Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

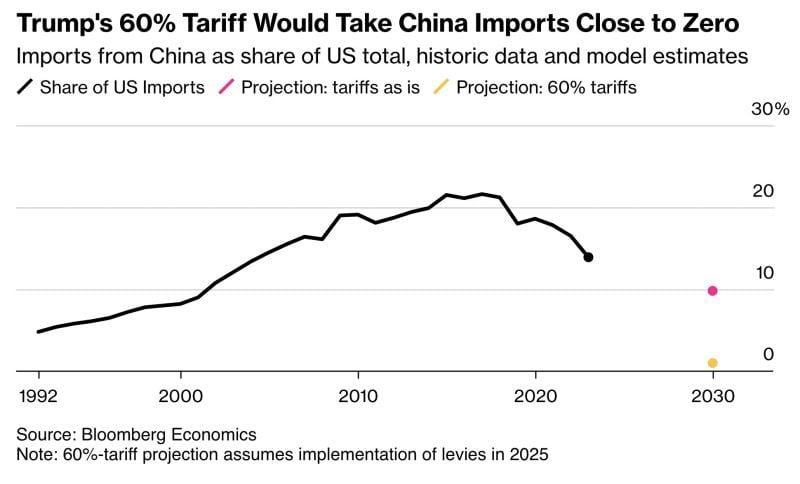

Donald Trump is pitching a 60% tariff on all Chinese imports.

That would shrink a $575bn trade pipeline to practically nothing, Bloomberg analysis shows. For China ’s economy and its slumping stockmarket — down >40% from its 2021 high — that’s bad news. Worse, Trump’s rhetoric may add pressure on Biden to take harsher measures in the run-up to election day Source: HolgerZ, Bloomberg

Jamie Dimon believes U.S. debt is the ‘most predictable crisis’ in history

And experts say it could cost Americans their homes, spending power and national security - Fortune Source: Markets & Mayhem

“Super Sick Monday"

16.1 million U.S. employees will be completely absent from work today following Super Bowl Sunday, according to this year’s research from UKG. In 2023, nearly 18.8 million employees said they planned on missing work on Super Bowl Monday. However, 6.4 million further employees plan to come to work late, another 11.2 million are unsure of whether they will come to work, and around 6.4 million will decide what to do on the day. The number jumps up for U.S. employees who plan to miss at least some work on Monday, reaching around 22.5 million employees – 14% of the U.S. workforce. The research also finds six million employees have not yet notified their employers and will call in sick on the day or simply ‘ghost’ their employer on Monday. source : The Harris Pol, UKG Workforce Institute

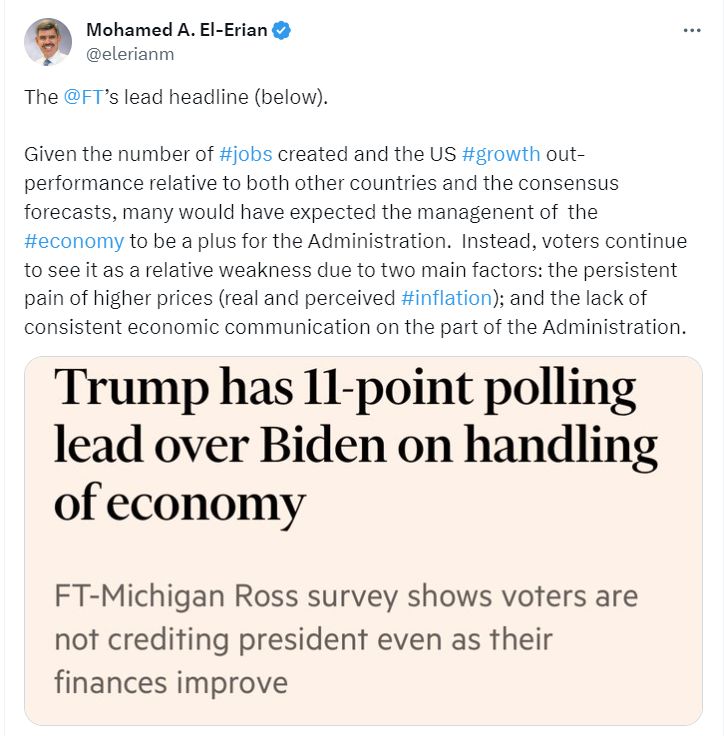

In an US election year, the spread between “Job Creation” and job “approval rating on the economy” has NEVER been wider...

Source: Mohamed A. El-Erian

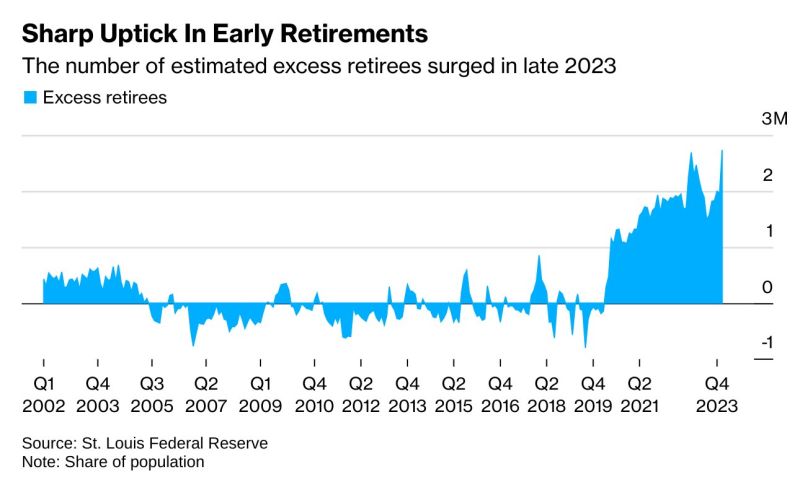

Another wave of early retirements is hitting as the stock market surges

This complicates the Fed's goals for the labor market to some degree, as it means there are more exiting the workforce. There's already 1.45 jobs available for every unemployed person seeking work. Source: Bloomberg, Markets & Mayhem

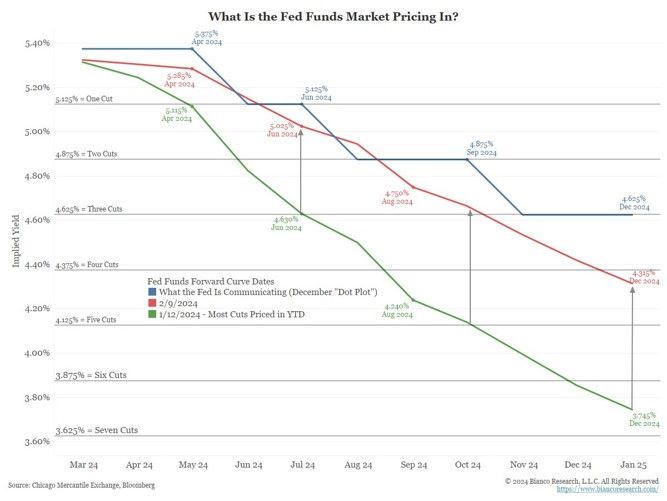

Four rate cuts are now priced in for 2024 (red), the LEAST number of cuts YTD.

This is down from seven rate hikes on January 12 (green), the MOST number of cuts (YTD). Source: Bianco Research

Here's the current expectation on Wall Street regarding the actions of the US Federal Reserve in 2024.

source : wsj, ntimiraos

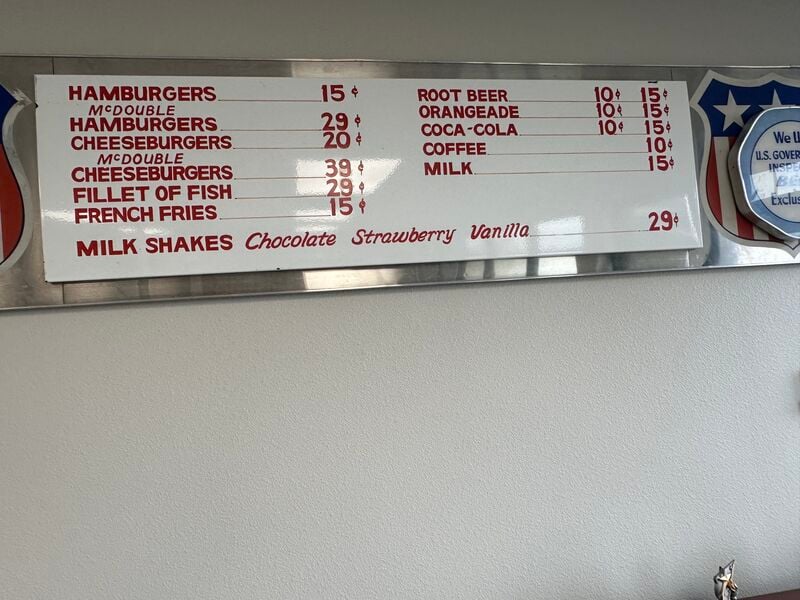

Inflation explained to a 5 years old kid: here's a 1960s McDonald’s menu.

Source: Peter Mallouk

Investing with intelligence

Our latest research, commentary and market outlooks