Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

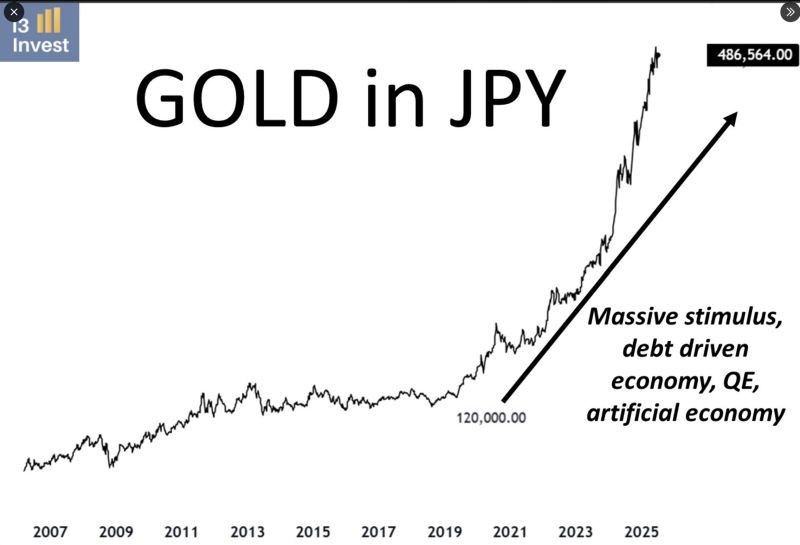

This is what happens to a currency when the focus is to increase debt to inject liquidity, rather than addressing the root causes of the problem.

Thank God we have gold (and bitcoin). Source: Guilherme Tavares i3 invest

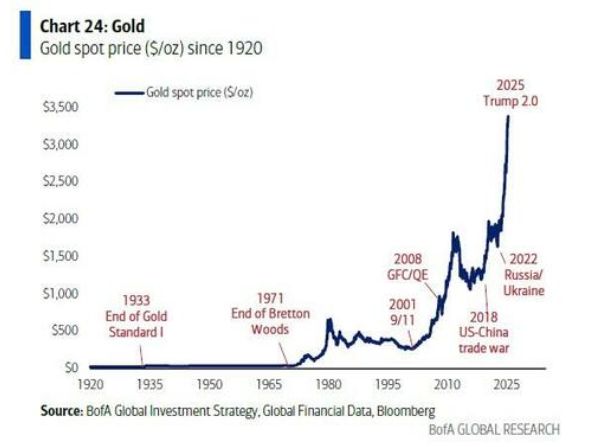

Citi Research global commodities head sees gold tumbling to $2500

Max Layton, global commodities head at CITI Research, predicts gold will trade at about $2,500 to $2,700 in the second half of next year, down about $900 or so less than where it is today. Layton said CITI had been bullish on gold for the last couple of years as investors flocked to the precious metal. He said people are buying gold to hedge against a downside risks to their household wealth over fears of slowing economic growth and global uncertainty. “The move from $2,600 to $3,300 this year has been all about investors buying bars and coins, particularly bars because they’re hedging against a downside in U.S. and global growth, as well as a downside in equities related to that downside in U.S. and global growth, which has come about because of the combination of still extremely high interest rates in the U.S. by historical standards, and the tariffs.” He however expects a drop in prices due to weakening investment demand, anticipated U.S. interest rate cuts and improved economic prospects. “We’re getting close to this One Big Beautiful Bill Act passing Congress,” said Layton. “We think that is going to mark a shift in sentiment towards U.S. growth and basically a slight reduction, or even a moderate reduction, or even possibly by the end of next year, heading into the mid terms with lower interest rates as well.” Source: BN Bloomberg

In case you missed it... As of July 1, 2025, gold will officially be classified as a Tier 1, high-quality liquid asset (HQLA) under the Basel III banking regulations.

That means U.S. banks can count physical gold, at 100% of its market value, toward their core capital reserves.

Germany and Italy are facing calls to move their gold out of New York following President Donald Trump’s repeated attacks on the US Federal Reserve and increasing geopolitical turbulence.

