Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

What a journey for Ireland...

Ireland has experienced unprecedented growth in prosperity in recent years. GDP per capita is now almost $100k, which is more than twice as much as in Germany and three times as much as in Italy. The small country with a population of 5 million has benefited from the large investments made by tech giants, who have settled here b/c of the low tax regime. No other country in Europe has a meaningful budget surplus, can set up 2 sovereign wealth funds, (Future Ireland Fund (FIF) and a smaller Infrastructure, Nature and Climate Fund (INCF) and has a war chest of €2.5bn before 3 important elections. Source: Bloomberg, HolgerZ

The Fed is still behind the curve...

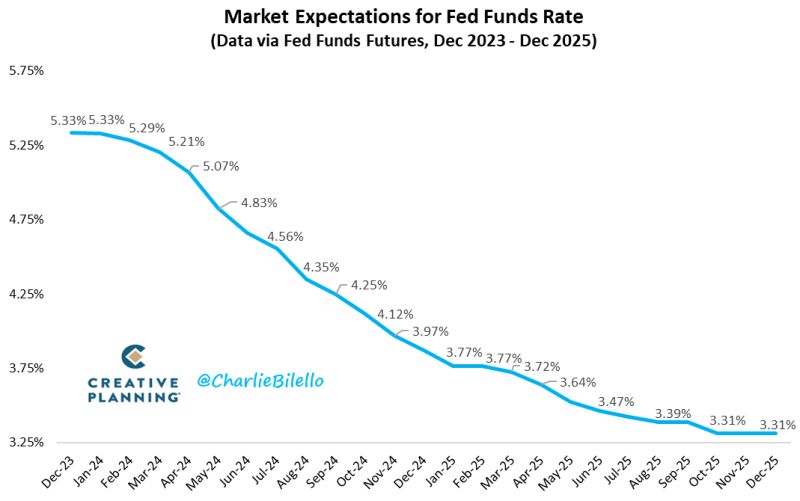

The market is now pricing in a Fed Funds Rate of 3.8% by the end of 2024, expecting significantly more easing than the Fed's projection of a move down to 4.6%. Source: Charloe Bilello

Up the mountain and back down in the valley

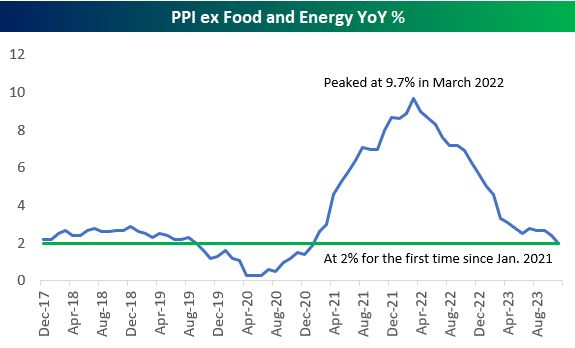

Here's a look at the year-over-year percentage change of PPI (producer prices) ex food & energy over the last five years. Core PPI is back down to 2% for the first time since January 2021 after topping out at 9.7% in March 2022. Source: Bespoke

The Fed is finally giving up...

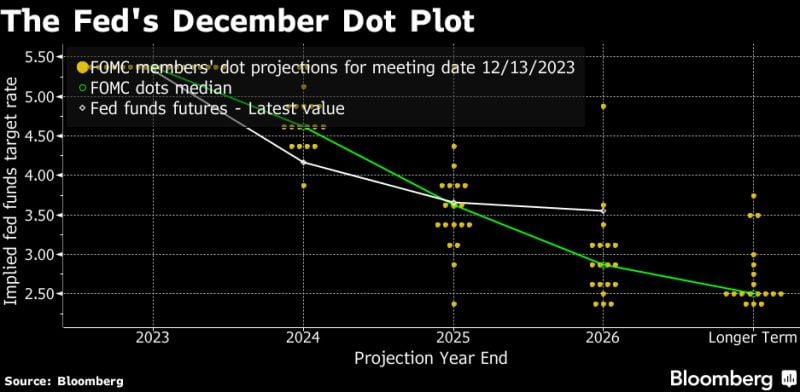

Fed holds rates steady but indicates three cuts coming in 2024. Indeed, the Dot Plot is adjusted down significantly more dovishly than expected, narrowing the gap to the market's expectation significantly... The US 10 year is down 20bp to 4%, the Dow surges by 300 points!

⚠️BREAKING:

*FED'S POWELL: IT IS NOT LIKELY WE WILL HIKE FURTHER *POWELL: POLICYMAKERS ARE THINKING AND TALKING ABOUT WHEN IT WILL BE APPROPRIATE TO CUT RATES Source: www.investing.com

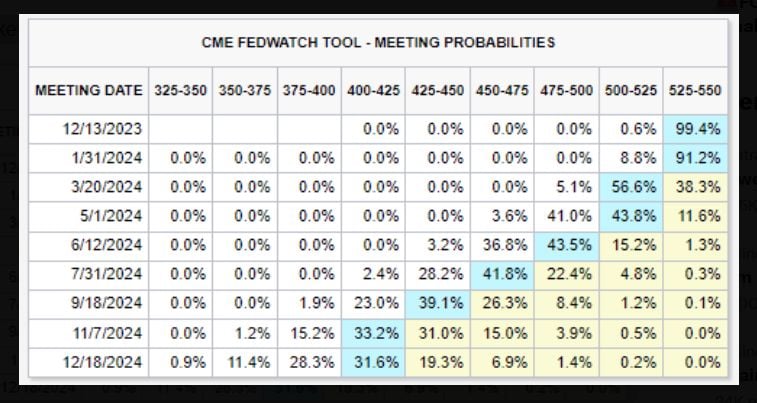

Interest rate futures shift to showing a ~57% chance of rate CUTS beginning in March 2024

Markets also see a growing 9% chance of rate cuts beginning as soon as next month. Futures are projecting a total of FIVE rate cuts in 2024. There's a 28% chance of 6 cuts and an 11% chance of 7 cuts in 2024. Meanwhile, the Fed just said they see just 3 rate cuts in 2024. So markets are still "fighting" the Fed. But the Fed is starting to adjust... Source: The Kobeissi Letter

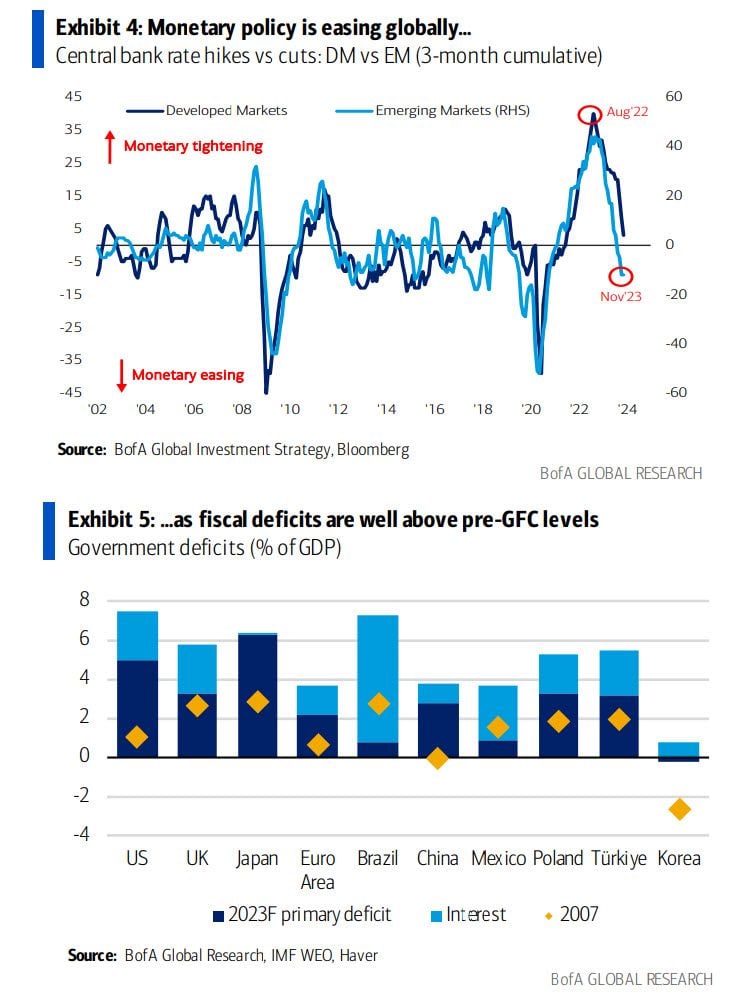

Monetary policy is now easing globally - and will ease much more in 2024/25 - at a time when fiscal deficits are far above the global financial crisis levels

Source: BofA

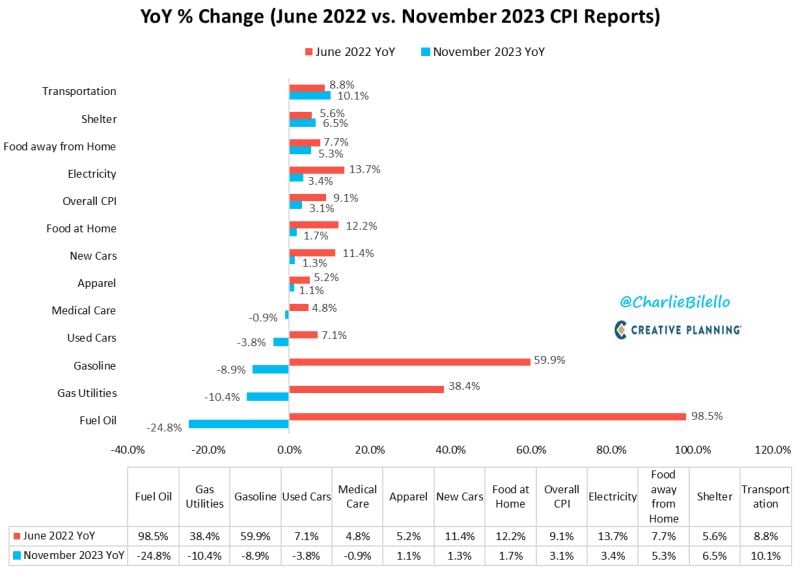

US CPI has moved down from a peak of 9.1% in June 2022 to 3.1% today

What's driving that decline? Lower rates of inflation in Fuel Oil, Gas Utilities, Gasoline, Used Cars, Medical Care, Apparel, New Cars, Food at Home, Electricity, and Food away from Home. Shelter and Transportation are the only major components that have a higher inflation rate today than June 2022. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks