Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

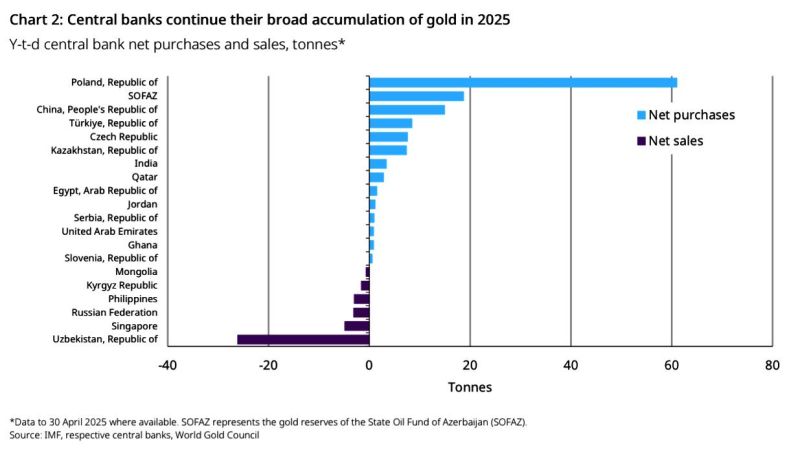

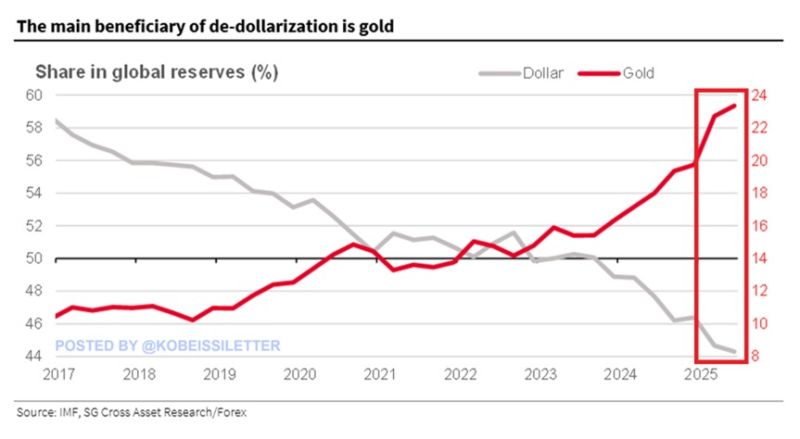

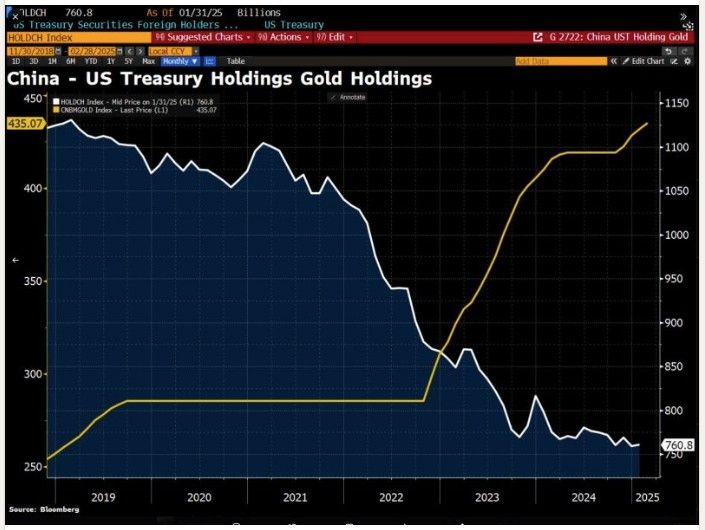

Gold's share of global reserves reached 23% in Q2 2025, the highest level in 30 years.

Over the last 6 years, the percentage has DOUBLED. At the same time, the US Dollar's share of international reserves has declined 10 percentage points, to 44%, the lowest since 1993 (dee left-hand scale). By comparison, the Euro's share has decreased 2 percentage points, to 16%, the lowest in 22 years. Gold is quickly replacing fiat currencies as a reserve currency. Keep watching gold.

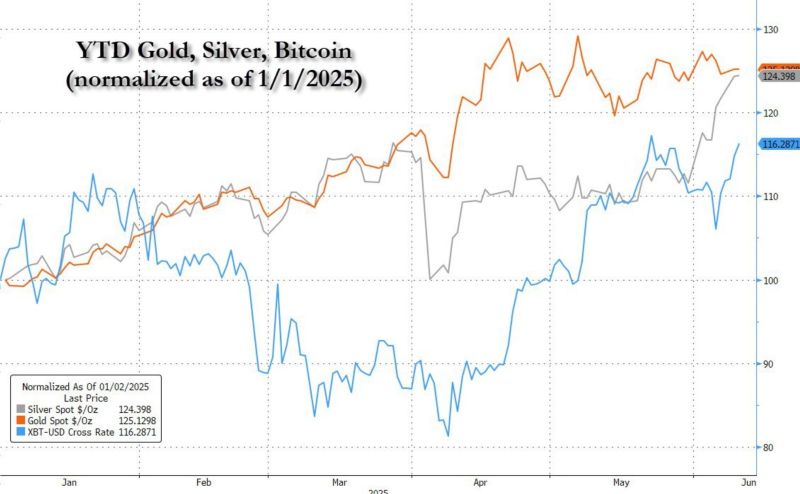

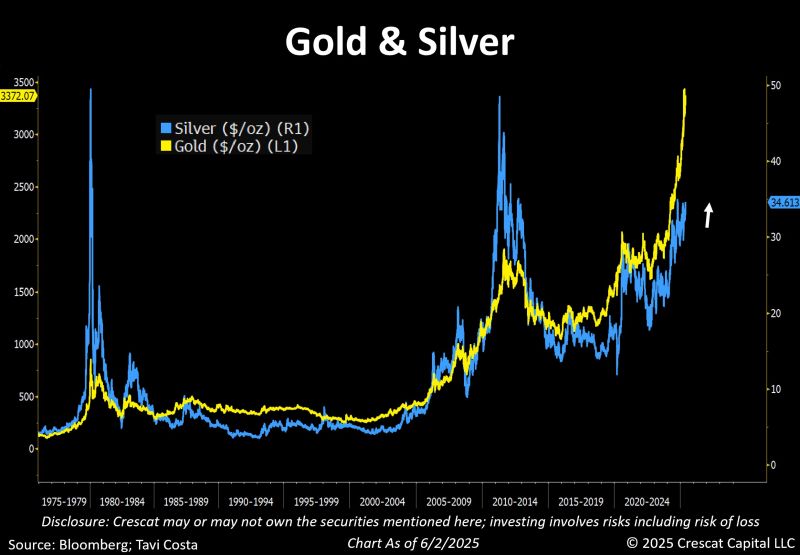

Silver about to surpass gold as best performing asset YTD

Source: zerohedge

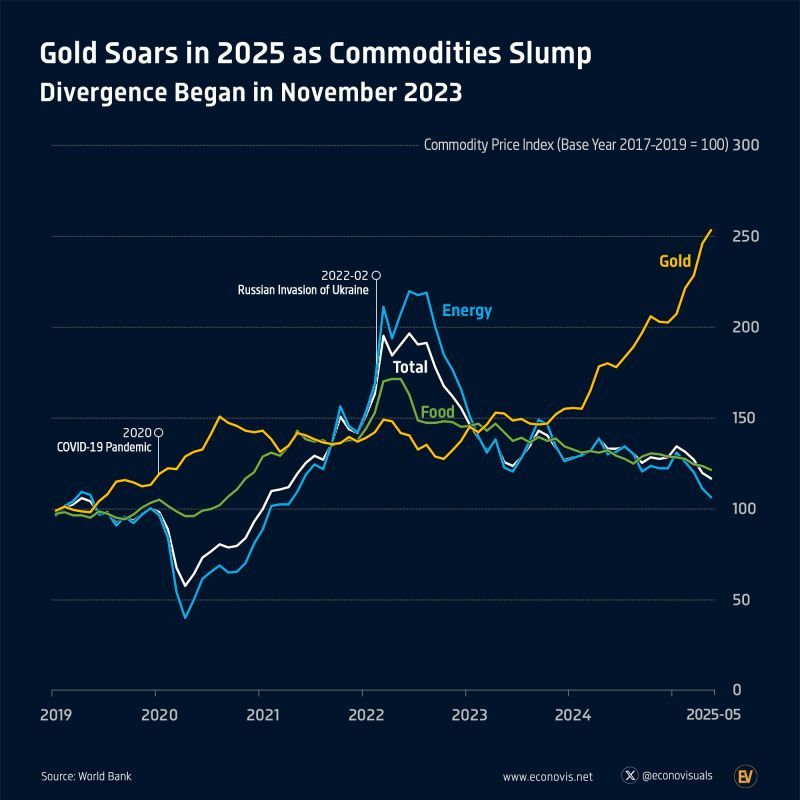

Gold’s 2025 Surge: Defying the Commodity Downturn

Divergence Began in November 2023 By May 2025, gold prices had surged 25.0% year-to-date, in sharp contrast to the broader commodity market slump. The overall commodity index fell 9.0%, with energy prices down 12.9% and food prices down 5.9%. Gold's value stood 153% above its pre-pandemic level—outpacing the commodity index by 117%, energy by 138%, and food by 109%. Source: Econonovis on X

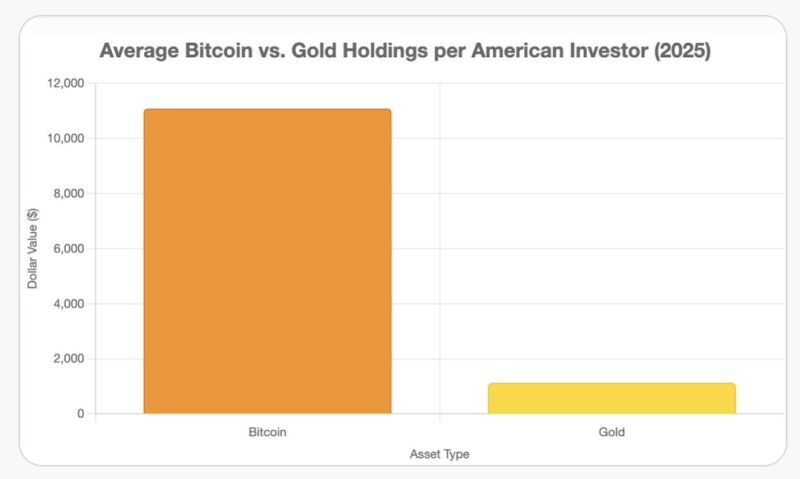

Is it time for silver to shine?

If history is any guide: Gold makes the first move — then silver takes over. With the gold-to-silver ratio near 100, is yesterday's sharp move on Silver (up +5%) just the beginning? Source. Bloomberg, Crescat Capital

Gold and JGBs 30y yield...

Wonder why gold was down yesterday? Japanese bond yields tumbled, as according to Reuters, Japan's Ministry of Finance (MOF) will consider tweaking the composition of its bond program for the current fiscal year, which could involve cuts to its super-long bond issuance... This was enough to fuel some profit taking on the yellow metal Source. The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks