Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

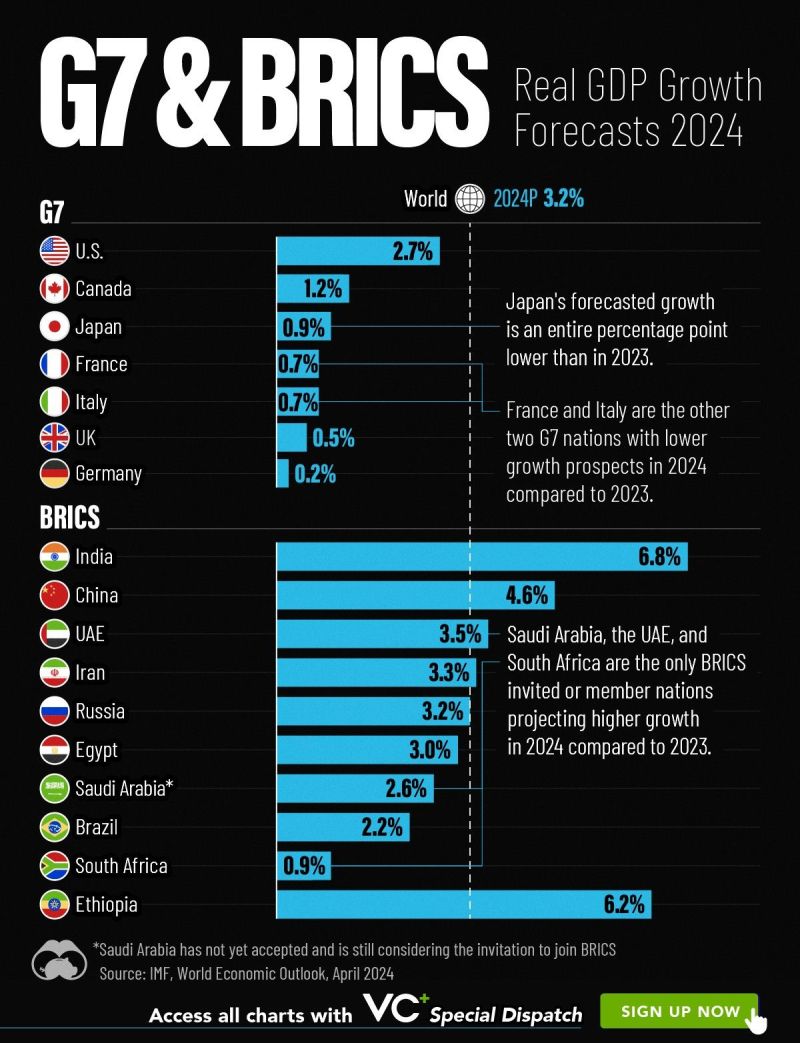

Economic Growth Forecasts for G7 and BRICS Countries in 2024 🗺️

Source: Visual Capitalist

WELCOME TO FOMC WEEK. Here's what's happening:

In the US: ◦ April ADP employment ◦ April ISM manufacturing ◦ March Job openings ◦ FOMC interest rate decision ◦ Fed Chair Powell press conference ◦ April employment rate ◦ $AAPL, $AMZN, $LLY, $MA, $KO, $AMD, $MCD, $QCOM earnings Rest of the world: ◦ In Europe, the focus will be on April CPI prints as well as the Q1 GDP reports. ◦ The latest economic activity and labour market indicators will also be in focus in Japan, and PMIs are due in China. Source: Trend spider

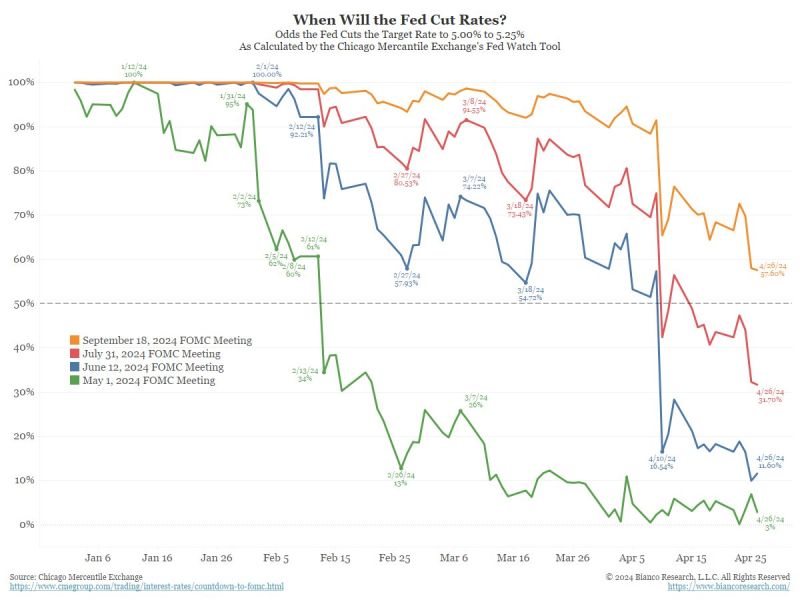

Fed Cut Probability Update - Jim Bianco (Bianco Research)

- May 1 FOMC meeting (green) less than 50% (meaning no move) - June 12 FOMC meeting (blue) less than 50% (meaning no move) - July 31 FOMC meeting (red) less than 50% (meaning no move) - September 18 FOMC meeting (orange) less than 60% (since it is 5 months away, effectively a coin-toss) After this, the next FOMC meeting is Thursday, November 7, two days after the election.

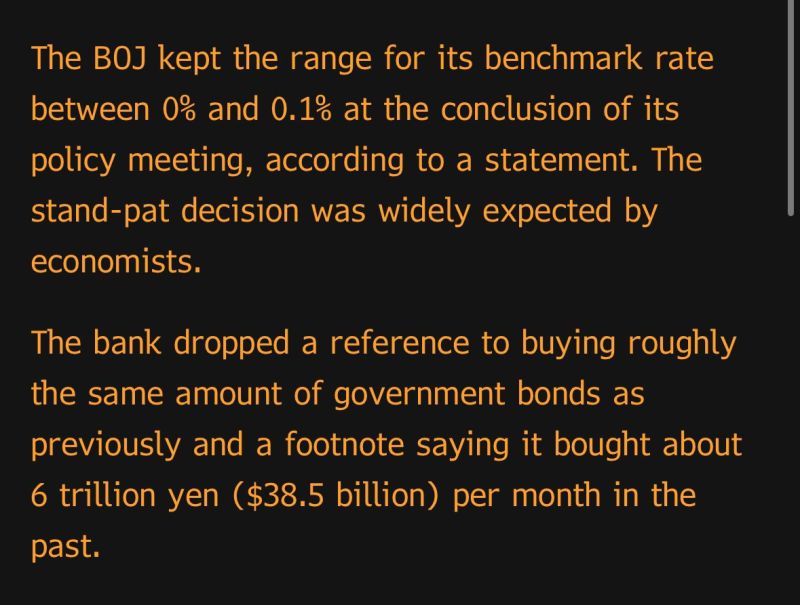

Bloomberg on the outcome of the BoJ Bank of Japan’s monetary policy meeting.

The Bank of Japan kept its policy rate unchanged Friday after its monetary policy meeting, holding its benchmark policy rate at 0%-0.1%. This is in line with expectations from economists polled by Reuters. While the move was expected, this comes after Tokyo’s April inflation came in lower than expected, with the core inflation rate at 1.6% compared to expectations of 2.2% from Reuters. The BOJ also said it will continue to conduct bond purchases. However, they dropped a reference to buying roughly the same amount of bonds as previously. No comment was made by the BOJ on the yen, which has steadily weakened since the BOJ ended its negative interest rate policy last month and abolished its yield curve control policy. The currency broke through the 156 mark against the U.S. dollar Friday after the decision, most recently trading at 156.11. Separately, the central bank also released its second-quarter outlook for Japan’s economy, raising its outlook for inflation in fiscal 2024. The BOJ now expects inflation between 2.5% and 3% for fiscal 2024, up from 2.2% to 2.5% in its January forecast. Inflation is then predicted to decelerate to “around 2%” in fiscal 2025 and 2026, the bank added. The BOJ also downgraded gross domestic product growth forecasts for fiscal 2024 to a range of 0.7% to 1%, down from January’s prediction of 1%-1.2% growth. Think of this as another small step in what the BoJ sees as a relatively long policy normalization journey. As mentioned by Mohamed El Erian, the length of this journey, both on a standalone basis and relative to the US, helps explain the weak Yen. Source: Bloomberg, CNBC

The us 10-year note yield rises to 4.73%, its highest level since November 1st, 2023.

This puts the 10-year note yield ~100 basis points above its December 2024 low. With just 1 interest rate cut now expected in 2024, discussions of more HIKES are back. If todays' PCE inflation data confirms that hashtag#inflation is back on the rise, we could see futures price out the last cut. Source: The Kobeissi Letter

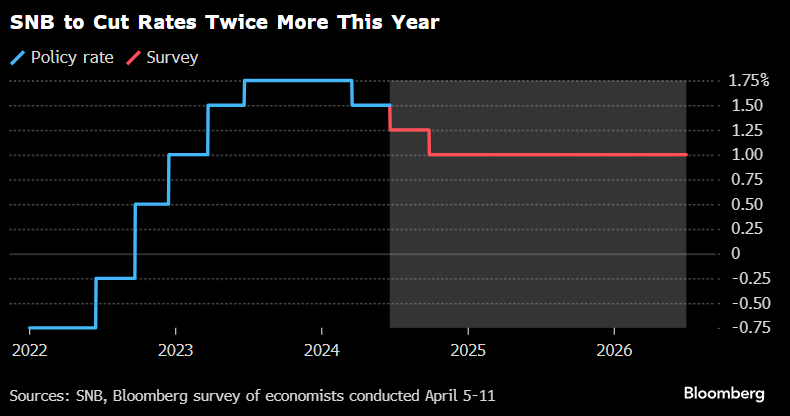

SNB’s Jordan Warns New Inflation Shocks Could Hit "At Any Time"

Speaking in Bern this morning, Jordan said: “We will therefore monitor the ongoing development of inflation closely and adjust our monetary policy again if necessary.” and also cautioned there’s “no guarantee” that the current favorable consumer-price outlook will hold.

Source: Bloomberg

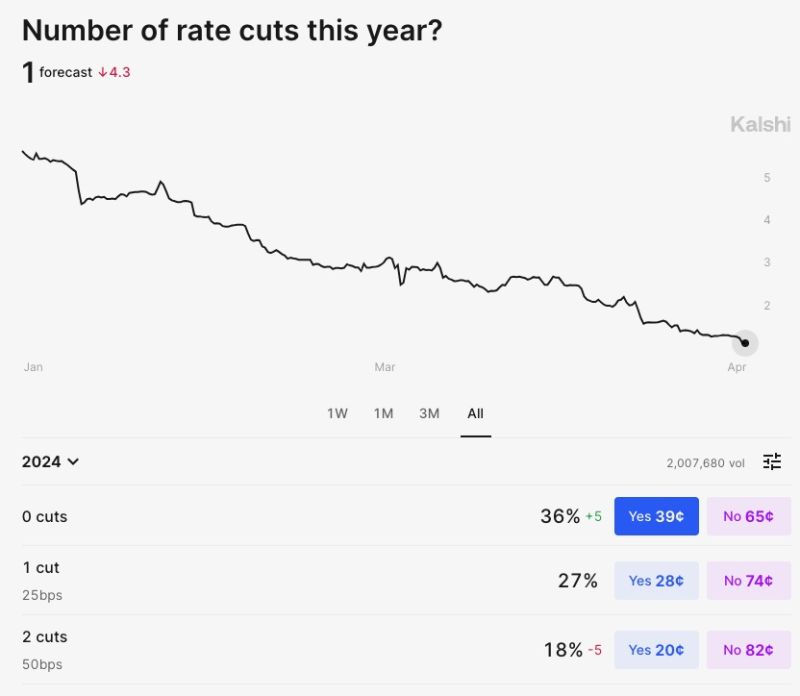

Prediction markets now show a 36% chance of ZERO interest rate cuts in 2024, according to Kalshi.

To put this in perspective, 4 months ago there was a ~3% chance of no rate cuts in 2024. The base case has gone from 6 rate cuts to 1 rate cut this year. There is just a 31% chance of 2 or more interest rate cuts this year. In other words, there is a higher chance of NO cuts than 2 OR MORE cuts. Could it be the fastest shift in Fed expectations of all time? Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks