Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

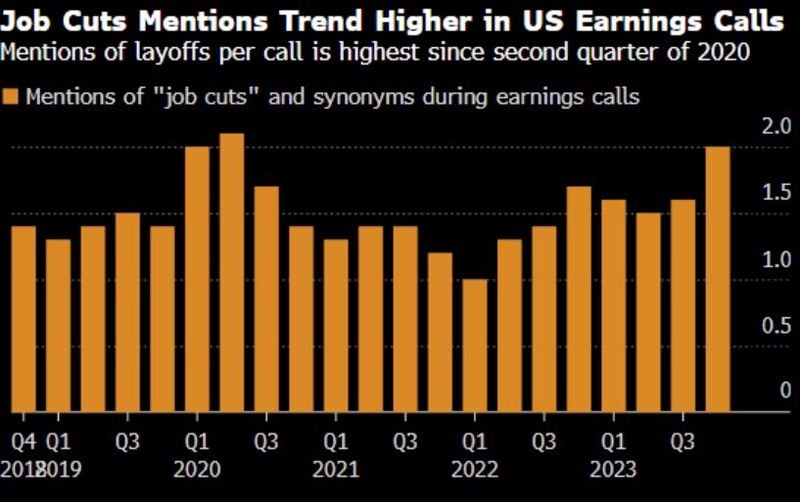

Mentions of Job Cuts in Earnings Calls Hits Pandemic Peak

Layoffs are being mentioned on US earnings calls at the HIGHEST rate since the pandemic, according to Bloomberg. Source: Bloomberg, Genevieve Roch-Decter, CFA

Nice cartoon by hedgeye...

Let see how long Powell will resist not cutting rates... Trump seems to have already decided about his faith anyway...

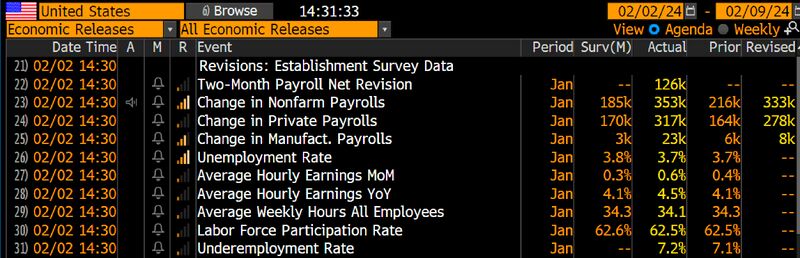

BREAKING: US NFP at 353k way above the estimated 185k, Wages came in hotter than expected +4.5% YoY vs +4.1% expected.

The December jobs report has been revised UP, showing 333,000 jobs added rather than the 216,000 originally reported. This breaks a 10-month trend of downward revisions in the reported jobs number. Meanwhile, average hourly earnings in January rose 0.6%, DOUBLING expectations. Unemployment rate held flat MoM at 3.7% (the Street was anticipating 3.8%). Note that according to the Household survey, the number of employed people dipped by 31k MoM, so US Non-farm-payroll report is not as hot as at 1st sight. Source: Bloomberg, HolgerZ

The US Treasury will hold some of its largest-ever debt auctions in the coming three months in an effort to fill the yawning federal budget deficit.

The Treasury said on Wednesday it would increase the size of auctions at most maturities for the next three months, with two-year and five-year auctions hitting record sizes. The five-year auction in April, for $70bn, would be the biggest ever for debt with a maturity of two years or more. The US has been increasing its borrowing over the past few quarters, as the gap between government spending and tax revenue has grown. The federal deficit stood at $1.7tn last year. Source: FT https://lnkd.in/eSyQHXu9

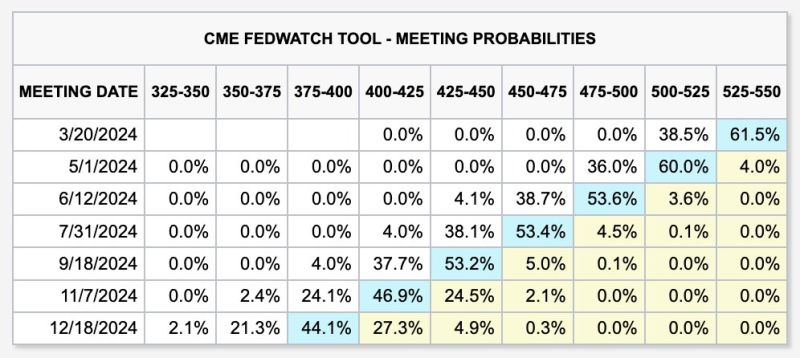

The Fed said that a March rate cut is "unlikely," yet futures are still pricing in a 39% chance it happens

Even as the Fed said they cannot cut rates until inflation is comfortably moving to 2%, markets still see 6 cuts in 2024. There's even a growing 23% chance of 7 interest rate cuts this year. Markets are pricing in a rate cut at EVERY remaining Fed meeting this year. As highlighted by the Kobeissi Letter, if the Fed is on track for a "soft landing," why do we need to many rate cuts? Source: The Kobeissi Lette

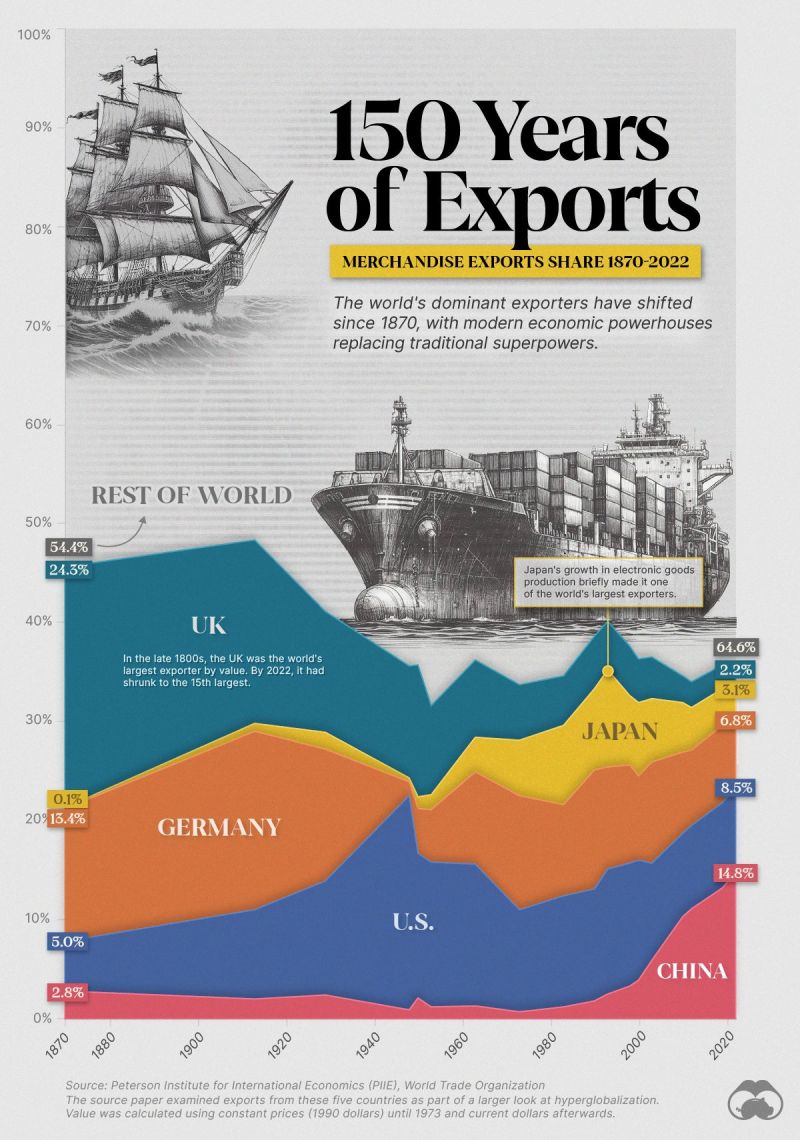

Visualizing 150 Years of Exports for Top Economic Superpowers

Source: Visual Capitalist

Divided Bank of England boe leaves policy unchanged, says interestrates are ‘under review’

- Inflation is projected to fall temporarily to the Bank’s 2% target in the second quarter of this year before rising again in the third and fourth, due to the varying contribution of energy prices to annual comparisons. - Headline inflation is not expected to return to target again until late 2026, the Bank’s newest Monetary Policy Report projected. - Bank of England: 6 votes to hold rates, 2 votes to hike, 1 vote to cut This is the 6th time in the BoE's 295 meeting history that we've seen a 3 way split vote. On most occasions (except for '06) - the doves have won & BoE have gone on to cut rates sharply https://lnkd.in/e64nMDB6

Investing with intelligence

Our latest research, commentary and market outlooks