Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

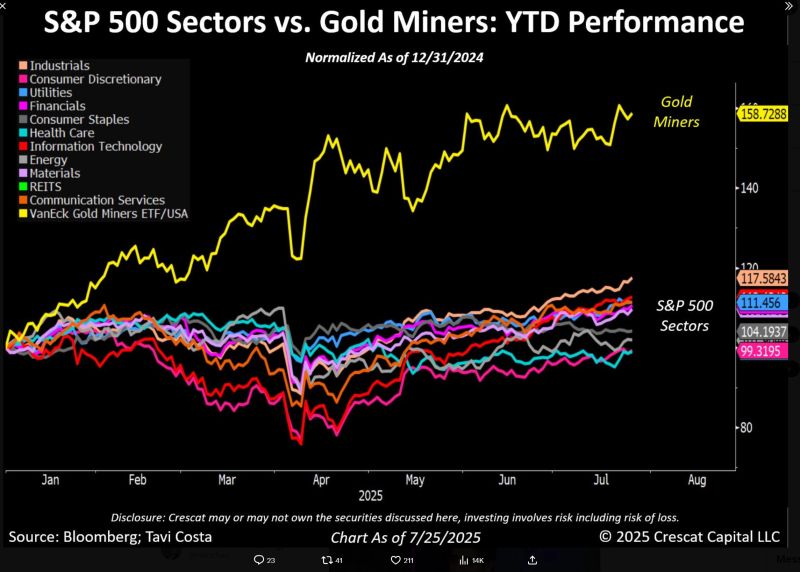

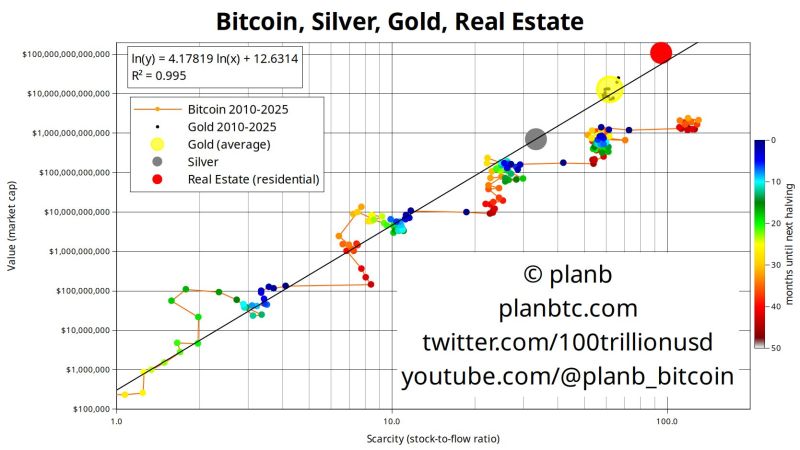

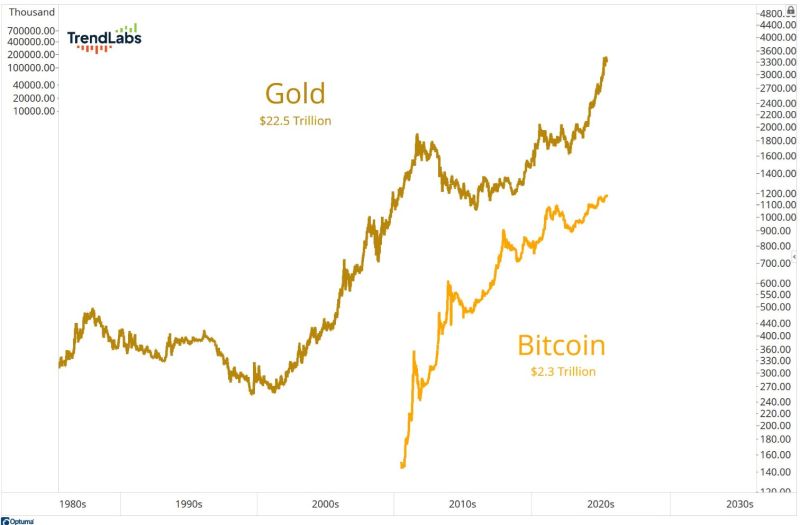

It is hard to see gold and other store of values as a bad long-term investment with Money Supply exploding all across the world!

Source: Andrea Lisi

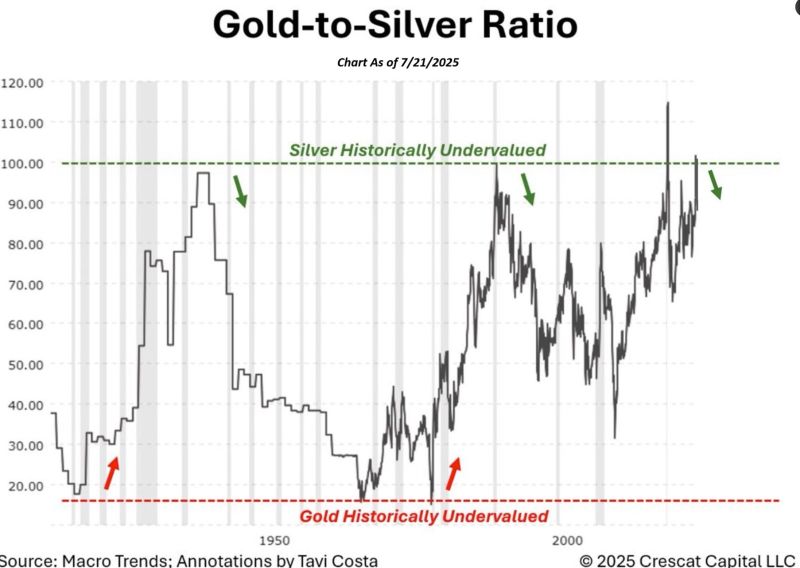

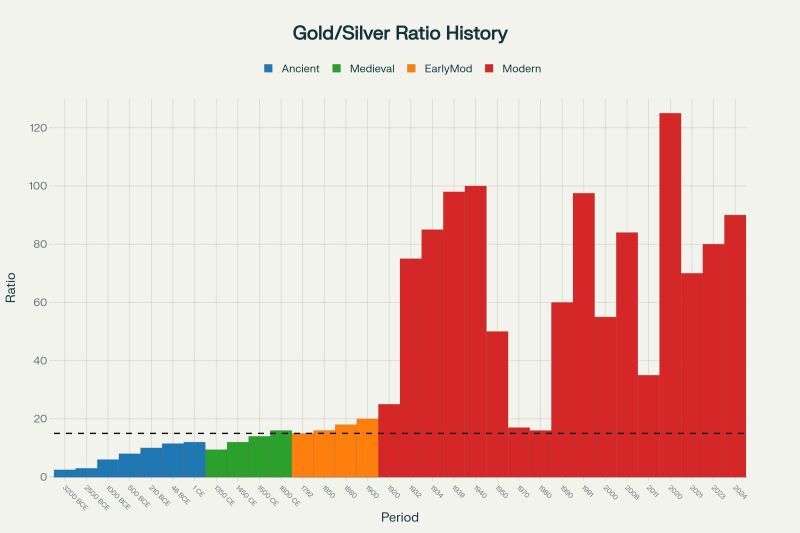

It's remarkable to see silver approaching $40/oz, yet still historically undervalued relative to gold.

Source: Tavi Costa

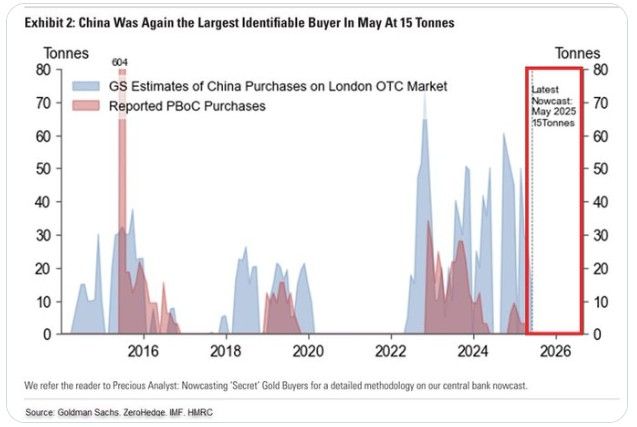

China continues to quietly acquire gold through the London market

China bought 15 tonnes of gold in May, according to Goldman Sachs estimates, 8 TIMES more than officially reported figures. Over the past year, China's monthly purchases have oscillated between 25-60 tonnes. Source: Global Markets Investors, Goldman Sachs

Gold now outperforming the U.S. Stock Market (dividends included) over the last 25 years.

Incredible! Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks