Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The gold price is rising again.

It fell back briefly after last week's Fed, as markets digested a more complicated meeting than they had hoped for. But now we're back off to the races and gold is resuming its rise. As rightly put by Robin Brooks, "the world is running out of safe havens. Gold is the winner..." Source: Robin Brooks

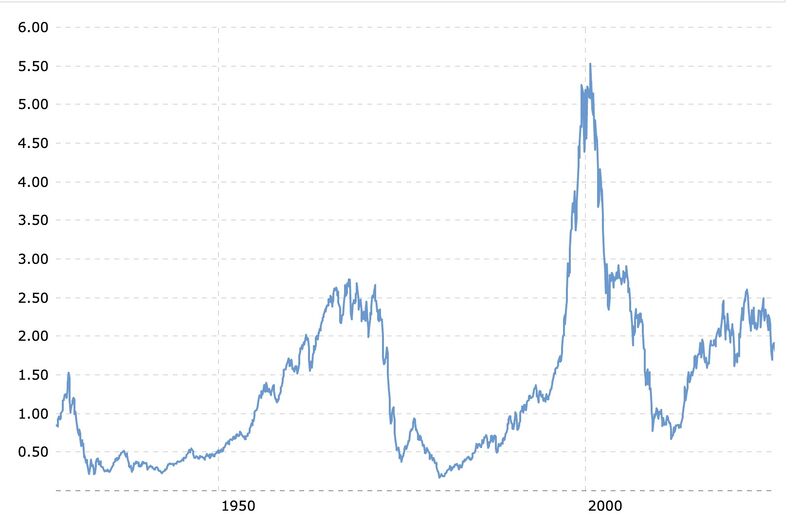

S&P 500 priced in gold...this is what the stock market looks like in real money (looks like a big head and shoulders pattern...)

As highlighted by Quoth the Raven on X, "If we go back to 0.5x, that puts gold at $12,000, or the S&P at 1850 or they meet in middle at $9000/4500 which would be gold 2.5x and S&P -30%ish"

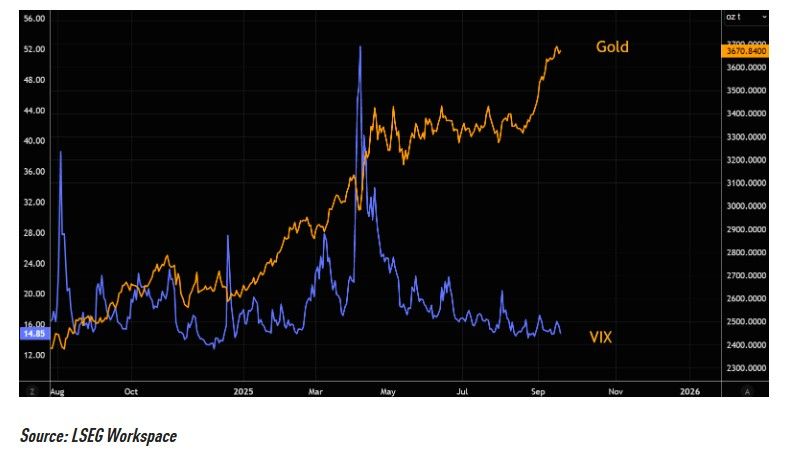

The hedge factor

Gold is the "everything hedge", but if you are looking for global equity hedges, then VIX looks relatively more interesting compared to chasing gold here. Source: TME, LSEG

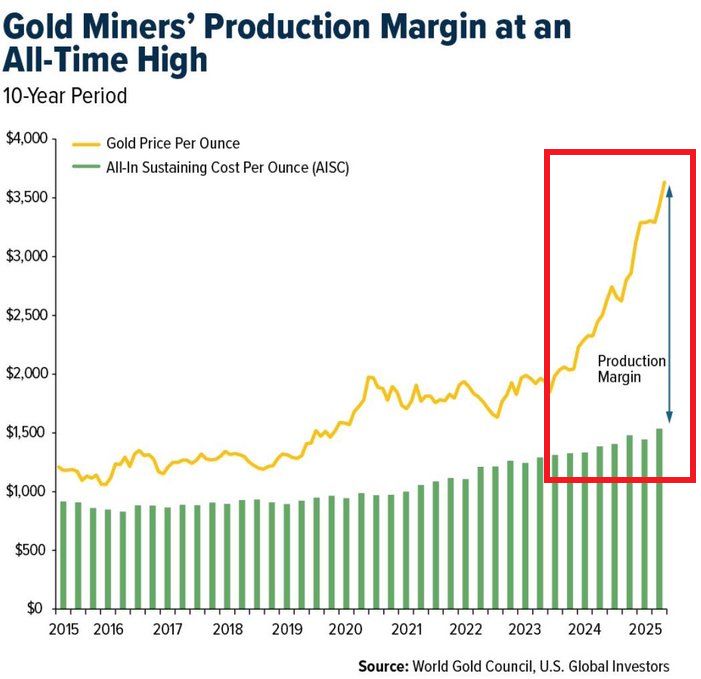

Gold miners are making record profits:

Production margins are at an all-time high as gold prices surge while costs rise much slower. Miners are now earning more per ounce than ever in the past 10 years. Meanwhile, gold miners ETF, $GDX, has skyrocketed 103% year-to-date. Source: Global Markets Investor

Interesting theory...

The Shanghai Gold Exchange (SGE) has activated two overseas vaults—one in Saudi Arabia, the other in Hong Kong—marking a direct expansion of RMB-denominated gold trading beyond mainland borders. This move represents a strategic move to enhance China’s gold trading infrastructure and strengthen the SGE’s role in global gold price discovery. These aren’t symbolic moves. They’re operational. They’re live. Source: Alasdair Macleod @MacleodFinance

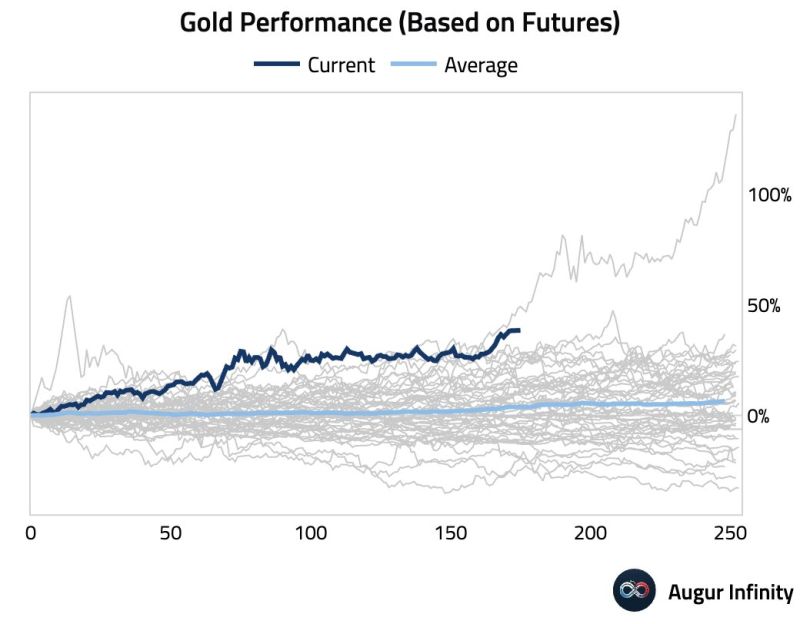

Gold stocks have crushed every sector of the S&P 500 this year

Source: Tavi Costa, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks