Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

FOMC: No rate change, QT tapering in June is DOVISH (timing + amount)

Stocks, bonds, gold, bitcoin are all rallying. dollar dumped In a nutshell: 1. Fed leaves rates unchanged for 6th straight meeting *FED HOLDS BENCHMARK RATE IN 5.25%-5.5% TARGET RANGE 2. Rate cuts not appropriate until greater confidence inflation is heading to 2% 3. Fed adds following sentence to the statement: "In recent months, there has been a lack of further progress toward the Committee's 2 percent inflation objective." Inflation has eased "but remains elevated" 4. Fed to slow pace of balance sheet runoff starting in June. The Fed is tapering QT by MORE than the $30BN consensus estimate, instead will taper QT by $35BN, meaning monthly redemption cap on us treasuries goes down from $60BN to $25BN (starting June 1st). This means $105BN less gross issuance needed in Q3 (i.e The Fed implicitly saying 'yields are too high'). 5. Fed maintains mortgage-backed securities redemption cap at $35 bln per month, will reinvest excess MBS principal payments into treasuries. 6. Economic activity continues to expand at solid pace, job gains have remained strong, unemployment rate has remained low. 7. Risks to achieving employment and inflation goals 'have moved toward better balance over the past year,' as opposed to 'are moving into better balance' in the March policy statement. 8. Fed Chair Powell says it is "unlikely that the next policy move will be a rate HIKE." BOTTOM-LINE: There are some hawkish comments but overall Fed QT tapering in June is DOVISH (timing + amount) -> Stocks, bonds, gold, bitcoin are all rallying. dollar dumped Fed Chair Powell's press conference is dovish as well in terms of content and the tone of his remarks. As a reminder, we live at a time of fiscal dominance, i.e fiscal policy leads monetary policy.

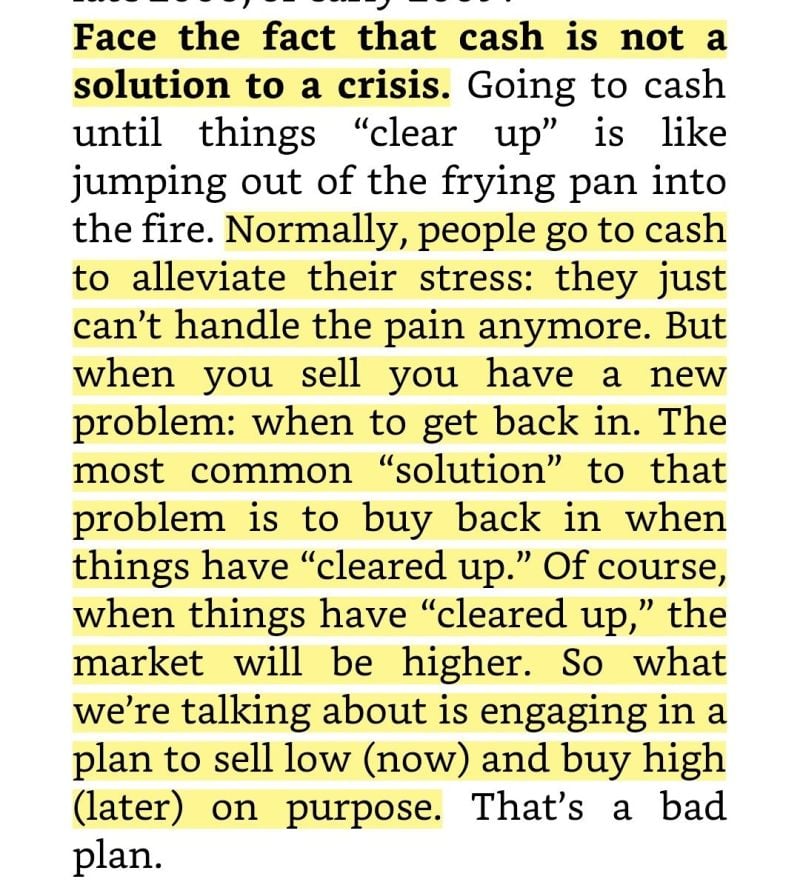

Face the fact that cash is NOT a solution to a crisis

Source: Investment Books (Dhaval)

