Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

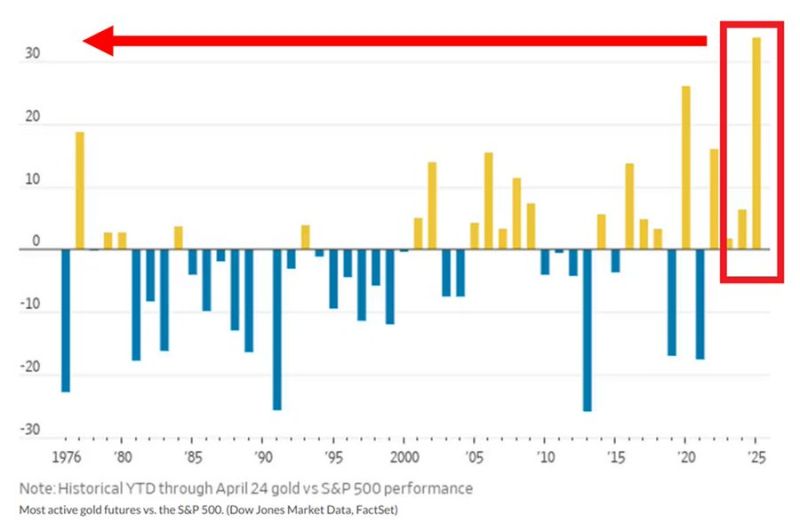

Gold prices have OUTPERFORMED the S&P 500 by 33% so far this year, the most since at least 50 YEARS.

Since the start of 2023, gold has rallied 82% while the S&P 500 44%, despite 2023 and 2024 being the best years for stocks since the Dot-Com BUBBLE. Source: Global Markets Investor

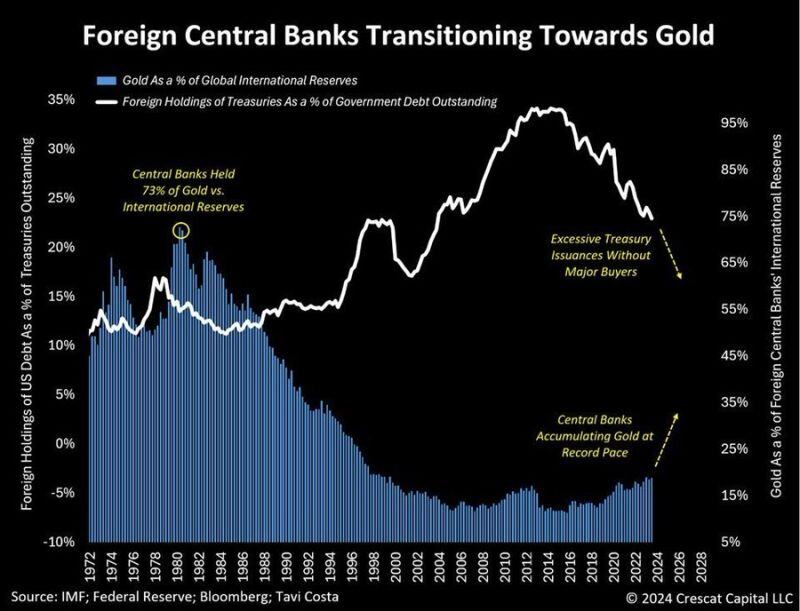

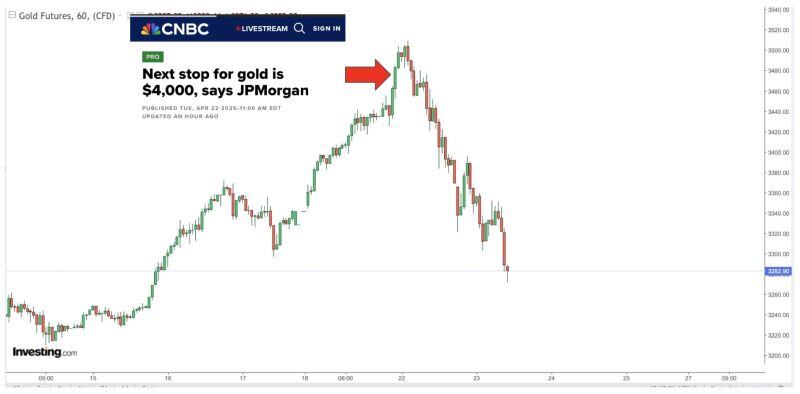

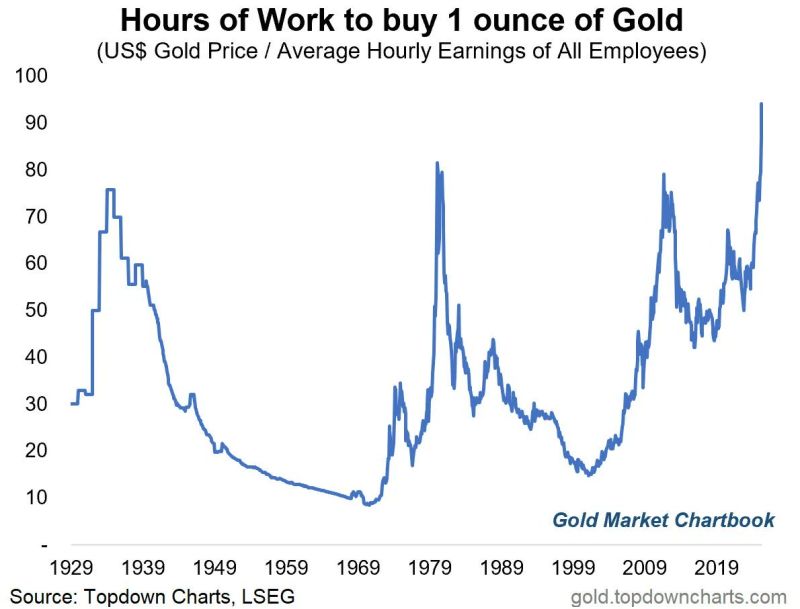

Should investors look at overbought signals on gold or focus on the long-term perspective?

Tavi Costa believes that when it comes to the yellow metal this as one of those key moments when traditional technical analysis like overbought conditions become largely irrelevant. We are likely in the midst of a monetary realignment, and attempting to time short-term corrections based on extreme RSI levels misses the forest for the trees, in his view. "This perspective underestimates the structural macro imbalances that continue to compel governments to accumulate gold" he added. He might be right...

Global Markets Investor @GlobalMktObserv ‼️

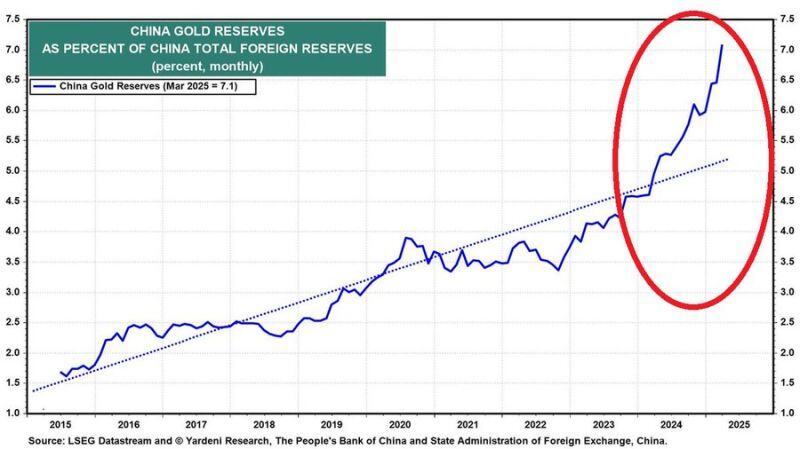

China's gold buying has been truly historic: China's gold reserves hit a RECORD 73.5 million troy ounces. China has bought a whopping 10 MILLION troy ounces of gold over the last 30 months. In effect, gold's share of China's total foreign reserves hit 7.1%, an all-time high. Source: Global Markets Investor

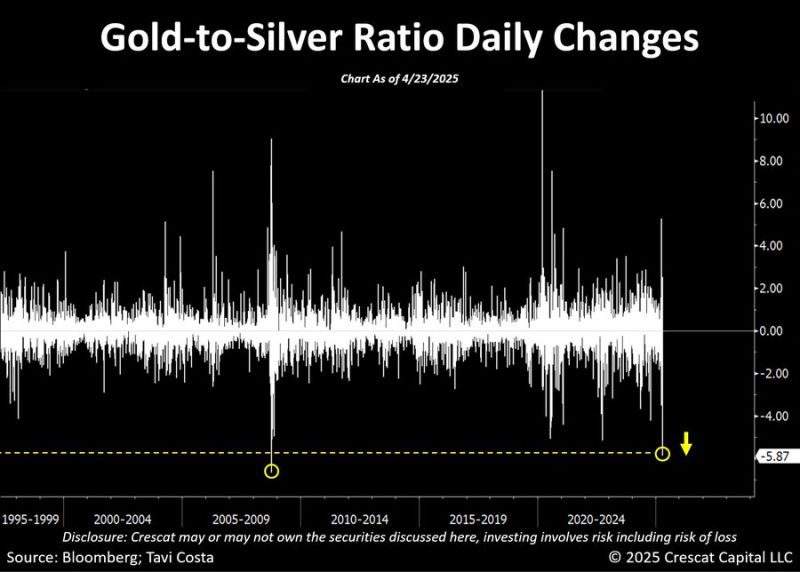

As highlighted by Otavio (Tavi) Costa, we're currently seeing the biggest drop in the gold-to-silver ratio since 2008.

That move back then marked the start of a long downtrend that eventually took the ratio all the way to 31 over the next three years. Are we heading into a similar setup now? (except we're starting from an even more extreme level). We’ve just dipped below 100; in 2008, the peak was 85. Just to put it in perspective: If the ratio drops to 30 today, silver would be trading around $110 an ounce. Source: Bloomberg, Crescat Capital

GOLD IS OUTPERFORMING THE STOCK MARKET BY A WHOPPING 42.5% SO FAR THIS YEAR 😮

Source: GURGAVIN @gurgavin on X

Investing with intelligence

Our latest research, commentary and market outlooks