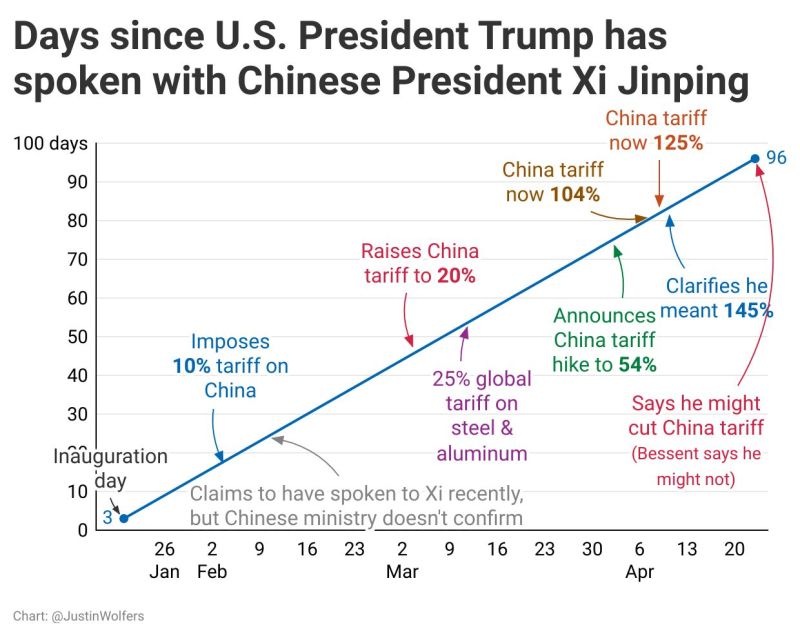

Trump - Xi Jinping summarized in one chart

Source: Justin Wolfers @JustinWolfers on X

Chinese state-backed funds are cutting off new investment in US private equity, according to several people familiar with the situation, in the latest salvo against President Donald Trump’s trade war.

State-backed funds have been pulling back from investing in the funds of US-headquartered private capital firms in recent weeks, according to seven private equity executives with knowledge of the matter. The moves come in response to pressure from the Chinese government, three of the people said. Some of the Chinese funds are also seeking to be excluded from private equity investments in US companies, even if those investments are made by buyout groups based elsewhere, some of the executives added. The change in approach to the US comes as China has borne the brunt of US tariffs announced in the past three weeks that threaten to significantly curtail trade between the world’s two biggest economies. Source: FT

President Donald Trump is registering the worst economic approval numbers of his presidential career amid broad discontent over his handling of tariffs, inflation and government spending

The survey found that the boost in economic optimism that accompanied Trump’s reelection has disappeared, with more Americans now believing the economy will get worse than at any time since 2023 and with a sharp turn toward pessimism about the stock market. The survey of 1,000 Americans across the country showed 44% approving of Trump’s handling of the presidency and 51% disapproving, slightly better than CNBC’s final reading when the president left office in 2020. On the economy, however, the survey showed Trump with 43% approval and 55% disapproval, the first time in any CNBC poll that he has been net negative on the economy while president. Source: CNBC

Donald Trump signalled he may offer carmakers some relief from tariffs, in the latest sign the US president will offer carve-outs to selected industries.

Trump said he was “looking at something to help car companies” that were making vehicles in North America. “They’re switching to parts that were made in Canada, Mexico and other places, and they need a little bit of time, because they’re going to make them here,” Trump said from the Oval Office on Monday. His remarks came after the administration at the weekend exempted smartphones, laptops and other consumer electronic goods from steep “reciprocal” tariffs, although US officials later said those items could be caught in a later round of levies. Trump unveiled steep tariffs of 25 per cent on imports of cars and parts last month, in a move that threatens to push up costs for American consumers and upend global auto supply chains. Under the trading regime, cars and parts made in Canada and Mexico face lower levies and only attract the 25 per cent tariff on their non-US content if they otherwise comply with the rules of the 2020 USMCA trade agreement. Trump’s comments on Monday suggest he may offer carmakers more time to move supply chains to North America. Source: FT

In trade negotiations. Bessent is highly qualified for the role, but is also tasked with finding quick solutions to complex issues while maintaining investor confidence in U.S. policies.

Bessent’s ascent is the direct outcome of the market turmoil that followed Liberation Day. When reporters asked him where the tariff negotiations were headed, his response was he did not know because he was not part of the negotiating team Source: Forbes

Investing with intelligence

Our latest research, commentary and market outlooks