Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

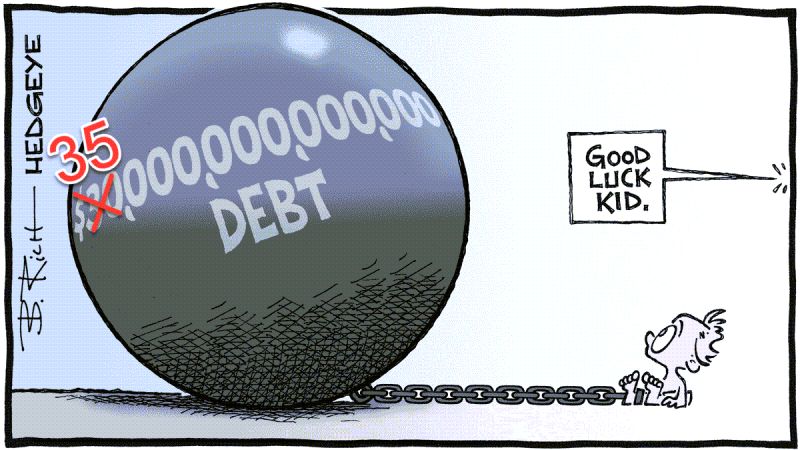

Cartoon of the Day by Hedgeye

$34.6 TRILLION and counting... Are we past the point of no return?

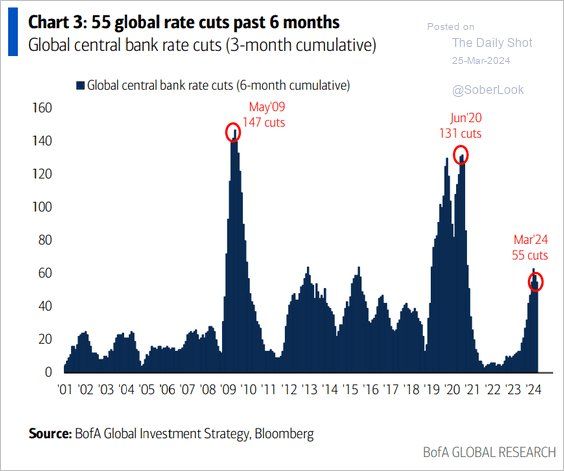

Central banks cut rates at the fastest pace since heading into the pandemic.

Source: BofA, The Daily Shot

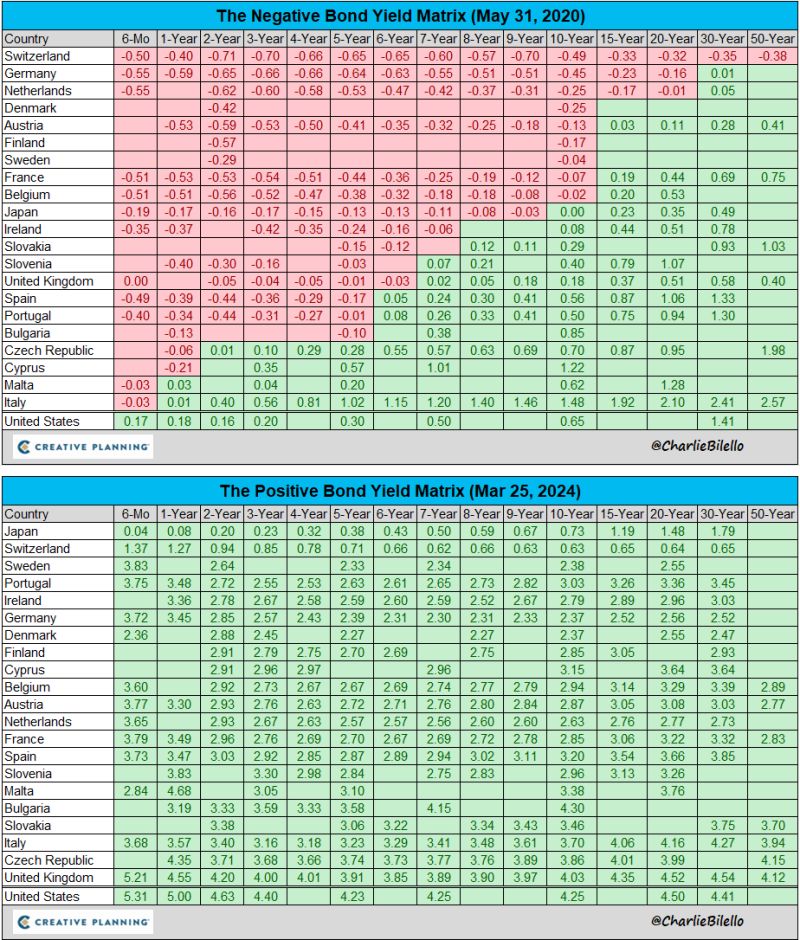

In May 2020, there were 21 countries with negative interest rates. Today there are none.

Sanity has returned to the global bond market... Source: Charlie Bilello

THE WEEK AHEAD... All eyes on inflation data + Powell speech on Friday

>>> In the US: 1. New Home Sales data - Monday 2. CB Consumer Confidence - Tuesday 3. US Q4 2023 GDP data - Thursday 4. February PCE Inflation data - Friday 5. hashtag#Fed Chair Powell Speaks - Friday 6. Total of 5 Fed Speaker Events >>> Inflation will also be the key theme in europe as flash CPI reports start to come in. >>> In Japan, the focus will be on the summary of opinions from this week's BoJ meeting as well as the Tokyo CPI, labour market data and industrial production. Picture via openart.ai/midjourney

Are us financial conditions becoming too easy to tame inflation ?

Source: Bloomberg, Steno Research, Macrobond

In case you missed it:

After bank of japan abolished negative interest rates this week for 1st time since 2016, the volume of bonds with negative interest rates has shrunk to $300mln. At its peak, there was a volume of $18tn worth of bonds with negative rates. But this weird experiment seems to be over – for now. Source: HolgerZ, Bloomberg

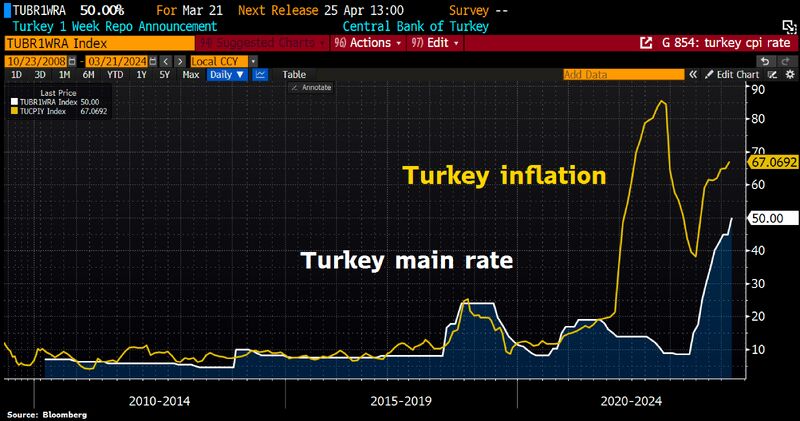

Turkey raises benchmark rate unexpectedly by 500bps to 50%.

But main rate still way below inflation of 67.1%. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks