Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

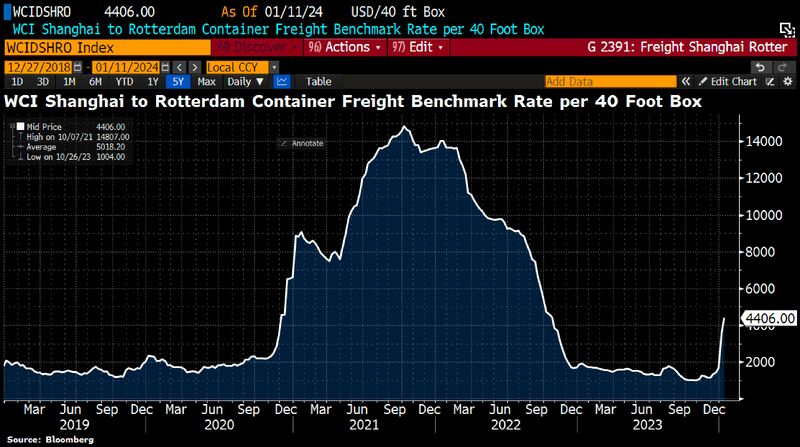

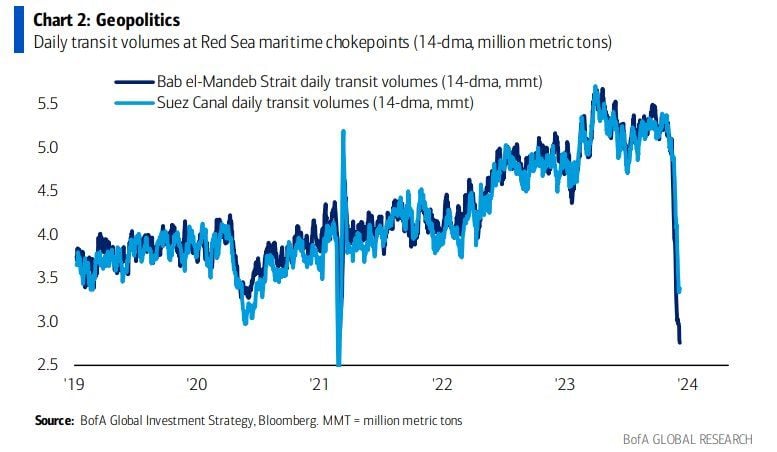

The Red Sea's inflation threat:

The disruptions in the Red Sea have roiled global supply chains and pushed up freight costs. The Houthis have pledged a “big” response to airstrikes. Iran wins either way w/US airstrikes on Houthis in Yemen. Source: HolgerZ, Bloomberg

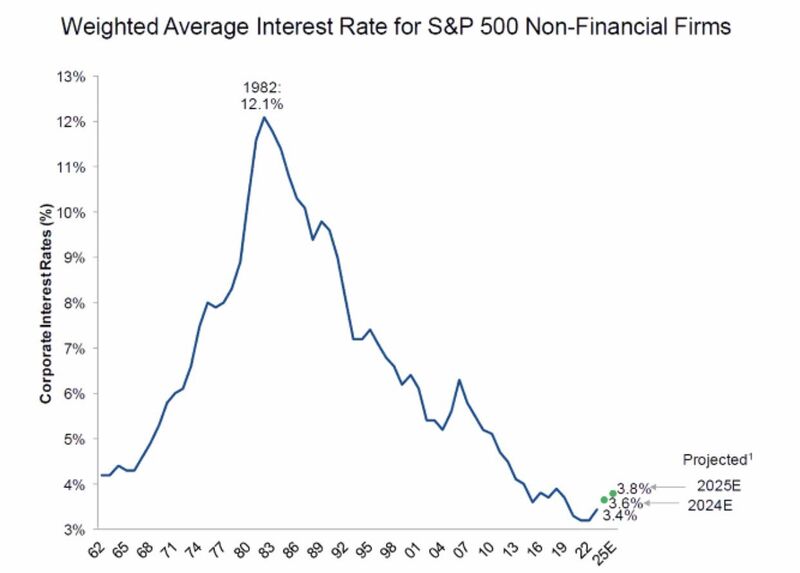

Weighted Average interestrate for sp500 non-financial firms is expected to pick-up in 2024e and 2025e but remains quite low by historical standard.

Source: Michel A.Arouet

Is this the reason why the Fed might be forced to cut rates in March?

We could have: 1. Reverse repo ends (see chart below) 2. BTFP expires 3. Fed cuts (allegedly) 4. QT ends (allegedly) I.e 3 and 4 could counter-balance 1 and 2

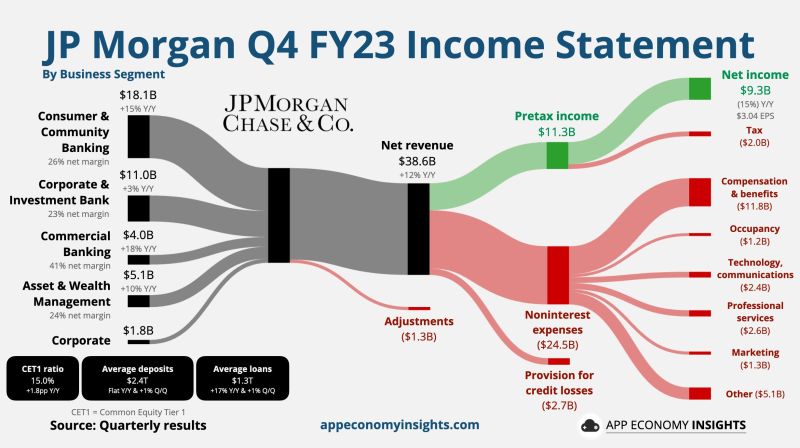

$JPM JP Morgan Chase Q4 FY23.

CEO Jamie Dimon: Deficit spending and supply chain adjustments “may lead inflation to be stickier and rates to be higher than markets expect." • Net revenue +12% Y/Y to $38.6B ($1.2B miss). • Net Income $9.3B. • Non-GAAP EPS: $3.97 ($0.37 beat). • CET1 ratio of 15.0%. • Expect FY24 NII of $90B (+1% Y/Y).

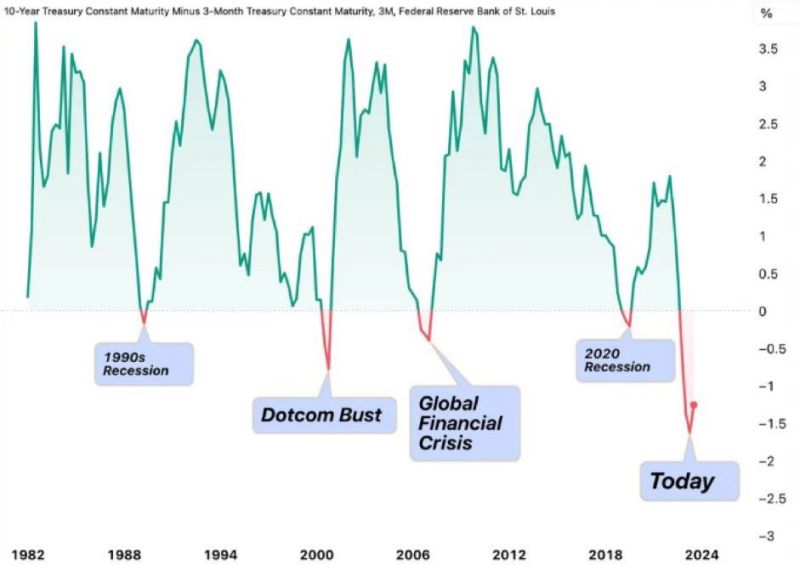

The last 4 times the 10Y Minus 3M Treasury Yield Curve inverted, it led to the 1990s recession, the Dotcom Bust, the Global Financial Crisis, and the 2020 Recession.

Will this time be different? 🤔 Source: Barchart

Uranium 16-Year High: Uranium going parabolic as it hits its highest price since November 2007

Source: barchart

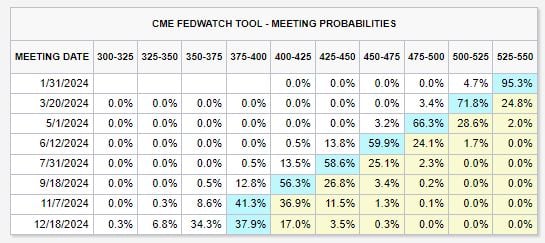

Surprise, surprise... Even with a hot jobs report and inflation rising to 3.4%, market expectations regarding timing and number of rate cuts have shifted more dovish.

Markets are now pricing-in a rate cut at EVERY Fed meeting this year beginning in March 2024 until December 2024. Effectively, markets are saying that us interestrates will move in a straight-line lower. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks