Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

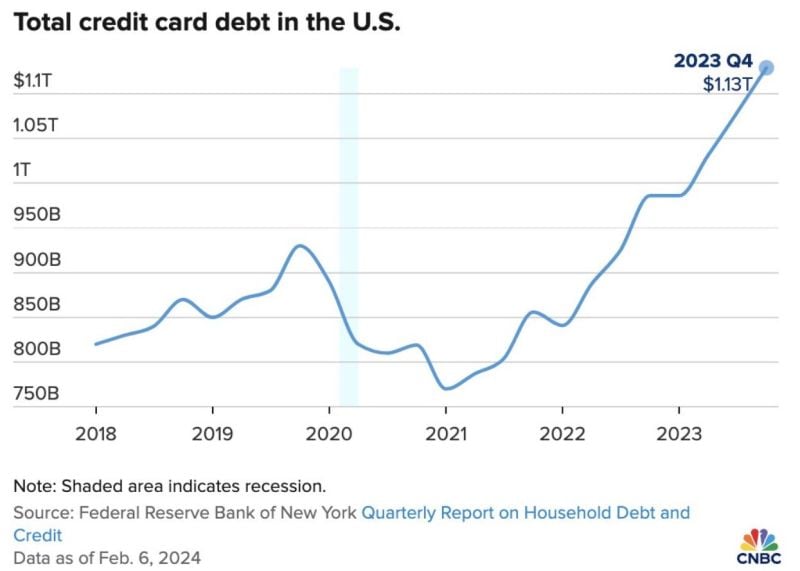

Americans now have a combined $1.13 Trillion of credit card debt, according to a new report from the Federal Reserve Bank of New York

source : cnbc

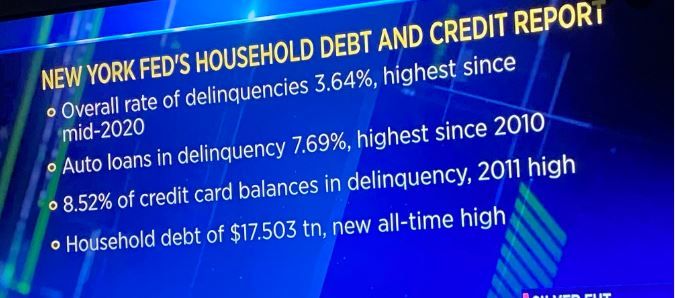

New York Fed's Household Debt and Credit Report

Total household debt climbed by $212 billion in the fourth quarter of 2023 to $17.5 trillion, the New York Federal Reserve said in its latest quarterly Household Debt and Credit Report. Amid the rise in debt, delinquency rates and the transition into troubled status were both higher. source : cnbc

Germany's exports to Kyrgyzstan were up 1200% in 2023 vs before Russia invaded Ukraine...

Source: Robin Brooks

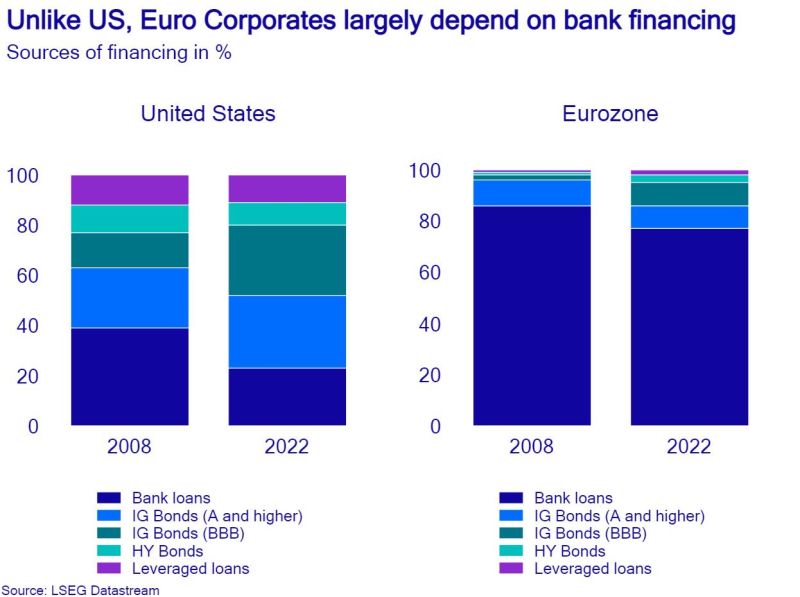

The reason why tighter bank lending conditions bite Eurozone economy faster, while US companies still don’t suffer under higher rates due to longer duration.

Source: Patrick Krizan, Michel A.Arouet

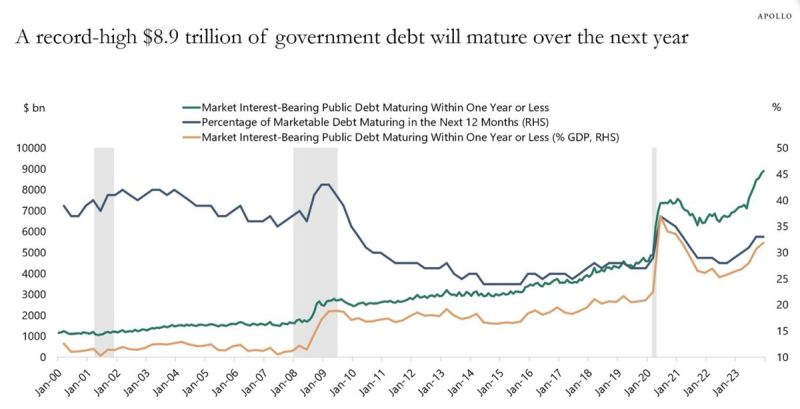

A record $8.9 trillion of government debt will mature over the next year.

Meanwhile, the government deficit in 2024 is projected to be $1.4 trillion. This means that someone will need to buy more than $10 trillion in US government bonds in 2024. That's nearly ONE THIRD of all outstanding US federal debt right now. All while the Fed is expected to start cutting rates, making buying these bonds less attractive. Who's going to fund all of this debt? Source: The Kobeissi Letter, Apollo

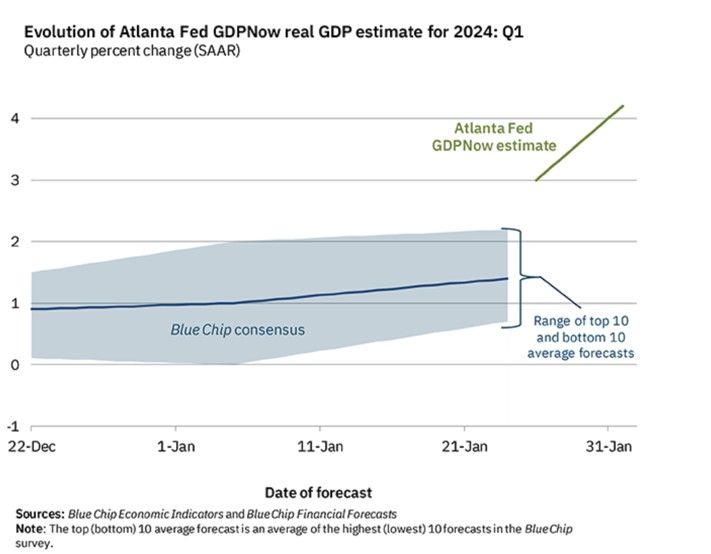

Do you remember the dramatic loosing of Financial conditions at the end of 2023?

The lagged effect of this massive loosening is now hitting and is supporting the US economy (and this NOT doing The Fed's job...). Indeed, US economic surprises keep surprising on the upside. The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 4.2 percent (!!!) on February 1, up from 3.0 percent on January 26

Investing with intelligence

Our latest research, commentary and market outlooks