Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

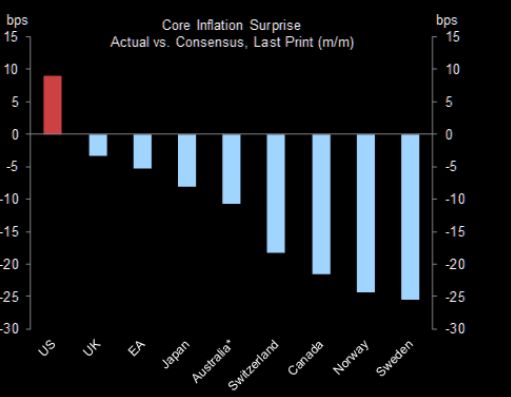

Did you know that the US is the only G10 economy where the latest core inflation print surprised to the upside?

Source: Goldman Sachs, TME

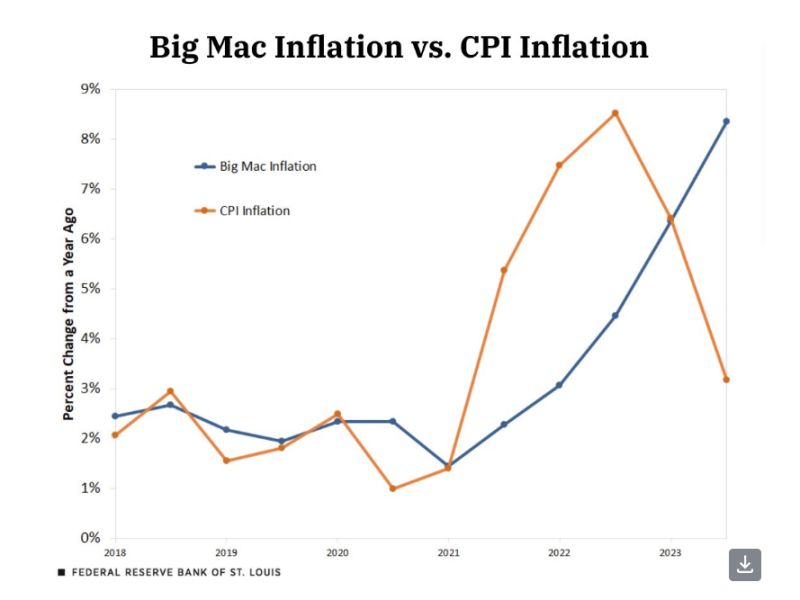

Big Mac inflation vs. CPI... which one is right?

While many investors are more confused than ever looking at "CPI", whatever that is, the real inflation gauge is giving off a serious warning. Source: J-C Parets

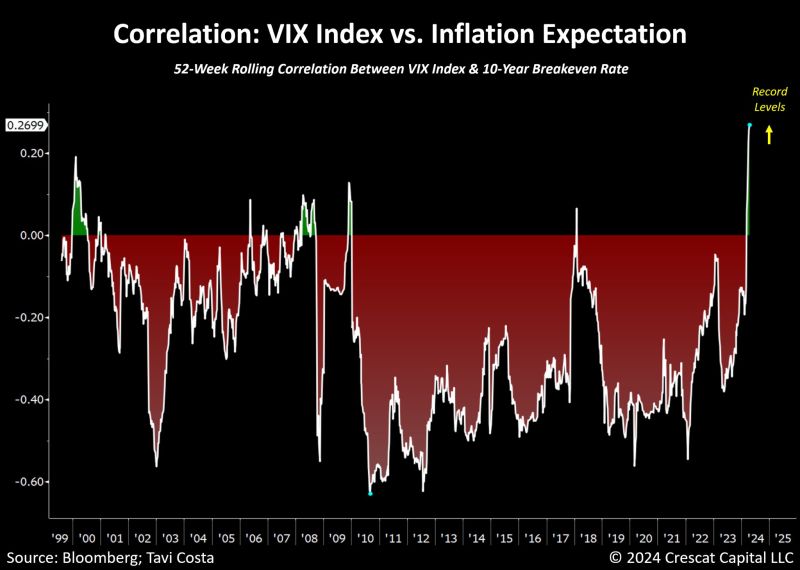

The correlation between equity market volatility and inflation expectations is at the highest level we've seen in decades.

Although the chart below doesn't extend as far back, a similar phenomenon occurred in 1973-1974 as markets faced difficulties whenever inflation reaccelerated. This is especially pertinent now, with energy prices, agricultural commodities, precious metals, copper, global freight costs, and other inflation indicators showing significant resurgence. Source: Tavi Costa, Crescat Capital, Bloomberg

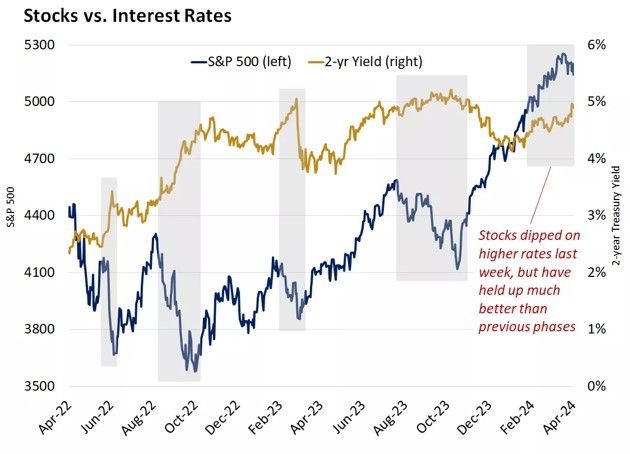

Yes, this week was painful for stocks.

But putting things into perspective, equities have been more resilient to higher rates recently versus previous periods of rising rates. Source: Edward Jones

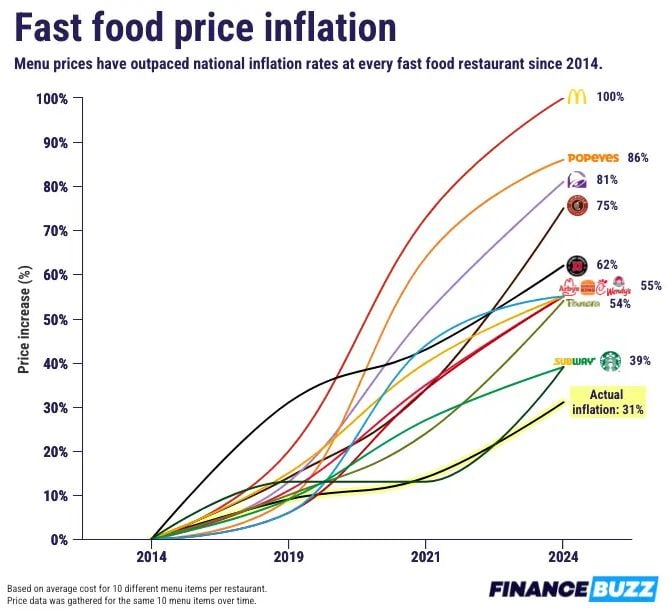

Price increases over last decade...

McDonald's: +100% Popeyes: +86% Taco Bell: +81% Chipotle: +75% Jimmy John's: +62% Arby's: +55% Burger King: +55% Chick-fil-A: +55% Wendy's: +55% Panera: +54% Subway: +39% Starbucks: +39% US Government Reported Inflation (CPI): +31% Source: Charlie Bilello

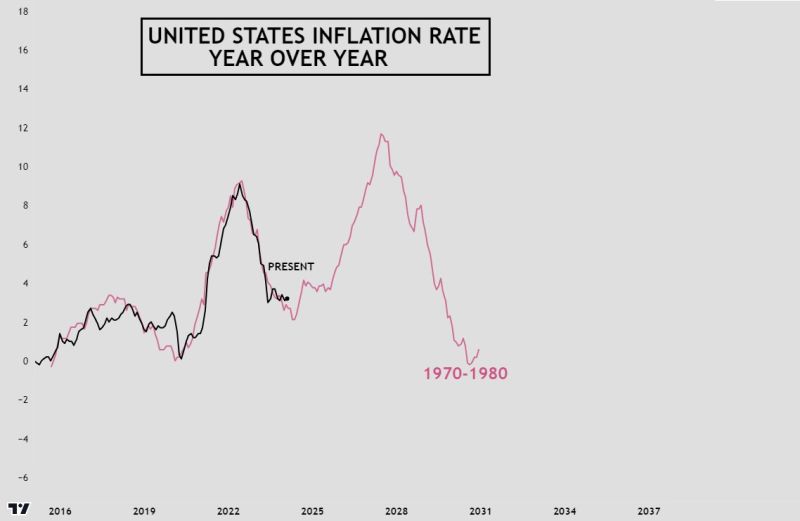

In our 2024 "10 surprises 2024" (see link below), we had surprise #6: "What if inflation rises again?"

The idea here was that inflation could experience a second wave similar to that seen in the 70s and 80s. And this would lead inflationary assets (e.g., cyclical stocks) to catch up with deflationary assets (e.g. technology stocks). Below an uopdate chart (courtesy of HZ on X) taking into account yesterday's US cpi print... Has a second inflationary wave begun? https://lnkd.in/eDPyFa_9

The Federal Reserve's next move might be to raise interest rates warns Former Treasury Secretary Larry Summers.

Source: Barchart

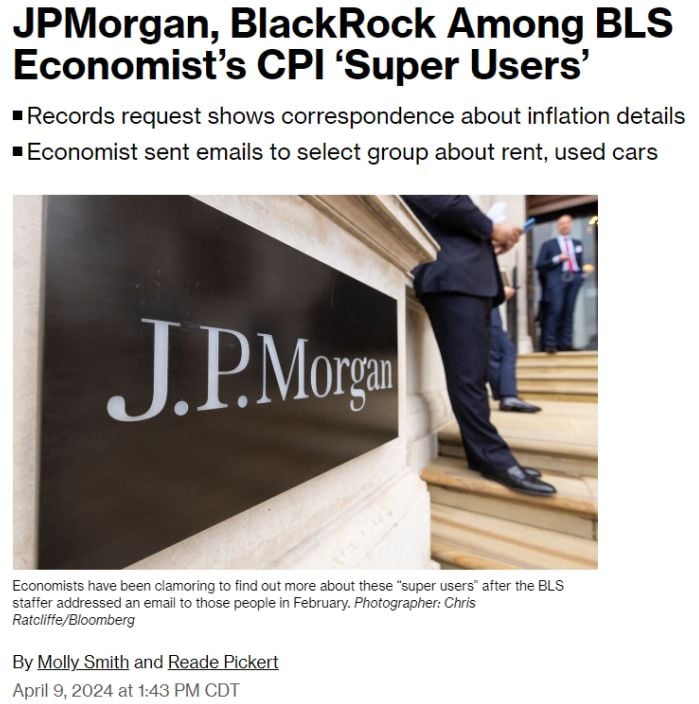

JP Morgan and BlackRock were given insider information about Wednesday's inflation numbers by the Bureau of Labor Statistics 🚨

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks