Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

JUST IN: Federal Reserve will cut interest rates by 50 basis points as soon as June and 150 points by the end of this year, says State Street in call against Wall Street consensus

Source: Bloomberg, radar

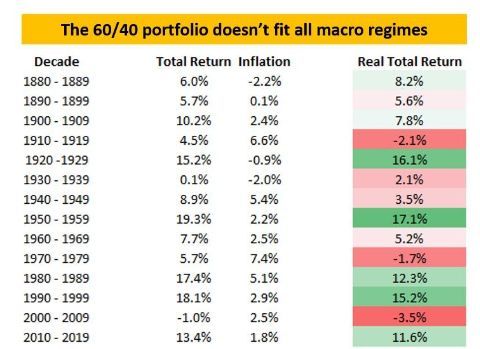

The 60/40 portfolio doesn't fit all macro regimes by Alfonso Peccatiello / The macro compass

The 60/40 portfolio (60% equities / 40% bonds) did work great for 3 of the last 4 decades, and that's because the macro regime was one of predictably low growth and inflation, and Central Banks ready to support markets and economies. But are you sure the next 10 years be the same as the last 10 years?

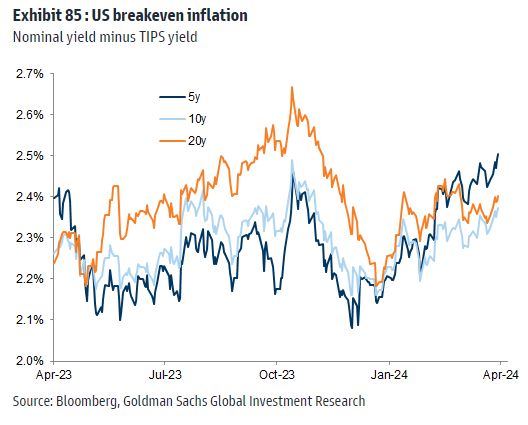

US breakeven inflation rates rising

Source: Win Smart; Goldman Sachs, Bloomberg

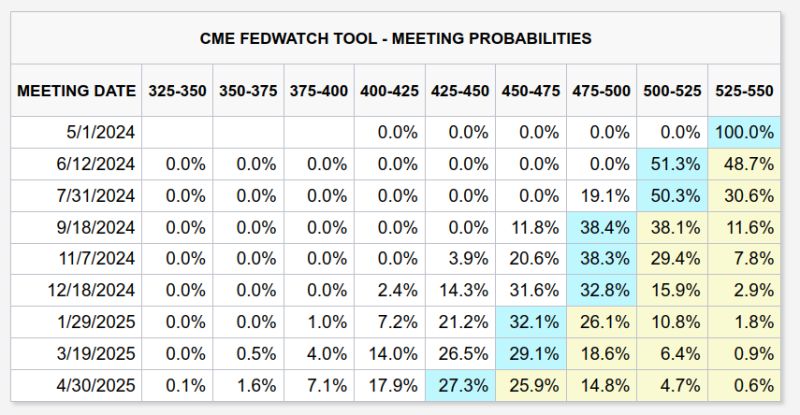

From expecting 6 Fed rate cuts to just two in 2024 😉

Source: Markets & Mayhem

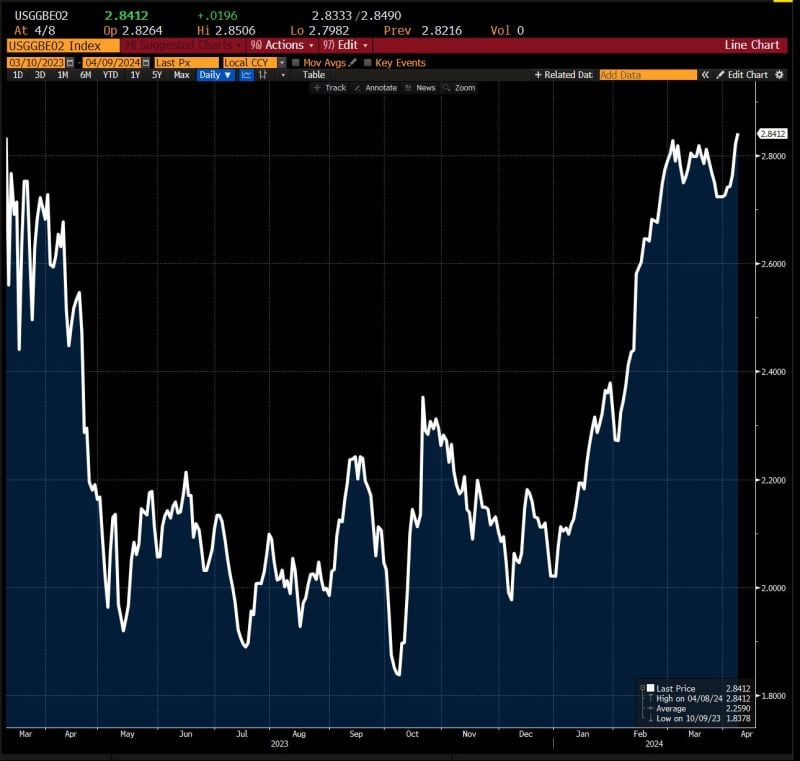

Ahead of US inflation numbers tomorrow (Wednesday), US 2-year breakeven rates just rose to 13-month highs...

Source: Bloomberg, David Ingles

Jamie Dimon's 61 page annual shareholder letter is finally out for FY2023!

-A rate spike is very possible with stickier inflation. Interest rates could soar to 8% -Says Federal deficit is a real issue hurting business confidence (govt spending could keep rates high) -US economy resilient so far with consumer spending, but the economy has also been fueled by government deficit spending and past stimulus -Market is pricing in 70-80% chance of a soft landing/no landing...Dimon thinks that is too high -Inflation resurgence, political polarization are risks for this year (Ukraine, Middle East, China) - AI may be as impactful on humanity as the printing press Source: SpecialSitsNews, Barchart

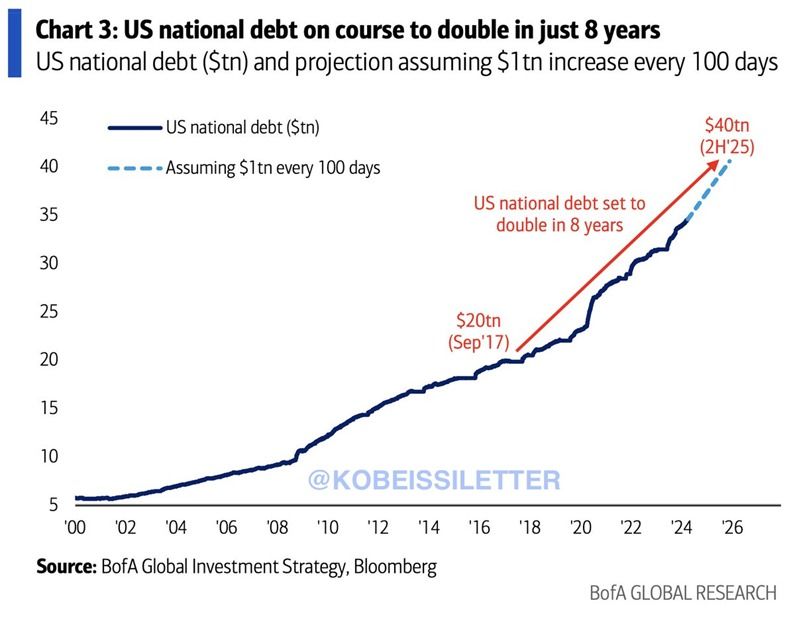

The US Federal debt is set to DOUBLE in just 8 years, rising from $20 trillion in 2017 to $40 trillion in 2025.

Currently, US Federal debt is rising by a whopping $1 trillion every 100 days. To put this in perspective, if US debt hits $40 trillion in 2025 that would be a $17 TRILLION increase since 2020. That would be a ~570% jump in US Federal debt since 2000, a 25-year period. The worst part? This analysis assumes that we are on track for a "soft landing." What happens if a recession hits? Source: The Kobeissi Letter, BofA

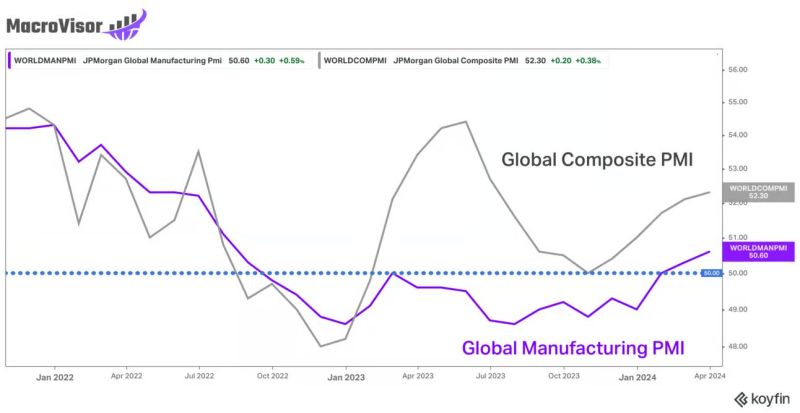

Global PMIs recovering nicely.

Source: Markets & Mayhem reposted Ayesha Tariq

Investing with intelligence

Our latest research, commentary and market outlooks