Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

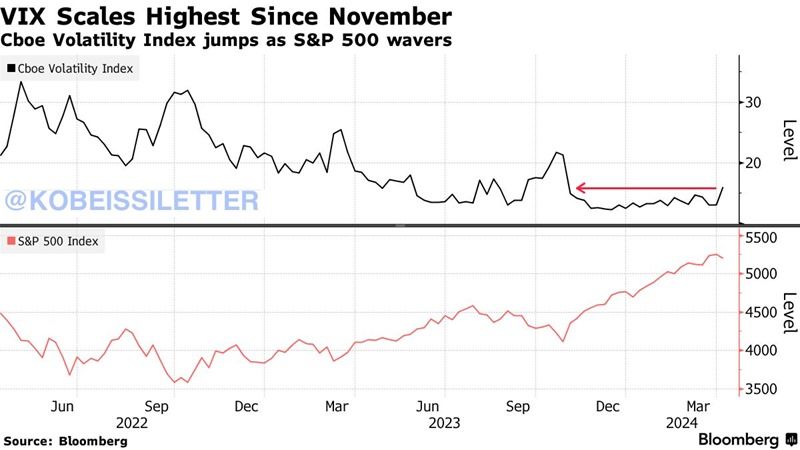

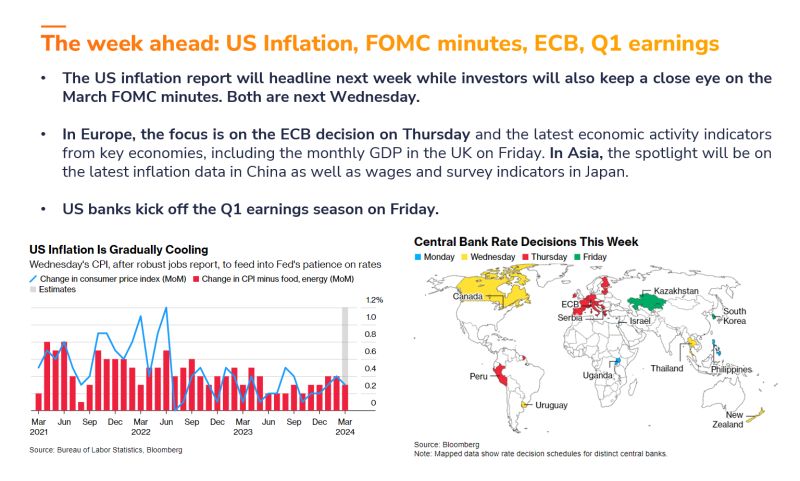

The volatility index, $VIX, spiked 23% this week, the largest weekly jump since September 2023.

It also marked the highest weekly $VIX close since November 2023. Meanwhile, the Dow posted its worst week of 2024 so far. This week, we will receive crucial inflation data including CPI and PPI inflation. If CPI inflation rises again, it will mark the 3rd straight monthly increase in inflation. Will the VIX continue to increase? Source: Bloomberg, The Kobeissi Letter

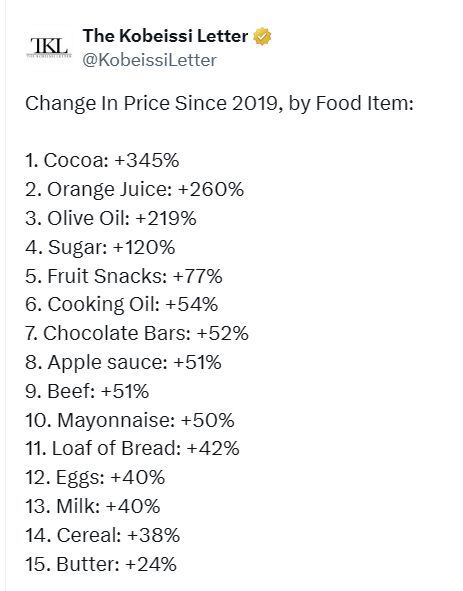

US inflation has officially been at 3% or higher for exactly 3 years.

The Average American is now paying nearly 40% MORE for groceries than what they were paying in 2019. Over 100 food items have seen inflation above 50% since 2019...

No one can make more than 21 million Bitcoin.

Source: Bitcoin Magazine

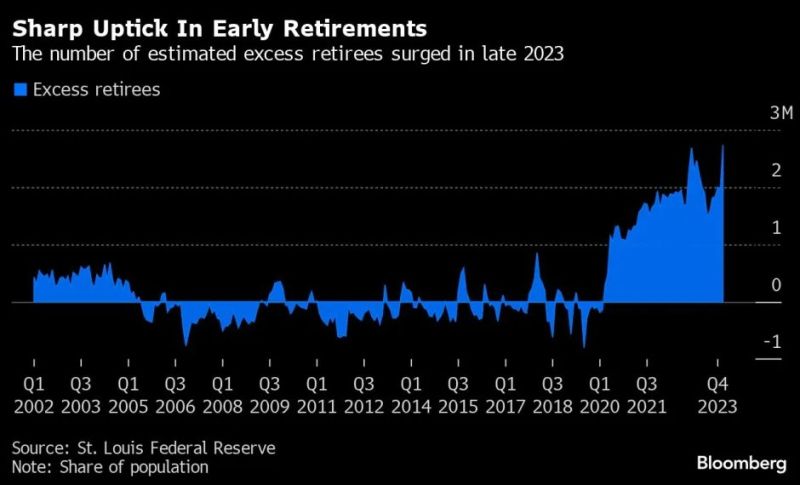

Early retirements surged again in late 2023 with the gains in the stock market and home prices, leading to a record 2.7 million excess retirees in the US.

Source: Bloomberg, Charlie Bilello

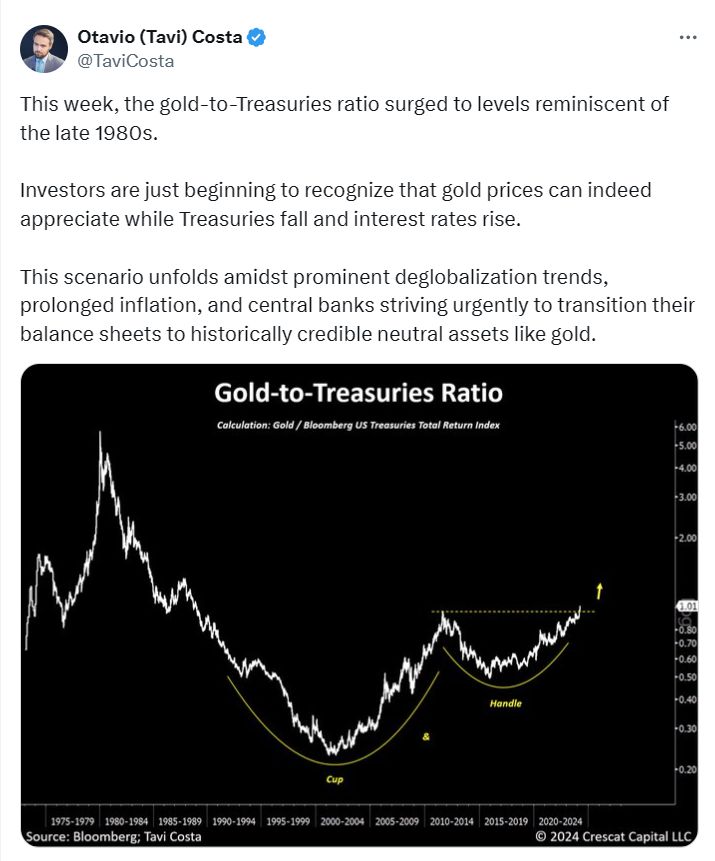

Gold as the ultimate macro hedge / diversifier within a multi-assets portfolio

This might be one of key investment theme of the current decade

Torsten Slok at Apollo is sticking to his view that there will be no US rate cut this year...

Source: Markets & Mayhem, Apollo

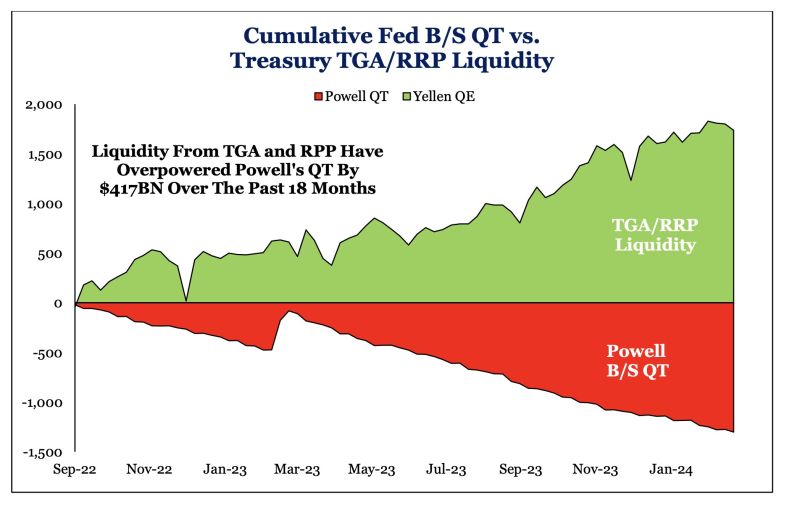

It's the liquidity, stupid! Yellen's stealth QE overpowering Powell's QT.

This probably helps risk assets performing well despite high interest rates and qt (Chart via SRP thru HolgerZ)

Investing with intelligence

Our latest research, commentary and market outlooks