Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

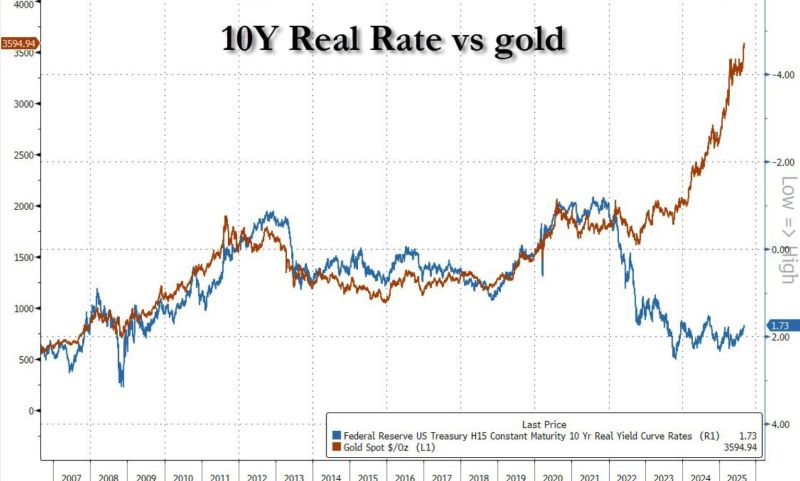

"The Ukraine war and the weaponization of the dollar was the straw that broke the camel's back"

Source: zerohedge

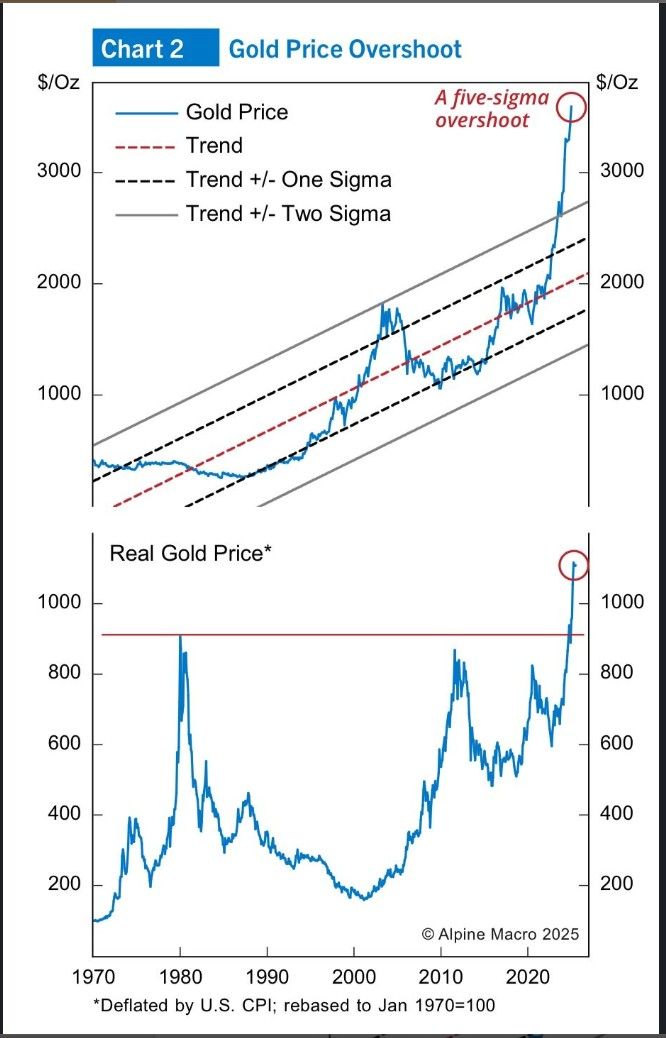

Gold is overshooting its time trend by 5 sigma

While the real gold price (after adjusted for U.S., CPI) is at the record highs, as this Alpine Macro chart shows. Source: Chen Zhao

According to the FT:

Tether, the world’s biggest stablecoin company, has held talks about investing in gold mining, seeking to deploy its vast crypto profits into bullion. -> FT: "The company has held discussions with mining and investment groups about investing in the entire gold supply chain, from mining and refining to trading and royalty companies, according to four people familiar with the recent talks. While gold has been a physical store of value for thousands of years and bitcoin has only existed as a digital instrument since 2009, there is a growing affinity between some industry executives. Tether chief executive Paolo Ardoino has likened gold to “natural bitcoin”. “I know people think that bitcoin is ‘digital gold’,” he said in a speech in May. “I prefer to think in bitcoin terms, I think gold is our source of nature.” However, within the conservative gold mining sector, Tether’s interest has been greeted with surprise and questions about whether the unconventional newcomer will succeed. “They like gold. I don’t think they have a strategy,” said one mining executive. Source: FT

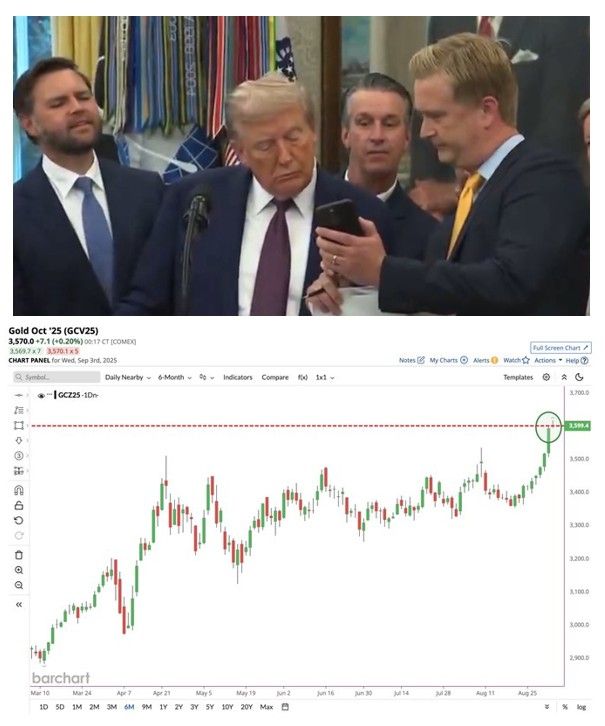

🚨 Goldman Sachs has doubled down on its optimistic forecast for gold, maintaining a structural bullish view on the precious metal

The investment bank predicts gold will reach $3,700 per ounce by the end of 2025 in its base case scenario, with further growth to $4,000 by mid-2026. Goldman’s analysis indicates that a recession could accelerate ETF inflows and drive prices even higher to $3,880. More dramatically, extreme risk events such as challenges to Federal Reserve independence or shifts in U.S. reserve policy could potentially catapult gold prices to $4,500 by year-end 2025. Source: www.goldsilver.com https://lnkd.in/eCau26HP

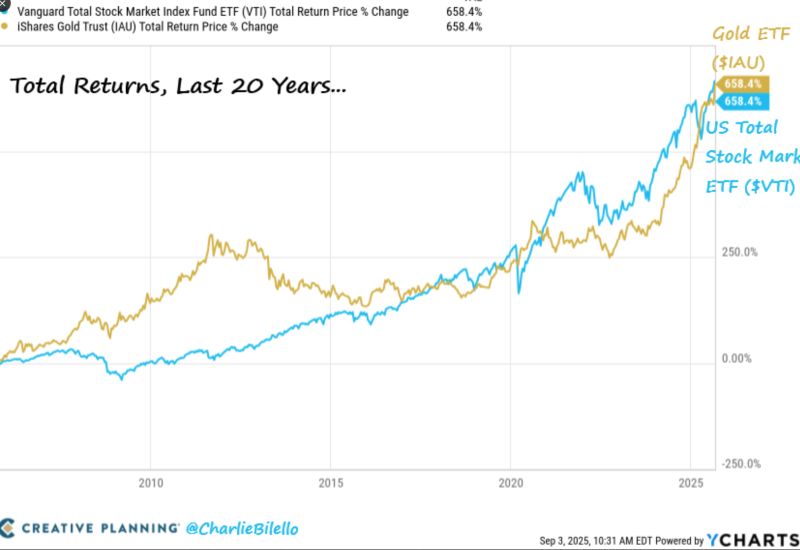

Total Returns over Last 20 Years:

US Stock Market $VTI: +658.4% / Gold $IAU: +658.4%, Source: Charlie Bilello

Gold knows

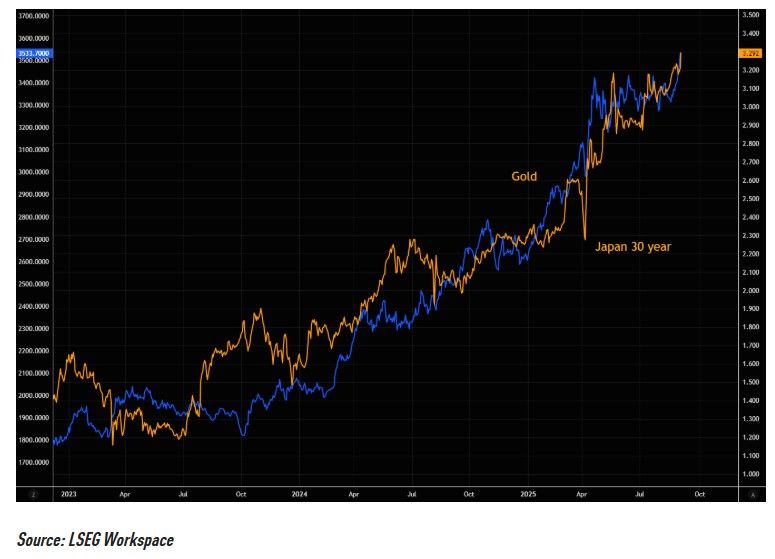

Gold is following the Japanese 30 year, pricing in "spillover" risks... Source: TME, LSEG workspace

Investing with intelligence

Our latest research, commentary and market outlooks