Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

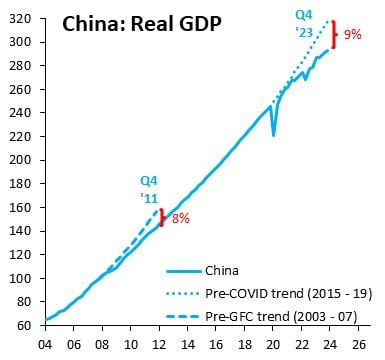

China's real GDP is now further below its pre-COVID trend than after the 2008 crisis

Will they be tempted to opt for more mercantilism (and expansionism)? Source chart: Robin Brooks

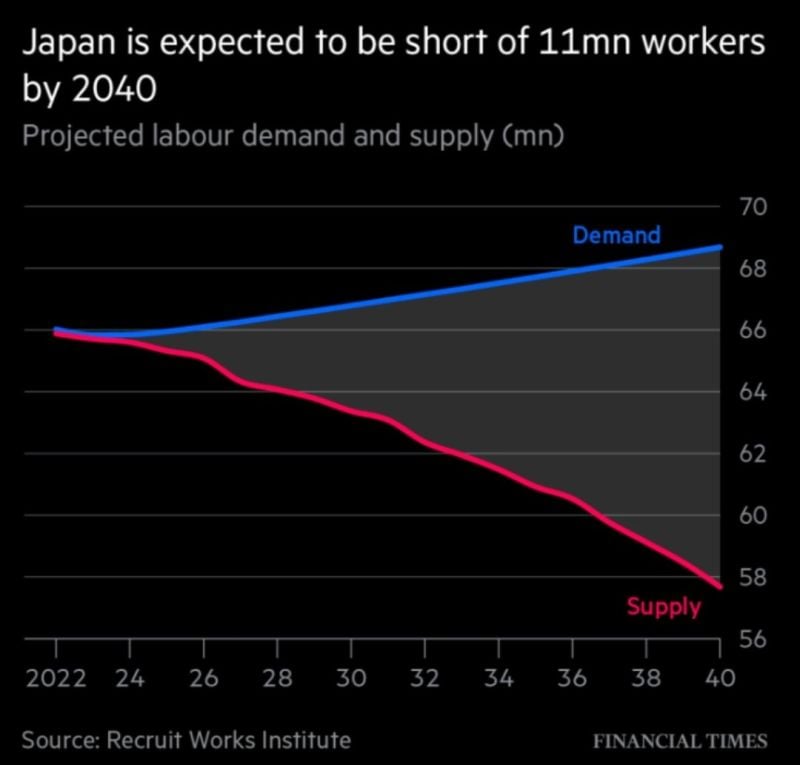

Japan is expected to be short 11 million workers by 2040

Source: Win Smart, FT

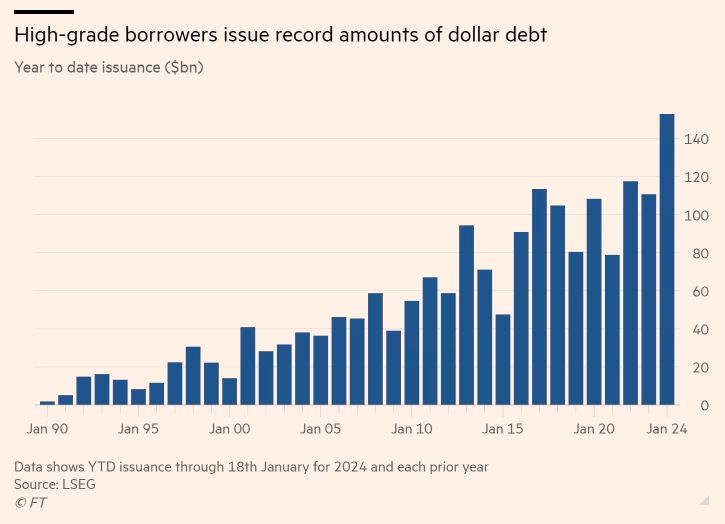

Corporate Borrowing Hits All-Time High 🚨:

Investment Grade Companies have issued more than $150 Billion worth of bonds through the first 18 days of the year, the highest amount in history at this point in the year. Source: Barchart, FT

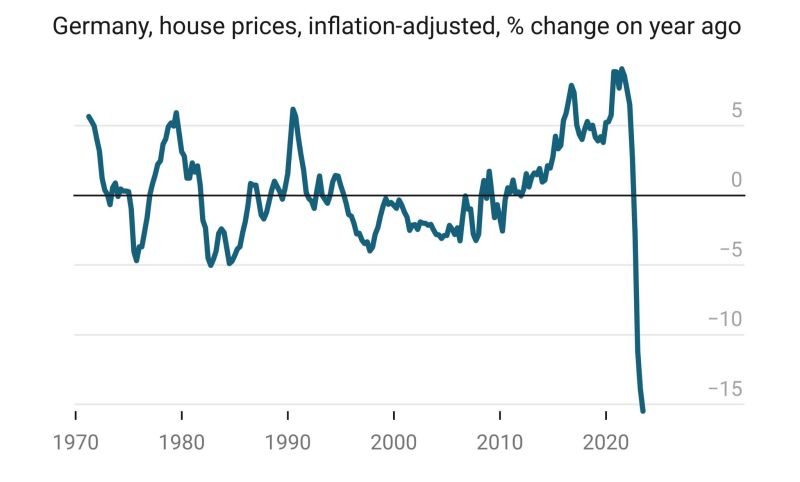

Real estate as inflation protection in one chart, updated

Source: Michel A.Arouet

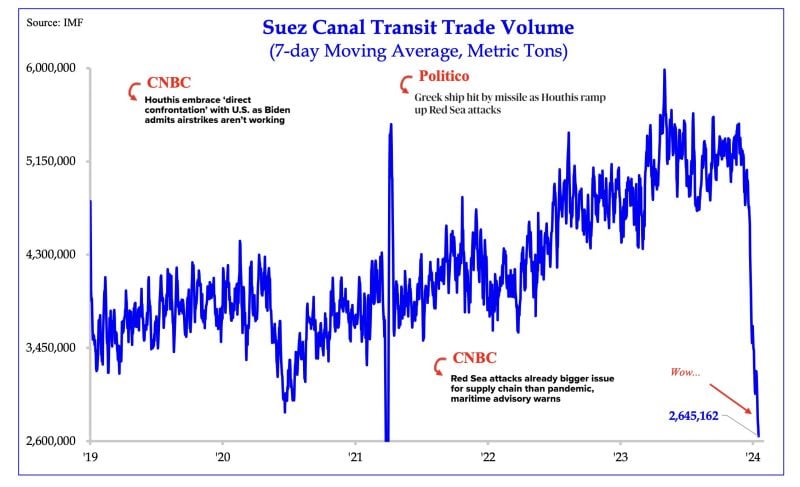

Suez Canal Transit Volume continues to plunge (Chart via SRP)

Source: HolgerZ

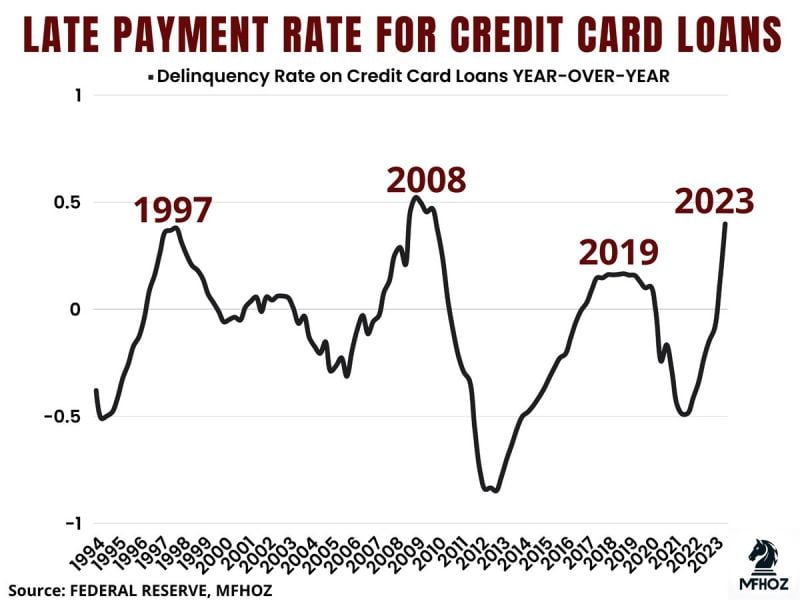

🟥 The delinquency rate for credit card loans in 2023 has risen sharply

Which, based on historical patterns, suggests that the economy might be heading towards a recession.

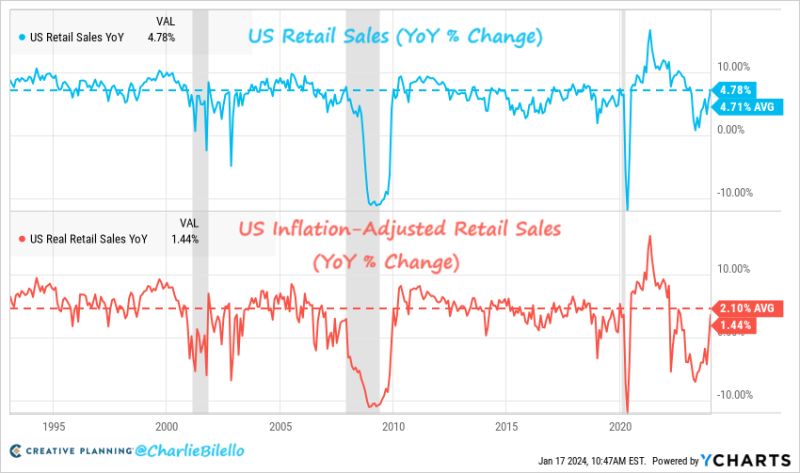

After 13 consecutive YoY declines, US inflation-adjusted retail sales rose 1.4% YoY in December, The first YoY increase since Oct 2022.

Nominal Retail Sales grew 4.78% over the last year, rising just above the historical average of 4.71%. Source: Charlie Bilello

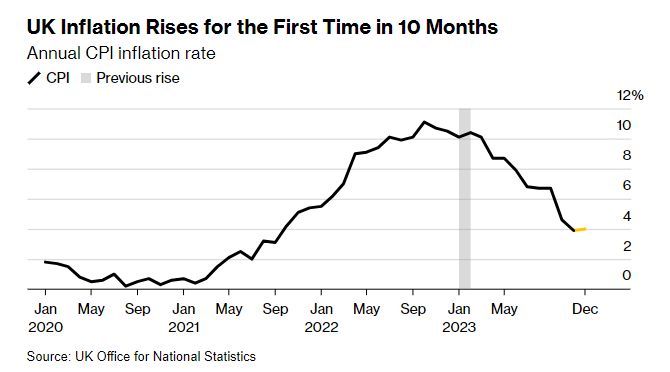

UK Inflation Rises Unexpectedly, Tempering Talk of Rate Cuts

UK inflation disappoints at both the headline and core levels: Headline inflation rose to 4.0% in December, above the consensus forecast looking for it to fall from 3.9% to 3.8%. Core inflation, which was also expected to fall, remained unchanged at 5.1%. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks