Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

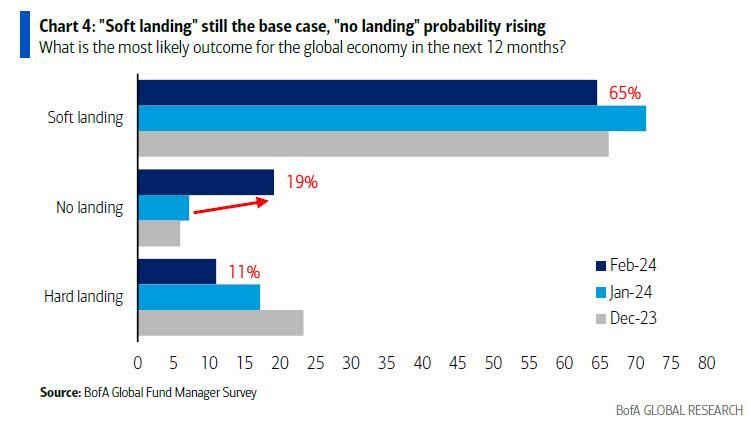

In the latest BofA fund managers survey

when asked for the path of the US economy this year, 2/3 of investors say "soft landing," 1/5 say "no landing," 1/10 say "hard landing" (again, guaranteeing a "hard landing")... Source. BofA

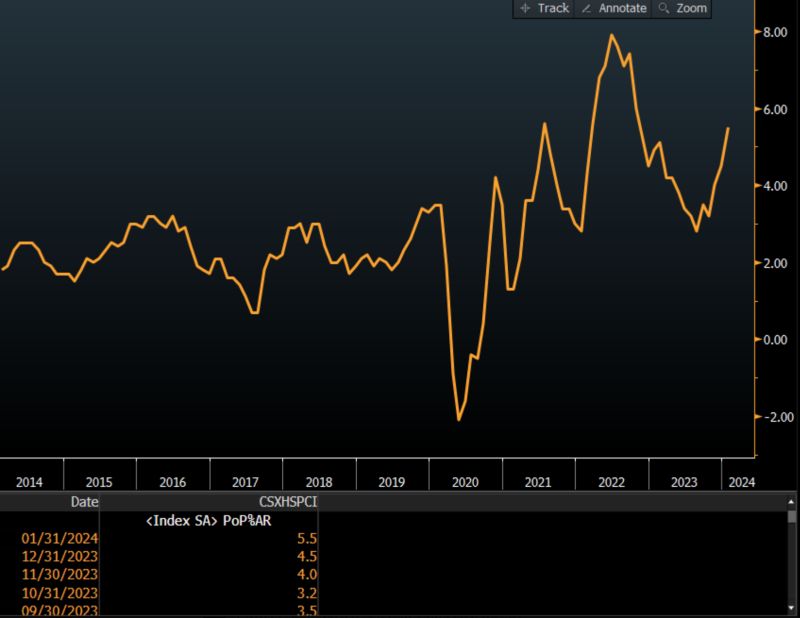

Another look at yesterday's inflation report by MacroAlf.

This chart shows supercore inflation - a measure of sticky inflationary pressures Powell & Co often refer to: - It slowed down vertically towards ~3% until the end of last year - But since then it has now accelerated rapidly to 5.5%! Source: MacroAlf

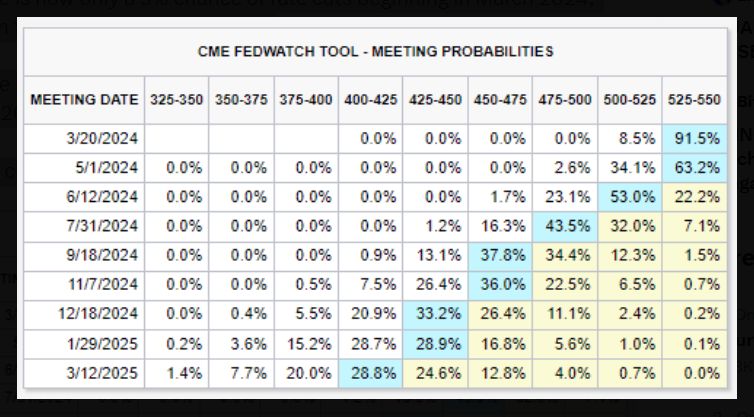

It's official, higher for longer is back! For the first time this year, markets are now pricing-in just 4 interest rate cuts in 2024.

Just 6 weeks ago, markets were expecting 6 interest rate cuts in 2024. More importantly, the timing of the first rate cut has been pushed all the way back to June 2024. There is now only a 9% chance of rate cuts beginning in March 2024, down from 90% just 6 weeks ago. There is also a ~63% chance that interest rates are unchanged through May 2024. Rate cuts are all but guaranteed. Source: The Kobeissi Letter

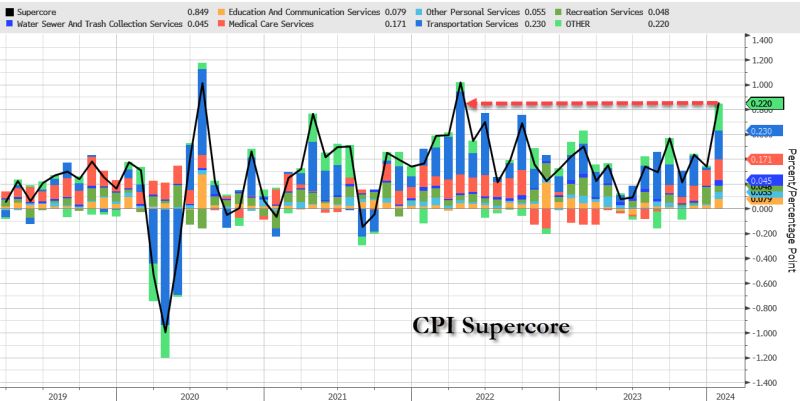

Headline CPI and Core CPI came out hotter than expected. SuperCore is the hottest since May 2023

-> Headline CPI: o Consumer prices rose 0.3% MoM (more than the 0.2% expected), driving the YOY change to 3.1% YoY versus 2.9% expected. Still, the decline from the +3.4% shows the disinflation trend is in place o Under the hood, food and Energy services costs jumped MoM along with transportation services -> Core CPI: o The index for all items less food and energy rose 0.4% MoM in January, the biggest jump since April 2023. The shelter index increased 0.6% MoM in January and was the largest factor in the monthly increase in the index for all items less food and energy. o Core CPI fell below 4.00% YoY for the first time since May 2021, but the +3.86% YoY print was hotter than the 3.7% expected. -> SuperCore CPI: o Core CPI Services Ex-Shelter index soared 0.7% MoM (the biggest jump since September 2022), driving the YoY change up to +4.4% - the hottest since May 2023 (see chart below). Our take: The disinflation trend remains in place. However, the “easy part” of the disinflationary process is behind. Buoyant final demand might sustain some upward pressures on prices. This data raises the odds that the Fed will stay put in March. Source: Bloomberg, www.zerohedge.com

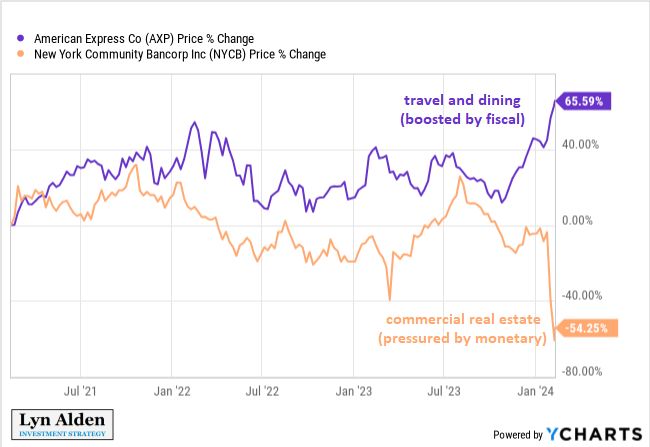

Great comment by Lyn Alden about the impact "FISCAL DOMINANCE" on sector performance divergence...

Bottom-line: go LONG Fiscal deficits receivers and go SHORT Fiscal deficit payers (i.e interest-rate sensitive sectors) "The wider-than-normal divergence between loose fiscal policy (which is stimulating) and tight monetary policy (which slows things down) contributes to wider-than-normal divergence between the performance of different economic sectors. It results in a wider-than-normal gap between sectors that are directly or indirectly on the receiving side of the deficits (eg business that rely on spending from upper and upper-middle class spenders) vs those that are the most sensitive to interest rates and thus are the most hurt by tight monetary policy (eg commercial real estate). And because some sectors of the economy are doing great partially due to the fiscal stimulus, it makes it unlikely that monetary policy or other assistance will arrive to the weaker areas any time soon. And ironically, because public debt levels are high, tight monetary policy *contributes* to looser fiscal policy by increasing the overall interest expense of the government, which goes to various entities in the economy and strengthens some of the sectors that are not sensitive to interest rates. This is a condition known as fiscal dominance". Lyn Alden

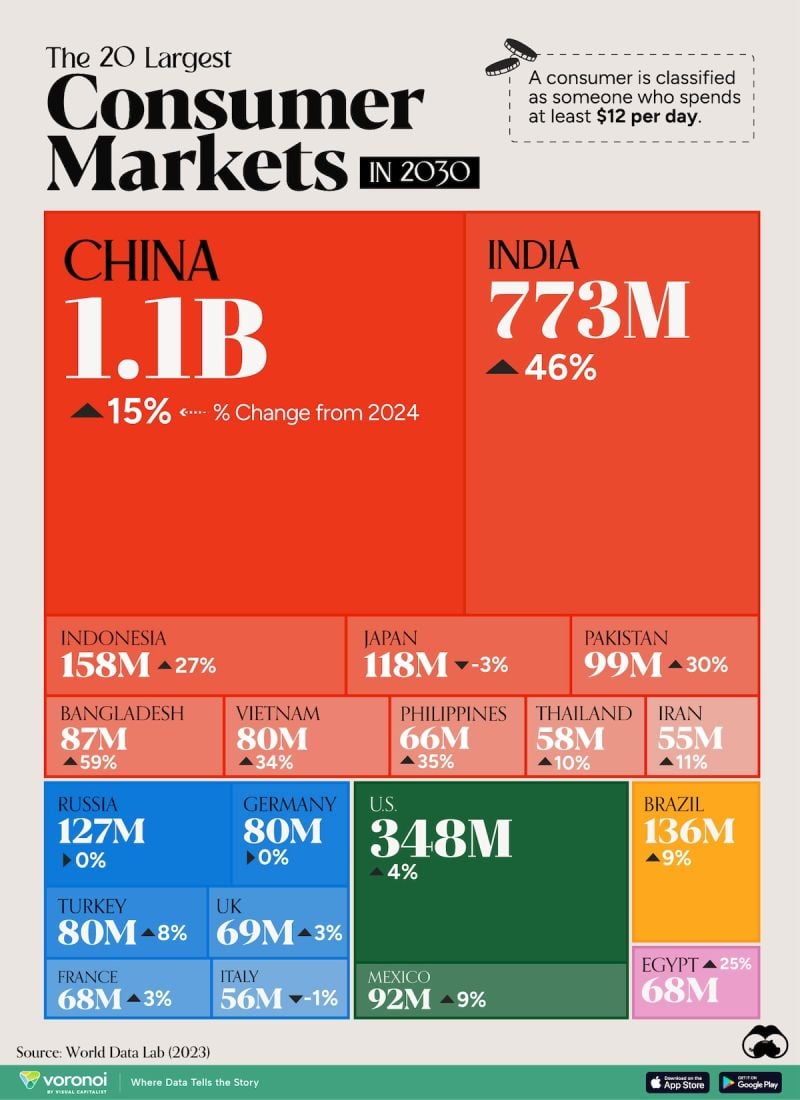

The World’s Largest Consumer Markets in 2030 🌏

Source: Visual Capitalist

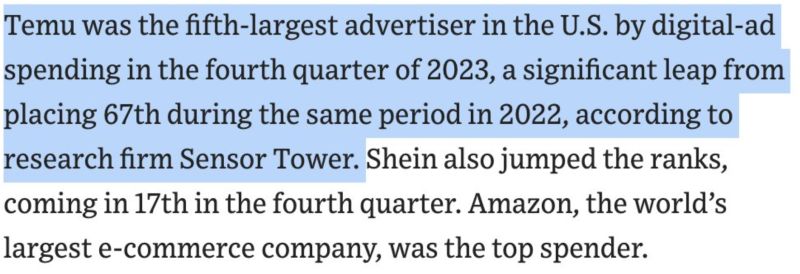

The Spend, Spend, Spend Strategy..

Temu is going all in on Marketing (including in this Sunday’s Super Bowl) Marketing spend: • 2023 - $1.7 billion • 2024 - $3 billion (est.) source : wsj

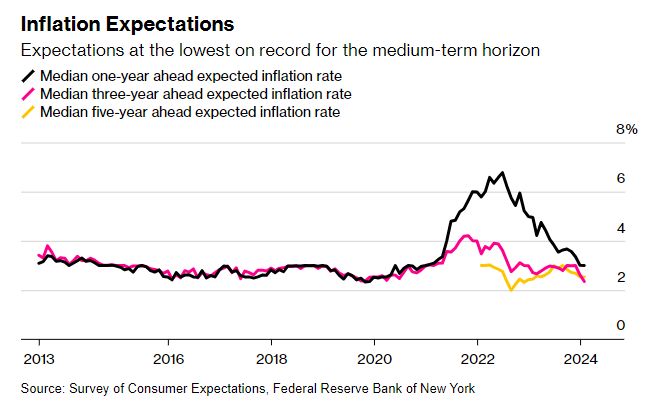

Has the fed won the party?

US Medium-Term Inflation Expectations Lowest in 11 Years of Data – Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks