Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

OOPS... stagflationary numbers out of US !!!

Real GDP expanded at a 1.6% rate in Q1, trailing all forecasts. Main growth engine – personal spending – rose at a slower-than-forecast 2.5% pace. BUT a closely watched measure of underlying inflation advanced at a greater-than-expected 3.7% clip... While "soft" macro data in the first 3 months of the year were "goldilocks" for markets (Growth surprising on the upside + disinflation), the effective Q1 print does not look as rosy... Source: HolgerZ, Bloomberg

Wall Street stalwart Jamie Dimon is concerned history may be repeating itself with the U.S. economy returning to the embedded stagflation it battled 50 years ago.

Speaking at the Economic Club of New York on Tuesday, JPMorgan CEO Dimon said now more so than ever the economy is resembling the 1970s, when both inflation and unemployment were high but economic growth was weak.

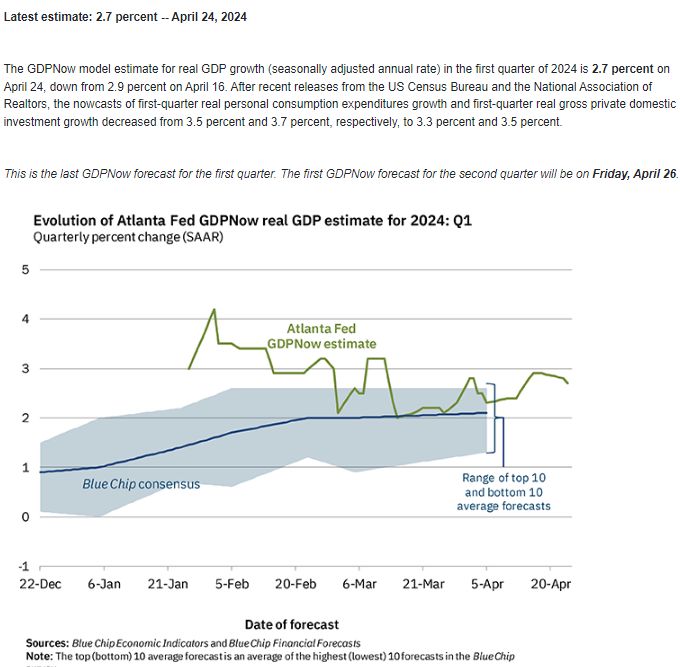

The last Atlanta Fed GDPnow was released on Wednesday -> 2.7% from 2.9%.

Street consensus is 2.5%. Q1 GDP will be published today

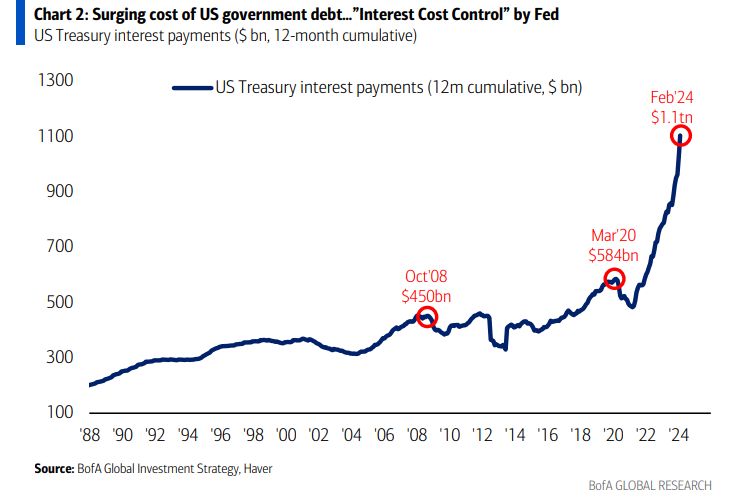

The annual interest expense on US debt is literally moving in a straight line higher, now at $1.1 TRILLION.

To put this in perspective, less than 3 years ago the annual interest expense on this debt was $450 billion. That's a 144% jump as total US debt has surged by over $11 TRILLION since 2020. Even in 2008, at the peak of the Financial Crisis, annual interest expense was just $450 billion. As interest rates surge and debt levels hit record highs, the US paying the prices for decades of deficit spending. Money is not "free" anymore... Source: BofA, The Kobeissi Letter

German economy has returned to growth.