Fabio De Masi, a former Die Linke MEP who joined the leftwing populist BSW party, told the Financial Times that there were “strong arguments” for relocating more gold to Europe or Germany “in turbulent times”. Germany and Italy hold the world’s second- and third-largest national gold reserves after the US, with reserves of 3,352 tonnes and 2,452 tonnes, respectively, according to World Gold Council data. Both rely heavily on the New York Federal Reserve in Manhattan as a custodian, each storing more than a third of their bullion in the US. Between them, the gold stored in the US has a market value of more than $245bn, according to FT calculations. The Taxpayers Association of Europe has sent letters to the finance ministries and central banks of both Germany and Italy, urging policymakers to reconsider their reliance on the Fed as a custodian for their gold. Source: FT

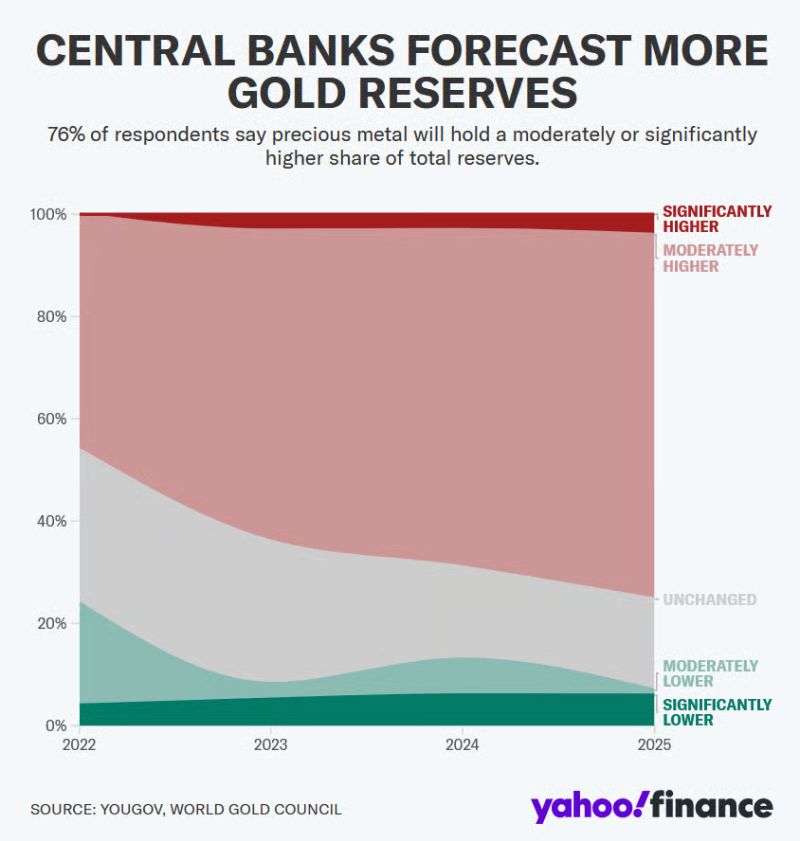

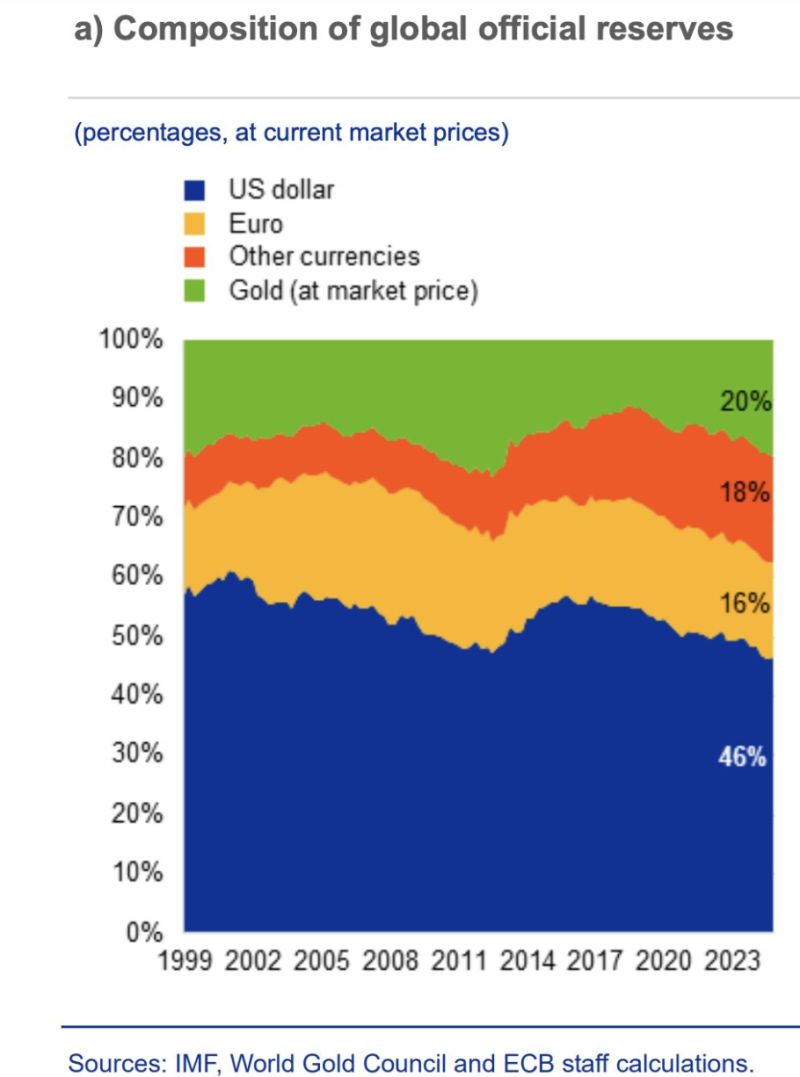

Central banks continue to DUMP the US Dollar for Gold:

95% of central banks expect global gold reserves to rise in the next year, according to a World Gold Council survey. A record 43% plan to boost their holdings. 73% expect USD reserves to decline over the next 5 years. Source: Global Markets Investor, Yahoo Finance

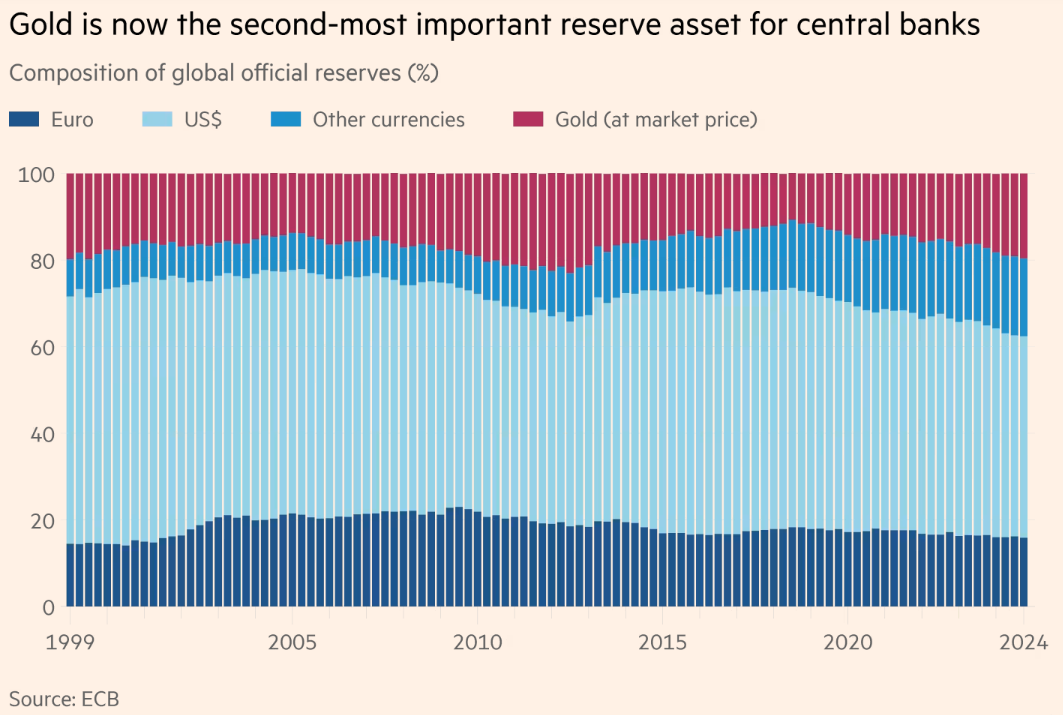

Gold is now the second-most important reserve asset for central banks

Source: ECB, MKS-PAMP, FT

Investing with intelligence

Our latest research, commentary and market outlooks