Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

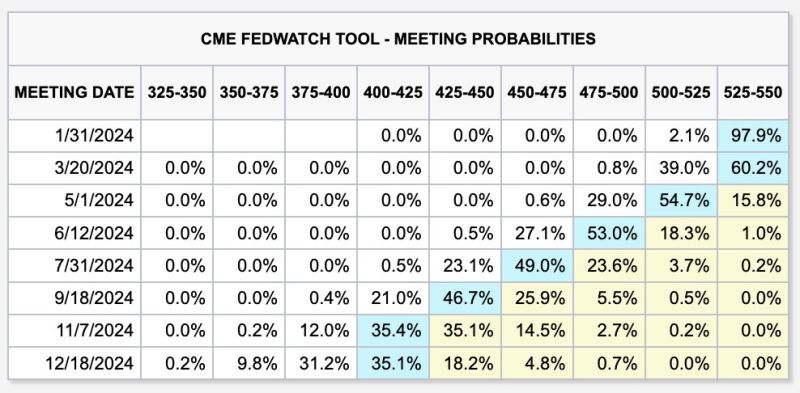

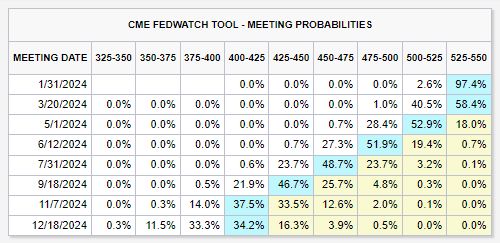

As we are less than 24 hours away from the first Fed meeting of 2024, odds of rate cuts are pulling back

Odds of a rate cut this week are down to 2% and odds of a rate cut in March are down to ~40%. This is the lowest probability of a March rate cut since November 2023. Still, futures are pricing-in a base case of 6 rate cuts for a total of 150 bps in 2024. - All eyes will be on Fed guidance on June 30zh Source: The Kobeissi Letter

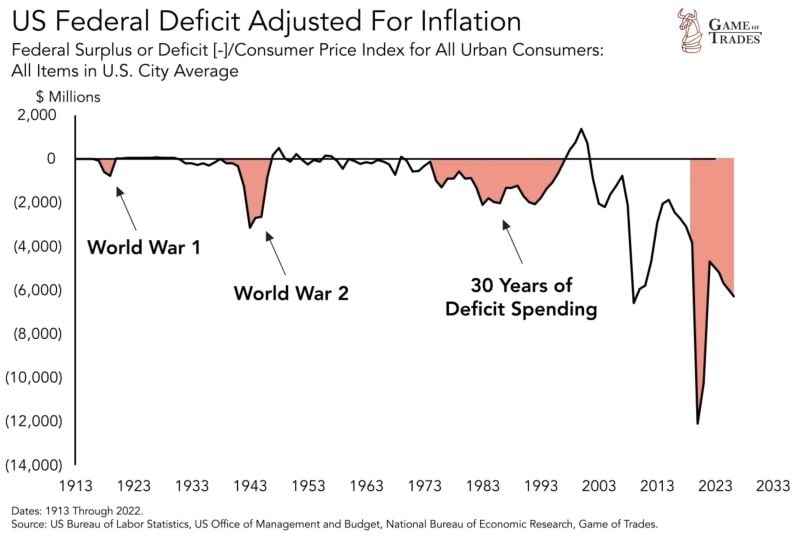

US government spending (inflation-adjusted) since 2020 has exceeded the combined spending of:

- World War I - World War II - 1970 to 1990 Is this sustainable?

All the headline numbers have showed that the labor market is incredibly strong

But is it really? Currently, the US has a record ~8.6 MILLION people that are holding 2 or more jobs. Since 2020, nearly 2.6 million people have taken on an additional job. Source: Bloomberg, The Kobeissi Letter

Interesting FT article highlighting the improvement of global liquidity (contributor -> Cross Border Capital as contributor)

Flows of global liquidity accelerated higher into early 2024, expanding by 9 per cent at an annual rate from September, led by strong increases in Japan and China In 2024, we expect greater liquidity support from central banks as more policymakers turn towards monetary policy easing. Aside from the Fed, the People’s Bank of China is the obvious central bank to watch as it already contributed almost one-fifth of the total increase in global liquidity last year.

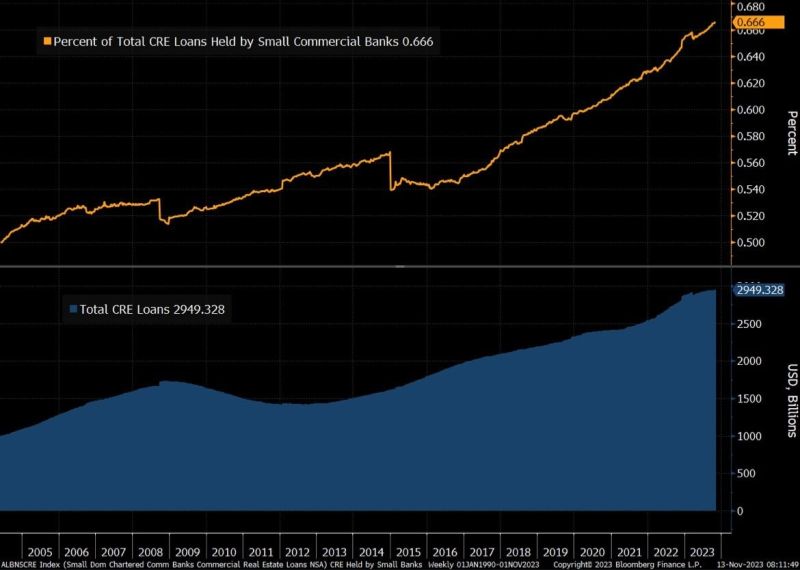

BREAKING: 14% of all commercial real estate (CRE) loans and 44% of office building loans are now in "negative equity."

In other words, the debt is now greater than the property value on all of these properties. Currently, US banks hold over $2.9 trillion of CRE debt, the majority of which is held by regional banks. Office building prices are down 40% from their highs and CRE as a whole is down over 20%. All as rates rise and many of these loans are due CRE is beyond bear market territory.

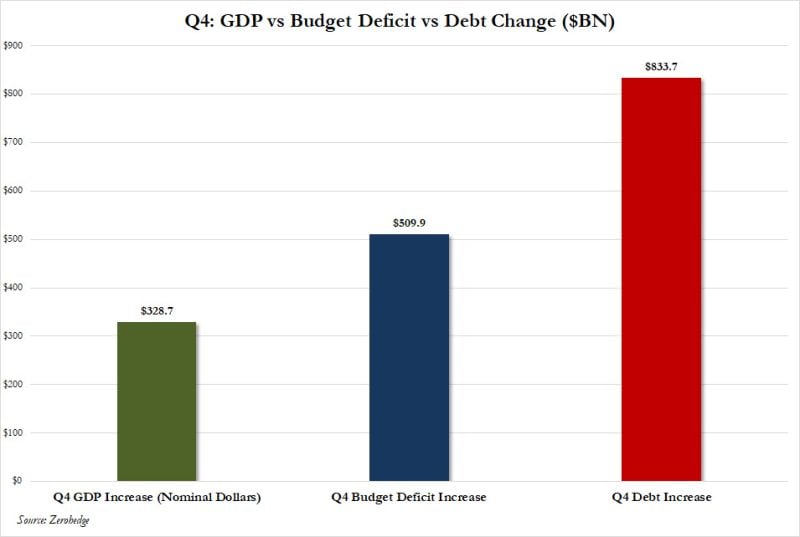

Gross domestic product data showed the U.S. economy grew at a rate of 3.3% in the fourth quarter

That’s much higher than the 2% expectation from economists polled by Dow Jones, underscoring continued economic resiliency despite interest rate hikes from the Federal Reserve. The result, for better or worse, speak for themselves: while Q4 GDP rose by $329 billion to $27.939 trillion, a respectable if made up number, what is much more disturbing is that over the same time period, the US budget deficit rose by more than 50%, or $510 billion. And the cherry on top: the increase in public US debt in the same three month period was a stunning $834 billion, or 154% more than the increase in GDP. In other words, it now takes $1.55 in budget deficit to generate $1 of growth... and it takes over $2.50 in new debt to generate $1 of GDP growth! Source; www.zerohedge.com

It's official: markets are no longer expecting a FED rate cut in March 2024.

There's still a ~42% chance of rate cuts beginning in March, but this is a major shift in expectations. Just two weeks ago, markets saw a 90% chance of rate cuts beginning in March. Odds of rate cuts beginning at next week's Fed meeting are now down to ~2%. We are still seeing ~150 bps of interest rate cuts priced-in to futures. But, Fed pivot hopes are slowly pulling back. Source: The Kobeissi Letter

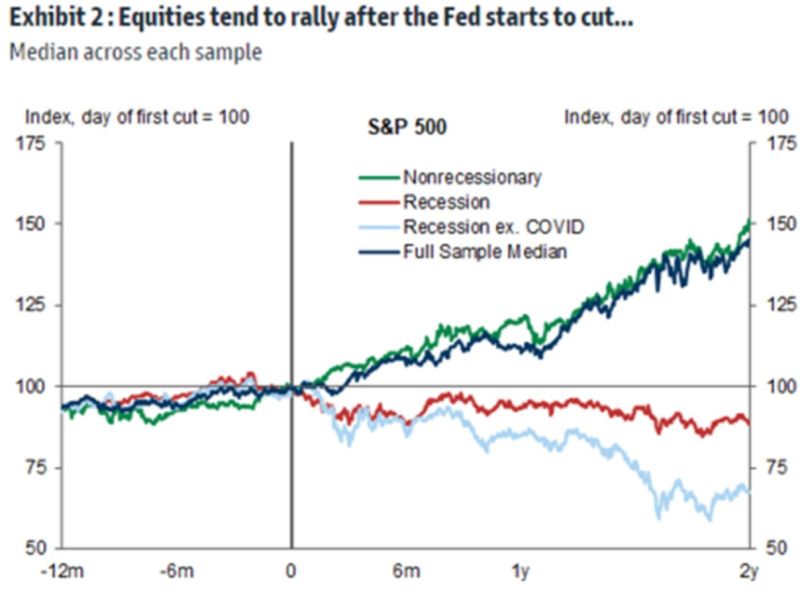

If we do not have a recession, stocks tend to rally after the Fed cuts

If we do, however, they tend to decline They say the economy isn't the market, but in this example it could have a measurable impact on the outcome Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks