Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Eurozone CPI slowed less than anticipated in Feb, highlighting stickiness in inflation

Headline inflation eased to 2.6% YoY in Feb, above 2.5% consensus estimate in BBG survey. Core inflation came down by 0.2%-pt to 3.1%, also an upward surprise compared to 2.9% consensus estimate. Source: Bloomberg

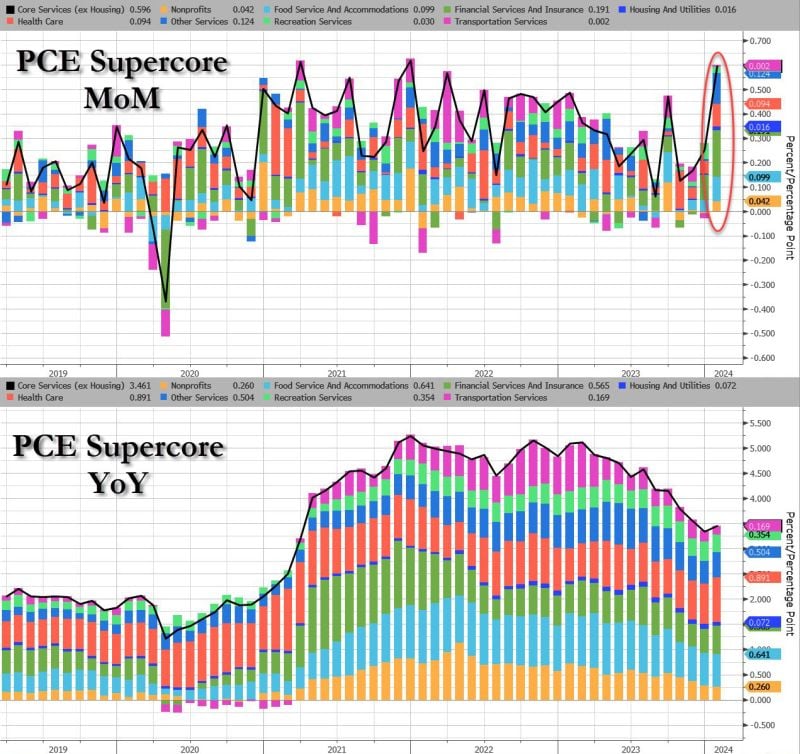

Supercore PCE MoM exploded, highest since Dec 2021

Source: www.zerohedge.com, Bloomberg

Today's report unveiled the largest positive surprise in US personal income since the surge in consumer prices began in 2021

Source: Tavi Costa, Bloomberg

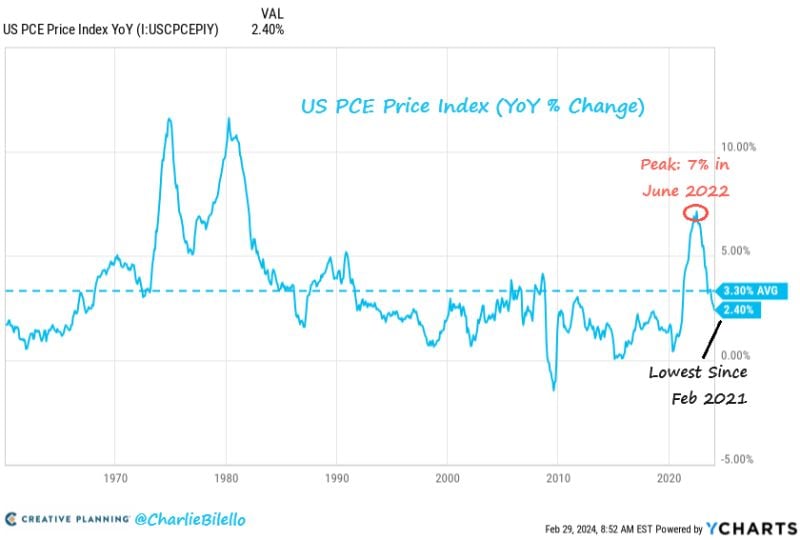

More evidence of a decline in US Inflation...

The PCE Price Index moved down to 2.4% in January, its lowest level since February 2021. Cycle peak was 7% in June 2022. Source: Charlie Bilello

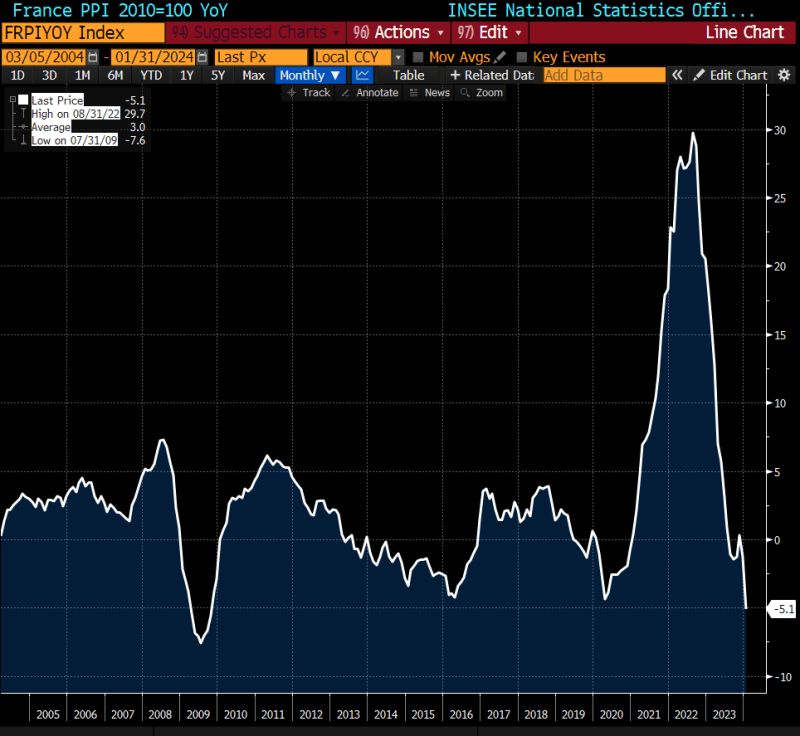

France PPI YOY is the lowest since 2009...

Source: Bloomberg, Alessio Urban

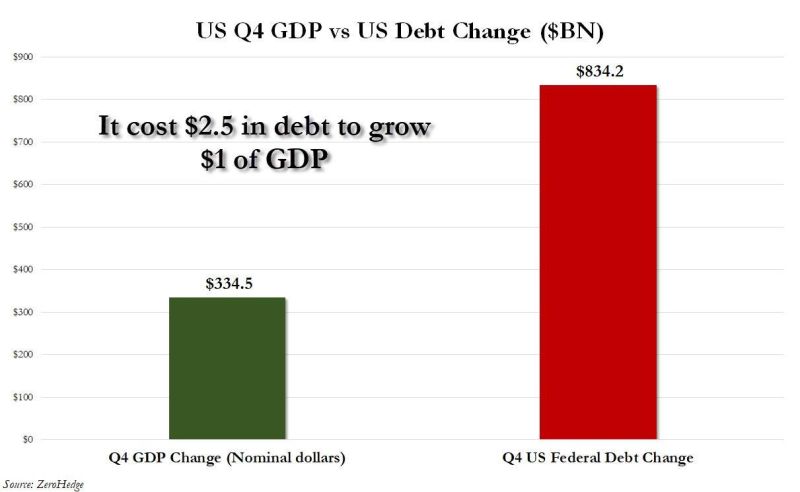

When you invest in US debt, think twice...

In Q4 2023, nominal GDP grew by 3.2% according to data on Wednesday. This would mean a $334.5 billion increase in nominal GDP. Meanwhile, over the same time period the US added $834.2 billion of debt. In other words, it cost us $2.50 of debt for every $1.00 of GDP last quarter, according to Zerohedge. As Fed Chair Powell recently said, "we are on an unsustainable fiscal path." What's the long term plan here? Source: The Kobeissi Letter, www.zerohedge.com

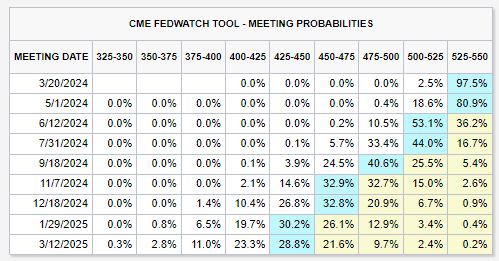

Interest rate cut expectations continue to scale back: Markets now see a ~38% chance of 4 interest rate cuts in 2024

Just over a month ago, the base case showed a 50%+ chance of 6 interest rate cuts in 2024. Meanwhile, odds of a March rate cut are down to 3% and odds of a May rate cut are down to 19%. For the first time in 2024, markets are close to the Fed's latest guidance of 3 cuts in 2024. Source: The Kobeissi Letter

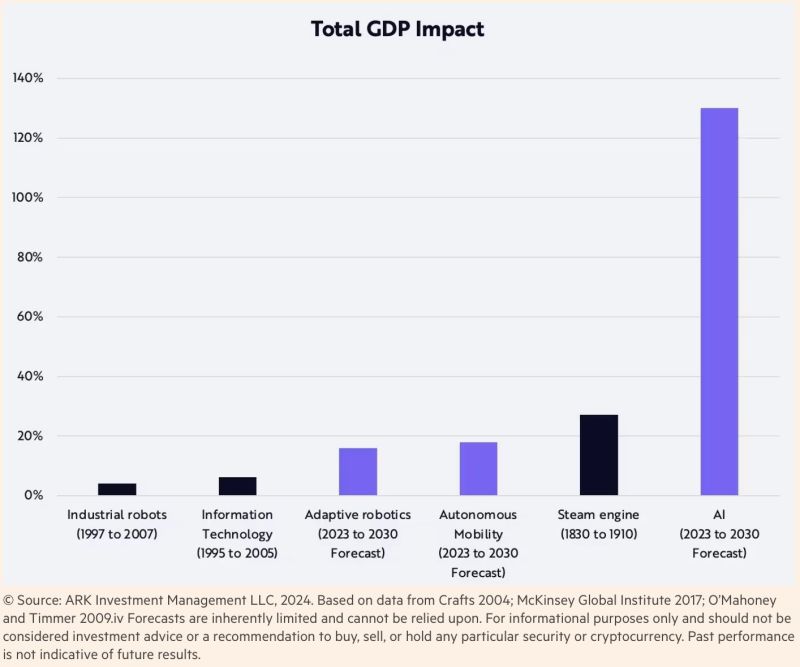

Artificial Intelligence is projected to increase the GDP by 130% according to Cathie Wood's Ark Investment Management

This is significantly higher than all major advances in technology including the Steam Engine and the Internet. Source: Barchart, Ark Invest

Investing with intelligence

Our latest research, commentary and market outlooks