Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

FOMC Minutes Show 'Most Officials Fear Risk Of Cutting Too Quickly'

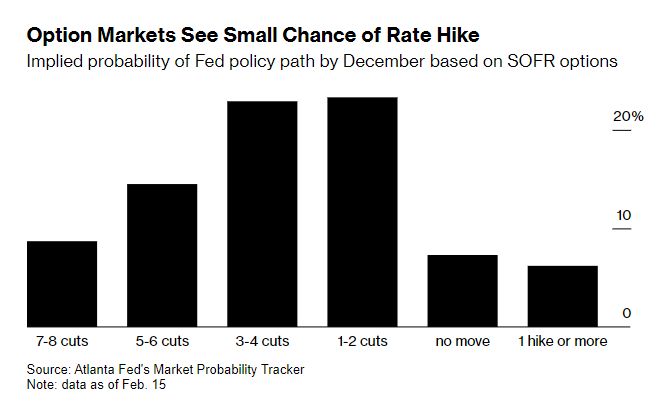

The discussion came as policymakers not only decided to leave their key overnight borrowing rate unchanged but also altered the post-meeting statement to indicate that no cuts would be coming until the rate-setting Federal Open Market Committee held “greater confidence” that inflation was receding. The meeting summary indicated a general sense of optimism that the Fed’s policy moves had succeeded in lowering the rate of inflation, which in mid-2022 hit its highest level in more than 40 years. However, officials noted that they wanted to see more before starting to ease policy while saying that rate hikes are likely over. Members cited the “risks of moving too quickly” on cuts. Source: CNBC Activate to view larger image,

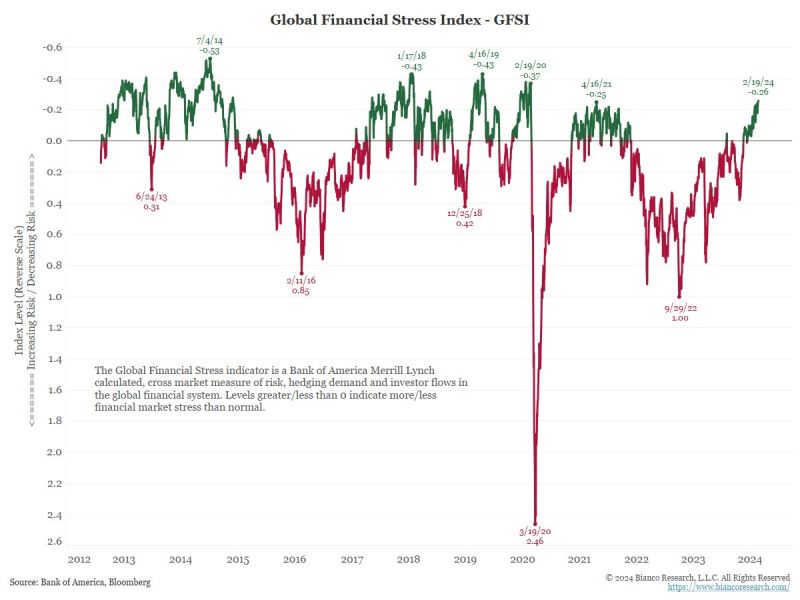

Below is the BofA Global Financial Stress Indicator.

It just exceeded its April 2021 extreme, showing the LEAST amount of financial stress since the Pandemic (February 2020).

US markets start to speculate if the next Fed move is up, not down - Bloomberg

Investors are beginning to war-game how the Federal Reserve can manage a us economy that just won’t land, with some even debating whether interest-rate hikes will be needed only weeks after a steady run of reductions appeared all but certain. Bets on lower rates coming soon were so prevalent a few weeks ago that Fed Chair Jerome Powell publicly cautioned that policymakers were unlikely to be in position to cut as of March. Less than three weeks later, traders have not only removed March as a possibility but May also looks improbable, and even conviction about the June Fed meeting is wavering, swaps trading shows.

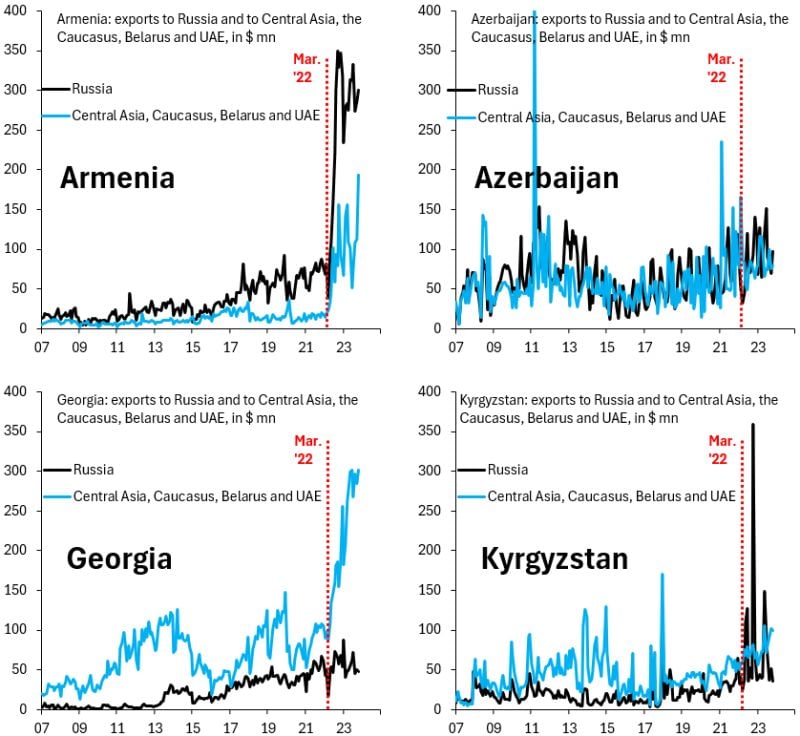

There's two hotbeds for re-export of western goods to Russia in Central Asia and the Caucasus: Armenia (top left) and Georgia (bottom left).

Armenia stands out for massive direct exports to Russia (black), Georgia for a huge surge in exports to Russia's satellite economies blue). Source: Robin Brooks

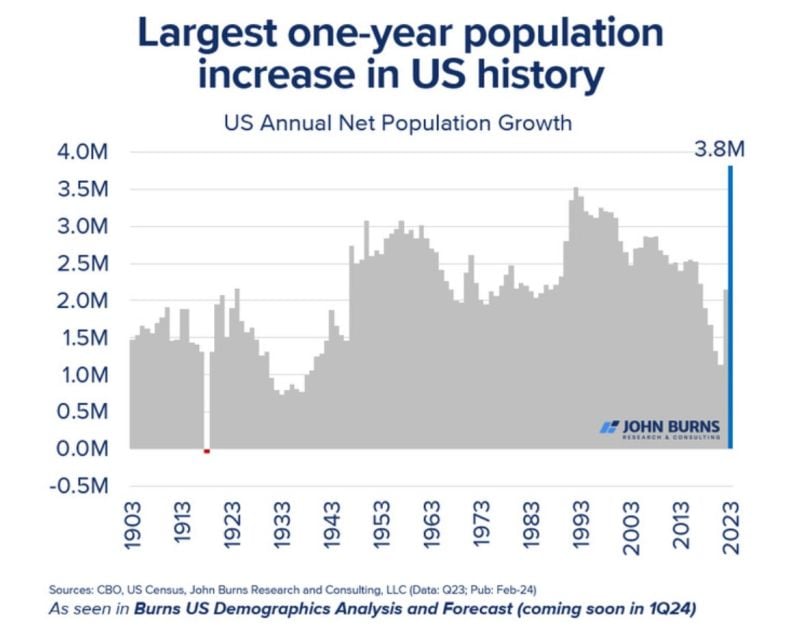

Will we soon see some relief on US wage inflation?

The US just experienced the largest population increase in a year ever. Mostly driven by the surge in immigration. Source: Tavi Costa

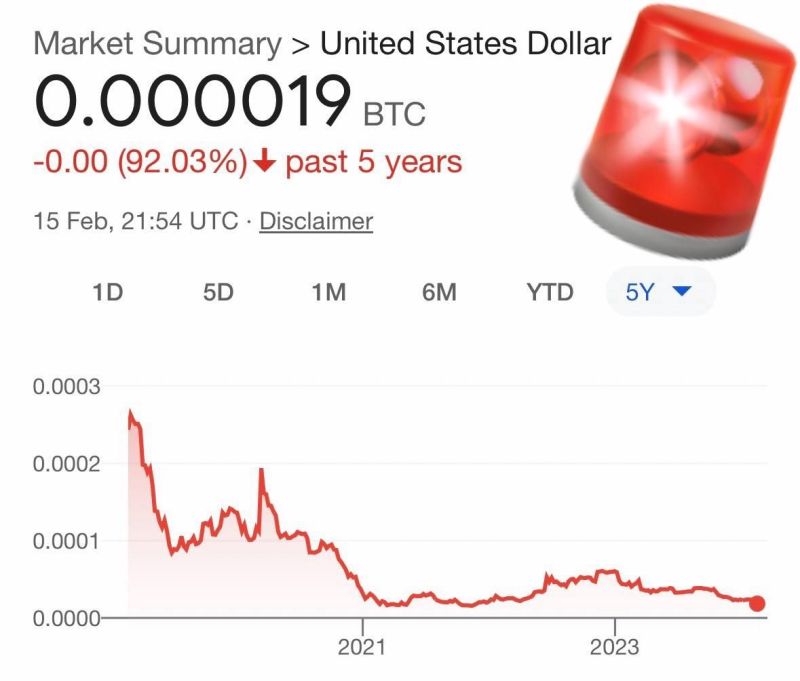

In just 5 years, the us dollar has plummeted by a staggering 92% when measured against Bitcoin...

Source: Loïc Staub

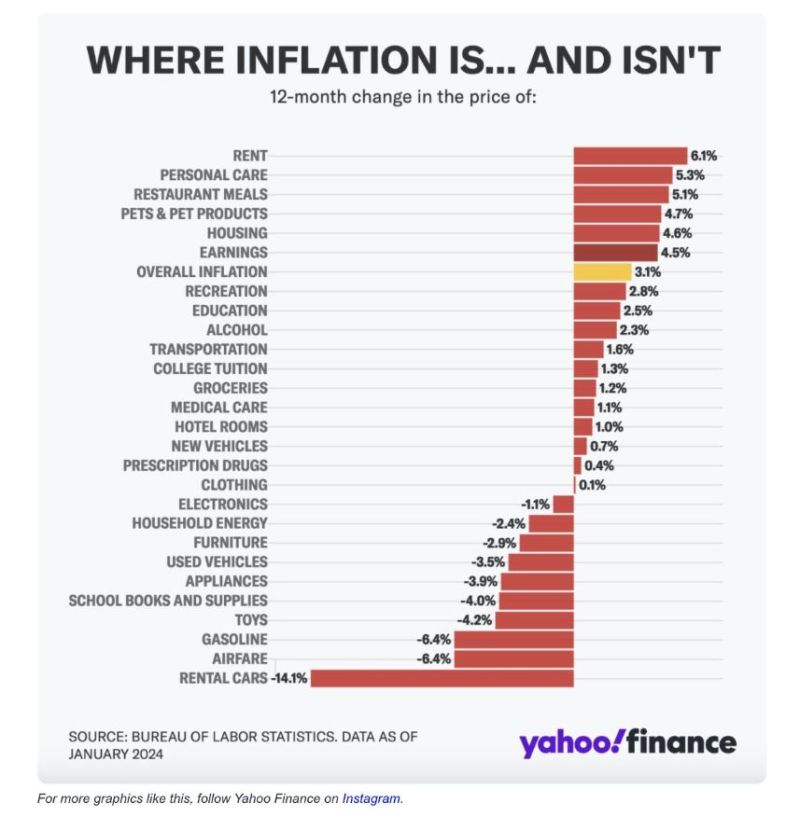

US Inflation – Where It Is And Isn’t

Source : Yahoo Finance

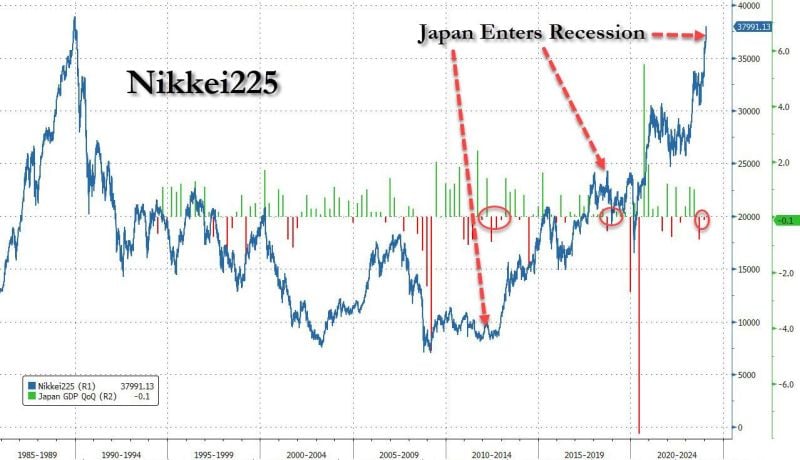

Japan enters recession with Nikkei about to hit All Time High as the yen trades at 150

The Nikkei has more than doubled from the covid lows and is about to breach its all time bubble highs set in in the last days of 1989... and moments ago Japan entered a recession. In fact, From its generational low set a decade ago, the Nikkei has almost quadrupled even as Japan's economy has slumped into recession three times! Once the second largest economy in the world, Japan reported two consecutive quarters of contraction on Thursday — falling 0.4% on an annualized basis in the fourth quarter after a revised 3.3% contraction in the third quarter. Fourth quarter GDP sharply missed forecasts for a 1.4% growth in a Reuters poll of economists. Source: CNBC, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks