Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

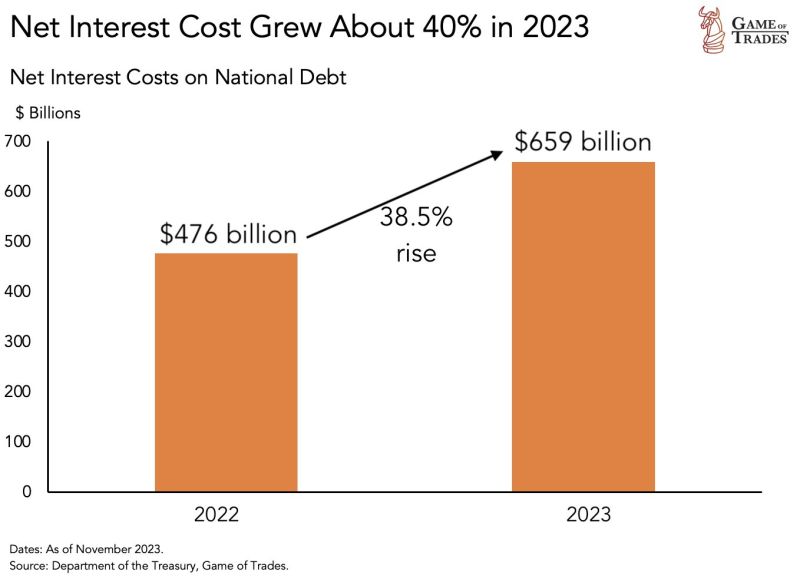

Net interest cost of US national debt grew by 38.5% just in 2023

Source: Game of Trades

Goldilocks continue with economic data (in red) remaining sluggish and financial conditions (in green) dramatically 'loosening'...

Source: www.zerohedge.com, Bloomberg

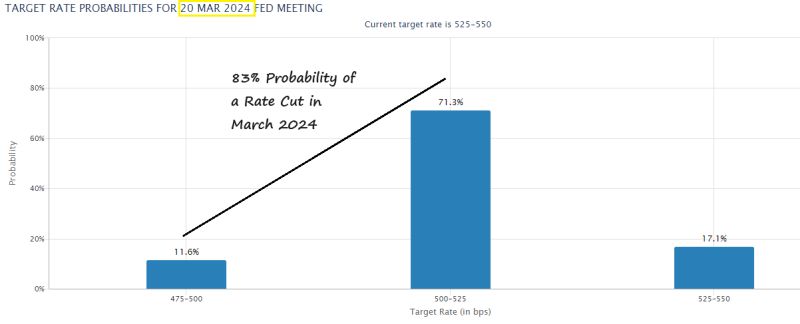

The probability of a Fed rate cut in March 2024 has jumped up to 83%. A month ago the odds were only 29%.

Source: Charlie Bilello

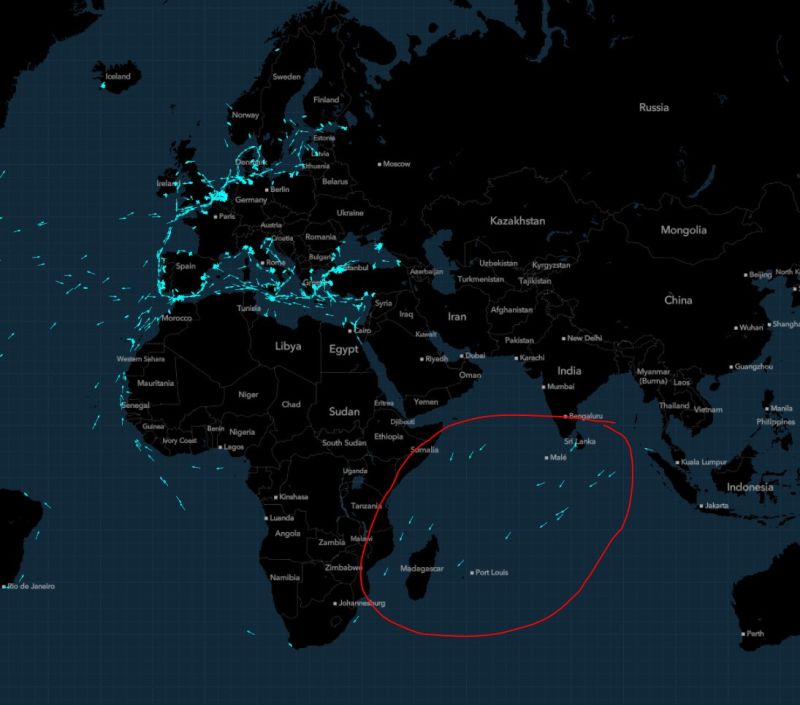

MAP OF THE DAY: The number of ships that have diverted from the Red Sea and instead taken the 10/14-day longer route around Africa has risen to >100.

The map shows **container ships** declaring European ports as destination, with one only left in the Red Sea | Red Sea Source: Javier Blas

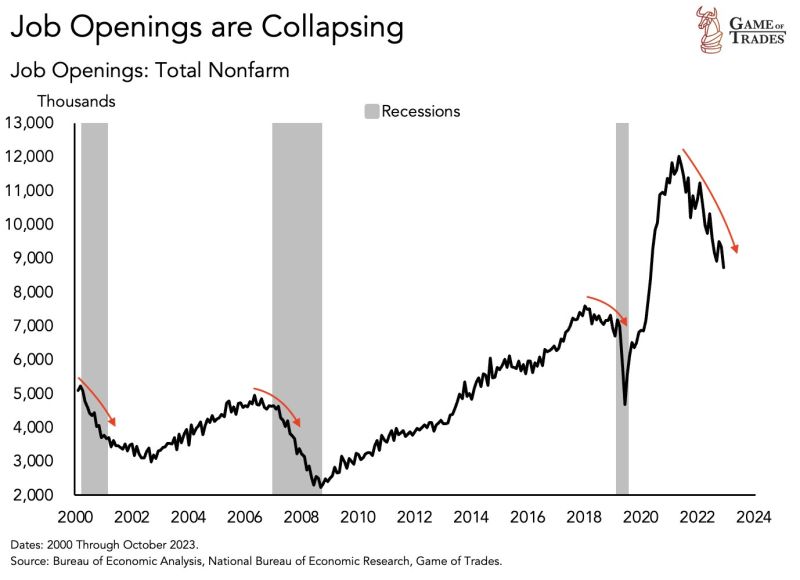

ALERT: Job openings are collapsing (but from a very high level)

Source: Game of Trades

Labor unions are pushing for big pay rise…

e.g Southwest Airlines pilot pay would increase 50pct under new labor contract. A wage-inflation spiral remains a threat (even if overall job creations are plunging) Source: CNBC

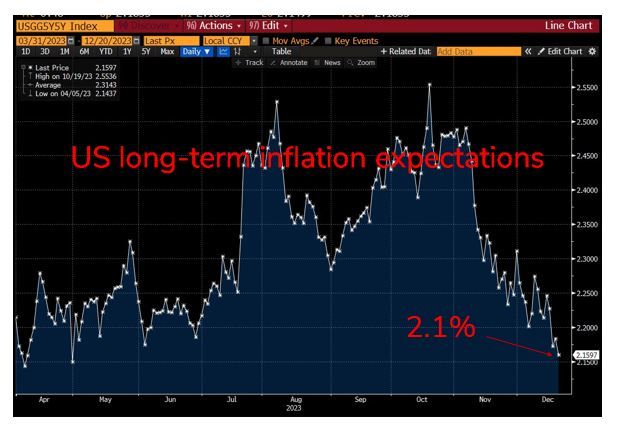

Longer-term US inflation expectations have fallen dramatically over the past two months, to close to the Fed's 2% target

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks