Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Alphabet $GOOGL fell below its 50-day moving average last week and now sits right at the 100-day

If that breaks, a return to the 200-day MA might be in play Source: Barchart

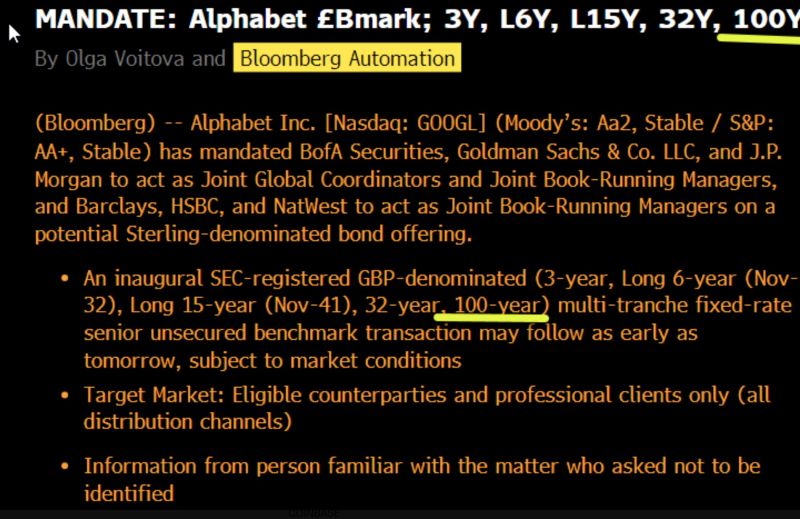

Alphabet has attracted >$100bn of orders for a bond sale that’s expected to be ~$15bn, BBG reports, citing people with direct knowledge of the matter.

The demand is among the strongest ever seen for a corporate bond offering, showing investor hunger to buy debt tied to the AI boom. Alphabet has also mandated banks for potential Swiss franc and Sterling debt offerings, including a rare 100-year Sterling note. Source: Bloomberg, HolgerZ

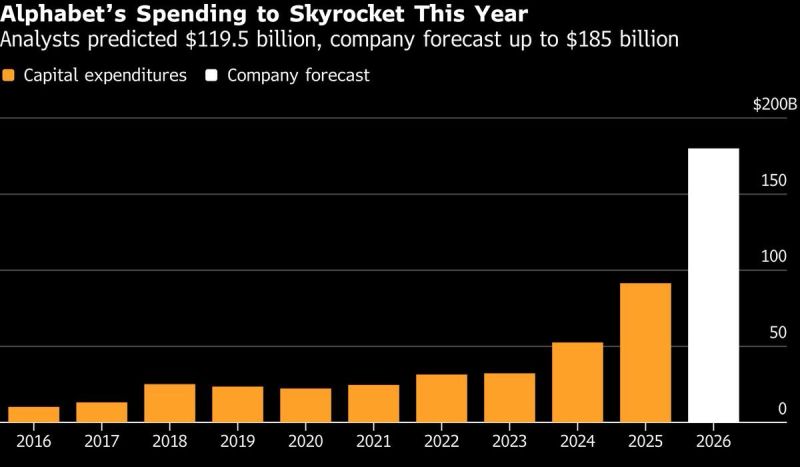

Alphabet is going to be spending more than the capex of:

ExxonMobil, Chevron, BP, Shell, TotalEnergies, Equinor, Eni, Antero Resources, APA Corporation, ConocoPhillips, Expand Energy, Continental Resources, Coterra Energy, Devon Energy, EOG Resources, EQT Corporation, Diamondback Energy, Occidental Petroleum, Range Resources, Permian Resources, Imperial Oil, Cenovus Energy, Canadian Natural Resources, Ovintiv, Suncor Energy, Tourmaline Oil COMBINED! Can the US grid support these projections ??? Source: The Crude Chronicles, Bloomberg

Alphabet $GOOGL Waymo weekly rides now at 450k:

• Jul 2024 ➝ 50k • Oct 2024 ➝ 100k • Dec 2024 ➝ 150k • Feb 2025 ➝ 200k • May '25 ➝ 250k • Dec 2025 ➝ 450k The latest figure appears to have been leaked from an investor-letter cited (Tiger Global) by media.

This is probably why the markets love Alphabet $GOOGL - at least for now.

Over the last 12 months, Alphabet generated $151.4B in operating cash flow, enough to: A) Spend $77.8B on capex B) Repay $19.8B of debt C) Buy back $59.5B of stock and pay $10B in dividends This is elite cash-machine territory. With much quality / over-indebtedness than with some of the other AI names Source: Gainify @gainify_io

Investing with intelligence

Our latest research, commentary and market outlooks