Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

What's next for gold?

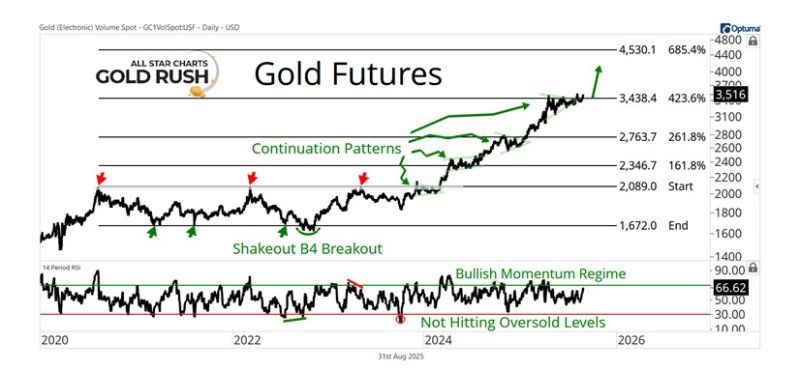

Here's the technical analysis view from J-C Parets: "After spending months coiling beneath the 423.6% Fibonacci extension, Gold futures are now resolving higher. This has been the pattern time and time again. Gold pauses at an extension level, builds energy, then launches to the next target. Every one of those continuation patterns has marked the beginning of another leg higher, and this one looks no different. As long as this breakout sticks, we think 4,500 is next". Source: All Star Charts team

Gold just hit all-time highs, 100 times the $35 it was in 1971 when Nixon closed the gold window

"The metal itself hasn’t changed; it’s still atomic number 79, the same as thousands of years ago. What changed is the dollar. Once it was tied to gold, now it floats, weakened by inflation and endless deficits. That’s why it takes over 100x more dollars to buy the same ounce". Source: StockMarket.News @_Investinq on X

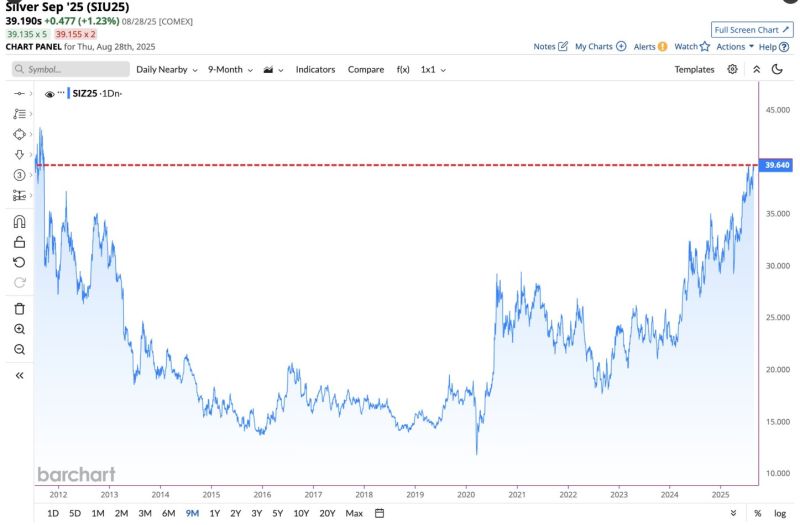

In case you missed it... silver hits highest closing price in almost 14 years 📈📈

Source: Barchart

Belated "Nixon closing the gold window anniversary" post

SPX priced in gold (blue) v. SPX priced in USD (red) since August 1971 when Nixon closed the gold window. Source: Luke Gromen @LukeGromen

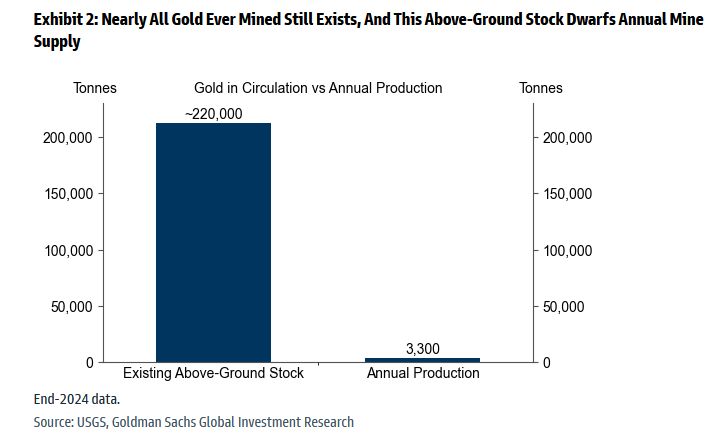

Gold is unlike other commodities – it is not consumed; it is stored.

Nearly all gold ever mined – about 220,000 tonnes – still exists, and this above-ground stock dwarfs annual mine supply. - From Goldman's primer on gold Source: zerohedge

Gold ETFs Breach 92 Million-Ounce Threshold

Bloomberg's measure of total gold ETF holdings jumped to a two-year high. At 92.7 million ounces on Aug. 15, my graphic shows this metric surpassing the 92 million threshold first reached in 2020, but with a big difference - stock market volatility was rising then. Source: Mike McGlone, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks