Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

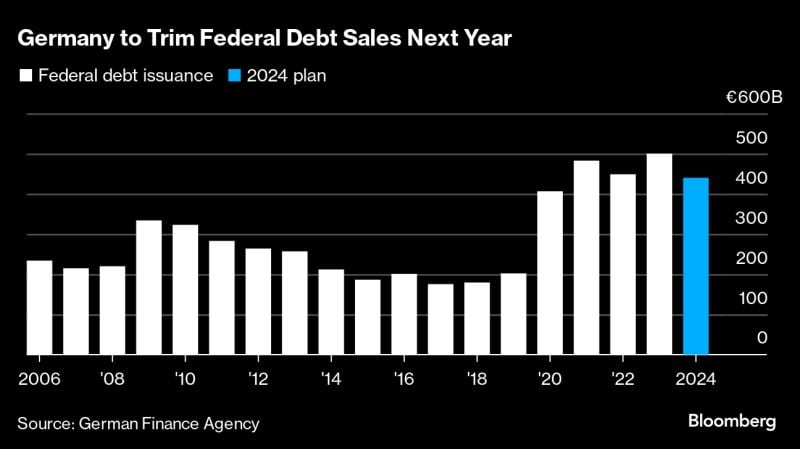

German federal government is set to trim federal debt sales next year following the German top court's 'debt brake' ruling. Berlin plans to issue ~€440bn in debt

That compares with a record volume of ~€500bn in 2023 Source: HolgerZ, Bloomberg

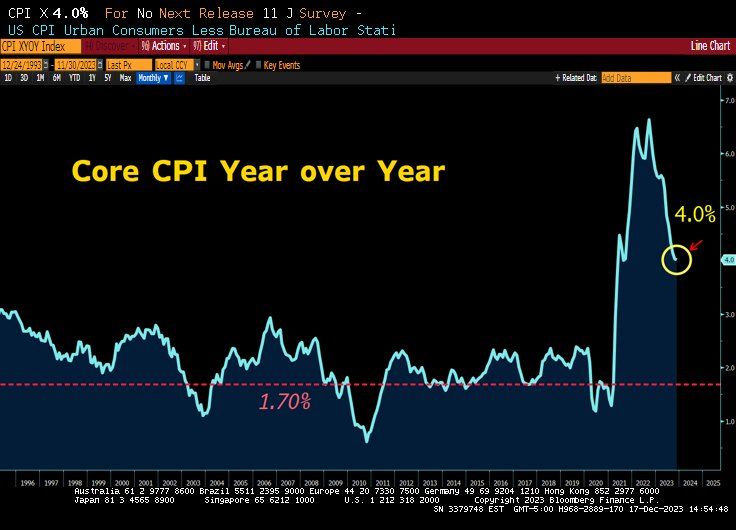

“The reports of my death are greatly exaggerated.” Mark Twain, 1897

Source: Lawrence McDonald, Bloomberg

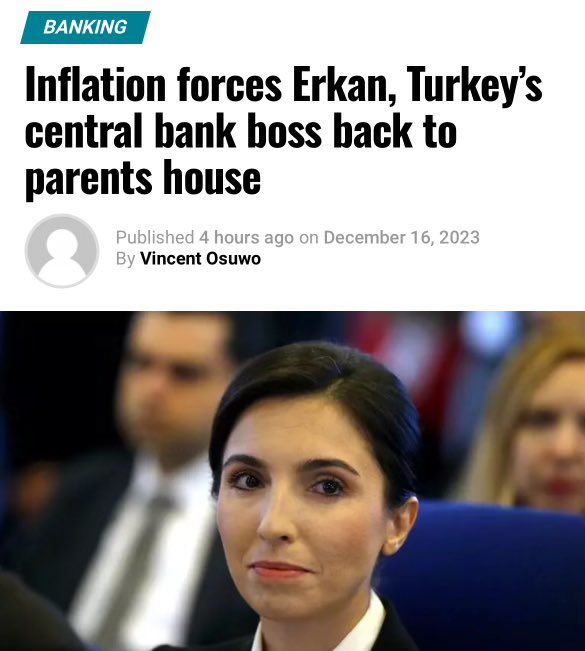

What a headline...

Hafize Gaye Erkan, the new head of Turkey’s central bank, said rampant inflation has priced her out of Istanbul’s property market, leaving the former finance executive with no choice but to move back in with her parents. “We haven’t found a home in Istanbul. It’s terribly expensive. We’ve moved in with my parents,” 44-year-old Hafize Gaye Erkan, who took up her post in June after two decades in the United States, told reporters. Source: Wall Street Silver

BREAKING >>>New York Fed President John Williams CNBC interview: The Fed "isn't really" talking about rate cuts right now

Mr. Williams said: - The Fed "isn't really" talking about rate cuts right now. - Committee members submit projections regarding path of interest rates. Inflation and economy is still uncertain, but base cases are looking pretty good. - Policy focused on getting inflation down to 2%. - Market reaction to all news events have been larger than normal. - Fed should be ready to hike again if needed. - Fed is at or near right place for monetary policy. - The policy restraints should be dialed back slowly over the next three years.

Believe it or not...

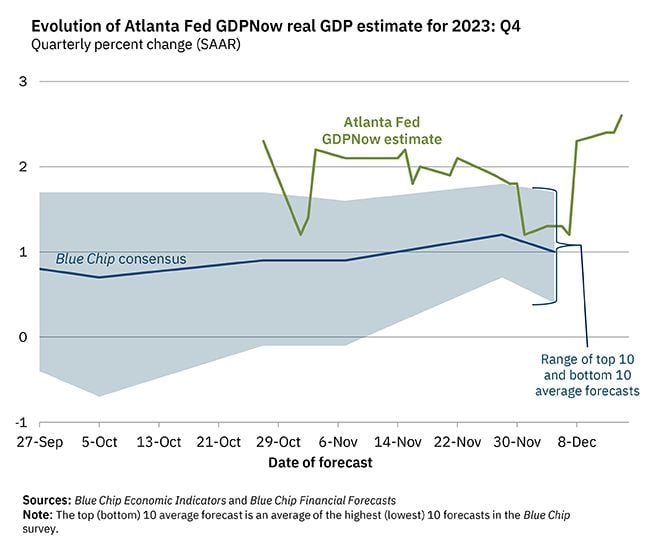

On December 14, the GDPNow model nowcast of real GDP growth in Q4 2023 is 2.6%.

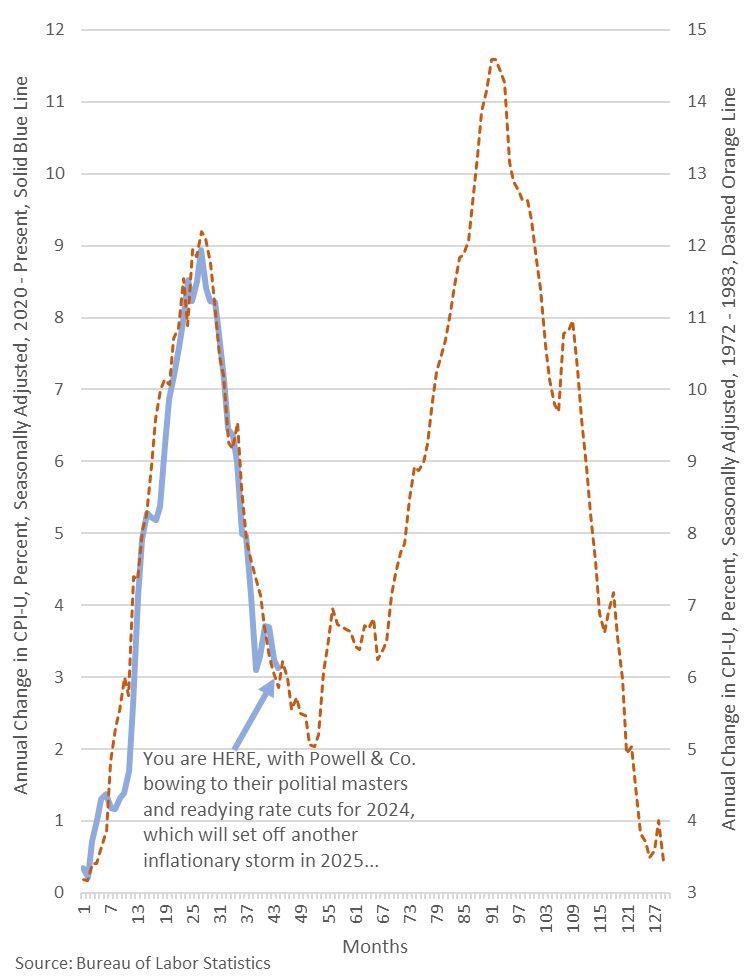

Is Fed making the same error as the mid 1970s?

In the 1970s they also thought they had beat inflation in 1974-1975, they lowered rates and then inflation roared back to even higher levels in the late 1970s. Inflation on came down in early 1980s because of two factors. 1) massive new oil (energy) supply from Alaska, Gulf of Mexico, North Sea and huge new fields in Mexico coming online. 2) 18% interest rates crushed the economy. Source: Wall Street Silver

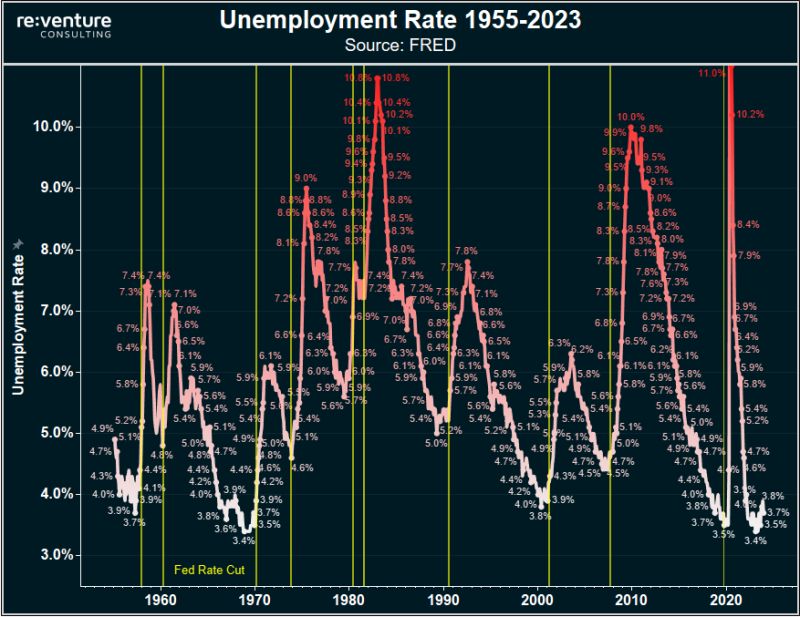

Unemployment rate in America from 1955-2023

Interesting how the unemployment rate tends to spike right after the Fed cuts rates. Suggesting that Fed policy easing is usually a negative signal for the economy. Not a positive one. Source: FRED, re:venture

Investing with intelligence

Our latest research, commentary and market outlooks