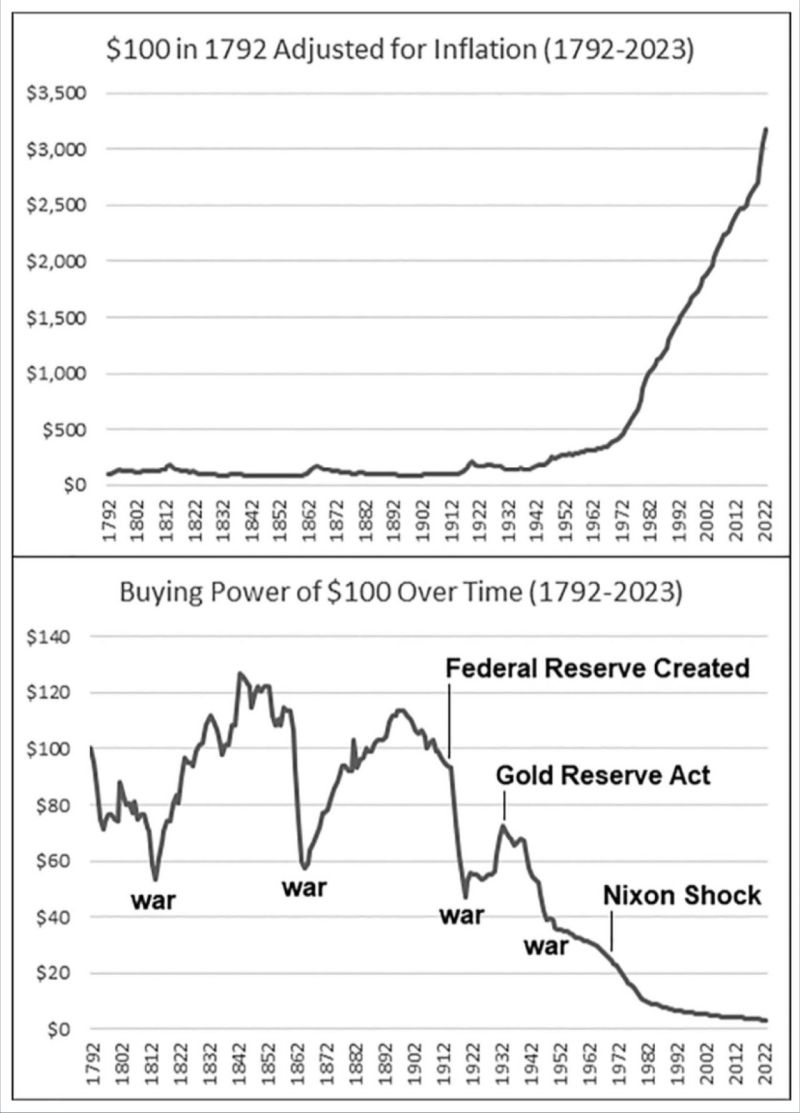

This is money debasement and loss of purchasing power looks like.

Below you can see the change in purchasing power of the U.S. dollar as measured by aggregate price inflation, including impactful historic events. Anyone who has attempted to save in dollars since the inception of the Federal Reserve until now has been robbed of their purchasing power. Source: Figure-7D, Broken Money thru Reese M.

What's going on here?

Source: Bloomberg, Lawrence McDonald

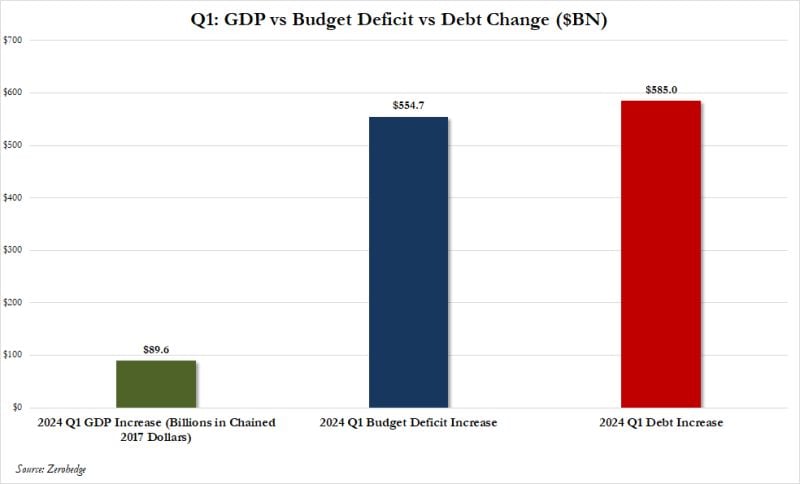

Here's the most shocking part of Q1 us GDP numbers...

Source: www.zerohedge.com

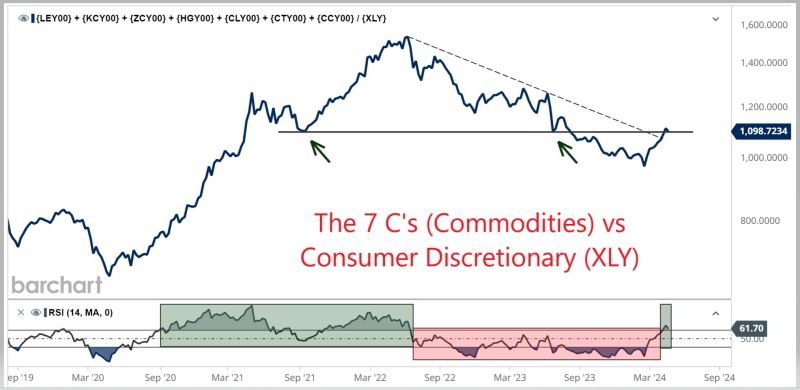

Nice relative price chart by Jay R. Ligon at TheeDisruptor

The 7 C's (Cattle, Corn, Crude, Cocoa, Cotton, Copper, Coffee) vs Consumer Discretionary $XLY Why? It is a clear measure of the inelastic demand for commodities (the ultimate staples) versus elastic demand of discretionaries. Plus we can eye inflation at work and the strength of commodities.

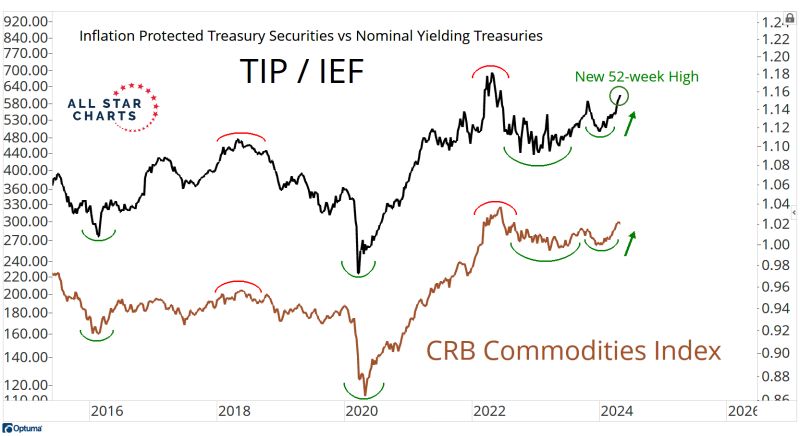

The bonds market's inflation expectations just hit new 52-week highs.

Commodities are following the trend. Source: J-C Parets

Investing with intelligence

Our latest research, commentary and market outlooks