German Composite PMI Index moved back to >50 growth threshold in Apr for 1st time in 10mths, driven by a buoyant services sector. At 50.5, up from 47.7 in March, it signaled a modest expansion rate in private-sector business activity. Service PMI recorded its strongest growth since Jun2023 (index at 53.3). The manufacturing PMI meanwhile remained in sub-50 contraction territory at 42.2. Source: HolgerZ, Bloomberg

Foodflation... After coffee, cocoa... now is Butter approaching all-time highs!

Breakfast is getting more and more expensive Source: Barchart

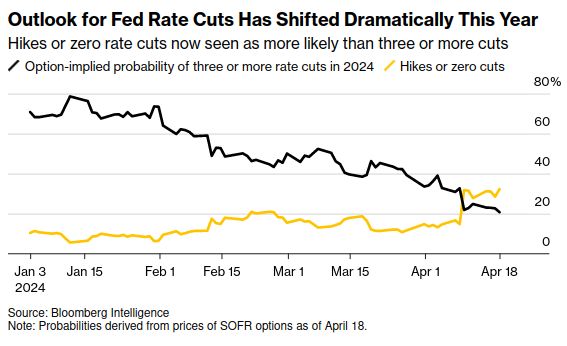

What a difference five months makes for the Fed rate cut outlook. 😉

Source: Bloomberg Intelligence, Markets & Mayhem

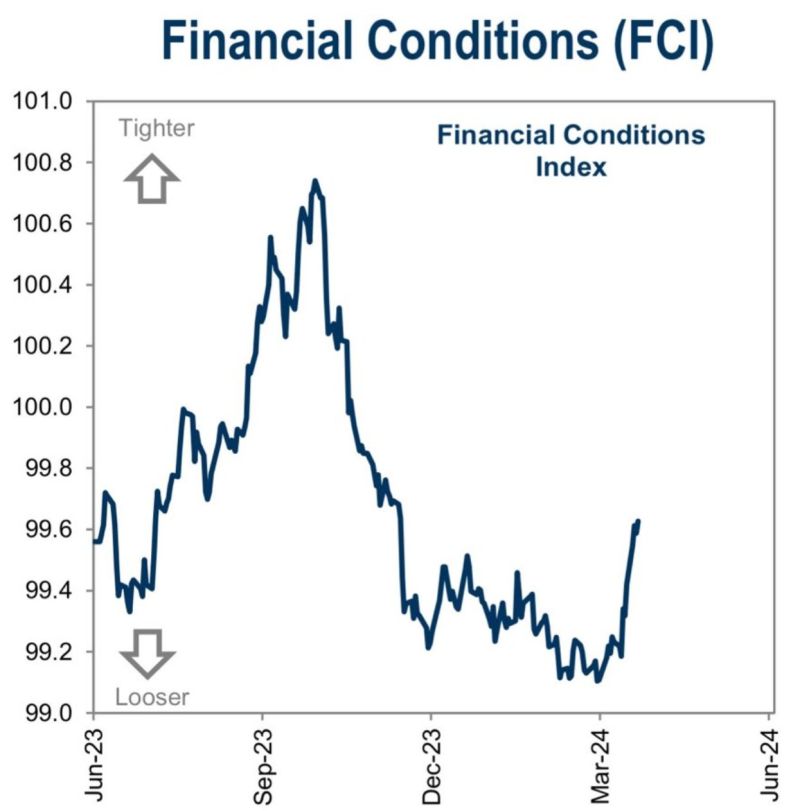

Financial conditions in the US are tightening as rates rise, equities fall and we see liquidity diminishing.

This setup could be set to continue as long as we see: 1) Signs of inflation remaining sticky or re-accelerating 2) The Fed cautious about the timing of cutting 3) Large deficit spending amid rising rates causing interest rate spend to surge (could hit $1.6T by Dec y/y w/o a rate cut) Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks