Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

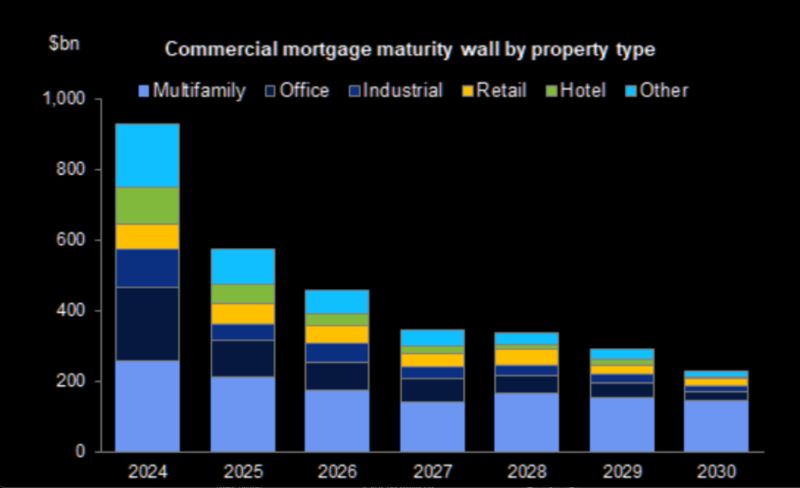

Maturity Wall

Roughly $930 billion in commercial mortgage loans are scheduled to mature in 2024. source : tme

Germany economic challenges in one chart

Source: Statistisches Bundesamt

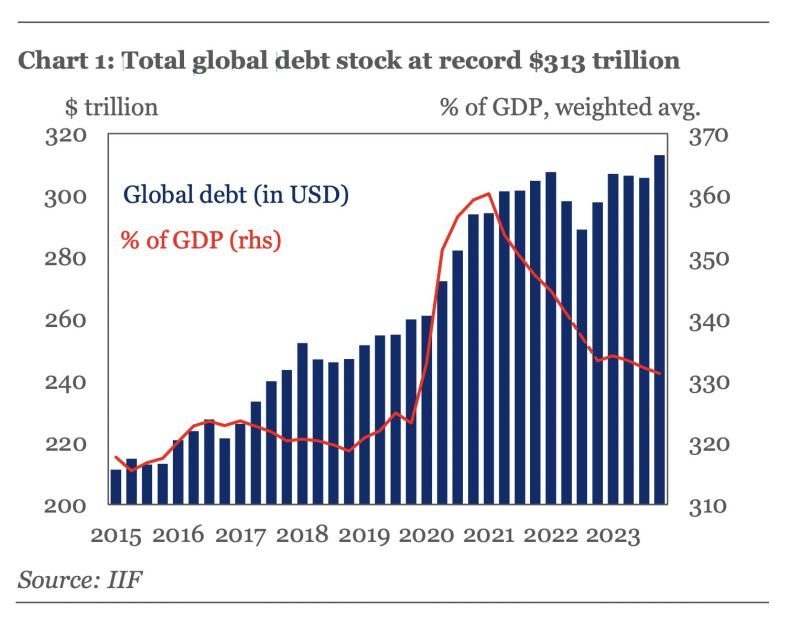

In case you missed it: Global debt surged by >$15tn in 2023 reaching a new record high of $313tn.

55% of this rise originated from mature markets, mainly driven by US, France, & Germany. BUT global debt-to-GDP ratio saw a decline of ~2ppts to 330% in 2023, acc to IIF. This marked the third consecutive annual drop. Source: HolgerZ, IIF

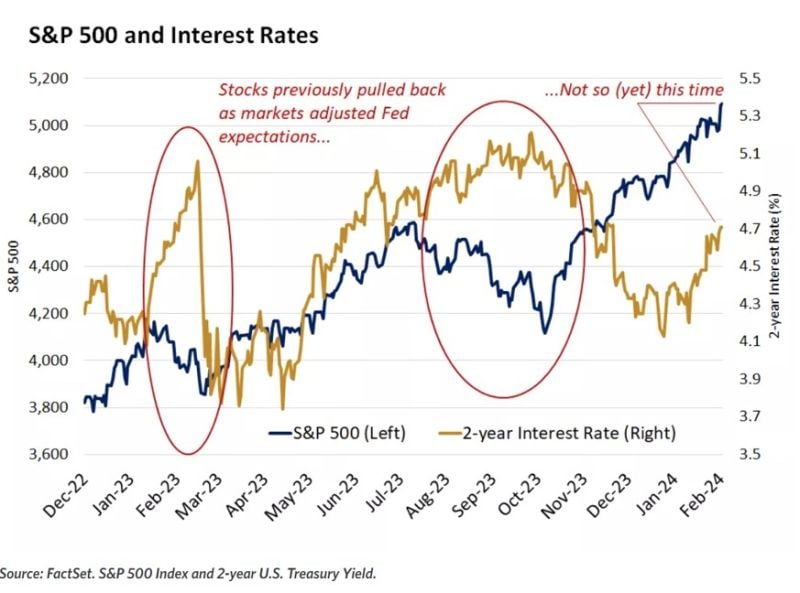

US equities are shrugging off higher rates.

The chart below shows the level of the S&P 500 Index and the 2-year U.S. Treasury yield. Yields have risen in 2024 but unlike prior episodes of rising yields last year, the S&P 500 has moved higher as well. Past performance does not guarantee future results. Source: Edward Jones

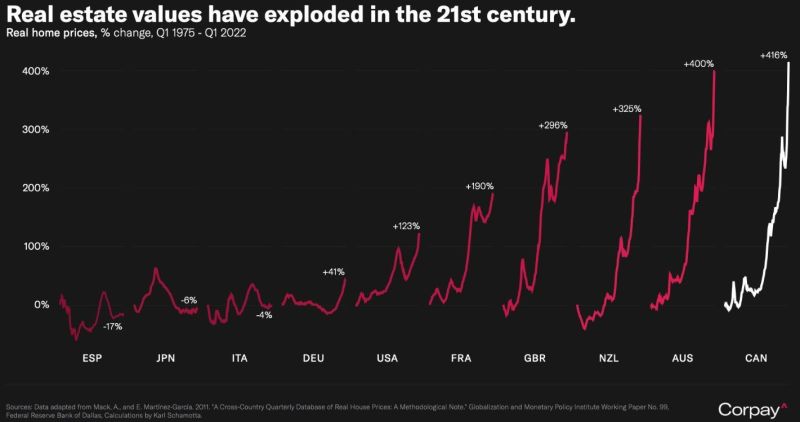

House prices adjusted for inflation since 1975.

The charts for Canada, Australia, New Zealand, and the UK look like a s**tcoin during a pump. The Japanese real estate bubble of the 1990s is barely visible as a comparison... Source: Bloomberg, MacroAlf

Goldman Sachs' analysts no longer expect a U.S. interest rate cut in May and see four 25 basis point cuts this year.

"Because there are only two rounds of inflation data and a little over two months until the May (Fed) meeting, the comments suggest to us that a rate cut as early as May, which we had previously expected, is unlikely," Goldman Sachs analysts said in a note. They now forecast an extra cut next year instead, with an unchanged terminal rate forecast of 3.25-3.5%." source : goldmansachs, reuters

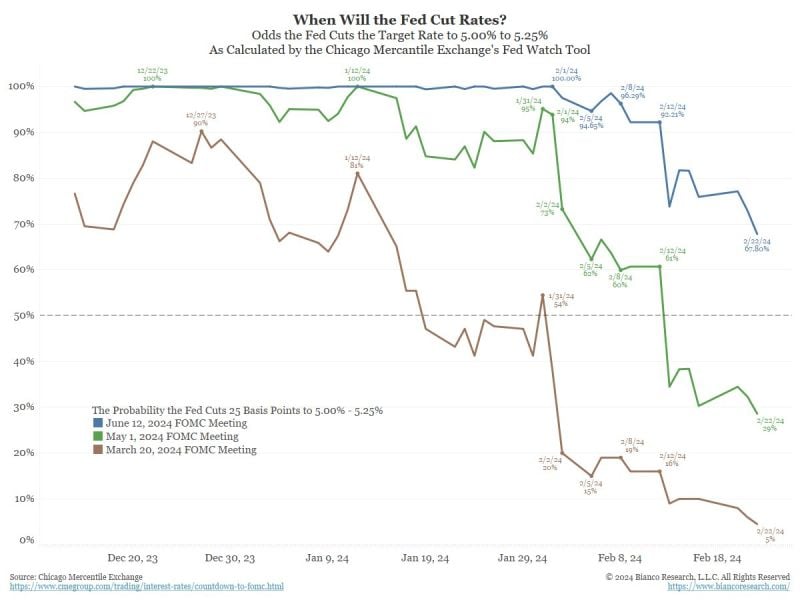

This chart shows the market pricing of a rate cut over the next three FOMC meetings.

March probability = 5% (was 80% at the start of the year) May probability = 29% (was 100% at the start of the year) June probability = 67% (was 100% at the start of the year) Source: Bianco Research

Germany’s manufacturing downturn unexpectedly deepens amid falling demand at home and abroad.

S&P Global’s PMI for the country’s industrial sector dropped to 42.3 from 45.5 the previous month – well below any economist estimate in a Bloomberg survey. The picture was brighter in France, where the contraction eased much more than analysts had predicted. Companies reported improving demand while expanding their workforce. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks