Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

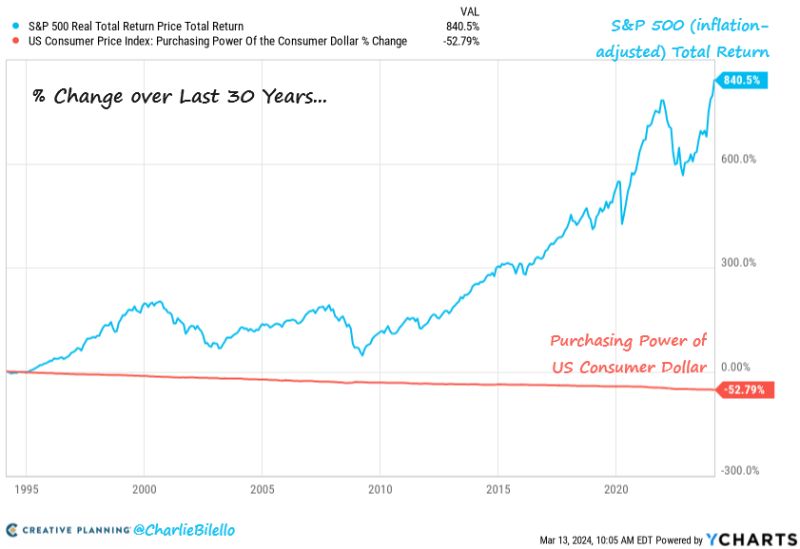

Why you need to invest, in one chart...

Over the last 30 years, the purchasing power of the US consumer dollar has been cut in half due to inflation. At the same time, the sp500 has gained 840% (7.8% per year) after adjusting for inflation... Source: Charlie Bilello

The Atlanta Fed's gauge of sticky inflation has risen to about 5% on a 3-month annualized basis.

Inflation is moving in the wrong direction for the Fed, so it's interesting that the market's base case is still that the Fed is going to cut rates by about 100bp by January 2025. Source: Bloomberg, Lisa Abramowitz.

Disinflationary forces continue in Germany.

Wholesales Prices drop 0.1% MoM in Feb after +0.1% MoM in Jan, plunge 3% YoY which is a good leading indicator for German food price CPI. Sources: Bloomberg, HolgerZ

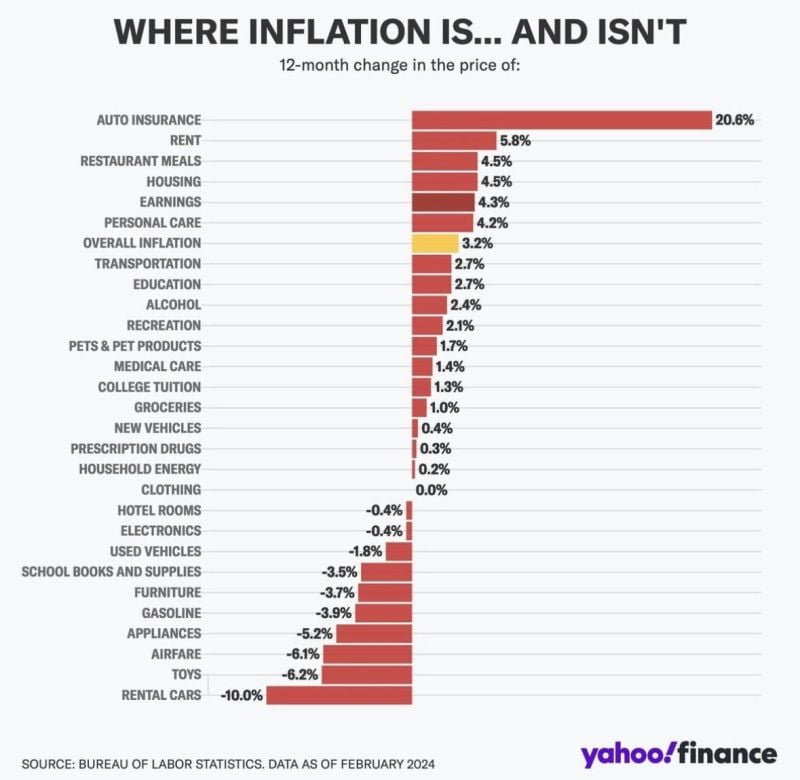

Where us inflation is and where it isn’t

Source: Evan, Yahoo Finance

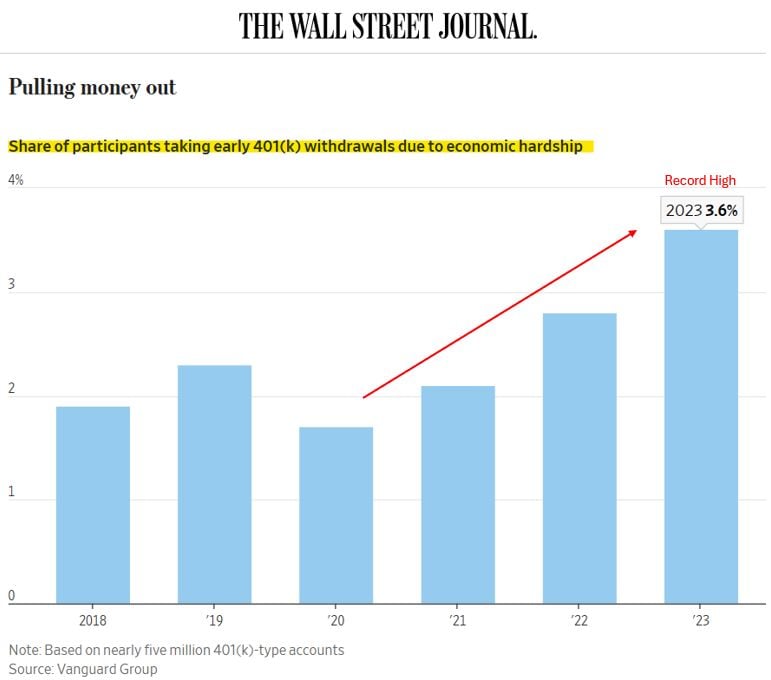

A record number of Americans are taking hardship withdrawals from their 401k.

The figure has nearly doubled over the last four years. 40% of these hardship withdrawals are to avoid foreclosure. Source: Nick Gerli, Wall Street Journal

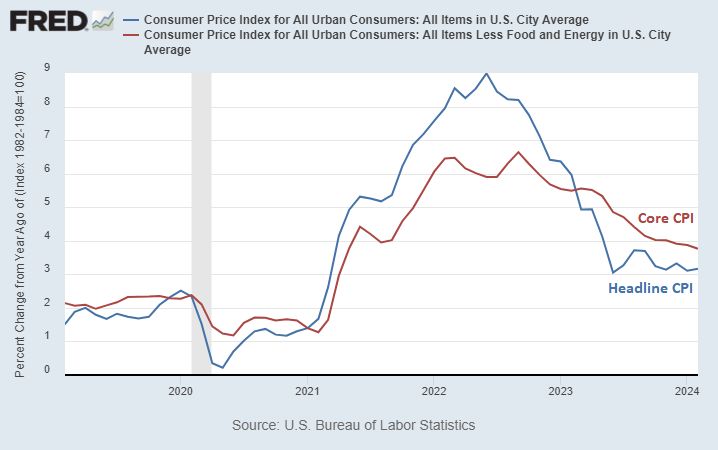

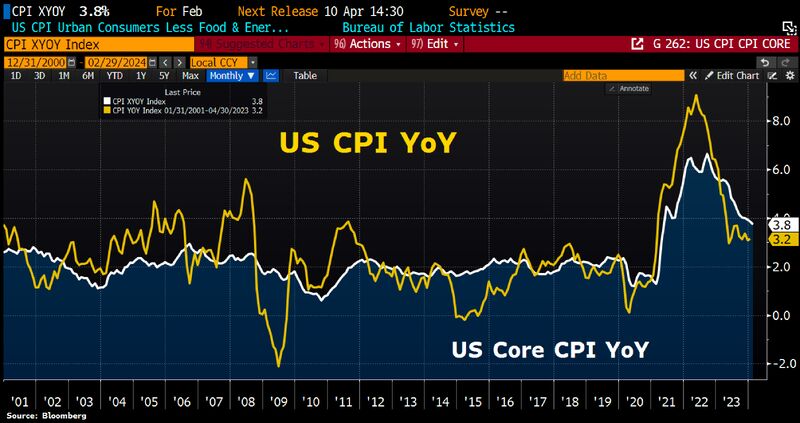

Yesterday's hot CPI prints shows that headline inflation is sticky around the 3% level.

Source: Lyn Alden, FRED

US inflation looks sticking, at least decline in the US headline CPI is stalling since Jun 2023.

In Feb, CPI rose by 0.4%MoM, both overall & excluding energy & food. Prices for services in particular increased, reflecting rising wage costs. High inflation rate in Jan was not an outlier. Source: Bloomberg, HolgerZ

Some interesting quotes by Donald Trump about rates, the dollar, macro and gold thru Ronnie Stoeferle:

- "I am a low interest rate person. If we raise interest rates and if the dollar starts getting too strong, we're going to have some very major problems." - "This is the United States government. First of all, you never have to default because you print the money." - "The Dollar is too strong. Our companies can’t compete with them now because our currency is too strong. And it’s killing us." - "The golden rule of negotiation: He who has the gold makes the rules." - "We used to have a very, very solid country because it was based on a gold standard. We don’t have the gold. Other places have the gold." - "I have been complaining about currency devaluations for a long time. I believe that we will all eventually, and probably sooner than people understand or think, be on a level playing field because that’s the only way its fair."

Investing with intelligence

Our latest research, commentary and market outlooks