Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

How is it possible? Below is the number of initial filings for unemployment insurance.

Five of the last six weeks, the exact same number. Effectively the same number in the last 11 weeks, except for the holiday weeks (President's Day and Easter). As highlighted by Jim Bianco, how is this statistically possible? --- Consider The US is a $28 trillion economy. It has 160 million workers. Initial claims for unemployment insurance are state programs, with 50 state rules, hundreds of offices, and 50 websites to file. Weather, seasonality, holidays, and economic vibrations drive the number of people filing claims from week to week. Yet this measure is so stable that it does not vary by even 1,000 applications a week. Just the number of applications incorrectly filed out every week should cause it to vary more than this...

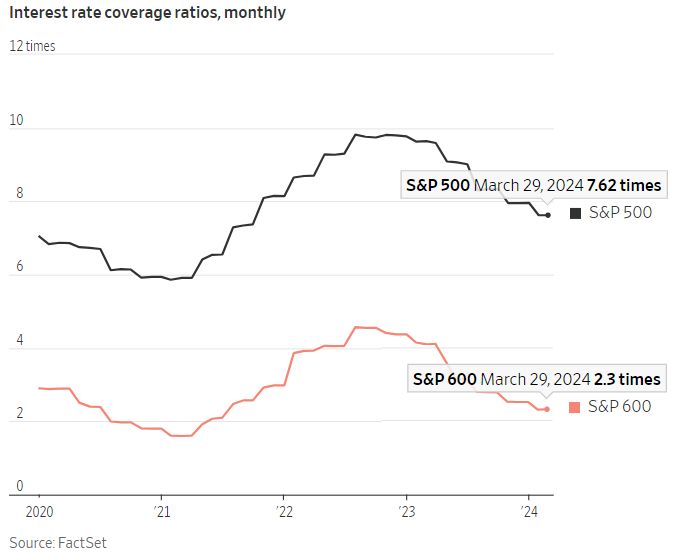

Smaller companies generally spend a much higher % of their income on debt service, making them more sensitive to rising rates.

The interest coverage ratio (operating income / interest expense) for the small cap S&P 600 is 2.3 times vs. 7.6 times for the large cap sp500. Source: Charlie Bilello

2022-2024 summarised in one cartoon

Thru Andreas Steno Larsen

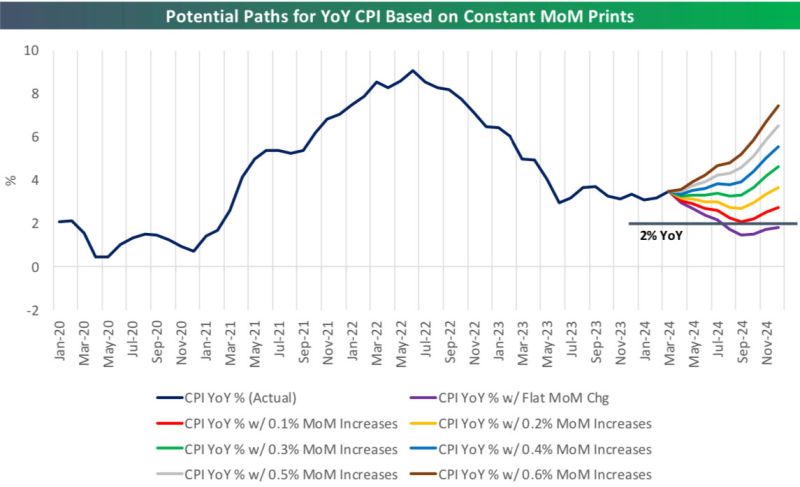

BREAKING >>> Fed Chair Powell says there has been a ‘lack of further progress’ this year on inflation

SUMMARY OF FED CHAIR POWELL'S COMMENTS (4/16/24): 1. Recent data "shows lack of further progress on inflation" 2. Inflation has "introduced new uncertainty" on whether the Fed can cut rates later this year 3. Fed can maintain higher rates for "as long as needed" 4. Recent data has not given greater confidence on inflation 5. Restrictive Fed policy needs more time to work 6. It will likely take longer to "regain confidence" on inflation https://lnkd.in/eMaJZNZZ Source: CNBC, The Kobeissi Letter, Trend Spider

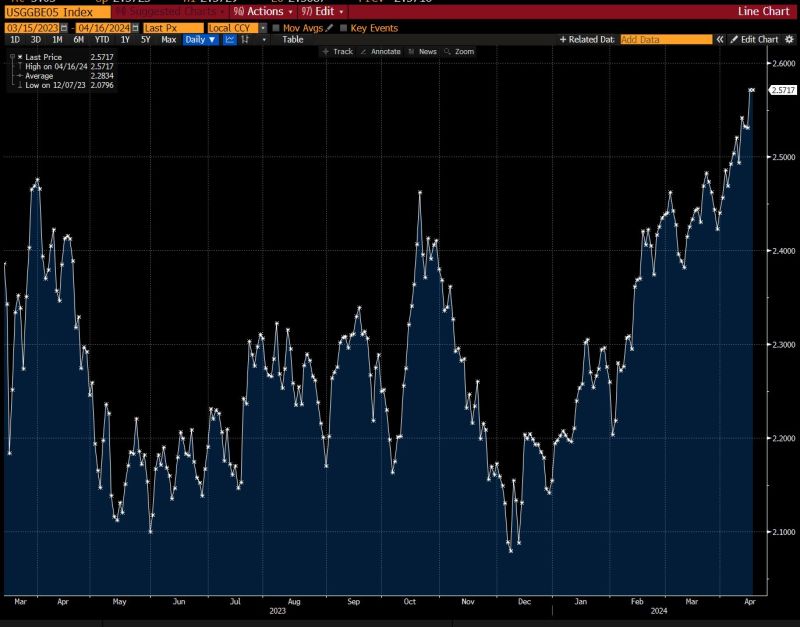

Longer-term inflation expectations are rising again.

The market's implied rate of inflation over the next five years has risen to the highest level in more than a year, at 2.6%, according to breakeven rates. Source: Bloomberg, Lisa Abramowitz

According to Alfonso Peccatiello, a $1 trillion worth liquidity wave is about to be unleashed on the US economy!

He is not talking about Powell or the Fed. He is talking about Treasury Secretary Yellen unleashing a large sum of stimulus further boosting the US economy right before elections! How? By almost emptying a $1 trillion+ Treasury General Account!

China’s economy in the first quarter grew faster than expected, official data released Tuesday by China’s National Bureau of Statistics showed.

Gross domestic product in the January to March period grew 5.3% compared to a year ago, faster than the 4.6% growth expected by economists polled by Reuters, and compared to the 5.2% expansion in the fourth quarter of 2023. On a quarter-on-quarter basis, China’s GDP grew 1.6% in the first quarter, compared to a Reuters poll expectations of 1.4% and a revised fourth quarter expansion of 1.2%. Beijing has set a 2024 growth target of around 5%. https://lnkd.in/eNZgs7zp Source: CNBC

Getting to 2% YoY CPI by the end of 2024 means we need to average monthly CPI prints of 0.1% or less from here.

Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks