Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

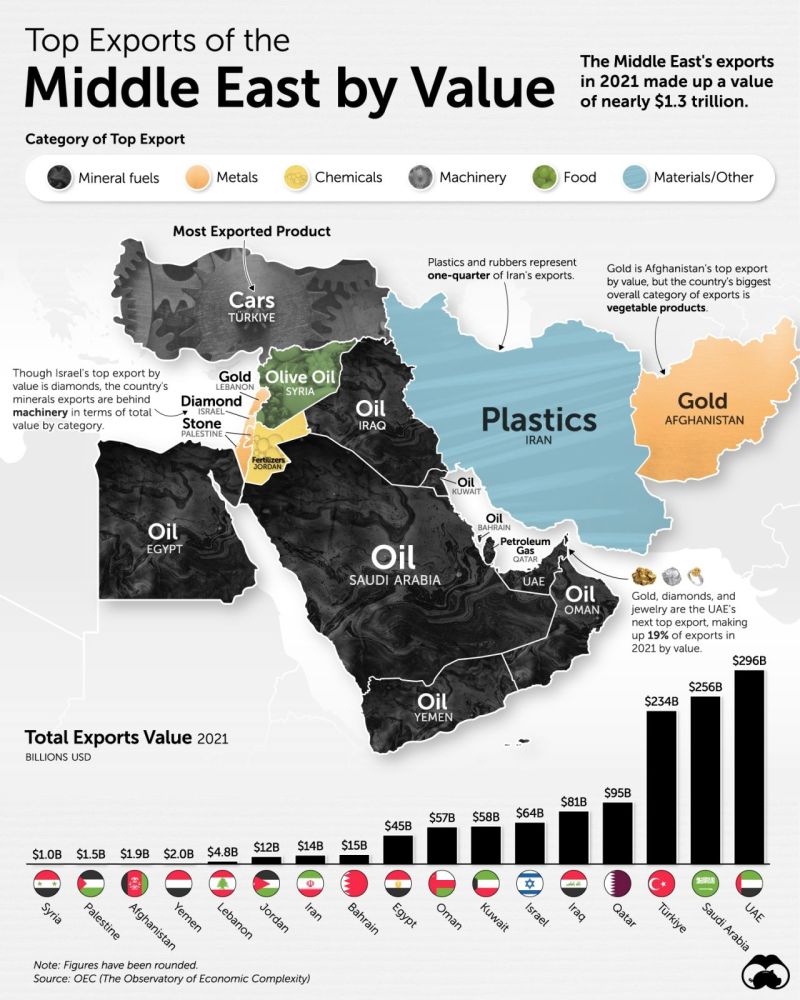

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

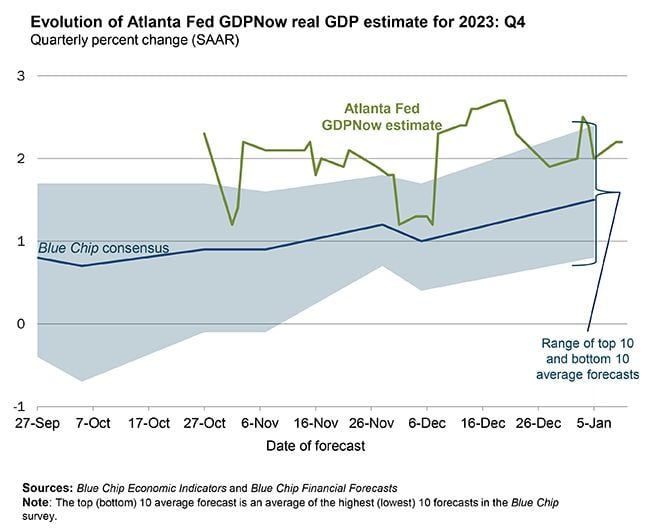

On January 10, the GDPNow model nowcast of us real GDP growth in Q4 2023 is 2.2%

Source: Atlanta Fed

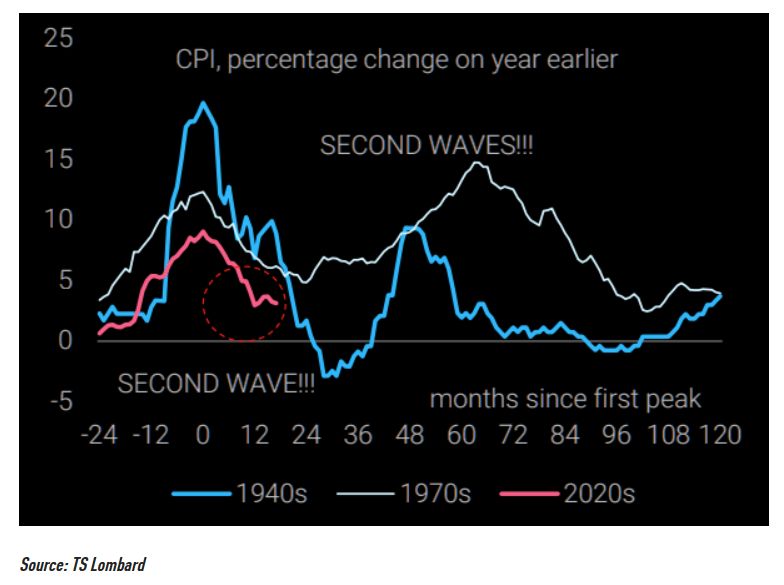

Beware the second wave...inflation moves in mysterious ways and sometimes you get that "unplanned" second wave.

Source: TS Lombard, TME

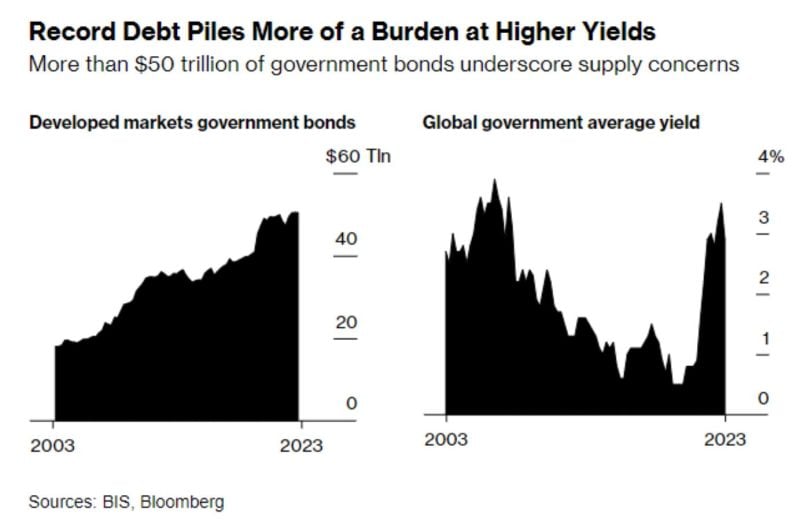

While G7 claims can offer short-term tactical opportunities, soaring G7 debt levels at the the of high yields mean that the long-term risk-reward remains unattractive.

Source chart: Bloomberg

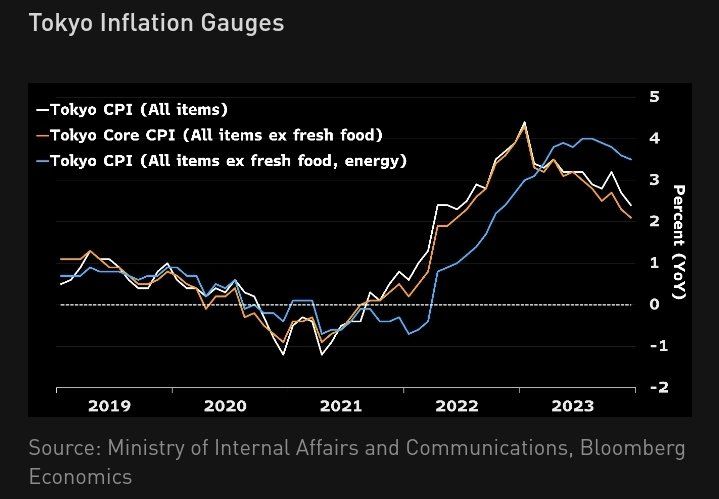

Tokyo CPI down again supports BOJ dovish stance for now

Source: Bloomberg

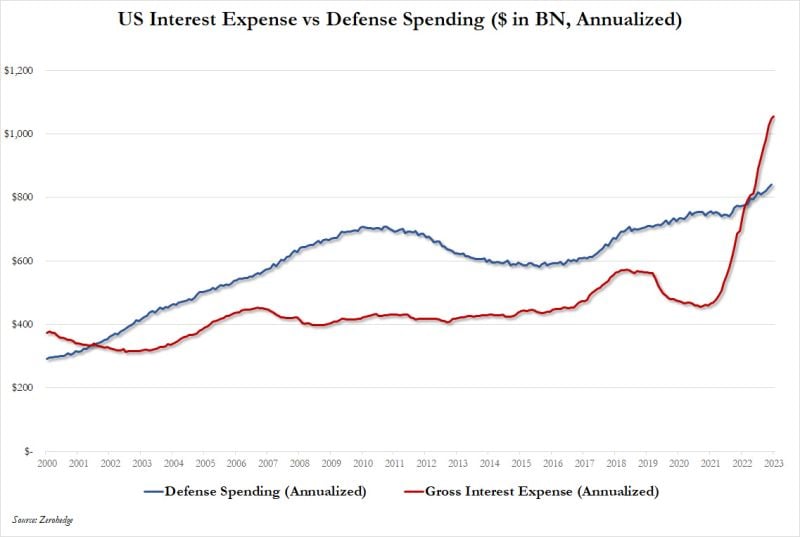

US defense spending vs interest on Federal debt

Source: www.zerohedge.com

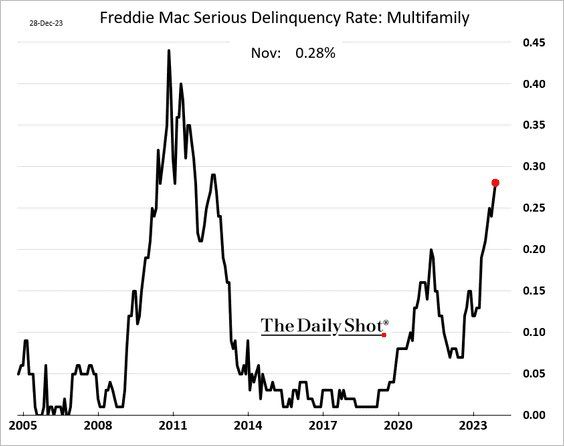

Freddie Mac Serious delinquency rate US multifamily homes

thru The Daily Shot

Investing with intelligence

Our latest research, commentary and market outlooks