Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

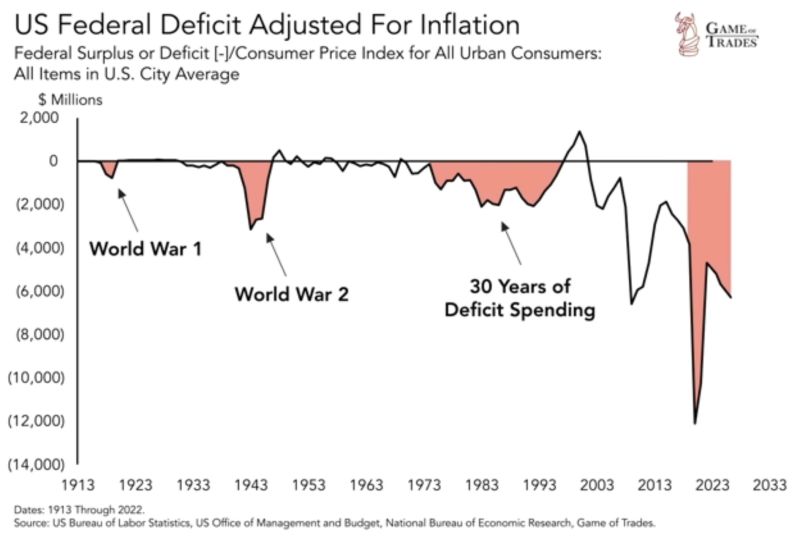

Inflation-adjusted US government spending since 2020 exceeds the combined spending of:

- World War I - World War II - 1970 to 1990 Source: Game of Trades

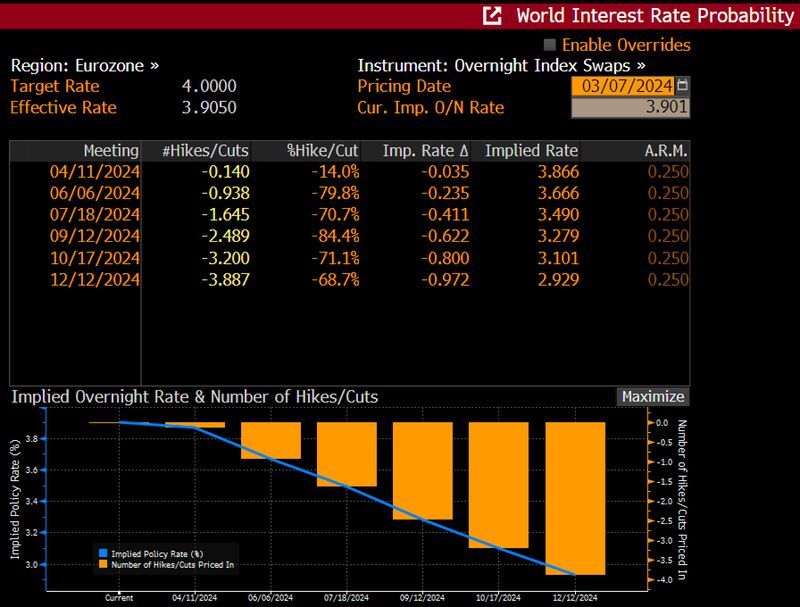

ECB’s Lagarde signals June rate cut w/2% inflation in sight.

Markets agree and price in 97bps cut for 2024. Source: Bloomberg, HolgerZ

As expected, the ECB lefts rates unchanged.

The European Central Bank approach continues to follow a data-dependent approach in determining rate path. THE STATEMENT • Inflation forecasts by ECB staff have been lowered, especially for 2024, largely due to reduced energy price pressures. Inflation is now expected to average 2.3% in 2024 and to stabilize around 2.0% in the following years; core inflation projections also revised downwards. They nevertheless say that domestic price pressures remain high, partly due to wages. They say that domestic price pressures remain high, partly due to wages. • Growth projections for 2024 have been downgraded to 0.6%, with a gradual recovery anticipated, leading to 1.5% growth in 2025 and 1.6% in 2026. • The ECB believes current interest rates, if maintained, will significantly contribute to reducing inflation and has committed to keeping rates at restrictive levels as needed. MARKET REACTION • EUR/USD is weaker on the news (to 1.0875) and EUR rates extend their move lower (they were already down every day this week, and prior to the ECB announcement). German 10y is down -7bp to 2.25% at the time we write • Rate cuts expectations are slightly increased for this year, but not massively so far (still four 25bp rate cuts by the end of the year when rounding the probabilities) OUR TAKE • Overall, this is a rather dovish statement for now - let see if Lagarde press conference will reinforces the dovish reading or if she counterbalances the message from the downward revisions on growth in inflation. Source: chart: Bloomberg

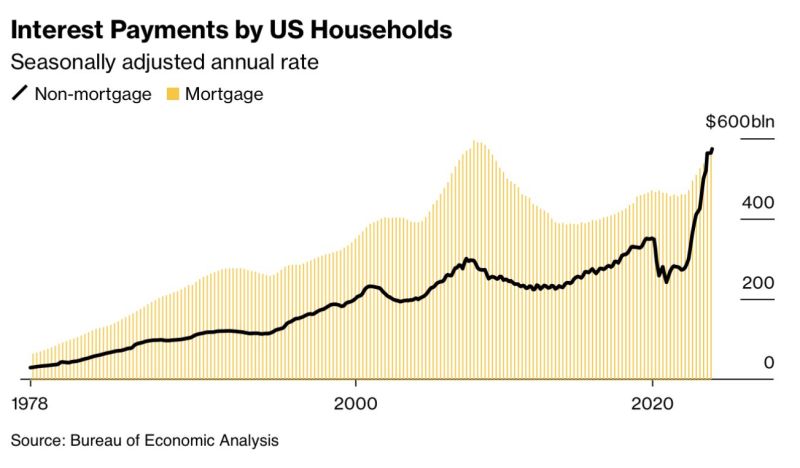

U.S. Households are now spending a record $573.4 billion on non-mortgage interest payments which for the first time in history is roughly the same as mortgage interest payments.

source : Barchart

With Powell's remarks, Wall Street's hopes for a March rate cut (once 97%) officially hit 0.

With Powell's remarks today, Wall Street's hopes for a March rate cut (once 97%) officially hit 0. "Maybe he should consider using models that have been consistently accurate, instead of listening to those who give him 'different answers' (his words) that have been consistently wrong." From : Mitchel Krause, hedgeye : With Powell's remarks today, Wall Street's hopes for a March rate cut (once 97%) officially hit 0. "Maybe he should consider using models that have been consistently accurate, instead of listening to those who give him 'different answers' (his words) that have been consistently wrong." From : Mitchel Krause, hedgeye :https://app.hedgeye.com/insights/147337-mitchel-krause-how-wall-street-s-hopes-for-march-cuts-quickly-collaps?type=guest-contributors

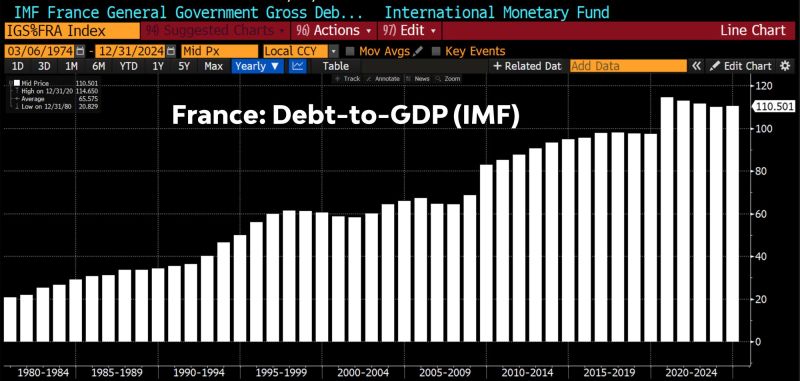

France's 2023 Deficit 'Significantly' Above 4.9%' (BBG)

France's budget (in)discipline... Since the Great Financial Crisis in 2008, France managed to keep its budget deficit below the 3% threshold (remember the Maastricht Treaty) just once (2018). This is far worse than Italy. France's debt-to-GDP ratio is at 110%, up from 64% pre-financial crisis. With potential GDP growth at a paltry 1% and declining, structurally low interest rates is needed to keep the debt burden afloat. Source: Jeroen Blokland, Bloomberg

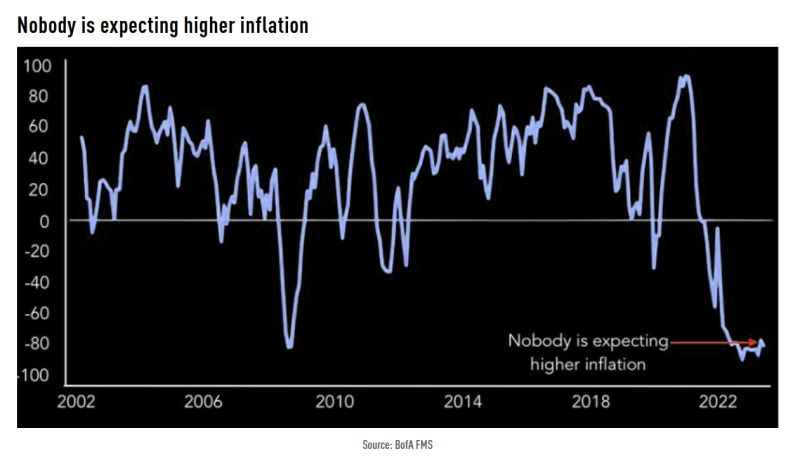

According to latest Fund Manager Survey by BofA, nobody is expecting higher inflation

Source: TME

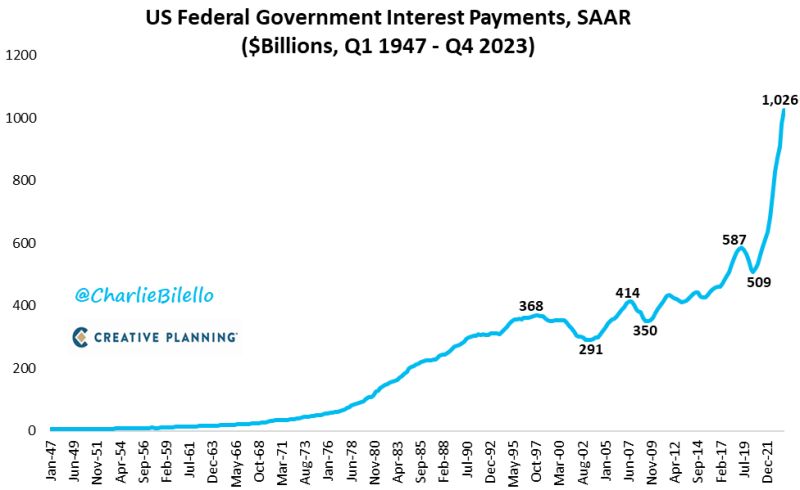

The interest payments on US Federal Government Debt have surpassed a $1 trillion annual rate, increasing 98% over the past 3 years

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks