Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Presented with no comment, Long-Term Gold Price, 3 centuries

Chart ~ Nick Laird, http://GoldChartsRUs.com

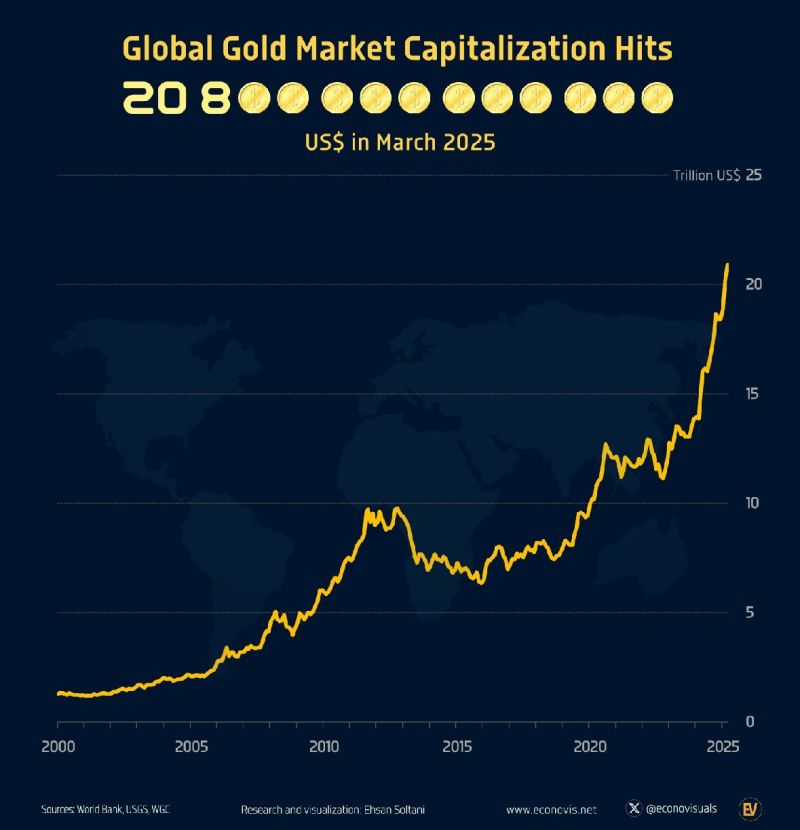

The bull market in gold has been truly historic: Gold has added ~$5.0 trillion in market value over the 12 months and is now worth a record $20.1 trillion.

Over the last 6 years, gold's market cap has risen by nearly $12 trillion, or 148%. In 2025 alone, gold prices have risen ~12% and marked multiple new all time highs. Furthermore, the gold to CPI ratio has hit a record 9.2x. This exceeds previous peaks of 8.4x and 8.1x posted in 1980 and 2011. Gold is making history. Source: The Kobeissi Letters, Blossom

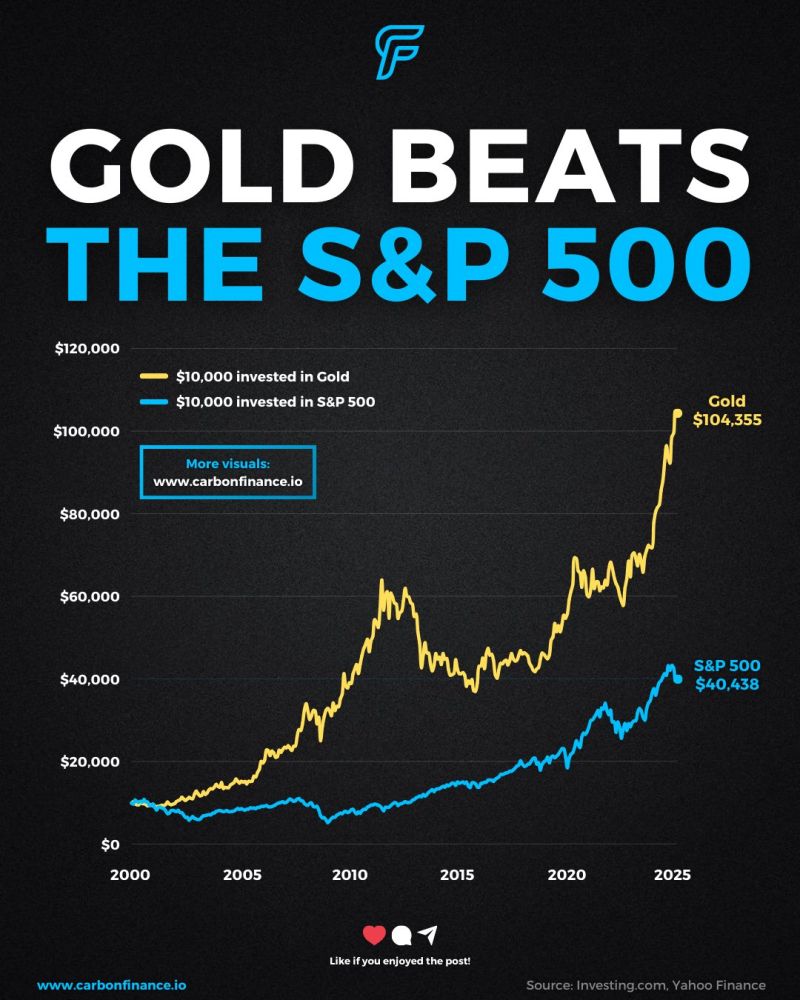

Gold $GLD has outpaced the S&P 500 $SPX by 2.5x since 2000.

A $10K investment in Gold is now $104K, while the S&P 500 sits at $40K. Source: Carbon Finance

The gold-to-S&P 500 ratio is now near 4-year highs.

Source: Bloomberg, Crescat Capital

The resilience of the yellow metal shines through as Gold reaches an All-Time High

Comparatively, other assets have experienced drawdowns from their respective All-Time Highs: - Berkshire $BRKB: -4% - Gold Miners $GDX: -4% - S&P 500 $SPY: -8% - Oil & Gas $XLE: -9% - NDX $QQQ: -12% - Transports $IYT: -15% - Mag7 $MAGS: -18% - Software $CLOU: -18% - Bitcoin $XBT: -22% - Banks $KRE: -22% - SOX AI $SOXX: -24% - Home Builders $ITB: -25% - ARK $ARKK: -68% Data Source: Lawrence McDonald

Gold ETFs drew largest weekly inflow since March 2022, says WGC

Physically backed gold exchange-traded funds (ETFs) registered the largest weekly inflow since March 2022 last week, data by the World Gold Council (WGC) showed on Monday. Gold ETFs store bullion for investors and account for a significant amount of investment demand for the precious metal, which hit a record high of $2,956.15 per troy ounce on Monday. Gold ETFs saw an inflow of 52.4 metric tons worth $5 billion last week, the largest amount since the first week of March 2022, when global markets were grappling with immediate consequences of Russia's invasion of Ukraine. This raised their total holdings by 1.6% to 3,326.3 tons, the largest since August, 2023. The U.S.-listed funds led the inflow last week with 48.7 tons. For comparison, in January they saw an outflow of 6.3 tons. source : reuters

Investing with intelligence

Our latest research, commentary and market outlooks