Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

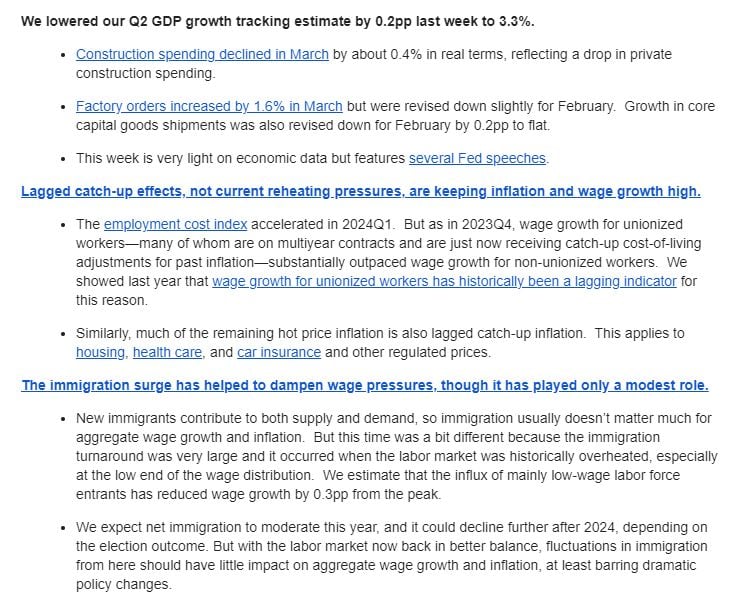

GS: much of the remaining hot price inflation is also lagged catch-up inflation.

This applies to housing, health care, and car insurance and other regulated prices Mike Zaccardi, CFA, CMT

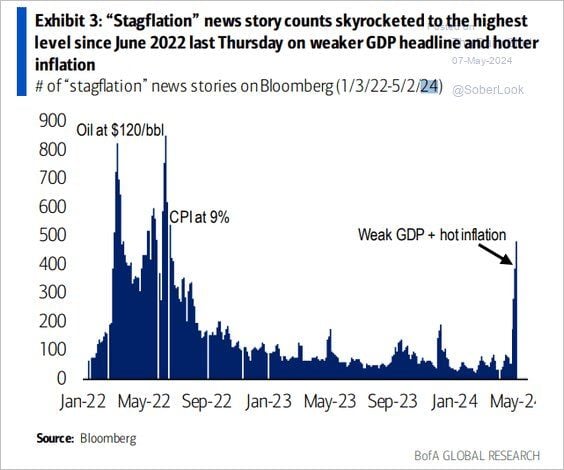

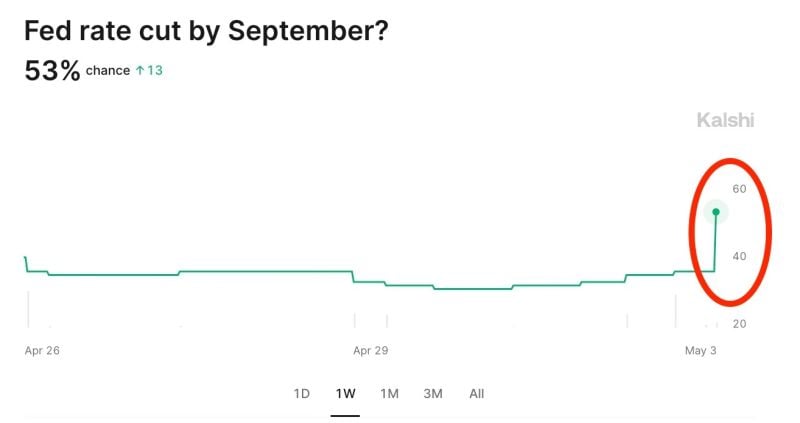

US Stock Market Capitalization as % of GDP...

1984: 42% 1994: 63% 2004: 93% 2014: 114% 2024: 187% Source: Charlie Bilello

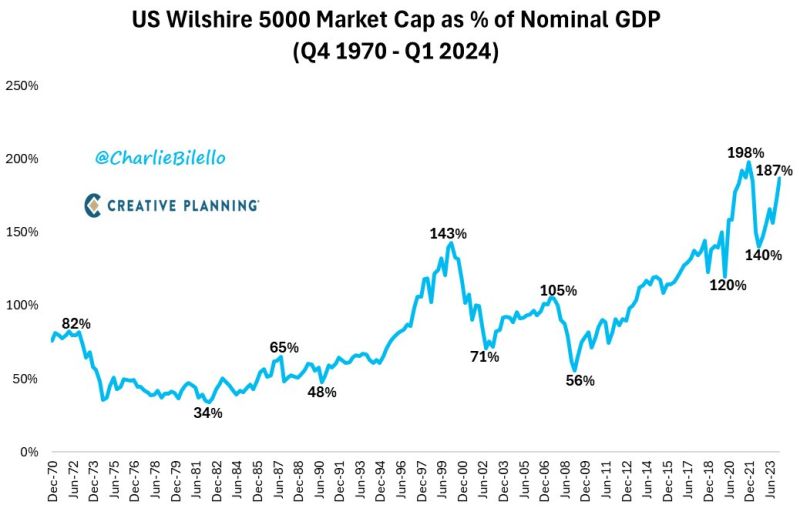

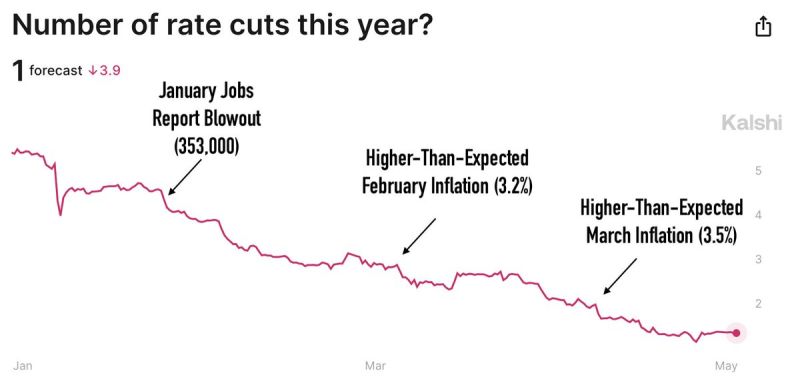

Odds of a September 2024 rate cut jump to 53% after the weaker than expected jobs report, according to Kalshi.

The base case now shows TWO interest rate cuts in 2024, up from ONE prior to the report. On Wednesday, Fed Chair Powell specifically said weakening of the labor market could spur rate cuts. Market implied odds of zero interest rate cuts this year have dropped from 35% to 27%. The Fed rollercoaster ride continues. Source: The Kobeissi Letter

Hong Kong growth beat estimates by the most in 13 years in the first quarter.

Source: David Ingles, Bloomberg

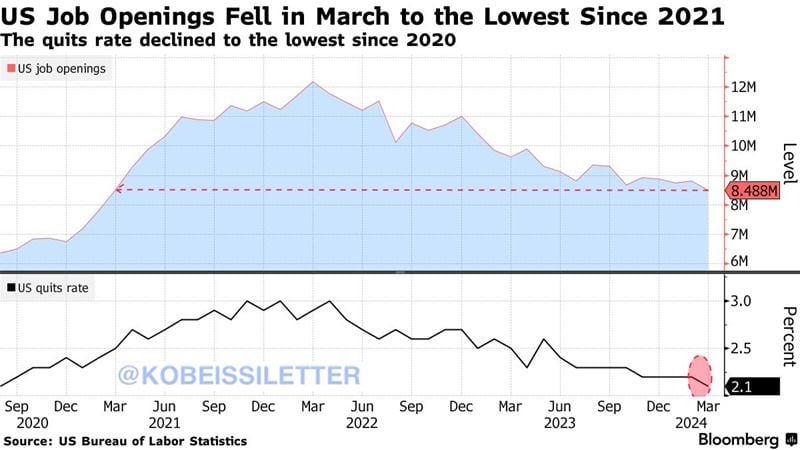

US job openings dropped in March to the lowest level in 3 years.

US available vacancies declined to 8.49 million from 8.81 million in February, hitting the lowest level since March 2021. Job openings have been declining for the past 2 years since the March 2022 peak of 12 million vacancies. Meanwhile, the quits rate has fallen to 2.1%, the lowest since August 2020. This suggests that many currently employed individuals are either losing confidence and/or are more dependent on their jobs. All eyes are on Friday's jobs report. Source: The Kobeissi Letter

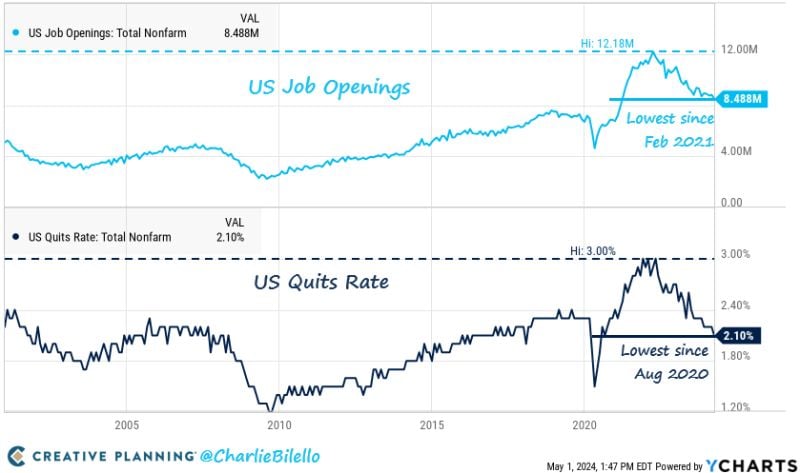

The tightest labor market in US history continues to loosen with Job

Openings moving down to 8.49 million (lowest since Feb 2021) and the Quits Rate moving down to 2.1% (lowest since Aug 2020). Source: Charlie Bilello

Interest rate futures have been wildly inaccurate over the last 12 months.

In September, just 2 rate cuts were expected by December 2024. In January, 6 rate cuts were expected by December 2024. Now, we will be lucky to get one rate cut over the next year or so. In fact, prediction markets are showing a 40% chance of ZERO rate cuts in 2024. Prediction markets also see an 11% chance of a rate HIKE in 2024 despite Powell saying he thinks it's unlikely. Source: The Kobeissi Letter, Kalshi

Investing with intelligence

Our latest research, commentary and market outlooks