Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

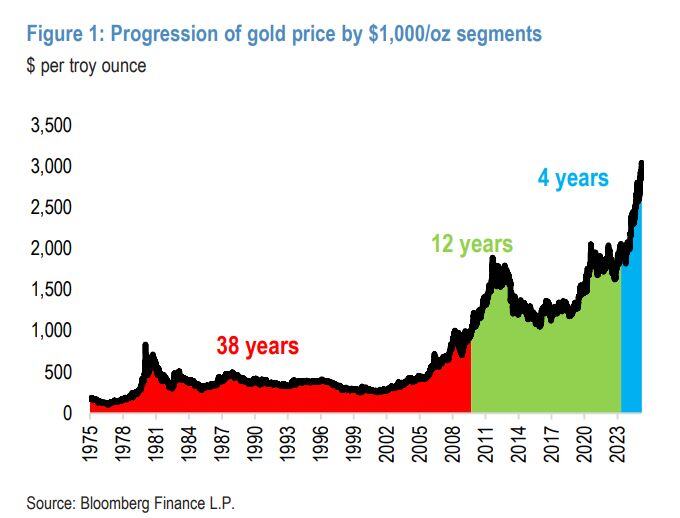

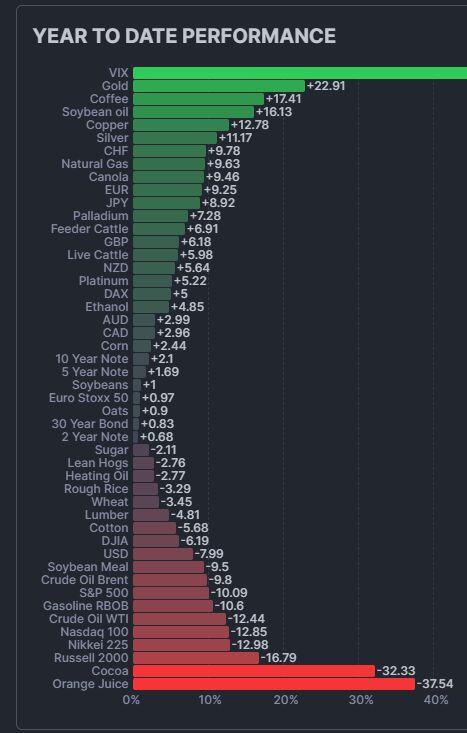

It took 38 years for gold to rise from $35/oz to $1,000/oz. Then it took 12 years to rise from $1,000/oz to $2,000/oz in 2020.

It only took 4 years to go from $2,000 ~~~> $3,000 Source: CEO Technician, Bloomberg

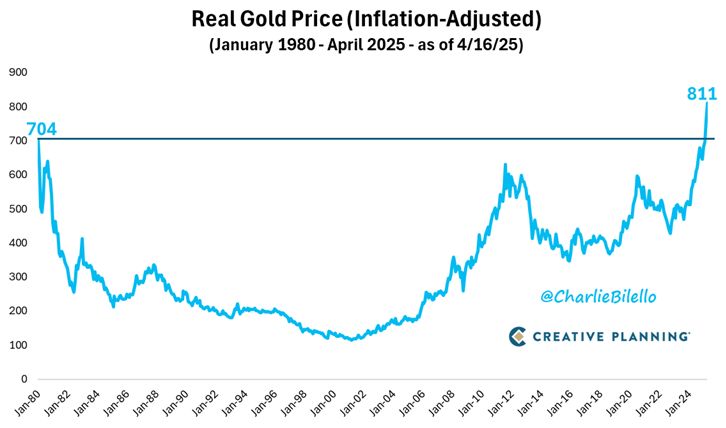

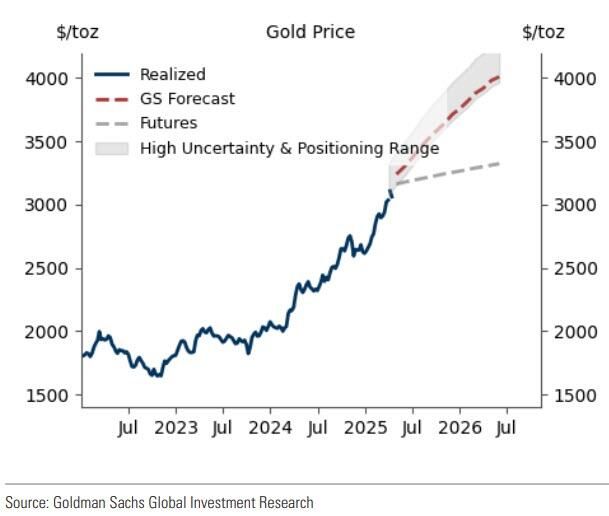

Gold could reach $4,000 over the next year+, according to a forecast by Goldman

Goldman Sachs now sees gold prices to hit $3,700 by the end of 2025. In the most extreme scenario, the bank sees gold prices to spike to $4,500 by the end of the year. Source: Markets & Mayhem

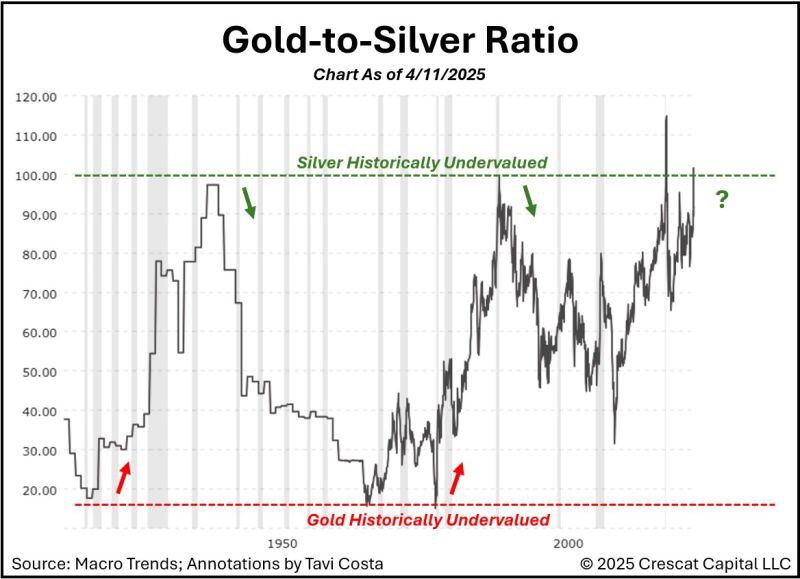

This is a fascinating chart for anyone looking at the gold-to-silver ratio in a historical context - courtesy of Otavio (Tavi) Costa.

Over the past 125 years, the ratio has only spent brief moments above the 100 level — extremes like this tend not to persist for long... Source: Tavi Costa, Crescat Capital

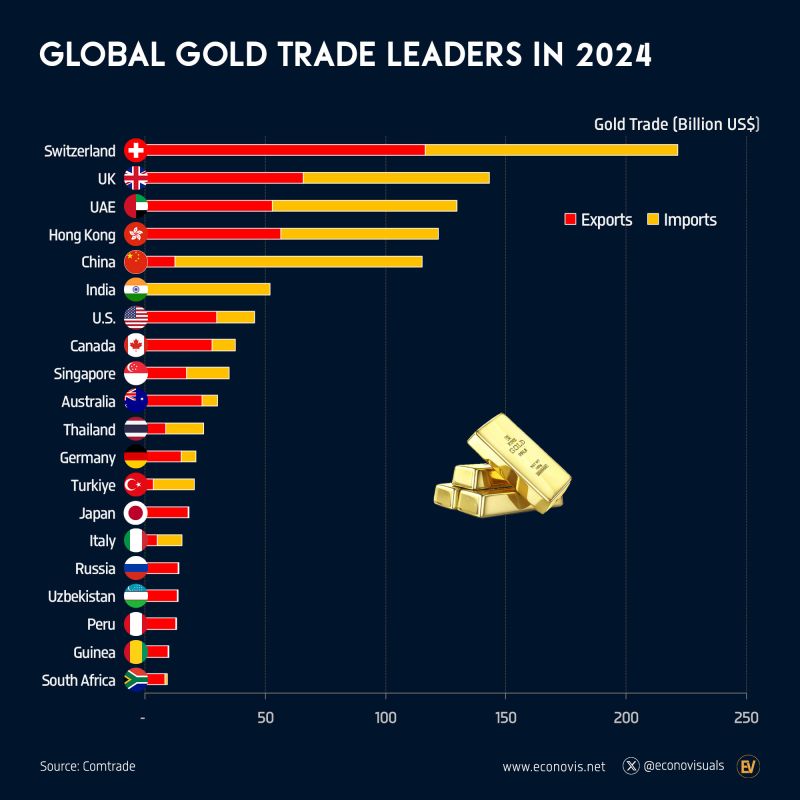

Global Gold Trade Leaders in 2024

In 2024, Switzerland ($116 billion), the United Kingdom ($66 billion), Hong Kong ($57 billion), and the United Arab Emirates ($53 billion) emerged as the world’s top gold exporters. These same economies also featured prominently among the top gold importers: Switzerland ($105 billion), the UK ($77 billion), Hong Kong ($65 billion), and the UAE ($77 billion). Meanwhile, China ($103 billion) and India ($52 billion) ranked as major gold importers but exported far less—$90 billion for China and $1 billion for India—making them the world’s largest net gold importers. Source: Econovis @econovisuals

Investing with intelligence

Our latest research, commentary and market outlooks