Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

It’s time to stop looking at real yields to determine gold price...

Source: Michel A.Arouet

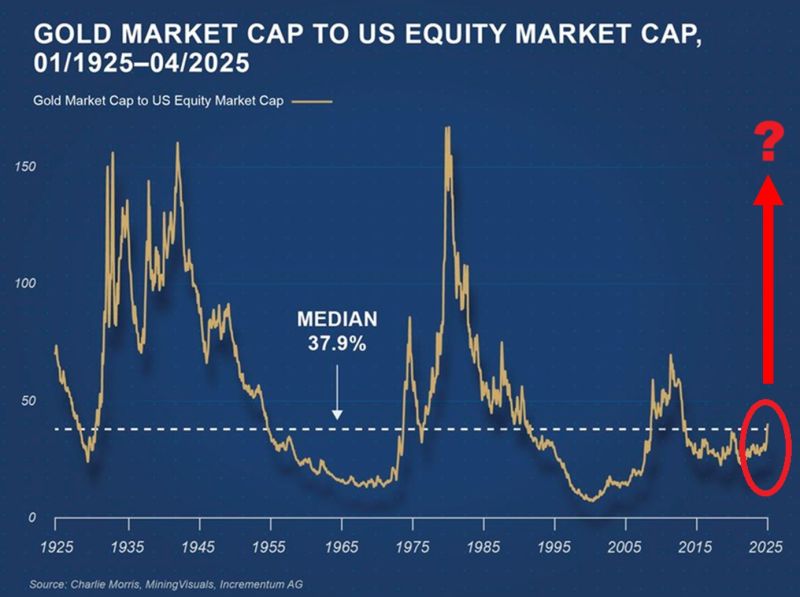

Gold market cap relative to the US equity market cap hit its highest level in 12 YEARS and is exactly at its long-term median.

Given the geopolitical and likely financial markets changes underway, will we see a repeat of the 1970s??? Source: Global Markets Investors, Incrementum AG

The Gold/Silver Price Ratio is now trading at 102x, the highest level in history since the U.S.

Dollar came off the Gold Standard (excluding the Covid scare) Source: Barchart

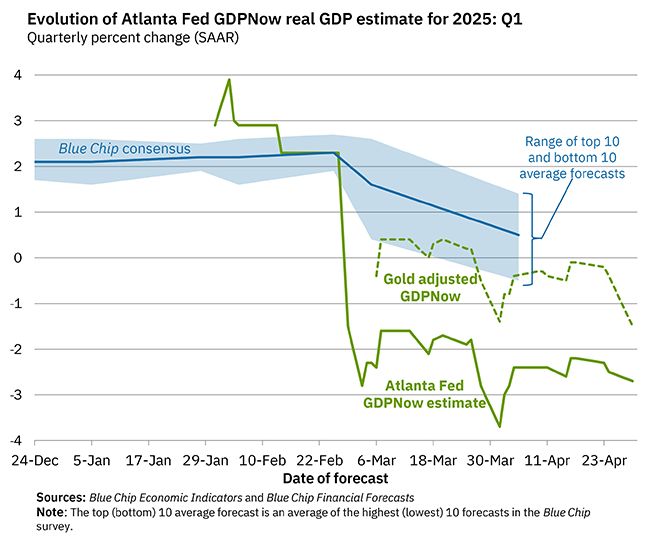

On April 29, the GDPNow model nowcast of real GDP growth in Q1 2025 is -2.7%.

The final alternative model forecast, which adjusts for imports and exports of gold, is -1.5% Source: Atlanta Fed

Investing with intelligence

Our latest research, commentary and market outlooks