Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

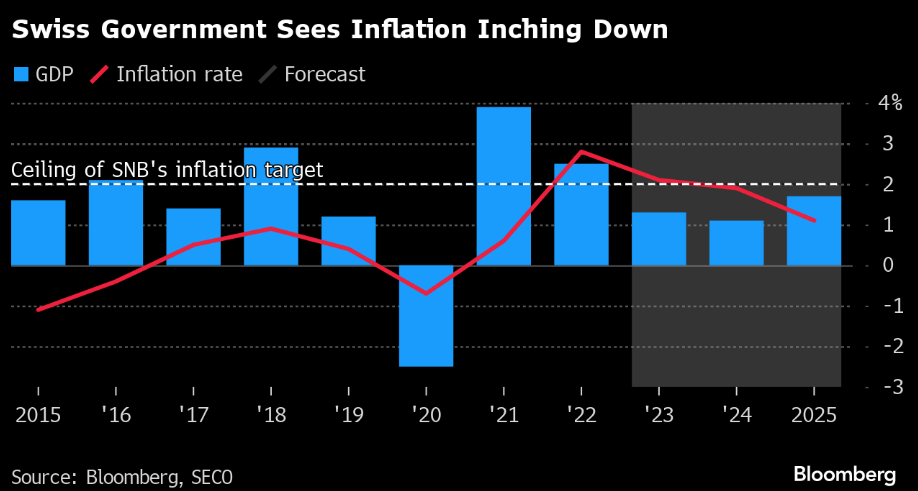

Switzerland’s inflation forecast backs SNB rate staying on hold

Switzerland’s government sees next year’s

inflation within the central bank’s target range, the latest evidence supporting a likely hold from policymakers this week. Consumer prices will grow at an annual 1.9% in 2024, in line with the previous forecast, the State Secretariat for Economic Affairs said on Wednesday.

Source: Bloomberg

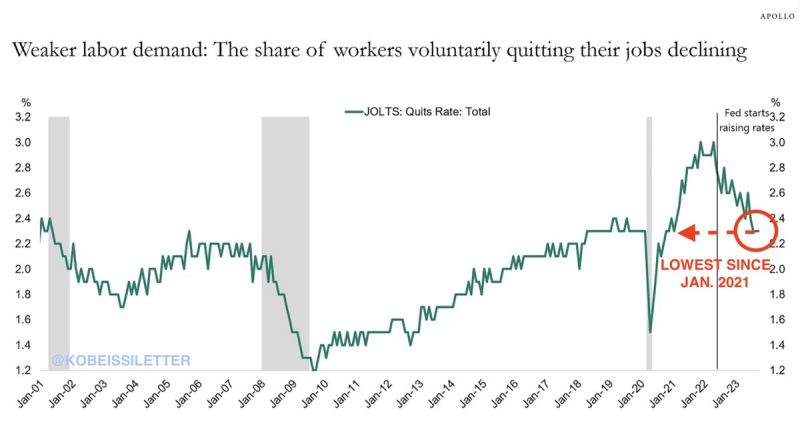

The share of workers voluntarily quitting their jobs is down to 2.3%

This is the lowest since January 2023 and down from 3.1% prior to the Fed started rate hikes. Weaker labor demand will be the theme of 2024 as job growth slows and rates stay higher for longer. Furthermore, as excess savings have now been depleted, consumers are more reliant on holding a job. Source: The Kobeissi Letter

A slightly disappointing US CPI inflation numbers for the markets...

US YoY CPI eased to 3.1% in November from 3.2% while the important core reading was unchanged at 4% YoY, despite seeing the MoM tick a bit higher. The so-called super-core, a measure watched by the Fed, meanwhile rose at one of the fastest monthly paces this year.

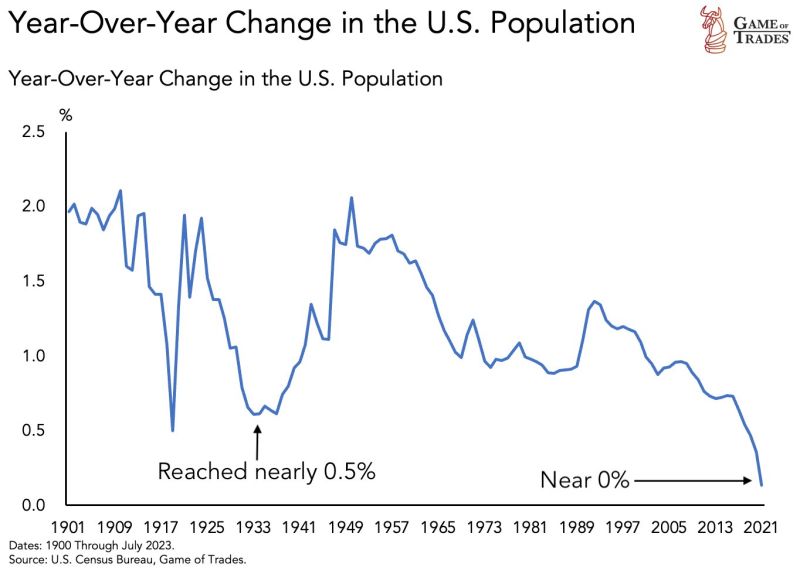

US population growth has fallen off a cliff. Nearing 0% levels indicating almost NO growth. Current levels have NOT been seen in 100+ years

Source: Game of Trades

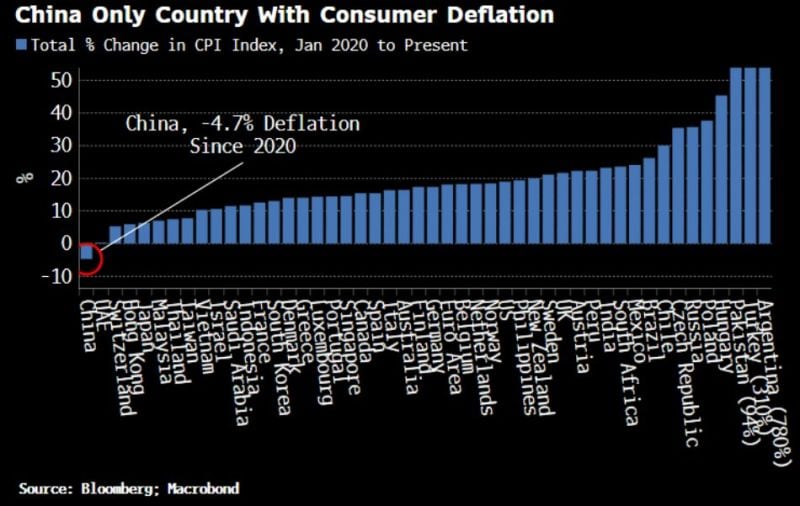

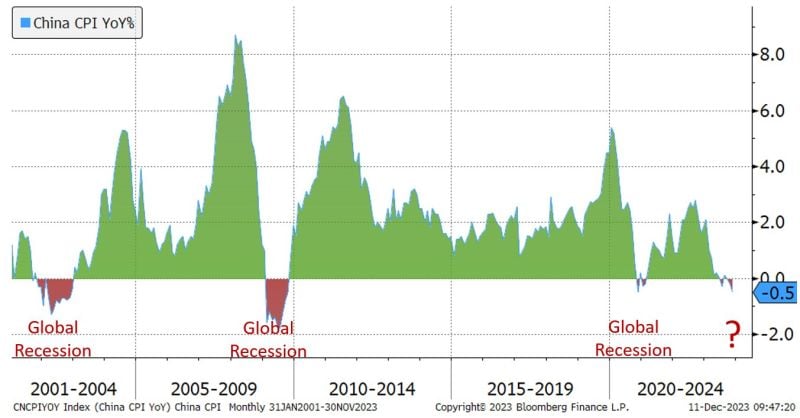

China is the only country experiencing deflation

CPI is down 4.7% since 2020 while every other country has experience inflation – some experiencing the highest in decades. Source: Genevieve Roch-Decter, CFA, Bloomberg, Macrobond

Each time inflation in China turned negative the global economy was in a recession: 2001, 2008-09, 2020... Is this time different?

Source: Jeffrey Kleintop, Bloomberg

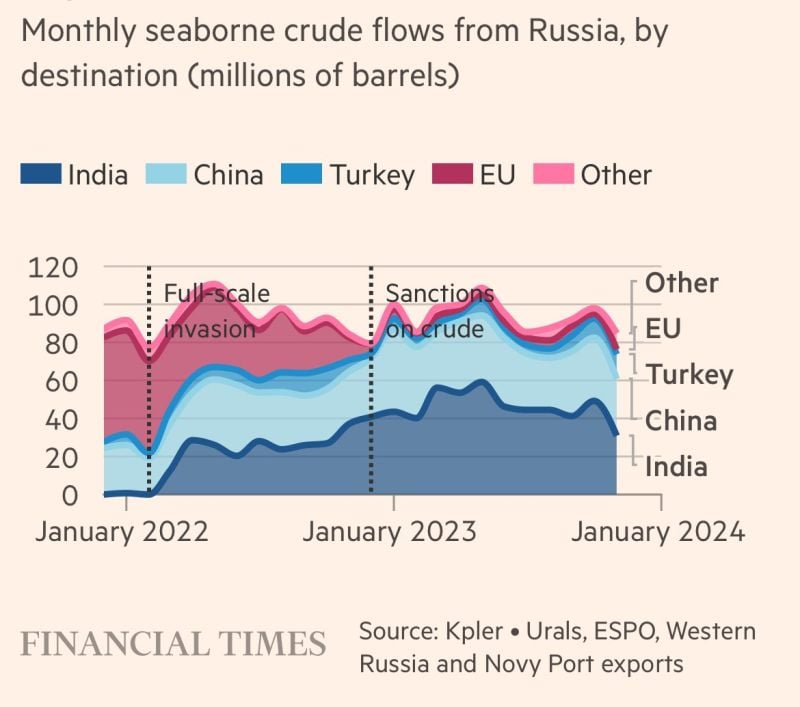

Russia replaced oil exports to the EU with exports to India and China

Source: FT

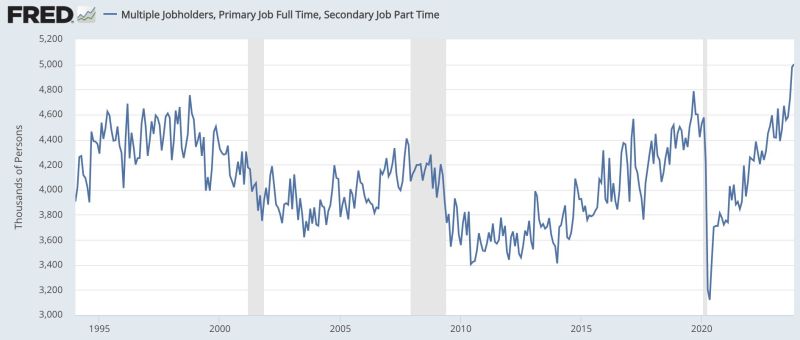

The number of Americans with a second job is again at all-time highs

Source: Fred, Win Smart

Investing with intelligence

Our latest research, commentary and market outlooks