Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

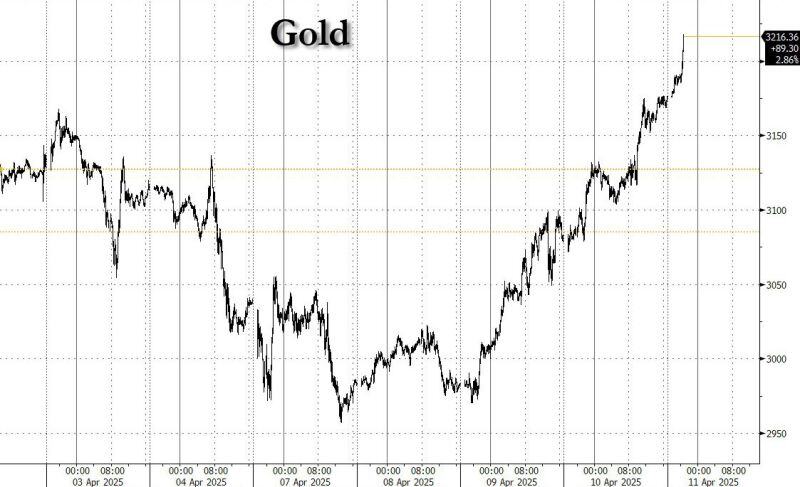

Physical gold craziness...

The big 3 vaults (Brinks, JPM, HSBC), are running out of space where to store the physical; the 3 alone hold more than 35 million oz of physical.

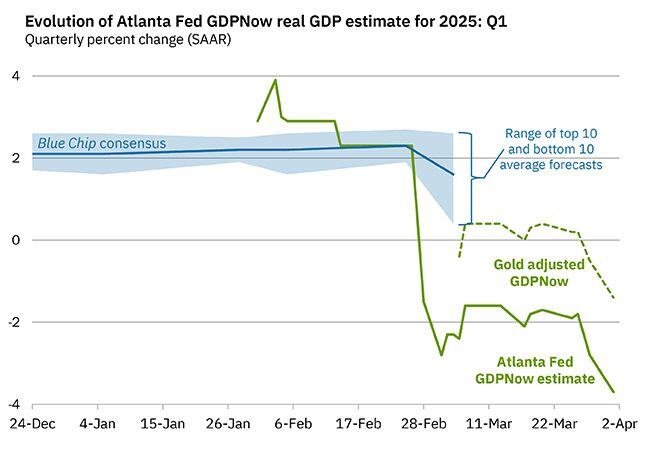

On April 1, the GDPNow model nowcast of real GDP growth in Q1 2025 is -3.7%.

Adjusting for gold imports, the model now sees -1.4% GDP contraction in Q1 2025. Just 2 months ago, they saw GDO growing by +3.8% in the same period...

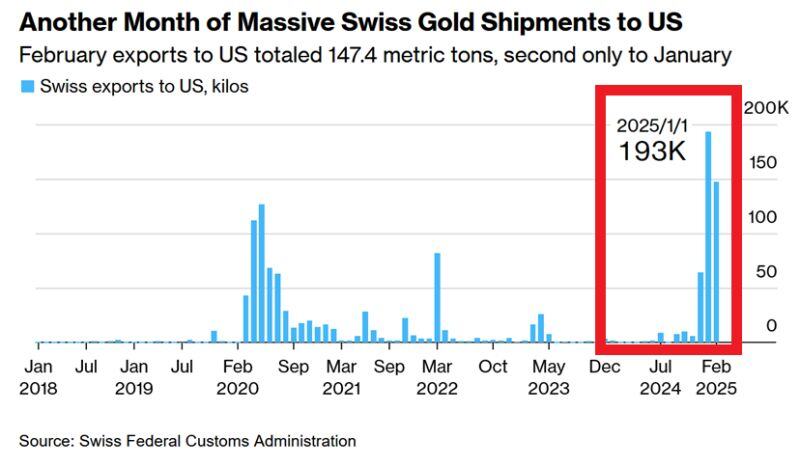

‼️Gold shipments to the US are SKYROCKETING:

Swiss gold exports to the US hit a record 404 metric tons over the last 3 months. Gold stockpiles on the Comex hit a record 42.6 million ounces on Tuesday, almost DOUBLE the inventory at the end of 2024. Rush for gold is real. Source: Global Markets Investor

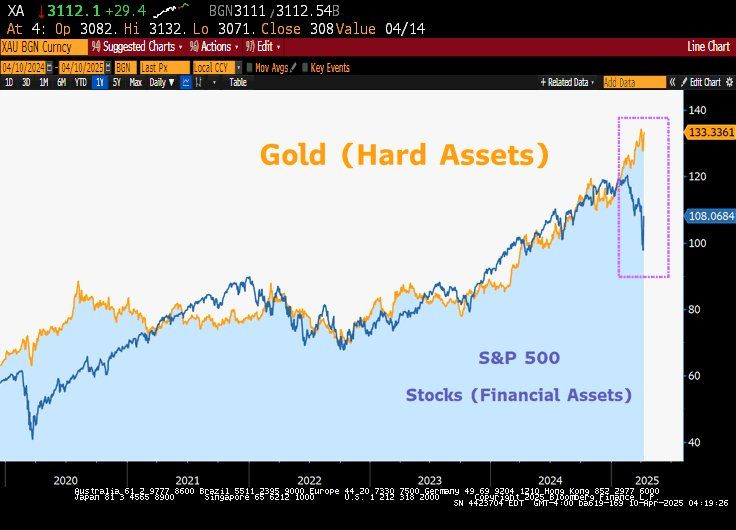

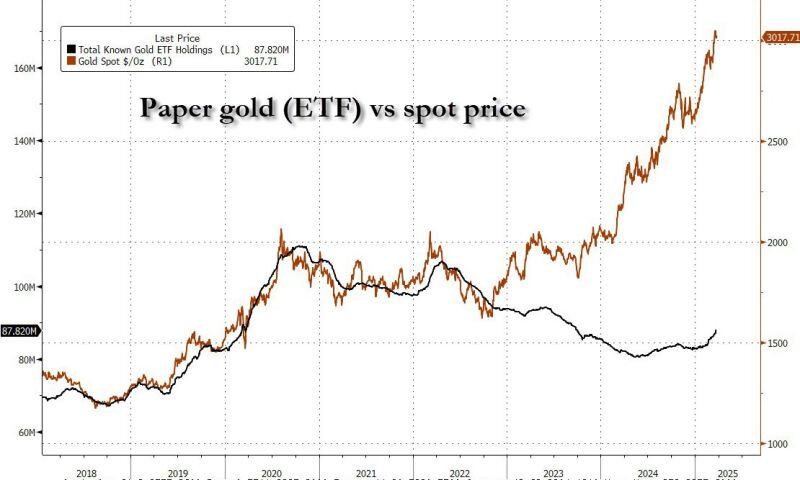

I think I already found my chart of the week...

The black line shows Total known Gold ETF Holdings while the brown line represents the Gold spot price. The ETF crew has finally woken up, but paper gold has a long way to go to catch up to physical buyers, who after the 2022 weaponization of the dollar are mostly central banks. Source: zerohedge

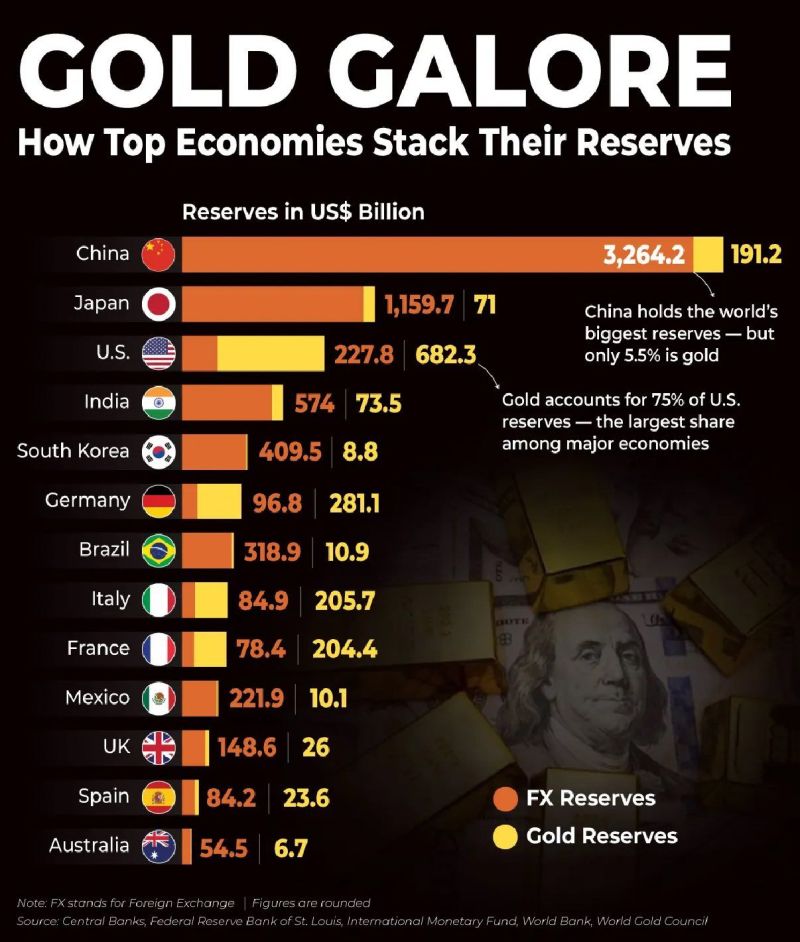

How Top Economies Stack Their Reserves...

Gold account for 75% of US reserves, the largest share among major economies. China holds the world's biggest reserves - but only 5.5% is gold... Source: Brad Moseley

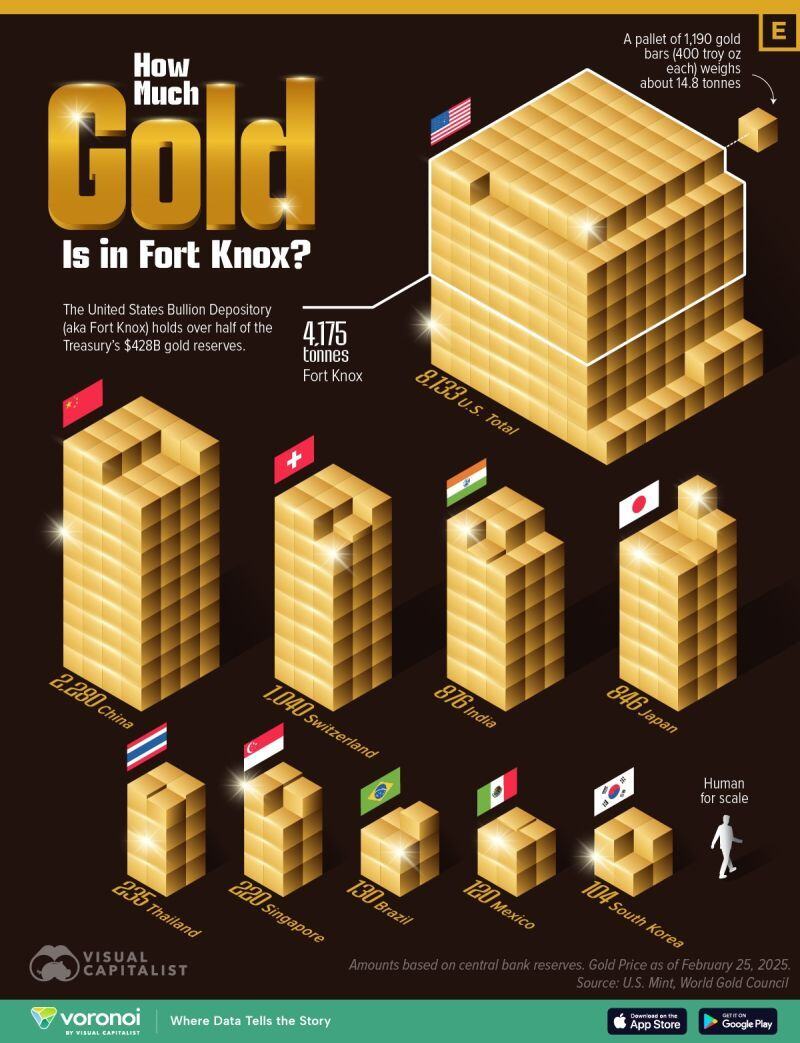

Visualized: How Much Gold Is in Fort Knox?

U.S. President Donald Trump has promised to visit Fort Knox “to make sure the gold is there.” Officially, the United States Bullion Depository (commonly known as Fort Knox) holds over half of the Treasury’s $428 billion of gold reserves. In this graphic, Visual Capitalist / Elements put that amount into perspective by comparing Fort Knox’s reserves with central bank gold reserves worldwide. The data comes from the U.S. Mint and the World Gold Council. For illustrative purposes, we considered a pallet of 1,190 gold bars (400 troy ounces each) weighing approximately 14.8 tonnes. What Is Fort Knox? Located in Kentucky, Fort Knox is a U.S. Army installation that serves as the primary storage site for America’s gold reserves. The facility was established in the 1930s to protect gold from potential foreign attacks. The first gold shipment arrived in 1937 via U.S. Mail from the Philadelphia Mint and the New York Assay Office. During World War II, Fort Knox safeguarded important U.S. documents, including the Declaration of Independence, the Constitution, and the Bill of Rights. It has also housed international treasures, such as the Magna Carta and the crown, sword, scepter, orb, and cape of St. Stephen, King of Hungary, before they were returned in 1978. Currently, it holds 4,175 tonnes of gold, equivalent to nearly half of China’s gold reserves and four times the Swiss central bank’s reserves. Only small samples have been removed for purity testing during audits; no major transfers have occurred for years. Source: Visual Capitalist, Elements

Investing with intelligence

Our latest research, commentary and market outlooks